Later Friday morning, US employment data for December will be released, immediately followed by heated debate amongst the “experts” along political rather than economic lines.

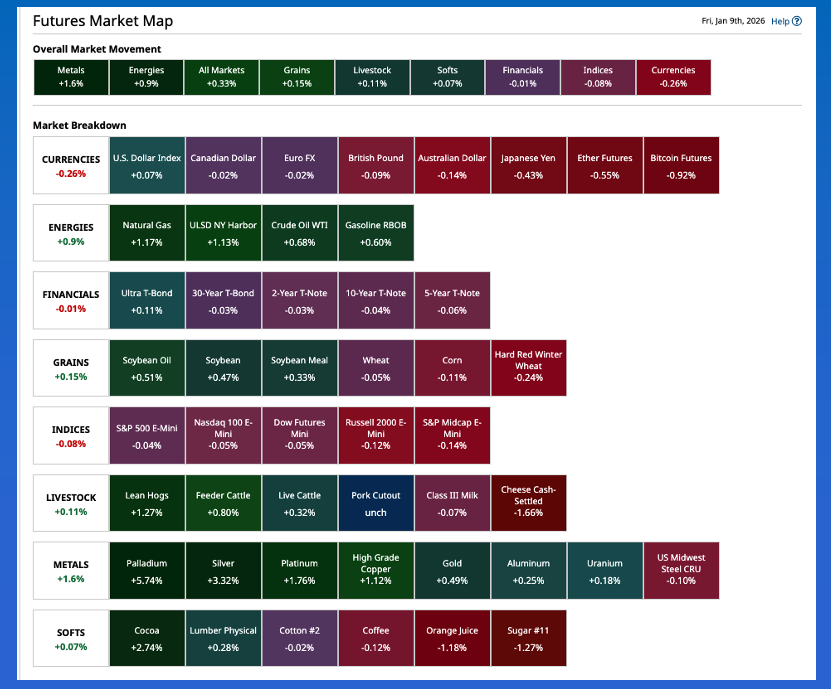

The commodity complex was mostly higher again pre-dawn Friday, with Metals and Energies leading the way.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.The next highly anticipated data dump, by many in the industry at least, is next Monday's January WASDE courtesy of USDA.

Morning Summary: The common theme of Friday morning’s market discussion[i] was to focus on the macro despite the “advice” from many telling us to pay attention to the individual distractions and diversions. In other words, we should be happy in our blissful ignorance rather than interested in the big picture. I found this a timely topic ahead of the government data dump over the next couple business days. Friday morning (8:30 ET) will see the release of the December US Employment report, including the unemployment rate and hourly wages. Average guesses for this set are reportedly 73,000 jobs, as compared to the November 64,000, 4.5% (4.6%), and 0.3% (0.1%). My interest in this particular dump is threefold: 1) How far off pre-report estimates tend to be, 2) Large revisions to previous dumps, leading to 3) Boisterous arguments amongst the “experts” basically divided on political rather than economic lines. Additionally, there was some talk about a possible US Supreme Court decision on the legality of the president’s tariffs coming in Friday. As I’ve said before, though, the US president isn’t overly concerned by what US courts, or Congress for that matter, do and/or say. The lead topic in markets was this week’s rally in both Brent (QAH26) and WTI (CLG26) crude oil.

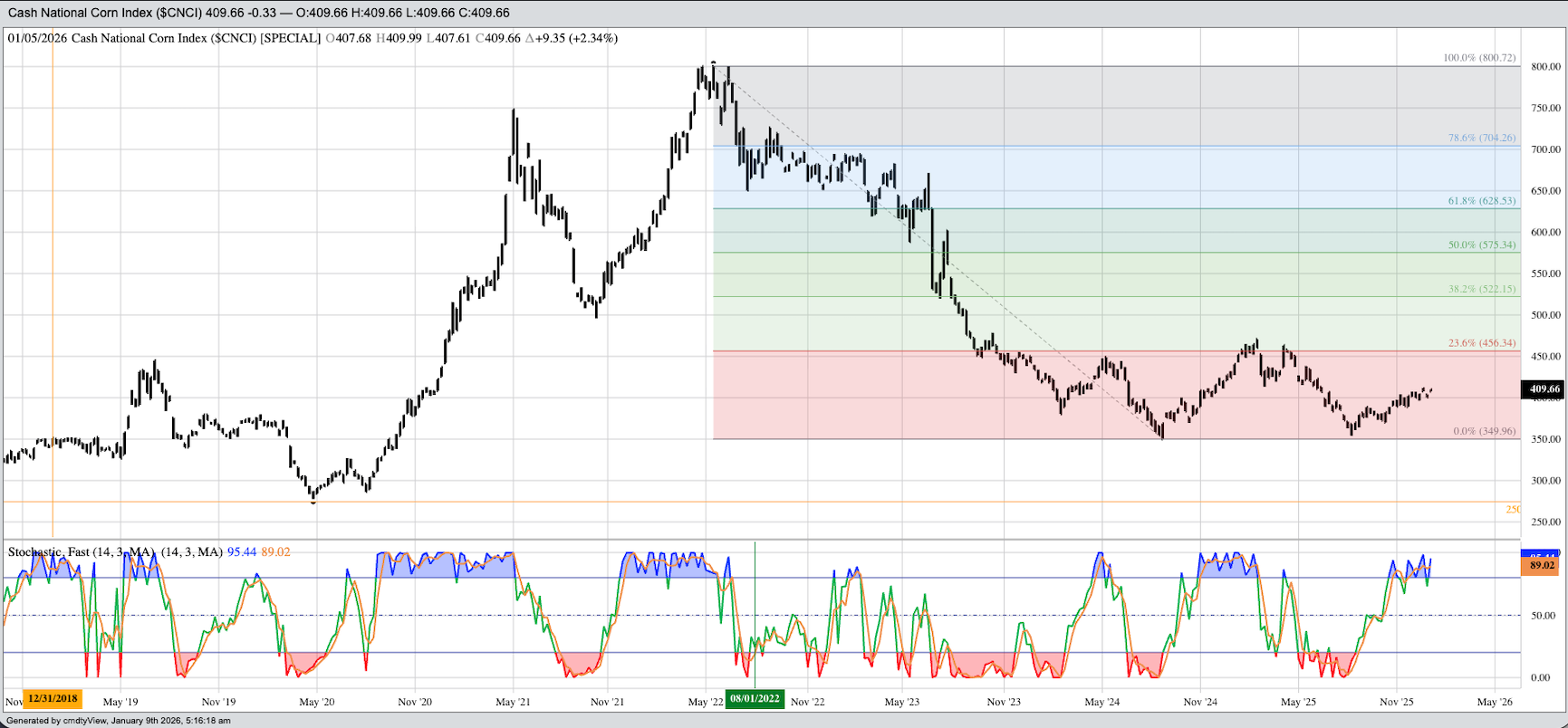

Corn: The corn market was quietly lower overnight through early Friday morning. The March issue was off 0.75 cent after posting a 1.25-cent trading range, all of it unchanged or lower on trade volume of about 12,000 contracts. Keep in mind the second data dump is next Monday’s January WASDE report courtesy of USDA. Let me be absolutely clear on this: The Grains sector will move on this dump. Historically it tends to be one of the more active report days of the year. But long-term investors understand the real supply and demand situation won’t change due to the dumping of a large quantity of imaginary numbers. That’s the reality many in the BRACE[ii] Industry can’t grasp. What are our real reads on corn’s supply and demand telling us pre-dawn Friday? The National Corn Index ($CNCI) was calculated at $4.0966 Thursday night, putting the Index in the lower 41% of its price distribution range based on weekly closes only from 2019. Additionally, the Index continues to run below previous 5-year end of month lows. Based on the Law of Supply and Demand, US supplies continue to outweigh demand. Further out, the May-July futures spread closed December covering 30% calculated full commercial carry as compared to 25% at the end of November.

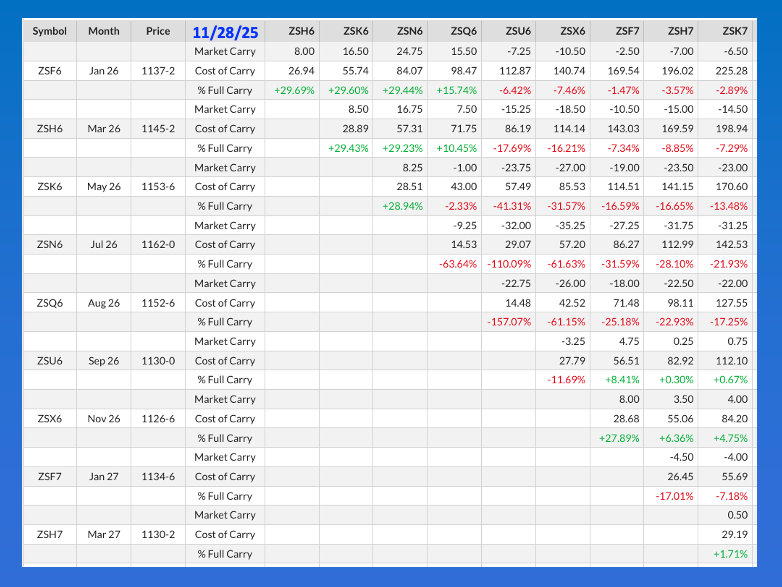

Soybeans: The soybean market was quietly higher at this writing. Here we see the March issue up 4.75 cents after rallying as much as 7.75 cents while registering only 12,500 contracts changing hands. As mentioned in Thursday’s Afternoon Commentary, daily changes in the soybean market’s total open interest reported by CME have been interesting this week. At yesterday’s close, this reportedly increased by 4,630 contracts despite decreases in January (145 contracts), March (1,460 contracts), and May (2,620 contracts). Yet July increased by nearly 6,300 contracts. A look back at Thursday’s session and we see the carry in the May-July futures spread strengthened by 1.5 cents, closing at 13.0 cents and covering 48% calculated full commercial carry. My read on this is the commercial side was rolling short futures positions forward from March and May to July indicating less expected demand for US supplies next summer. At the end of December this same spread covered 49% as compared to the end of November’s 29% indicating the commercial side grew more comfortable with Brazil’s 2026 production potential during December. As for the National Soybean Index ($CNSI), Thursday night saw it priced at $9.9023, still up about 21.0 cents for the month and holding above its previous 5-year end of January low at $9.7761.

Wheat: The wheat sub-sector was quietly lower pre-dawn Friday. (Having said that, it is probably safe to assume all markets will be quiet overnight for the foreseeable future.) The March HRW issue was down 3.0 cents at this writing, on its session low while registering fewer than 2,000 contracts changing hands. The nearby SRW issue was down 2.0 cents, also on its overnight low and showing trade volume of roughly 4,000 contracts. Closing out the trifecta we see March HRS sitting 0.5 cent lower, one tick off its session low on trade volume of 65 contracts. Pretty exciting stuff in wheat, right? The big picture in the sub-sector is that Watson – the noncommercial side – adjusts its futures position from time to time while real fundamentals aren’t changing. Thursday night saw the three National Cash Indexes come in at $4.6297 ($CSWI), $4.6039 ($CRWI) , and $5.5534 ($CRSI), all continuing to hold below previous 5-year end of January low prices set last year. Further out, all three are also running below previous 10-year average end of January prices. The bottom line for US wheat, again based on the Law of Supply and Demand, is simple: Low market price (Cash Indexes) mean supplies outweigh demand.

[i] On CNBC’s Squawk Box Europe

[ii] Brokers/Reporters/Analysts/Commentators/Economists who never saw a set of government numbers they didn’t believe were the most important thing they’ve ever seen.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart