Micron (MU) stock is pushing meaningfully higher on Jan. 2 after a senior Bernstein analyst, Stacy Rasgon, issued a constructive note in it favor.

Today’s rally drove MU’s near-term relative strength index (9-day) into the mid-70s, which is often interpreted as the overbought territory.

Including today’s gains, Micron shares are trading at nearly 5x their price in April 2025.

Why Does Bernstein Remain Bullish on Micron Stock?

Stacy Rasgon expects MU stock to push higher mostly because he sees “the largest pricing upcycle in the memory sector” ahead.

According to him, the artificial intelligence (AI)-driven demand for DRAM will materially exceed supply, driving prices to record levels in 2026.

On Friday, the Bernstein analyst maintained his “Outperform” rating on the semiconductor firm and raised his price target to $330, indicating potential upside of another 16% on its previous close.

A 0.15% dividend yield and billions in authorized share repurchases make Micron Technology all the more attractive as a long-term holding.

Note that MU came in handily above Street estimates in its latest reported quarter on Dec. 17.

MU Shares Are Super Cheap for an AI Name

Bernstein expects DRAM prices to climb as much as 25% in the first quarter of 2026.

Last month, Micron’s revenue guidance for its fiscal Q2 ending Feb. 26 topped consensus estimate by a staggering $4.5 billion, reinforcing Rasgon’s view on the expected price hikes.

Most importantly, despite its meteoric rally, Micron stock is currently trading at a forward earnings multiple of less than 10x only, which is super cheap for a company riding the AI tailwinds.

Plus, MU currently sits decisively above its major moving averages (50-day, 100-day, 200-day), suggesting bulls remain fully in control across multiple timeframes.

How Wall Street Recommends Playing Micron

An exciting combination of robust fundamentals and uniquely attractive valuation is keeping Wall Street analysts positive on Micron shares for the next 12 months.

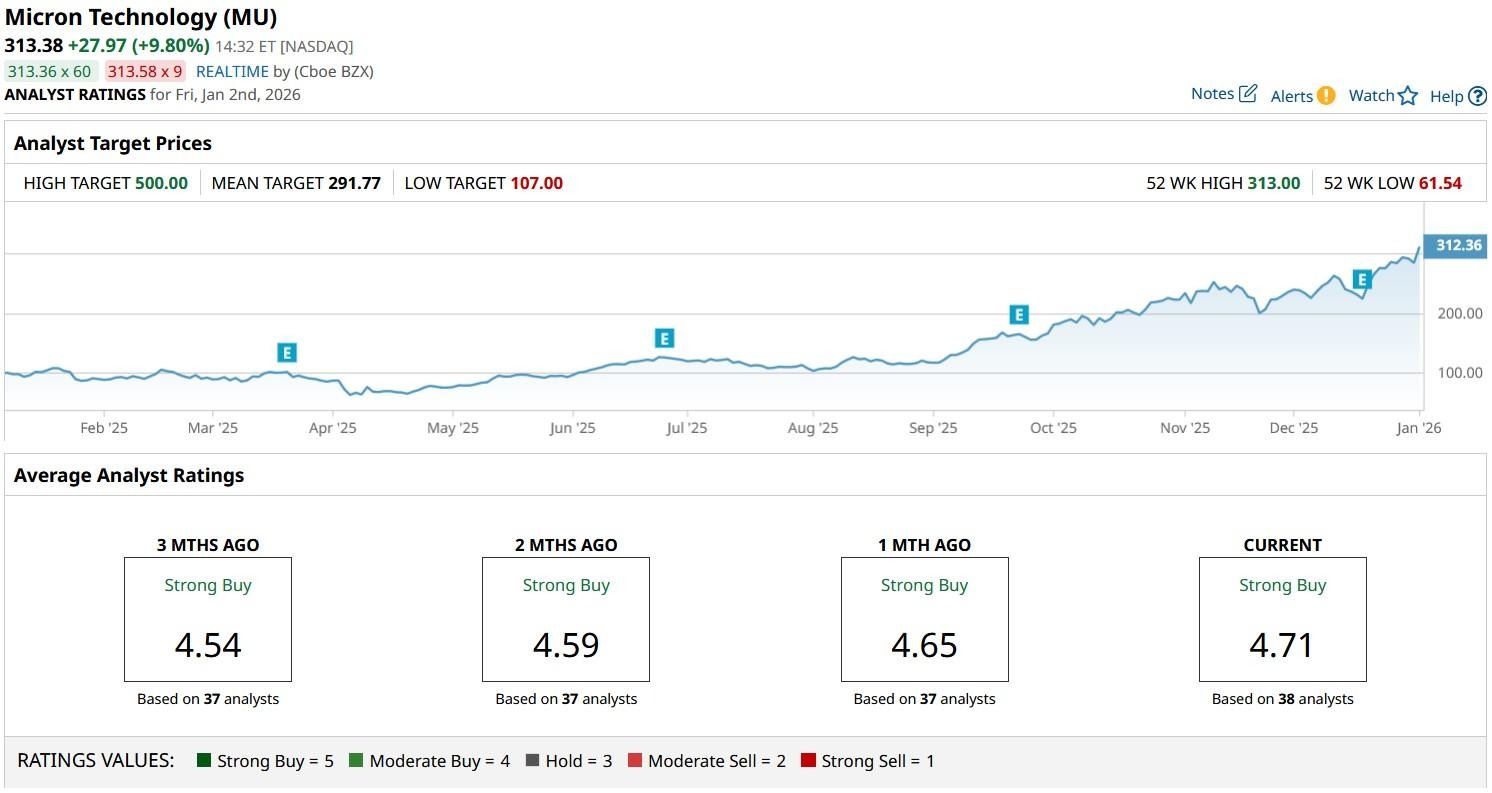

According to Barchart, the consensus rating on MU shares remains at “Strong Buy” with price targets going as high as $500 indicating potential upside of a whopping 60% from current levels.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Under-the-Radar AI Company Could Be the Best Stock You Buy in 2026.

- LRCX Outperformed in 2025, but Valuation and Options Activity Flag 2026 Risks

- Micron Stock Just Moved Into Overbought Territory After Massive 2025 Run. Is It Too Late to Buy MU Shares?

- Super Micro Computer Just Launched a New AI Server. Should You Buy SMCI Stock Today?