What are the odds that quantum computing specialist IonQ (IONQ) manages to pop higher from now over a given time period? While I’m obviously focused on IONQ stock at the moment, this basic question has been asked rigorously by leading mathematicians and scientists for the last hundred years or so. That’s one of the underlying themes behind “The Physics of Wall Street: A Brief History of Predicting the Unpredictable” by James Owen Weatherall.

However, it also occurred to me that, throughout the book, there was no mention of Andrey Markov. That’s probably because the Russian mathematician was focused on studying stochastic processes in the abstract and (to my knowledge) not really caring about the financial markets. Still, this doesn’t mean Markov’s probabilistic philosophy, where the future state of a system depends only on the present state, isn’t useful.

Let’s talk about football. Suppose someone asked, what is the probability that the next play is a pass (instead of a run)? There would be two legitimate answers. You could reference the general statistic over the course of a modern NFL season, where passes generally hover around 60% to 65% of all plays. However, this stat is only useful as an informational scaffolding; tactically, this knowledge is rather useless.

If Markov were still alive — and a football fan — he would almost certainly say it would depend on the current state of the system. If the offense is behind late in the fourth quarter with the clock ticking, the next play is almost guaranteed to be a passing play.

My contention is that IONQ stock or any other (especially popular) public security operates very much like football strategies. I don’t believe in a probability of tomorrow as a static entity but rather as a branch. Therefore, how I respond to the market will depend on what the market reveals at the line of scrimmage.

Right now, IONQ stock is signaling for a sizable move. As such, it may be prudent to consider positioning yourself ahead of the potential wave.

Prepping for a Possible Swing Higher in IONQ Stock

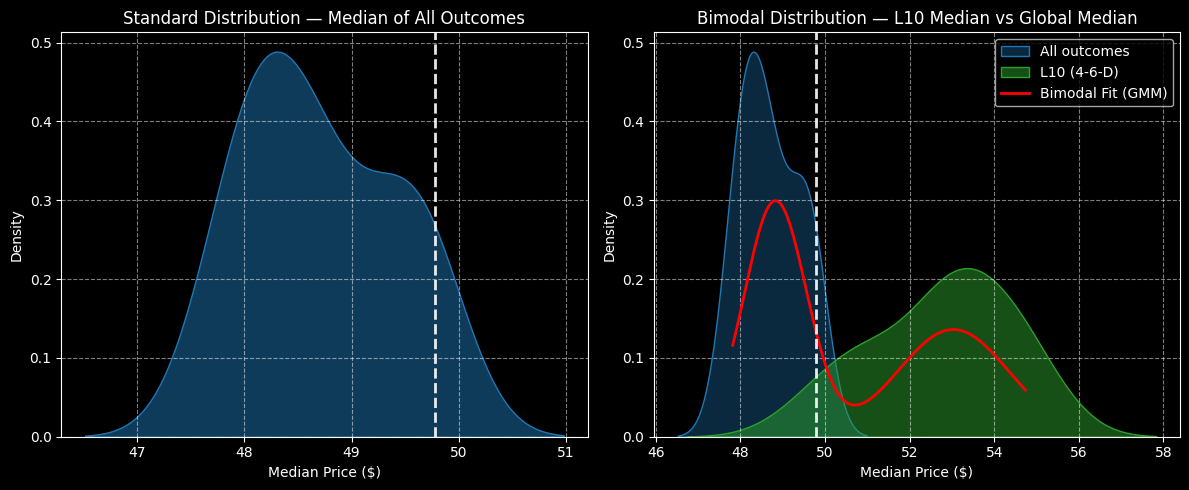

Under ordinary circumstances, any given long position held for a 10-week period would likely land between $46.35 and $51 (assuming a spot price of $49.78). Most outcomes would be expected to cluster around $48.20, meaning that as an aggregate, IONQ stock suffers from a negative bias.

However, this is an interesting but tactically useless piece of trivia — it’s basically the equivalent of the passing-percentage-over-a-season inquiry. What we want to know is what might happen after the ball is snapped on the current play.

In that regard, IONQ stock has lined up in a 4-6-D sequence. In the last 10 weeks, IONQ printed only four up weeks, leading to an overall downward slope. Under this setup, the forward 10 weeks would be expected to have a positive bias, with outcomes likely to range between $47 and $58. Further, probability density would likely peak at around $53.50.

To use a football analogy, I would argue that IONQ stock is attempting to run a play-action pass. In the candlestick chart, there doesn’t appear to be anything special on the horizon. But from a quantitative view, IONQ bulls have historically responded well to periods of extended pessimism. Therefore, data-driven traders can jump ahead of the coming route and potentially grab an interception.

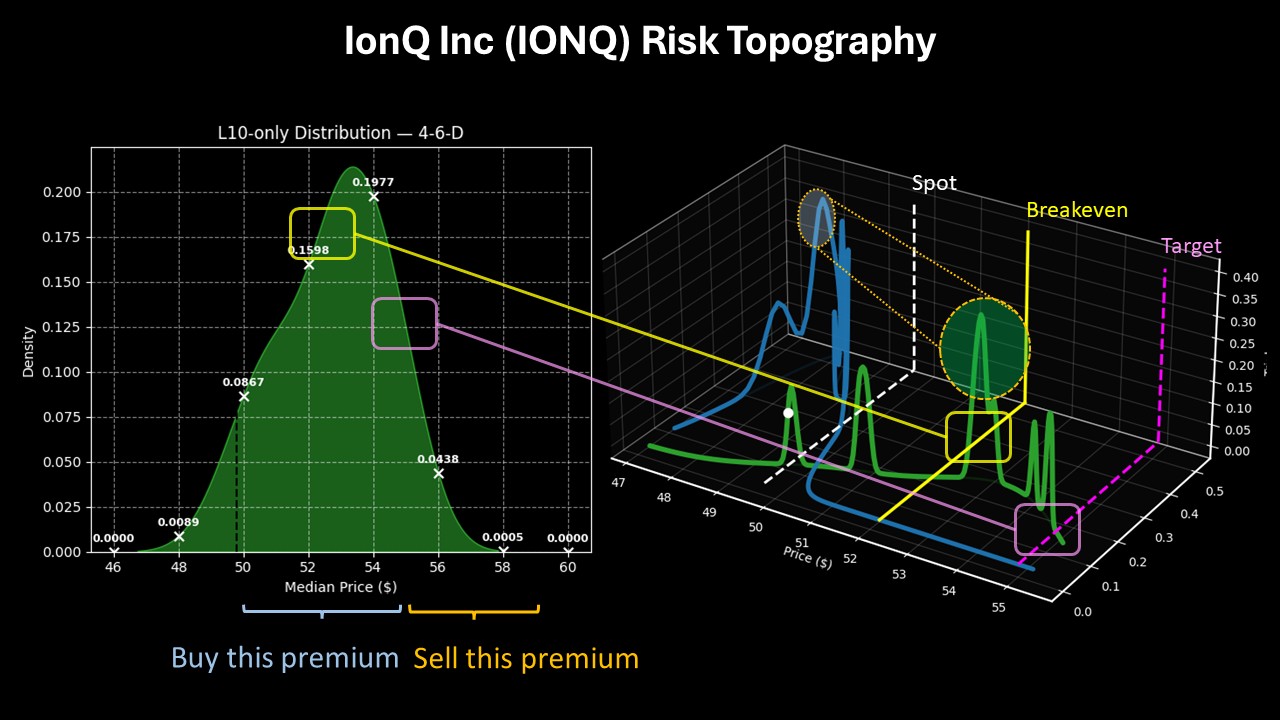

Looking at risk topography — a three-dimensional view of demand structure — we can get a better view of how the play may pan out. Risk topography covers three elements: expected (terminal) price, probability density and population occurrence. With the first two elements already discussed, it’s the latter element that raises intrigue.

Essentially, traders may anticipate heightened activity between $52 and $55 over the course of the next 10 weeks. At the conclusion of this fixed period, IONQ stock tends to terminate (resolve) at $53.50. But given the population data, it’s not inconceivable that the terminal price could end up being higher.

Choosing an Enticing Options Spread

Among the available ideas for a directional upside wager, I’m most intrigued by the 50/55 bull call spread expiring Feb. 20, 2026. Here, the proceeds from the sale of the $55 call are used to partially offset the debit paid for the $50 call, with the idea that we’re targeting the realistic side of IONQ’s expected distributional curve. If the stock manages to rise through the $55 strike at expiration, the maximum payout clocks in at over 127%.

To be sure, the above call spread is ambitious. However, one thing that tames the aggression is the breakeven price, which sits at $52.20. That’s very close to where probability density should peak under 4-6-D conditions, adding statistical credibility to the trade.

Ultimately, nobody knows for sure how the future will pan out — and I don’t have any special insight as to where IONQ stock will go. However, we know that based on similar structural patterns, an upside move may be more likely. If you want to follow the data, the 50/55 bull spread may be a prudent idea.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart