Lockheed Martin (LMT) stock remains in focus after President Donald Trump passed an executive order disabling defense companies from returning capital to shareholders in the form of dividends and buybacks.

Trump’s new mandate directly threatens LMT’s dividend yield that currently sits at about 2.67%, a key attraction for income-focused investors who have relied on the firm’s historically consistent capital returns.

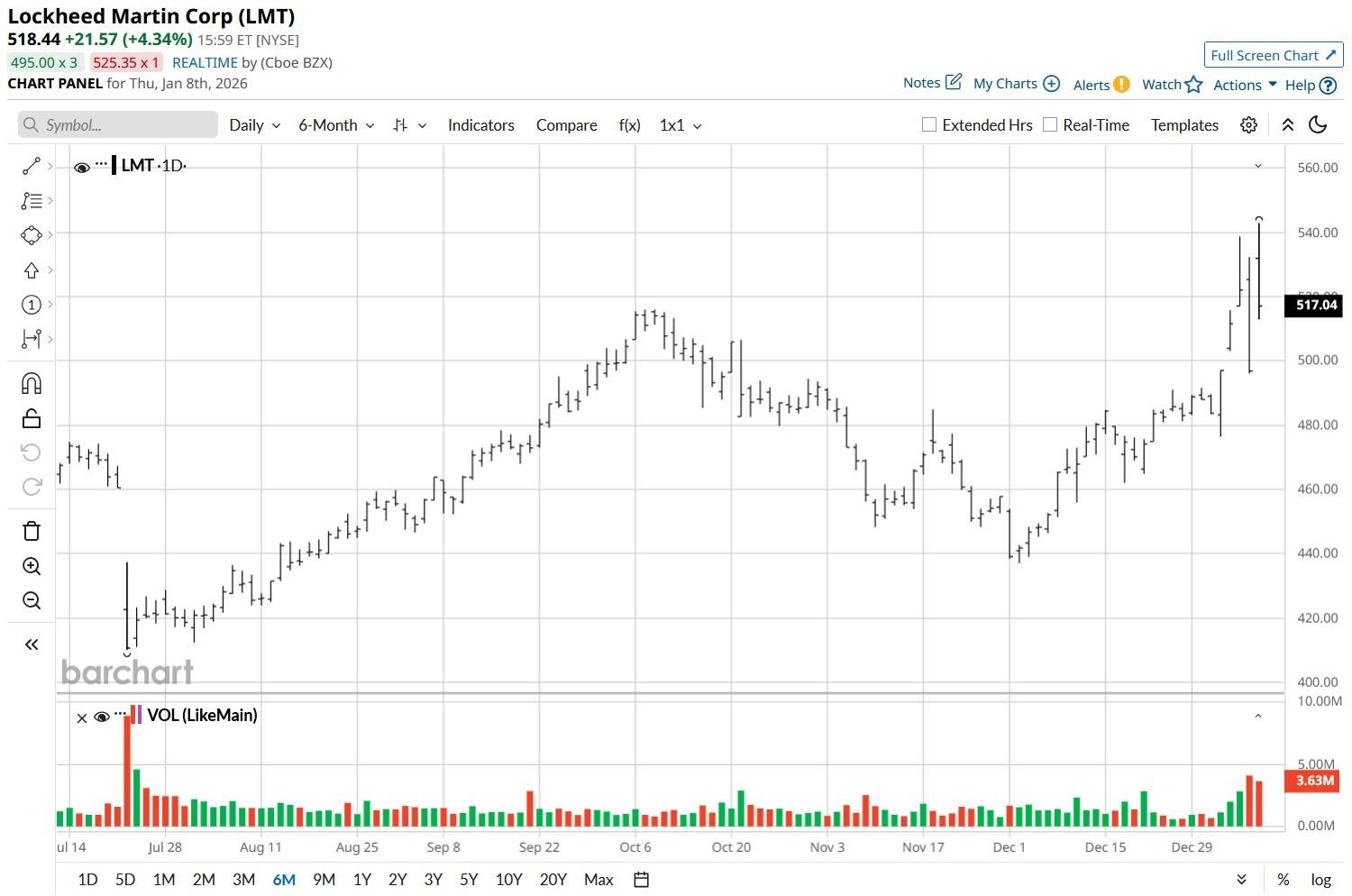

At the time of writing, Lockheed Martin stock is up nearly 26% versus its 52-week low.

Lockheed Martin Stock Is Still Worth Buying

Despite this structural headwind, LMT stock remains attractive because the president subsequently proposed a massive $1.5 trillion defense budget for fiscal 2027, nearly double the $850 billion last year.

This enormous increase in defense allocation more than offsets dividend concerns and indicates robust future revenue opportunities for the multinational based out of Fort Worth, Texas.

The Pentagon’s recent seven-year contract to more than triple Patriot missile production to about 2,000 further reinforces the long-term revenue potential for defense contractors like Lockheed Martin.

Meanwhile, continued geopolitical tensions in Ukraine, Taiwan, and the Middle East remain a key tailwind for the NYSE-listed firm as well.

Technicals Favor Investing in LMT Shares

At the time of writing, Lockheed Martin shares are trading at a price-to-sales (P/S) ratio of about 1.59x only, which means they aren’t particularly expensive to own in 2026.

In terms of technicals, the defense and aerospace manufacturer sits decisively above its key moving averages (MAs), with the long-term relative strength index (100-day) at 54, signaling potential for continued upward momentum ahead.

Note that LMT came in handily above Street expectations in its latest reported quarter. At the time, its management also raised its earnings outlook for the full-year.

This fundamental and technical strength keeps Susquehanna analysts bullish on Lockheed Martin, with a price target of $590.

How Wall Street Recommends Playing Lockheed Martin

Other Wall Street analysts also recommend sticking with LMT shares in 2026.

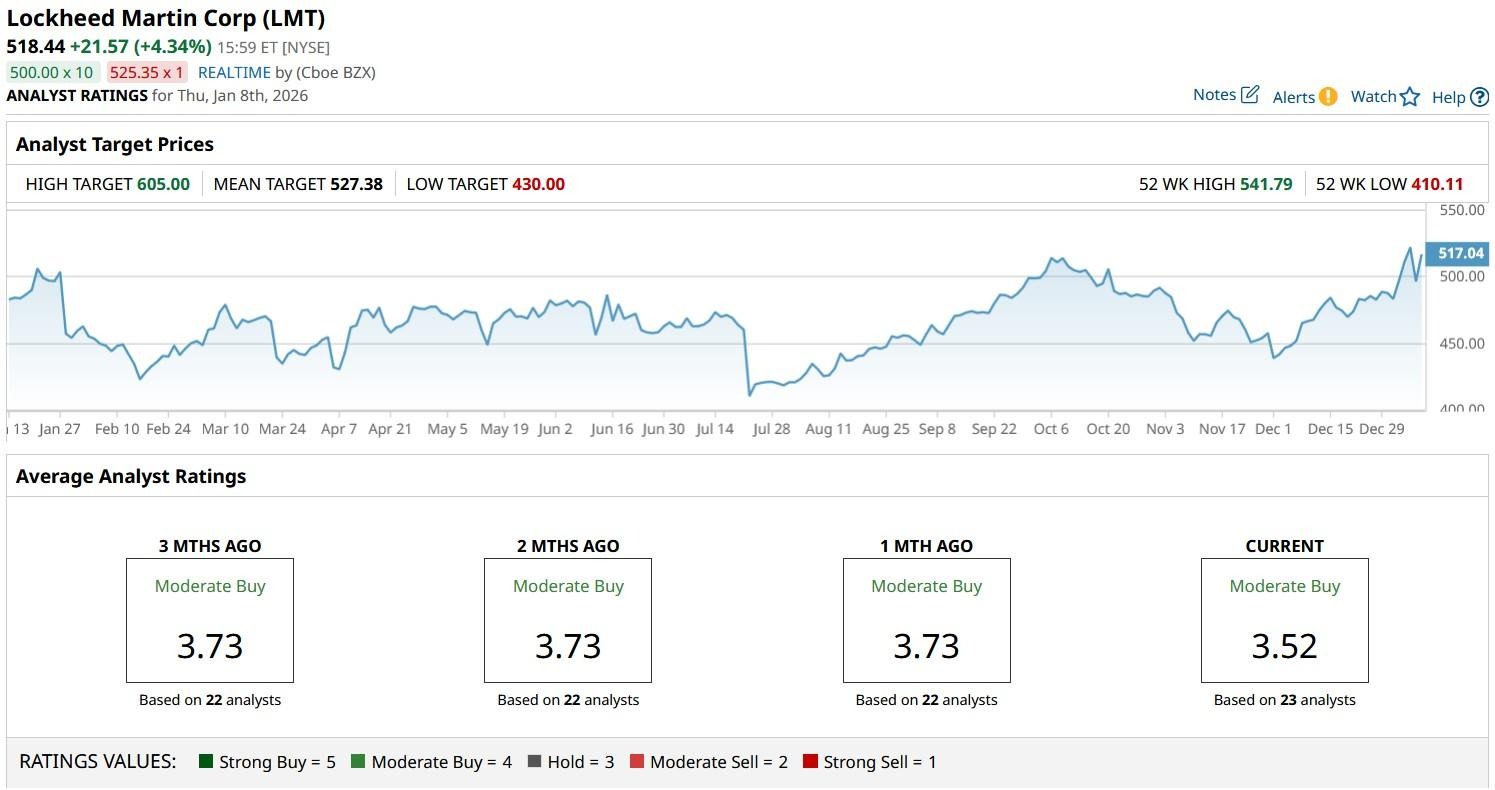

According to Barchart, the consensus rating on Lockheed Martin stock remains at “Moderate Buy” with price targets going as high as $605, indicating potential upside of about 15% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart