For decades, nuclear energy was the “black sheep” of the power sector as high costs and safety concerns kept it on the sidelines. Today, nuclear power is being rediscovered as the “gold standard” for the clean energy transition.

The reason is simple: we need more electricity than ever before. Between the massive power requirements of AI data centers and the global shift toward electric vehicles (EVs), the grid is under pressure.

Compared to solar and wind energy, which are intermittent, nuclear energy provides “baseload” power. It runs 24/7, emits zero carbon, and is reliable. In this article, I have identified three nuclear energy stocks you can buy in 2026 and benefit from the “nuclear renaissance.”

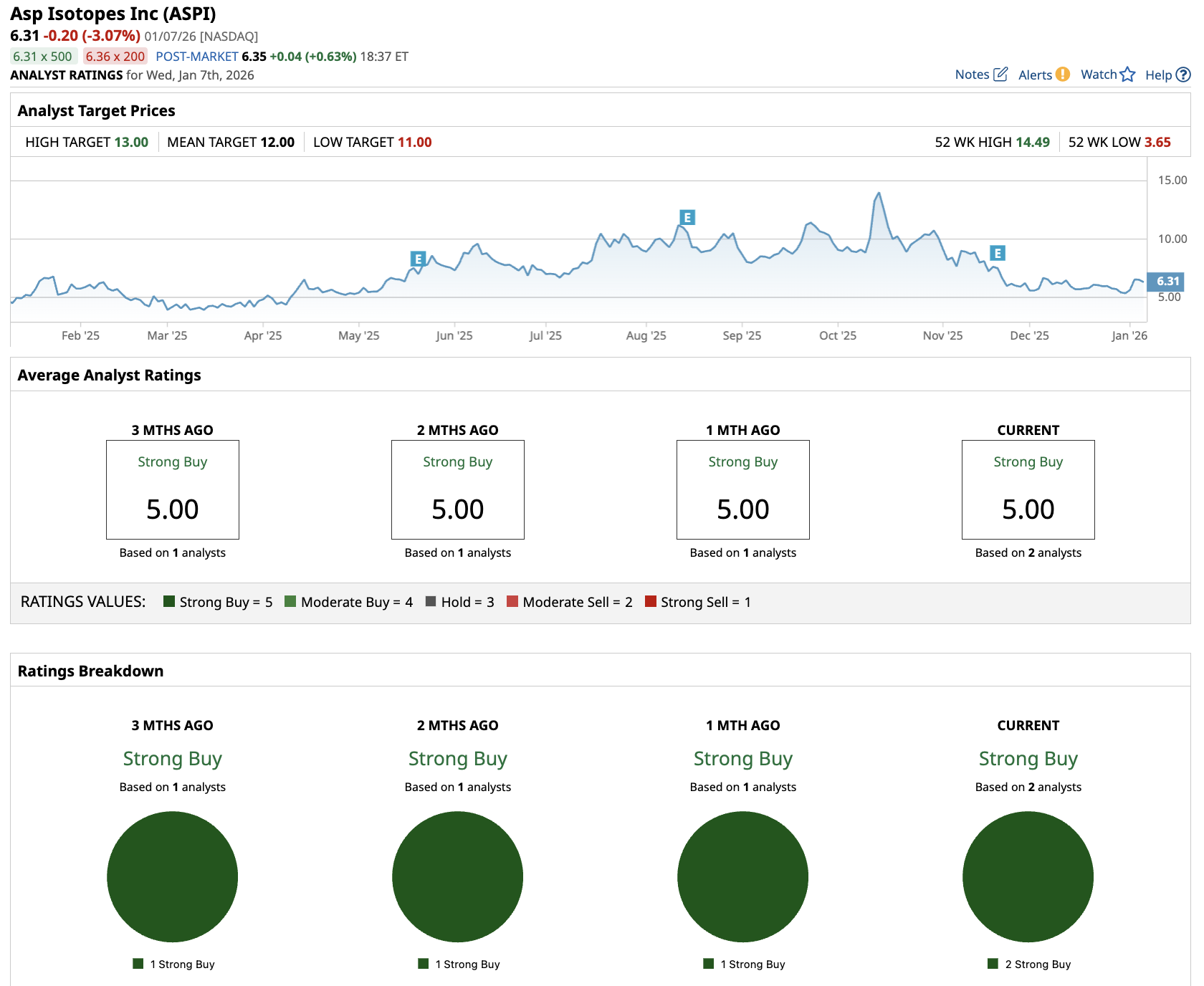

ASP Isotopes (ASPI): High-Risk, High-Reward

If you’re looking for a high-risk, high-reward opportunity, ASP Isotopes (ASPI) should be on your radar. ASPI focuses on the “fuel” side of the equation, which includes the enrichment process.

To understand why ASPI is important, you have to look at the chemistry of uranium. Naturally occurring uranium is mostly U-238, which doesn't undergo nuclear fission. To power a reactor, you require U-235. The process of separating these is called enrichment, and very few companies in the world can do it efficiently. ASPI uses a proprietary process called Aerodynamic Separation, which is a more efficient and cost-effective method for producing specialized isotopes.

The big catalyst for 2026 is their focus on HALEU (High-Assay Low-Enriched Uranium). This is the specific fuel required for next-generation small modular reactors (SMRs). Currently, there is a massive global shortage of HALEU. By positioning itself as a primary supplier, ASPI is entering a highly lucrative niche.

The company recently raised over $72 million to build an enrichment facility in South Africa. It also acquired Renergen Limited, which adds helium production to its business. This gives ASP a more stable revenue stream as it scales up its nuclear business.

In the first nine months of 2025, ASP lost close to $100 million. It ended Q3 with $113 million in cash, suggesting ASPI will need to raise additional capital to cover its operating expenses.

Two analysts covering ASPI stock have a “Strong Buy” recommendation. The mean stock price target is $12, above the current price of $6.31.

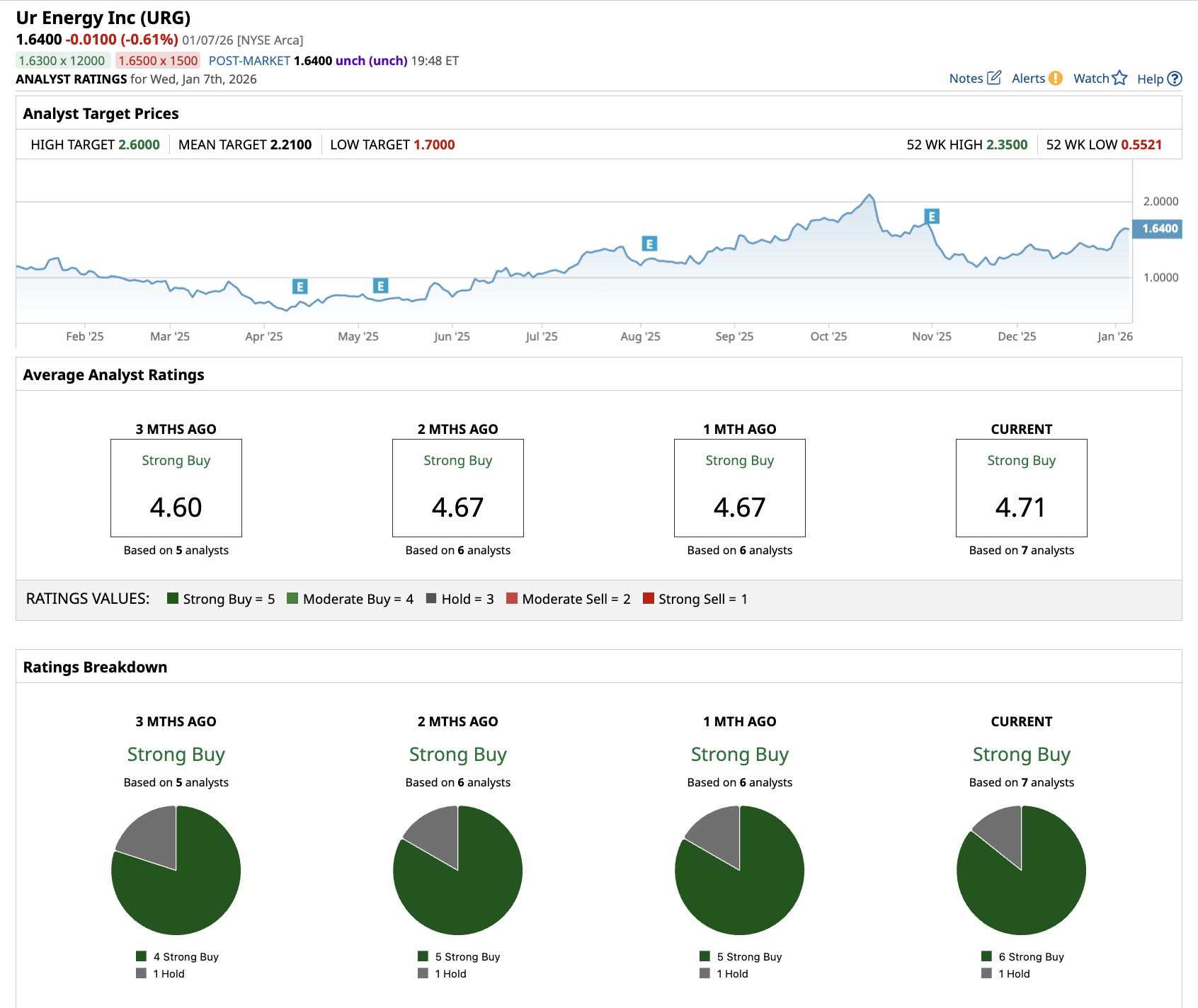

Ur-Energy (URG): A Bet on American Energy Independence

If ASPI is the “tech” play, Ur-Energy (URG) is the “resource” play. In recent years, geopolitical tensions have made the U.S. government very nervous about relying on foreign countries for nuclear fuel.

This has led to a massive push for homegrown uranium, and Ur-Energy is perfectly positioned to benefit from this shift toward energy independence. Ur-Energy uses a method called in-situ recovery at its Lost Creek facility. Think of the method like using a straw to pull minerals out of the ground rather than digging a massive hole. It’s cheaper, faster to set up, and much better for the environment than traditional mining.

Currently, Ur-Energy is ramping up production. Although it faced minor maintenance hurdles in late 2025, the new Shirley Basin project is expected to go live in 2026, doubling production capacity.

In early 2025, the U.S. government issued executive orders aimed at quadrupling nuclear capacity by 2050. This includes potential tariffs on imported uranium, which would make Ur-Energy’s domestic product even more valuable.

With eight long-term contracts already in place and a clear path to increasing production, Ur-Energy is a solid choice for investors who want exposure to the raw materials side of the nuclear boom.

Out of the seven analysts covering Ur-Energy, six recommend “Strong Buy,” and one recommends “Hold.” The average URG stock price target is $2.21, above the current price of $1.64.

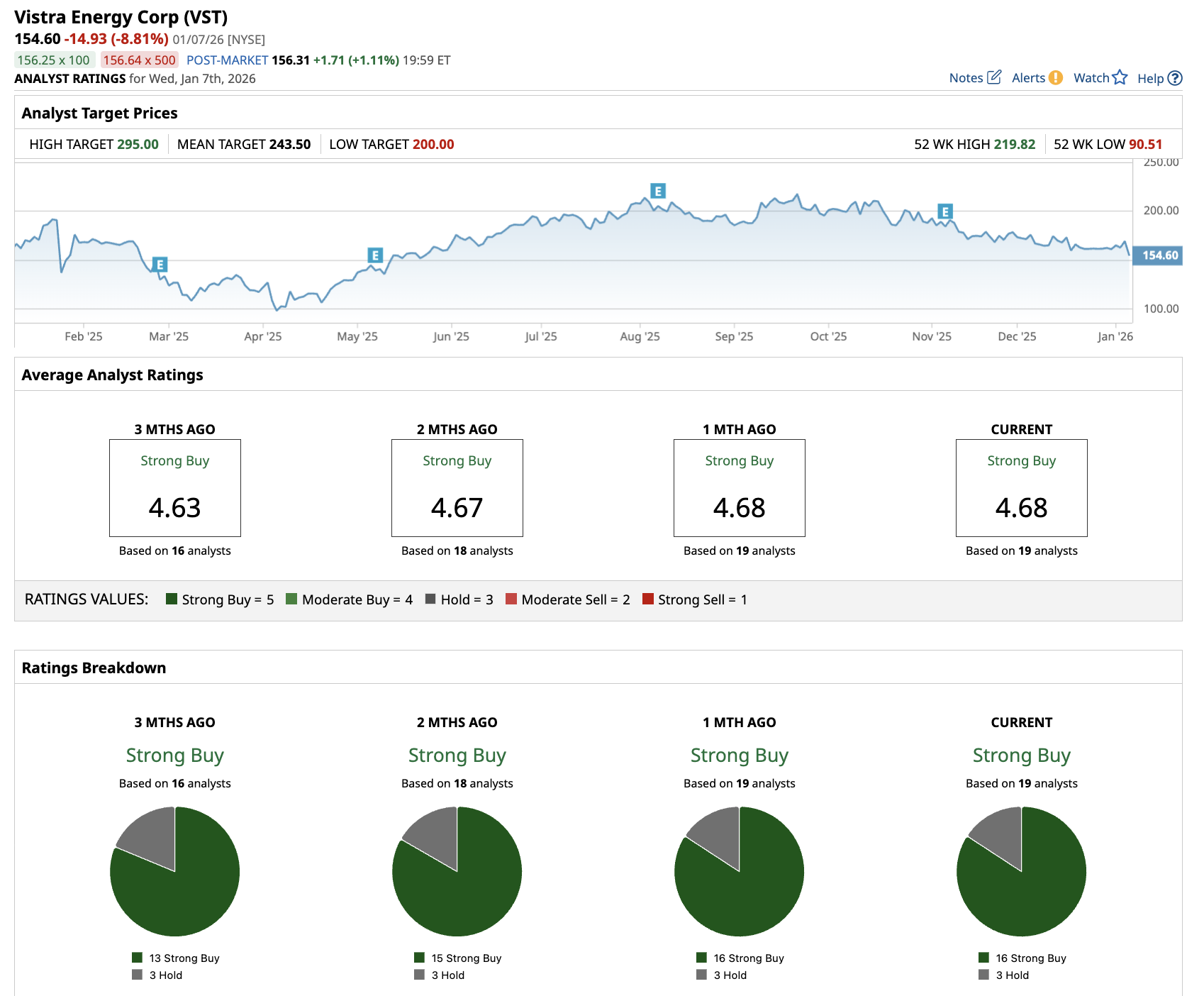

Vistra Energy (VST): The AI Powerhouse

Finally, we have Vistra Energy (VST), which is among the largest power producers in the U.S. AI data centers require an incredible amount of electricity and need it to be “clean” to meet corporate ESG goals, making Vistra’s nuclear fleet the perfect solution.

In late 2025, the company signed a massive 20-year deal at its Comanche Peak facility to provide 1,200 megawatts of power to a single customer. The contract provides Vistra with a stable revenue stream for decades.

As more tech giants scramble for carbon-free power, Vistra sits on some of the most valuable infrastructure. Meanwhile, it is also returning massive amounts of cash to shareholders. Since late 2021, it has bought back about 30% of its shares, which has translated to solid EPS growth. VST is forecast to end 2025 with an EPS of $6.60 per share, up from $1.57 per share in 2022.

Management expects adjusted EBITDA to jump from around $5.8 billion in 2025 to $7.6 billion in 2026. Vistra offers the stability of a utility company and combines it with the high-growth potential of the AI boom.

Out of the 19 analysts covering Vistra Energy, 16 recommend “Strong Buy,” and three recommend “Hold.” The average VST stock price target is $243, above the current price of $155.

The "Trade of the Decade" might just be nuclear energy. We are moving into a world where electricity demand is skyrocketing, but carbon emissions must go down, and nuclear energy is a solution that bridges that gap.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart