With a market cap of around $132 billion, Medtronic plc (MDT) is a global medical technology company that develops, manufactures, and sells device-based therapies to healthcare providers and patients worldwide. It operates across cardiovascular, neuroscience, medical-surgical, and diabetes care, offering innovative solutions that address a wide range of chronic and acute conditions.

Shares of the Galway, Ireland-based company have lagged behind the broader market over the past 52 weeks. MDT stock has increased 13.5% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.2%. However, the stock has returned 7.3% on a YTD basis, outpacing SPX's 1.6% rise.

Looking closer, shares of the medical device company have also outperformed the State Street Health Care Select Sector SPDR ETF's (XLV) 6.1% return over the past 52 weeks.

Shares of Medtronic rose 4.7% on Nov. 18, 2025, after the company reported strong Q2 2026 results, with adjusted EPS of $1.36 and revenue of $8.96 billion, exceeding forecasts. Investor sentiment was further boosted by 6.6% reported revenue growth, standout 71% growth in Cardiac Ablation Solutions, and the company’s strongest cardiovascular revenue growth in over a decade, excluding the pandemic. Medtronic also raised its 2026 guidance, increasing expected organic revenue growth to ~5.5% and adjusted EPS to $5.62 - $5.66.

For the fiscal year ending in April 2026, analysts expect MDT’s adjusted EPS to grow 2.7% year-over-year to $5.64. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

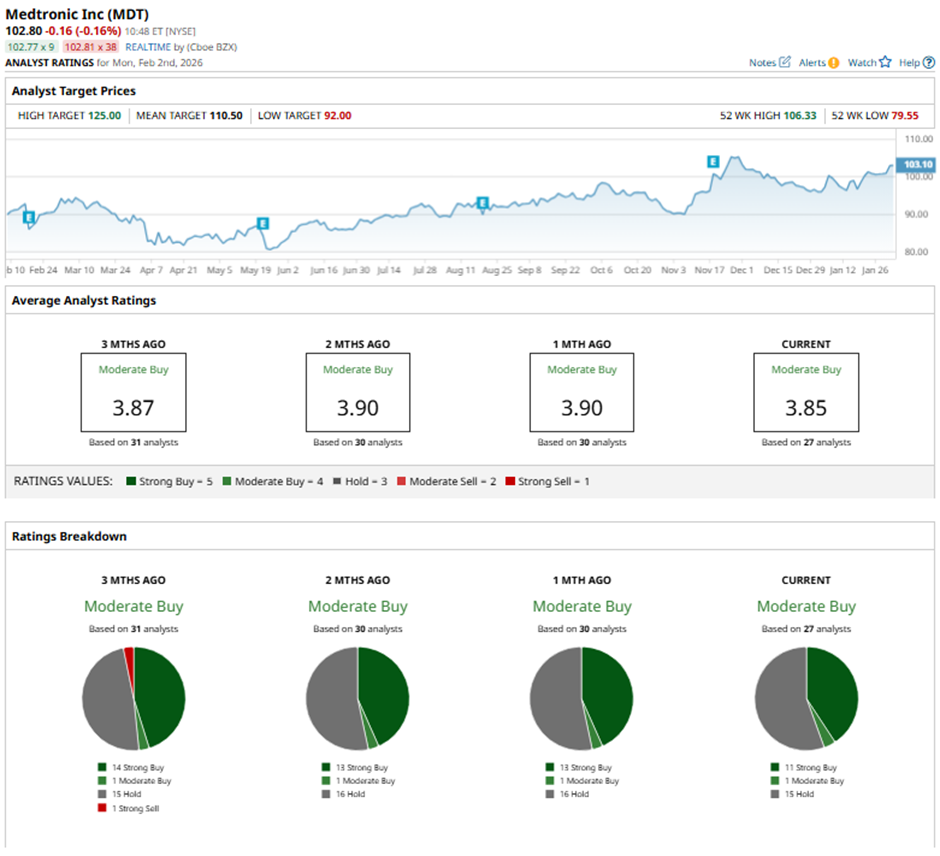

Among the 27 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, one “Moderate Buy,” and 15 “Holds.”

This configuration is less bullish than three months ago, with 14 “Strong Buy” ratings on the stock.

On Nov. 18, 2025, Evercore ISI raised its price target on Medtronic to $115 and maintained an “Outperform" rating on the stock.

The mean price target of $110.50 represents a 7.5% premium to MDT’s current price levels. The Street-high price target of $125 implies a potential upside of 21.6% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear Reddit Stock Fans, Mark Your Calendars for February 5

- Michael Saylor's Strategy Is Now Underwater on Bitcoin. Is The Dam Breaking Open?

- AMD’s Q4 Earnings Are Set To Impress: Should You Buy, Sell, Or Hold?

- ‘Solar Is Everything’: Tesla’s Elon Musk Says Other Energy Sources Are a Waste of Time, Like ‘a Caveman Throwing Some Twigs Into the Fire’