Intel (INTC) shares gained more than 6% on Jan. 7 after Daniel Rogers, the semiconductor firm’s vice president of PC products, confirmed plans of launching a new gaming chip and a platform.

On Wednesday, the titan also unveiled its Core Ultra Series 3 processors, its first built on the 18A process, that reportedly outperform predecessors by a staggering 77% on gaming.

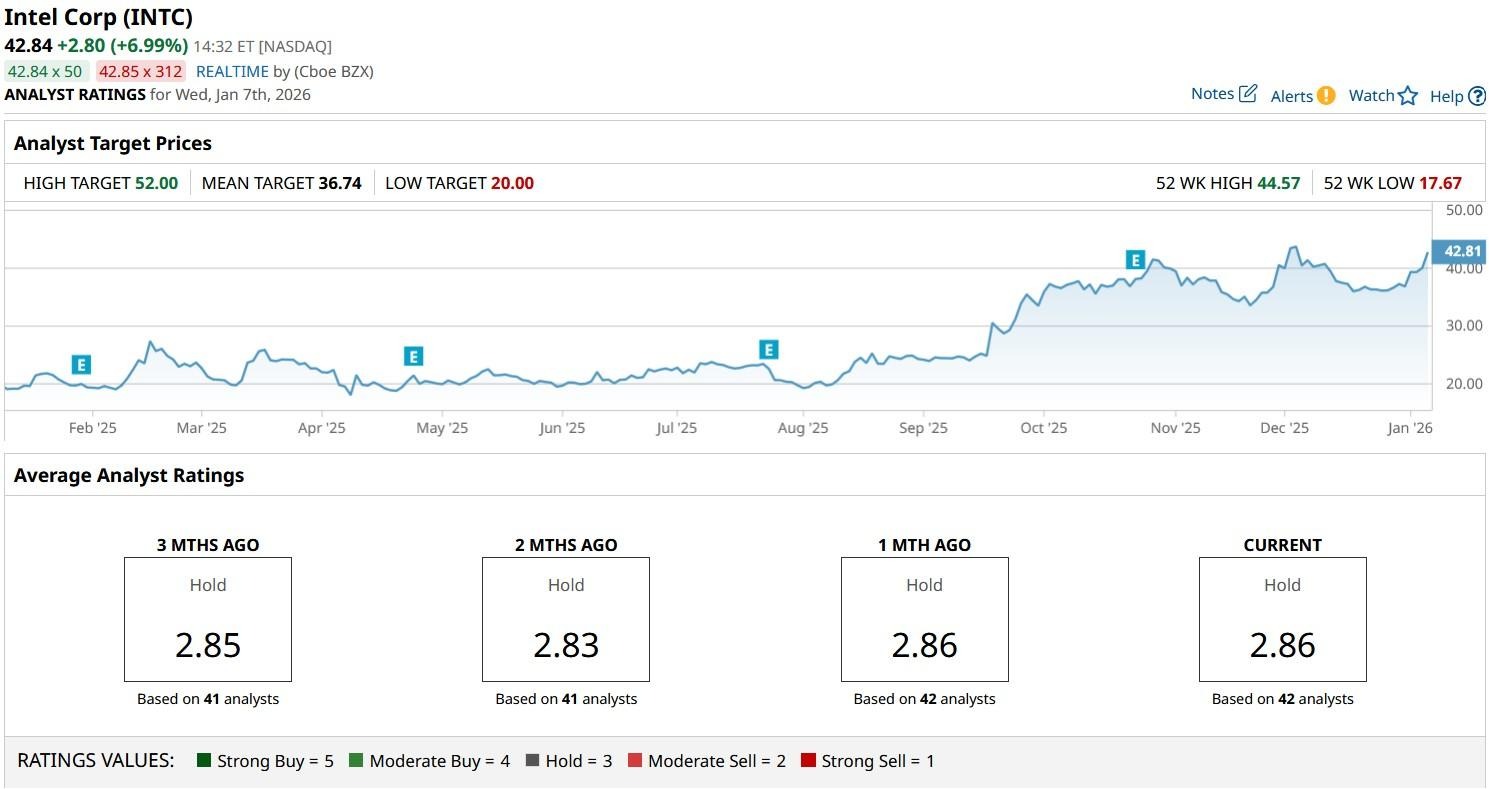

Following today’s rally, Intel stock is up roughly 140% versus its 52-week low.

What Panther Lake Processors Mean for Intel Stock

Intel’s CES 2026 launch of its Core Ultra Series 3 “Panther Lake” processors is largely bullish for the stock as it confirms the company’s much-anticipated 18A node does indeed work at scale.

Moreover, the chips’ massive performance gains, including 60% in multithreaded workloads, signal INTC is regaining competitiveness against rivals like Advanced Micro Devices (AMD) and Nvidia (NVDA).

Stronger product differentiation boosts confidence in Intel’s turnaround strategy, while showcasing execution on advanced manufacturing process reassures investors about long-term growth.

INTC’s stock price rally on Wednesday reflects optimism that these innovations can drive market share gains and improve profitability over time.

Why INTC Shares Are Worth Owning in 2026

While challenges remain, Intel shares are worth owning for long-term investors for a very simple reason: Taiwan Semi (TSM) can’t possibly produce enough chips to meet the rapidly increasing demand.

In other words, Intel is a fallback plan for global customers, and given the sheer scale of the chip demand, being a reliable substitute may still prove enough to trigger a multi-year rally in its stock.

INTC has received billions in investments from the likes of Nvidia, SoftBank (SFTBY), and even President Donald Trump’s administration, which reinforces its strategic importance in the global semiconductor supply chain.

Even from a technical perspective, Intel’s long-term relative strength index (100-day) sits at about 58 only despite a meteoric rally since last April, further substantiating that the bull run isn’t over just yet.

Wall Street Recommends Caution on Intel

On the flip side, Wall Street analysts recommend caution in playing INTC shares at current levels, since they may be due a correction following the aforementioned surge.

The consensus rating on Intel stock sits at “Hold” only, with the mean target of about $37 indicating potential downside of nearly 14% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart