Cipher Mining (CIFR) deserves a closer look, especially with the cryptocurrency sector deciding to wake up. Granted, since hitting a closing high of $24.71 on Nov. 5, CIFR stock is still down a sizable 24%. Nevertheless, rising sentiment in the blockchain ecosystem bodes well for adjacent players. Sure enough, CIFR has been one of the strongest-performing assets recently, moving up nearly 16% in the past five sessions.

If the options market has anything to say about it, Cipher Mining stock could be due for even more upside.

Specifically, options flow — which focuses exclusively on big block transactions likely placed by institutional investors — has witnessed a transition from bearish to bullish net transactions. Between the Jan. 8 and Jan. 9 sessions, net trade sentiment landed at more than $3.7 million below parity, thus favoring the bears.

To be fair, most of the negative sentiment trades were sold calls, which aren’t necessarily the most pessimistic transactions. However, for much of early January, options sentiment for CIFR stock was rather pensive, which was completely understandable given the crypto market context.

Up to Jan. 11, the total market capitalization of all blockchain assets trended around $3.1 trillion. But over the past week, the emotion of greed has started to creep back into cryptos. Perhaps not coincidentally, options flow data for CIFR stock has enjoyed a steady stream of net positive transactions.

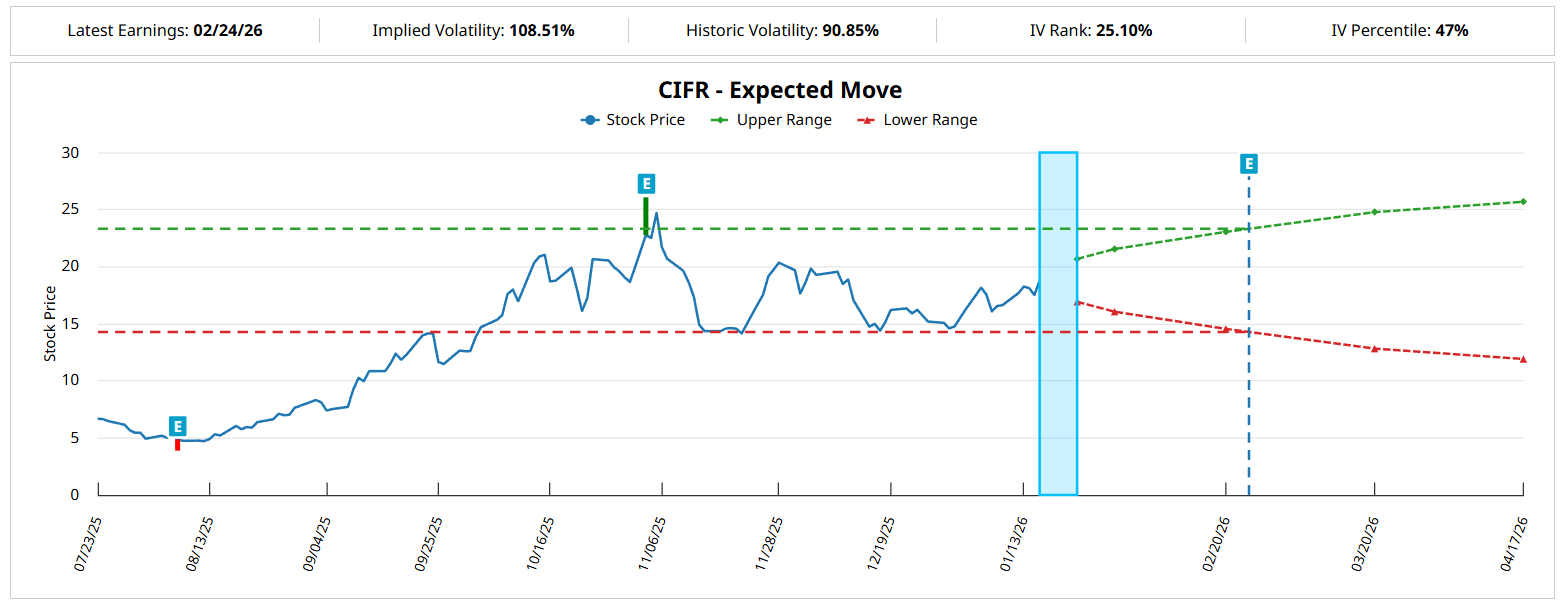

If that wasn’t enough, implied volatility (IV) data suggests that CIFR stock may see a sizable swing in either direction for the Feb. 20 options chain. Under the Black-Scholes-derived Expected Move calculator, CIFR may range from $14.55 to $23.05, representing a symmetric high-low spread of 22.61%.

However, as a first-order analysis, we don’t know where in the dispersion CIFR stock is likely to end up. That’s where a second-order Markov property framework may help offer critical intelligence.

Leveraging the Practical Applications of the Markov Property for CIFR Stock

While Black-Scholes is the Wall Street standard for pricing derivative market contracts, the mathematical architecture represents a one-size-fits-all framework. Don’t get me wrong — I’m not saying that this formula is structurally flawed because of this dynamic. However, it’s important to note that the forward probabilities derived from Black-Scholes may not be optimal.

For example, the “probability of profit” of CIFR stock reaching approximately $22 by Feb. 20 is defined as roughly 31.7%. However, this probability presupposes that the reality of CIFR’s kinetic movements is best described by the Black-Scholes formula. That’s a major presupposition that the claimant must demonstrate.

In other words, a true analysis should never end at the probability of profit. Instead, you as the reader should be presented an empirical case that attempts to determine whether this metric optimally defines reality. In the case of CIFR stock, I believe the Black-Scholes pricing is suboptimal, leading to a contrarian opportunity.

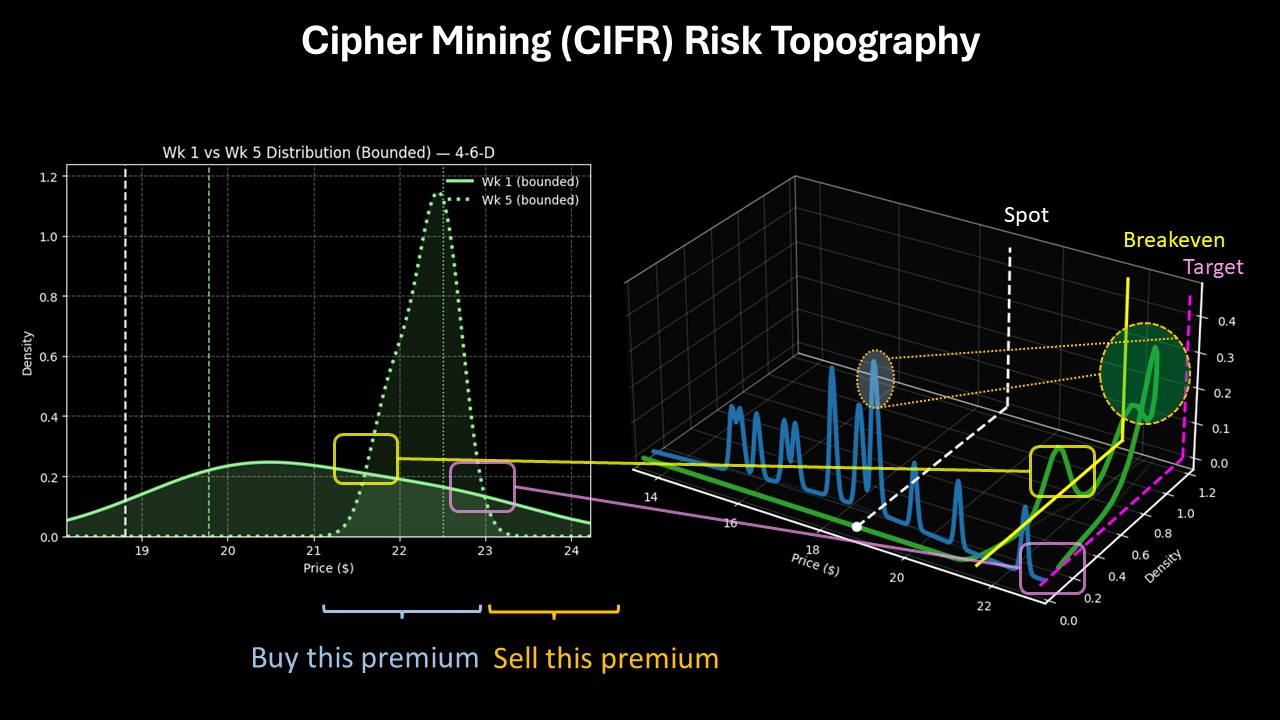

Under the Markov property, the future (behavioral) state of a system depends only on the current state. Regarding Cipher Mining, the security is under selling pressure. In the past 10 weeks, CIFR stock printed only four up weeks, leading to an overall downward slope. Therefore, we would expect this 4-6-D sequence to spark a different set of probabilities than had other sequences flashed.

Using past analogs, we can measure the unique response of the 4-6-D sequence across many trials. Over the next five weeks (thus coinciding with the Feb. 20 options chain), CIFR stock would be expected to generate peak probability density at around $22.50. With any luck, an outsized performance can potentially push CIFR to $23.

Going back to Black-Scholes, the $22.50 target certainly lands within the expected dispersion for the February options chain. However, if we were depending purely on Wall Street’s standard pricing model, we would have to buy (or sell) a sizable volatility spread, like an iron condor. However, if we believe that CIFR stock will likely reach $22.50, trading for downside volatility would be suboptimal due to the increased cost or risk exposure.

Taking a Directional Wager on Cipher Mining

With the market intelligence above, the trade that might make the most sense for aggressive speculators is the 21/23 bull call spread expiring Feb. 20. This wager involves two simultaneous transactions: buy the $21 call and sell the $23 call, for a net debit paid of $58 (the most that can be lost).

Should CIFR stock rise through the $23 strike at expiration, the maximum profit would be $142, a payout of almost 245%. Breakeven lands at $21.58, which greatly enhances the probabilistic credibility of the trade (since a Markovian second-order analysis would see CIFR’s probability density peak around $22.50).

To be clear, nobody knows what the future will hold. While Black-Scholes derives its probabilities from a parametric formula, the Markovian probability also assumes that the observed sentiment regime will stay consistent. Stated differently, we’re hoping that the collective response to the 4-6-D sequence will apply to the flashing of the same signal this time around.

It’s always possible, though, that CIFR stock could suddenly decide to act in an aberrant manner. Still, the beauty of the Markovian framework is that we’re betting on the power of observed frequency. Over many conditioned trials, patterns typically emerge.

More often than not, we’re better off trading with the patterns than trading against them. As such, speculators should keep close tabs on the 21/23 call spread.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Rising Crypto Sentiment Could Make Cipher Mining (CIFR) a Strong Bullish Options Trade

- ETHA: The ‘Other’ Crypto ETF Is About to Step Out of Bitcoin’s Shadow

- This Trump-Linked Penny Stock Just Regained Nasdaq Compliance. Should You Buy It for 2026?

- MicroStrategy Just Exponentially Increased Its Bitcoin Purchases. What Does That Mean for MSTR Stock?