Coinbase Global (COIN) is a leading U.S. cryptocurrency exchange, making digital assets easy to buy, sell, trade, and store. It offers a user-friendly platform with advanced tools for retail investors and institutions, including secure wallets, staking rewards, and its Base Layer-2 network for low-cost DeFi apps. Coinbase custodies billions in crypto, nearly 12% of all Bitcoin (BTCUSD), and powers the cryptoeconomy with services for spending, earning, and using tokens securely.

Founded in 2012, the company has a presence in over 100 countries and 100 million-plus users worldwide.

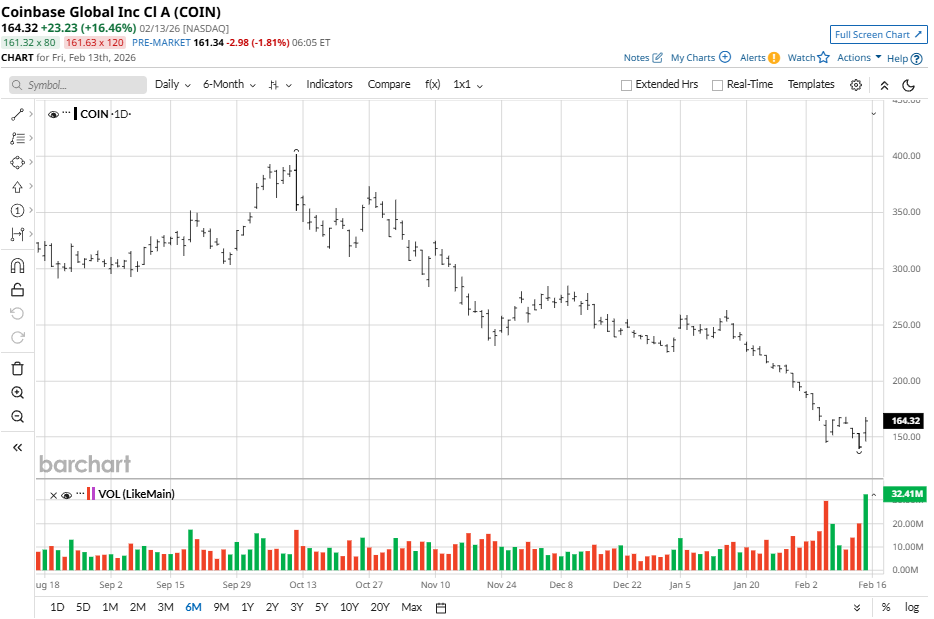

Coinbase Stock Continues to Struggle

Coinbase stock has been highly volatile in recent days. Its five-day performance is up by less than 1% while COIN stock has crashed 32% in the past one month. Coinbase has also lost 37% over the past three months and 38% in the past 52-week period. Shares are currently 63% below the 52-week high of $444.64 set back in July 2025.

Compared to the relevant S&P 500 Financials Index ($SRFI), which has also endured a tough period, Coinbase underperforms. The index has a 3.5% loss for the past one month and a flat performance for the past 52-week period. The sentiment is further supported over a longer time period; in a two-year frame, SRFI has a 32% return against Coinbase’s 9% loss.

Coinbase Reports Mixed Results

Coinbase released fourth-quarter 2025 results on Feb. 12 amid mixed crypto markets. Total revenue came in at $1.78 billion, down 22% year-over-year (YOY) but nearly matching analyst estimates of $1.79 billion, marking a slight miss. Non-GAAP EPS of $0.66 fell sharply from $3.37 last year and missed expectations, with the company citing lower trading fees.

Net revenue totaled $1.71 billion, with transaction revenue of $983 million slipping 37% YOY on softer volumes, offset by subscription and services growth of 14% to $727 million. Blockchain rewards were down 30%, but other services were up 13%.

GAAP net income swung to a loss amid increased costs, while adjusted EBITDA remained positive but was pressured. Coinbase's cash position was strong at $11.28 billion, with free cash flow supportive from ops and KPIs like Coinbase One subscibers, which hit an all-time high near 1 million.

For Q1 2026, Coinbase expects subscription and services revenue between $550 million and $630 million, as well as transaction expenses in the low-to-mid teens as a percentage of net revenue. Research & development and general & administrative expenses are expected to be between $925 million and $975 million, sales and marketing is anticipated between $215 million and $315 million, and stock-based compensation is expected at $250 million.

With the results, management highlighted doubled trading volumes and market share, product highs, and Base network growth for stablecoins and DeFi. The firm is eyeing regulatory wins and international expansion amid volatility.

Coinbase Gets an Analyst Downgrade

Monness, Crespi, Hardt analyst Gus Gala recently downgraded COIN stock to a “Sell" rating with a $120 price target, implying potential downside of 27% from current price levels, with a potential trough valuation near $100 based on 2026 estimates.

Gala slashed 2026 to 2027 forecasts, calling steady recovery hopes naive amid crypto bear markets that typically last 350 days from peak to trough. MCH sees weakness through the first half of 2026, with revenue, EBITDA, and EPS projected below consensus.

Despite long-term bullishness, near-term risks loom with a 50% stock drop since late 2025, declining trading volume share, falling monthly active users/downloads, and rising price competition. MCH prefers waiting for a better entry point over chasing a rebound from their prior target near the $300 level.

Should You Sell COIN Stock?

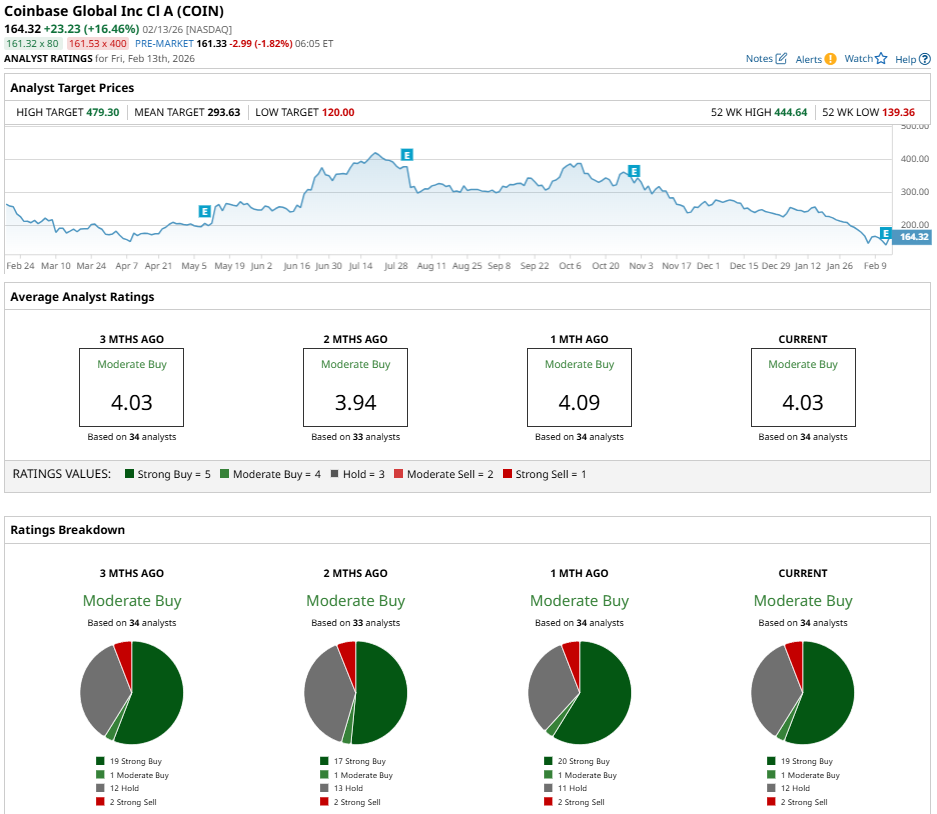

Coinbase stock continues to struggle and, while long-term bulls see value, near-term headwinds suggest otherwise. Analysts have a consensus “Moderate Buy” rating with a mean price target of $261.61, indicating potential upside of 60% from the curent market rate.

Out of 34 market experts with coverage, COIN stock has 19 “Strong Buy” ratings, one “Moderate Buy” rating, 12 “Hold” ratings, and two “Strong Sell” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart