If there ever was a national emergency related to the rise of self-directed investors, the use of option-driven ETF strategies would be it. That “emergency” takes place every day now, in the form of only accounting for a partial range of possible outcomes.

This has become such an issue for me, as someone who really wants to see investors DIY successfully, that I even turned those last four words in the previous paragraph into an acronym: ROPO. As a reminder, I’m talking about the “range of possible outcomes.”

First, every trader has to decide for themselves how hands-on they want to be. When you look at a ticker like the YieldMax Alphabet Option Income Strategy ETF (GOOY), that yield calls out to you. Great company, monster yield, sign me up! But wait, there’s more.

GOOY: You Are Getting Paid, But You Are Not Very Protected.

Investors need to ask themselves: Is it “worth it?” That depends on what you think you’re buying. If you buy GOOY, you are outsourcing your decision-making to a synthetic covered call strategy. You get the income, yes, but you’ve effectively capped your upside while remaining almost entirely exposed to the downside.

The DIY investor sees that huge “distribution rate” and thinks they’ve found a loophole in the laws of physics. They haven’t. They’ve just engaged in a ROPO trade. One with a high range of possible outcomes. That includes a downside blowout, but not an upside surge.

But if you buy call options, like my colleague here Mark Hake recently recommended, you can only lose what you put up. That’s why, alongside collars and buying puts, that’s my personal favorite route for most option trades. Because when I buy options, I can’t lose any more than I put up. So I put up only what I’m willing to lose. Yes, you can make analogies to going into the casino with $100 cash and your wallet up in your hotel room!

When you sell puts, there’s a double-edged sword, similar to that of GOOY’s structure. You get paid on the assumption the stock won’t drop big and suddenly. But in my experience, earnings season is now hunting season for bears. It might work out, but is it worth the risk to pick up what is a nice annualized yield? Again, a very individual decision. I’ve never sold a put in my life, despite doing thousands of option trades. But that’s me, one investor. With a desire to keep ROPO low.

The other aspect of this is whether a trader wants control over the specifics of the option setup. With GOOY, you are transferring that responsibility to someone else.

The Ooey-Gooey Case for GOOY

If the long call option doesn’t pan out because the stock falls, so be it. But if the puts are sold and the stock drops well below that level, it is just like having a stop-loss order into a bad earnings event. One day at 4 p.m. Eastern, you are just fine, thinking you are protected. The next morning at 9:30 a.m. Eastern, you are not.

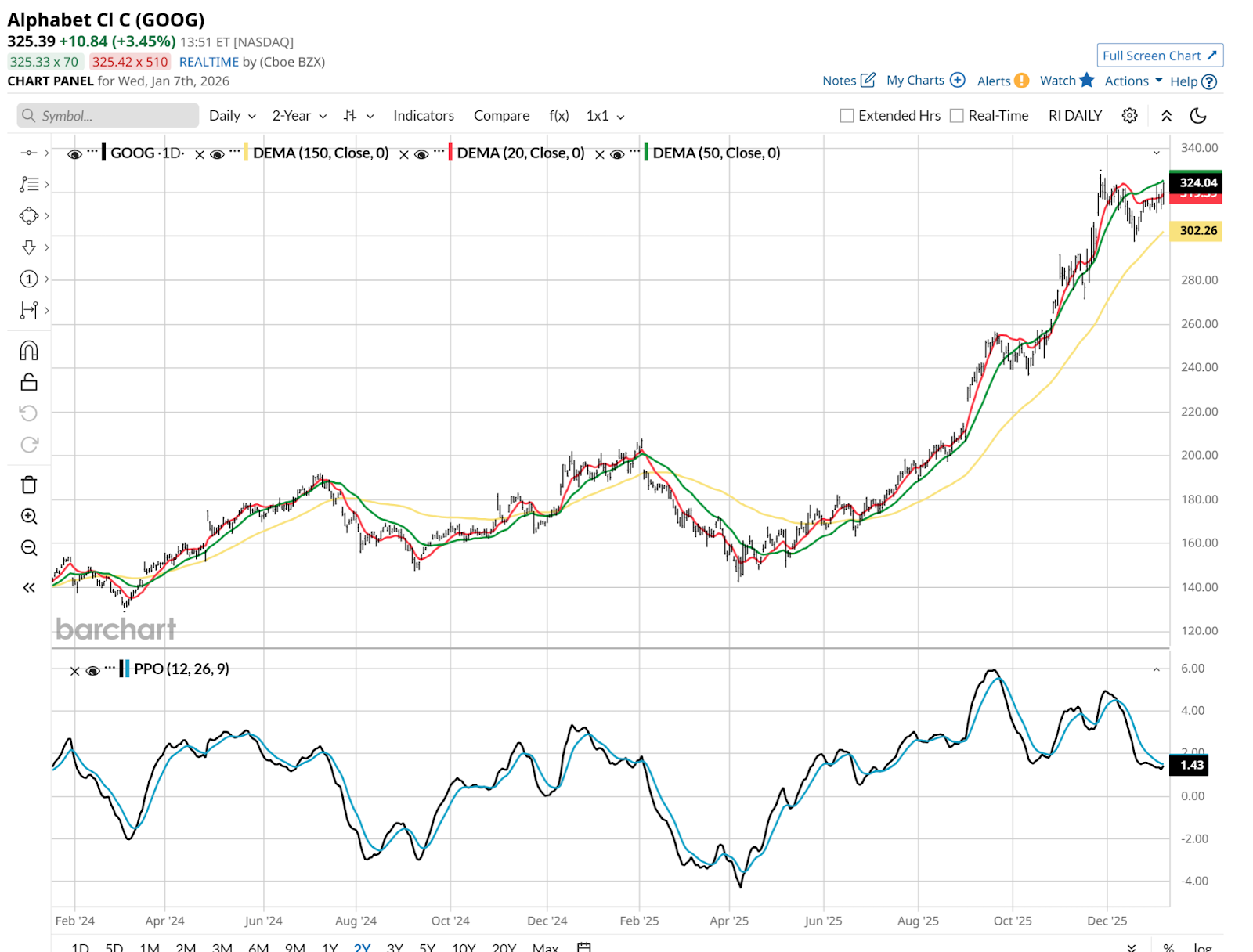

Case in point: Google (GOOG) (GOOGL) itself, the underlying equity for GOOY.

The stock has had four different days since 2020 in which it fell by at least 7% overnight. GOOY loses a bit less when that happens, at least initially. But the protection fades after that because the protective feature of the option income is quickly used up. And that renders GOOY as a holding that suddenly has experienced a similar downside to the stock, and the income has become your own money paid to you. Not profits.

You can be the one defining the ROPO, if you want to. Don’t just trade for the outcome where things stay “okay.” Trade for the outcome where things get weird. Because in 2026, things always get weird.

The Barchart option screeners are tools for range management. Use them to take back the steering wheel.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer. For more of Rob’s research and investor coaching work, see ETFYourself.com on Substack. To copy-trade Rob’s portfolios, check out the new Pi Trade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart