With a market cap of $75.4 billion, Corning Incorporated (GLW) is a global materials science company operating across optical communications, display technologies, environmental technologies, specialty materials, and life sciences, serving telecommunications, consumer electronics, automotive, and scientific markets. The company delivers advanced glass, ceramics, and optical solutions worldwide.

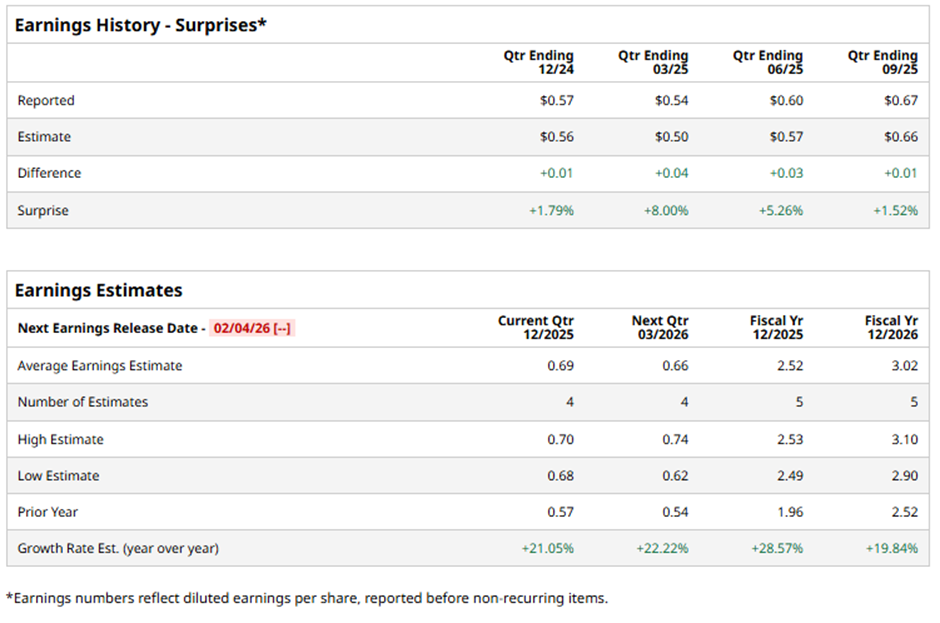

The Corning, New York-based company is slated to announce its fiscal Q4 2025 results soon. Ahead of the release, analysts expect GLW to report adjusted EPS of $0.69, a 21.1% increase from the $0.57 in the year-ago quarter. It has exceeded Wall Street's earnings expectations in the past four quarters.

For fiscal 2025, analysts predict the specialty glass maker to report adjusted EPS of $2.52, a 28.6% surge from $1.96 in fiscal 2024.

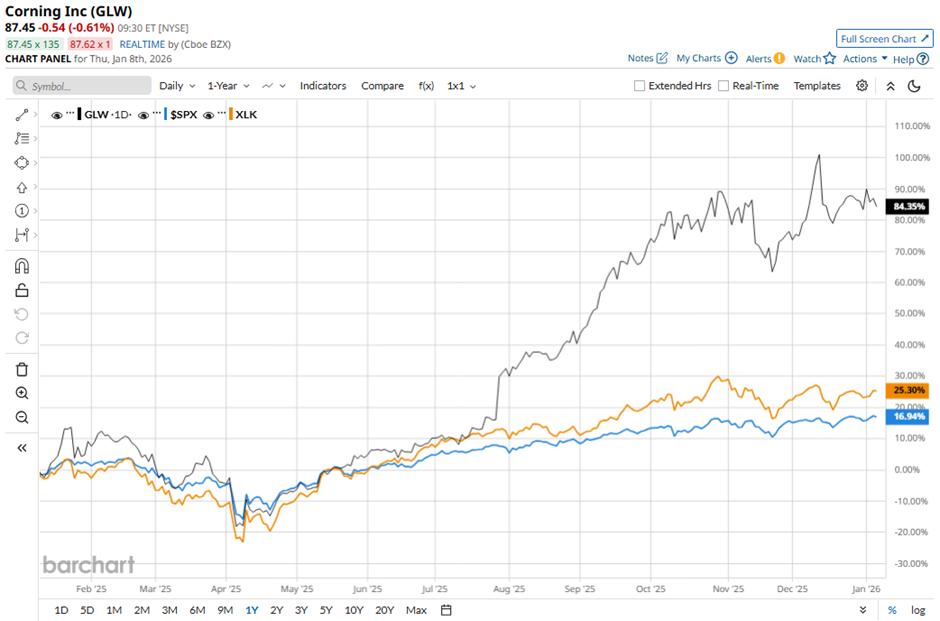

Shares of Corning have soared 83.3% over the past 52 weeks, significantly outpacing the broader S&P 500 Index's ($SPX) 17.1% gain and the State Street Technology Select Sector SPDR ETF's (XLK) 24.9% return over the same period.

Despite beating expectations with Q3 2025 adjusted EPS of $0.67 and core sales were $4.27 billion, Corning shares fell 3.3% on Oct. 28 as its largest business - optical communications posted net sales of $1.65 billion, missing analyst expectations. Investors were also concerned about pressure on its fiber business from slower network spending in China and a 37.9% anti-dumping tariff imposed on Corning’s optical fiber products.

Analysts' consensus view on GLW stock remains strongly optimistic, with a "Strong Buy" rating overall. Out of 13 analysts covering the stock, 10 recommend a "Strong Buy" and three "Holds." This configuration is slightly less bullish than three months ago, with 11 analysts suggesting a "Strong Buy."

The average analyst price target for Corning is $98.31, indicating a potential upside of 12.4% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cathie Wood Just Had a Comeback Year. This Controversial Stock Is Still Her Top Holding.

- Should You Buy the Dip in First Solar Stock?

- This AI Data Center Power Stock is About to Break Out. Spot the Trade as It Unfolds With This Chart Signal.

- This Covered-Call Google ETF Yields 41%. These 2 Option Trades Are Even Better.