ResMed Inc. (RMD), headquartered in San Diego, California, manufactures, distributes, and markets medical devices and cloud-based software applications. Valued at $35.7 billion by market cap, the company offers a range of products for respiratory disorders, including diagnostic tools like ApneaLink Air and NightOwl, cloud-based platforms like AirView and myAir for patient monitoring, and U-Sleep for HME providers, connectivity solutions, as well as out-of-hospital software solutions. The sleep tech giant is expected to announce its fiscal second-quarter earnings for 2026 in the near future.

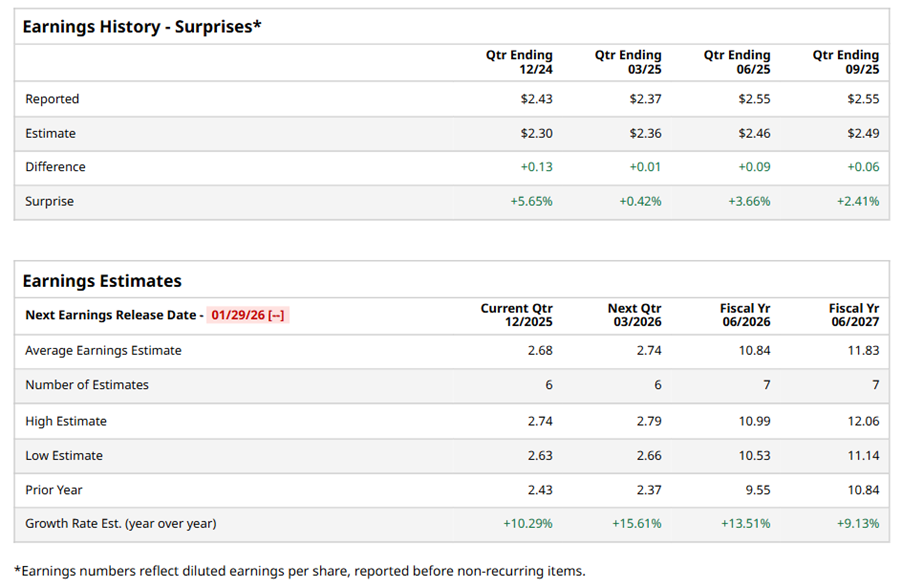

Ahead of the event, analysts expect RMD to report a profit of $2.68 per share on a diluted basis, up 10.3% from $2.43 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect RMD to report EPS of $10.84, up 13.5% from $9.55 in fiscal 2025. Its EPS is expected to rise 9.1% year over year to $11.83 in fiscal 2027.

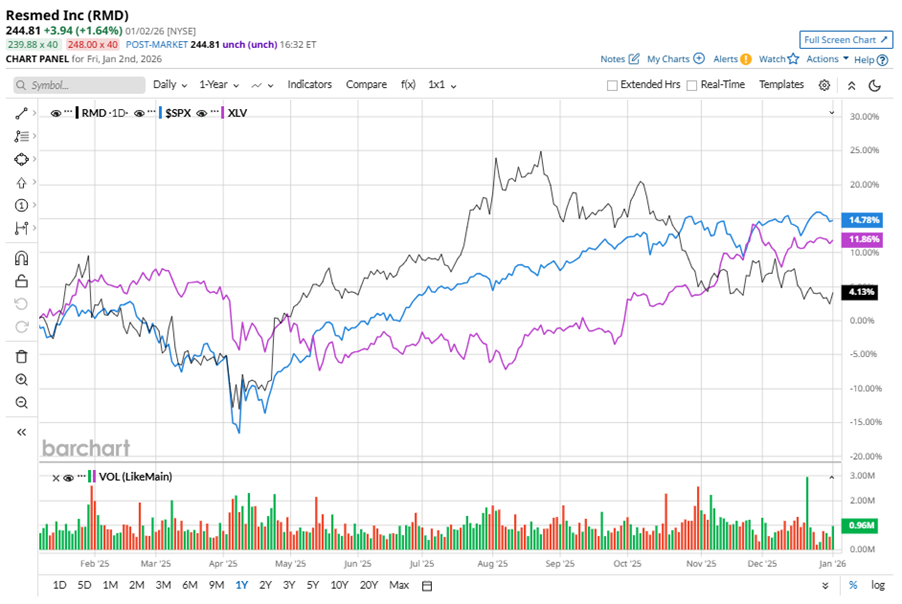

RMD stock has underperformed the S&P 500 Index’s ($SPX) 16.9% gains over the past 52 weeks, with shares up 7.2% during this period. Similarly, it underperformed the Health Care Select Sector SPDR Fund’s (XLV) 13% returns over the same time frame.

On Oct. 30, RMD shares closed down marginally after reporting its Q1 results. Its adjusted EPS of $2.55 surpassed Wall Street expectations of $2.49. The company’s revenue was $1.34 billion, topping Wall Street forecasts of $1.32 billion.

Analysts’ consensus opinion on RMD stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 19 analysts covering the stock, eight advise a “Strong Buy” rating, two suggest a “Moderate Buy,” eight give a “Hold,” and one recommends a “Strong Sell.” RMD’s average analyst price target is $289.38, indicating a potential upside of 18.2% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- CES 2026, Sector Rotation and Other Key Things to Watch this Week

- Tesla Stock Has Been Flat For 2 Months - How to Make a 3.2% Yield in One-Month Puts

- GOOGL Stock Rocked in 2025, But Is Google’s 2026 Forecast as Bright?

- The Saturday Spread: How Basketball Analytics May Help Extract Alpha (CPNG, DBX, BBY)