Since the expanded Argentine beef quotas were announced around mid-October 2025, U.S. live cattle futures prices dropped significantly, creating volatility and near-term bearishness, with some sources noting a 20% dip in cash prices. However, producers framed this as artificial, given the tight national herd and ongoing high costs, with the import increase seen as too small to affect retail prices much. While cattle futures fell, retail beef prices remained high, as the overall herd contraction, not imports, drives the market.

Impact on Cattle Prices (Futures & Cash):

- Futures Sell-Off: Live cattle futures saw sharp declines after the quota announcement, with a bearish technical outlook emerging.

- Cash Price Dip: Cash cattle prices also fell, with some reporting a roughly 20% reduction during the fall selling season.

- Producer Perspective: Many ranchers felt this price drop was artificial, as fundamental supply issues (small U.S. herd) haven't changed, and their costs (feed, fuel, etc.) remain high.

Impact on Retail Beef Prices:

- Continued High Prices: Retail beef prices remained elevated and were forecast to stay high, with little relief expected from the limited Argentine imports.

- Small Import Impact: The increased quota (from 20k to 80k metric tons) amounts to a tiny fraction (about 0.3 lbs) of the per capita U.S. beef supply, leading experts to say it wouldn't meaningfully lower consumer costs.

Underlying Market Factors:

- Small U.S. Herd: The primary driver of high beef prices is the historically small U.S. cattle herd, which takes years to rebuild after droughts and liquidation.

- Packer Profits: Some argue that high retail prices reflect large profits for multinational packers and wholesalers, not just high producer costs.

In essence, the quota news triggered a temporary futures market reaction, but the long-term trend of high prices driven by tight supply persists, with producers feeling squeezed and consumers still paying more.

Recent Article for Barchart

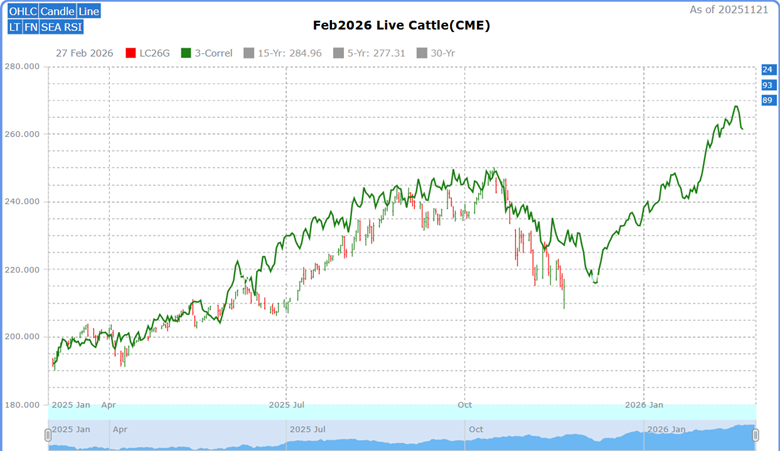

In an article written for Barchart in November 2025, "Argentina Beef Quota Just Opened — Why Your Grocery Bill Won't Budge, and Live Cattle Is Still Setting Up for a Monster Move". The discussion was about how the live cattle market had been closely correlated with the previous three years (green line).

Source: Moore Research Center, Inc. (MRCI)

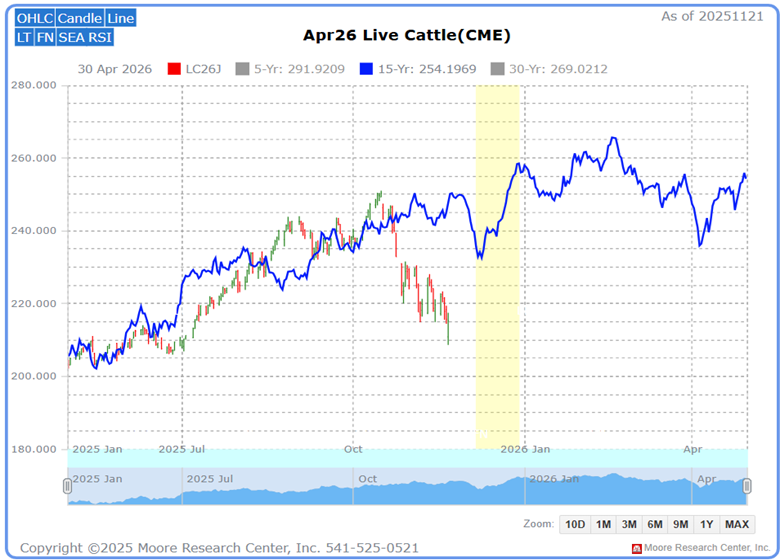

Simultaneously, MRCI research identified a seasonal buy window (yellow box).

Source: MRCI

The fundamentals of the lowest herd inventory in history had not changed. The smart money piled into buying the live cattle futures, and here we are today, approaching new highs again.

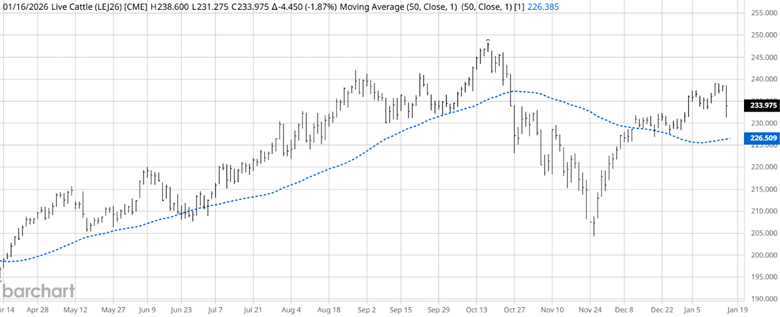

Source: Barchart

The futures sell-off created temporary technical concern when prices began closing below the 50-day moving average, and the average then began to trend lower. After the November rally, prices began trading above the 50-day average, and now the live cattle seem convinced that the grass is greener on the upside of the moving average, as it has started to slope up again.

Current Seasonal and Correlation Year Scenario

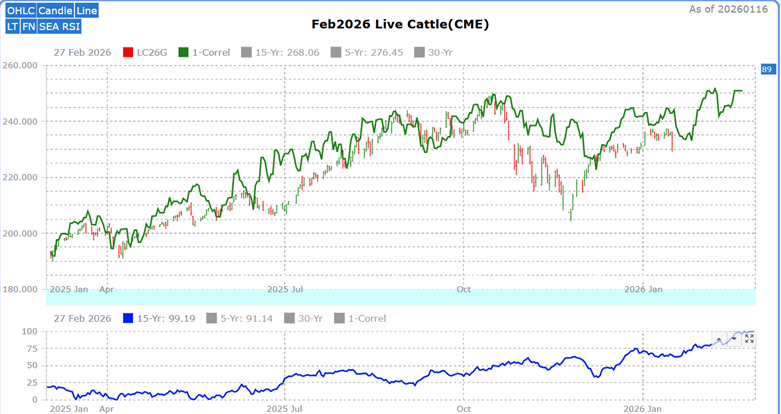

Source: MRCI

The correlated years have dropped to 1989, and the correlation is 89% (green line). There appears to be a trough in upcoming prices where they began to rally. The correlated year and 50-day moving average are hinting at higher prices. Additionally, MRCI research has found that live cattle prices stalled at the beginning of the year and then rallied over the past 15 years (blue line).

Assets to Trade Live Cattle

Futures traders could trade the standard-size contract (LE). At this time, there are no ETFs for live cattle alone. There are a few commodity ETFs that blend hogs and cattle.

In Closing…

So here we are in mid-January 2026, and live cattle futures have shaken off that October scare and are charging toward fresh highs again. The brief panic over those extra Argentine tons proved to be just noise—the fundamentals never budged. Our herd is still razor-thin after years of drought and culling, packer margins are fat, and the seasonal patterns MRCI has tracked for decades are lining up like clockwork for another leg higher. Ranchers are still grinding through high costs and tight supplies, while shoppers keep seeing those same painful price tags at the meat counter.

Bottom line: the import headline was a head-fake. Tight supply still rules the day, and anyone betting against this cattle rally might want to think twice before fading the tape. The grass really does look greener on the upside right now.

On the date of publication, Don Dawson did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart