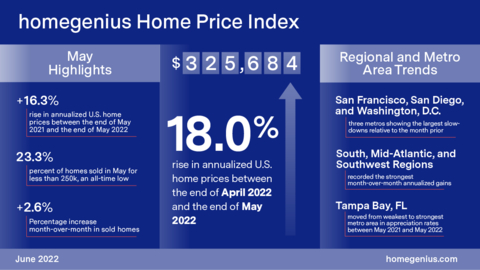

Home prices across the United States set a new all-time record for price appreciation, rising at an annualized rate of 18.0 percent in May 2022 from April 2022, according to homegenius Home Price Index (HPI) data released today by homegenius Real Estate LLC, a Radian Group Inc. company (NYSE: RDN). The company believes the homegenius HPI (formerly Radian HPI) is the most comprehensive and timely measure of U.S. housing market prices and conditions available in the market today.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220628006083/en/

(Photo: Business Wire)

The homegenius HPI also rose 16.3 percent year-over-year (May 2021 to May 2022), a modest jump over the year-over-year increase of 15.7 percent recorded last month, both represented all-time records. The homegenius HPI is calculated based on the estimated values of more than 70 million unique addresses each month, covering all single-family property types and geographies.

“Despite increasing headwinds, home prices in the U.S. set new records once again in May,” said Steve Gaenzler, SVP of Products, Data and Analytics. “While home prices have been increasing at record paces, there are reasons to expect slowing appreciation rates in some or all of the country later this year. Historically, the rate of home price appreciation has been inversely correlated to mortgage interest rates; the higher the mortgage rate, the slower price appreciation occurs, and vice versa. Since January 2022, the average 30-year fixed rate mortgage has surged by 285 basis points, the largest increase over six months since 1980 and the largest percentage increase in U.S. history. Rising from 3.2 percent at the start of 2022 to 5.78 percent in the latest weekly report, mortgage rates are 80% higher (256 basis points) than just six months ago. Strong home price appreciation combined with rapidly increasing mortgage financing costs is a double whammy for home affordability and consumer confidence,” added Gaenzler.

NATIONAL DATA AND TRENDS

- Median estimated home price in the U.S. rose to $325,684

- Percentage of lower-priced homes sold fell to lowest on record.

Nationally, the homegenius HPI estimated the median price for single-family and condominium homes rose to $325,684. Across the U.S., home prices nationally rose 15.5 percent over the last three months, much higher than the 13.2 percent reported for the three months from February through April. Home prices remain buoyed by a supply and inventory of homes for sale that continues to decline. While inventory of homes for sale rose by six percent in May from the prior month, supply was five percent lower than May 2021 and is 35 percent lower than the average of the month of May in 2017-2020.

The mix of homes sold by price band provides valuable information on what is driving home price growth. In May, only 23.3 percent of homes sold cost less than $250,000, the lowest recorded percentage for that category and roughly half of the 43.9 percent tally from just two years ago. In contrast, 34.6 percent of homes sold in May cost more than $500,000, which is more than 4.0 times larger than the 8.2 percent share recorded a decade earlier (May 2012). This shift towards higher-priced homes has a beneficial impact on the growth rate of indices that only measure home prices of sold properties (i.e., repeat sales and median sales price indices). The homegenius HPI measures the change in value to all properties based on the entire housing stock, not the mix of homes that happen to transact in a given month.

In May, the number of homes that were sold increased from the prior month by 2.6 percent. Over the first five months of 2022, the aggregate count of home sales nationally was 5 percent lower than the first five months of 2021. However, sales were five percent higher than the average of the same 5 months (Jan-May) in each of the prior four years (2017-2020).

REGIONAL DATA AND TRENDS

- All U.S. Regions appreciated at a faster rate in May

- South records 11th straight month as strongest region

In May, home price appreciation rose from the prior month in all regions. After finding a recent low in appreciation rates in February or March of this year, the homegenius HPI has seen stable growth in home prices broadly across geographies. The South (+21.5%), Mid-Atlantic (+17.4%), and Southwest (+17.3%) recorded the strongest month-over-month annualized gains. The South region has been the strongest region for eleven consecutive months, and fourteen of the last nineteen months.

All six regions recorded actual 12-month price appreciation rates between 13.0 and 21.5 percent, signaling a robust market in all parts of the U.S, although with wide disparity in performance. The result of the continued strong gains in home prices equates to record levels of homeowner equity. In aggregate, the rise in home values over the past year equates to more than $6.5 trillion dollars of new equity for homeowners.

METROPOLITAN AREA DATA AND TRENDS

- Tampa Bay, FL leads all metro areas in appreciation rate

- Slightly slower appreciation the norm in most, larger metropolitan areas

While all regions continued to report strong price appreciation rates in May 2022, only three metropolitan areas (Philadelphia, PA, Baltimore, MD, St. Louis, MO) recorded faster price appreciation when compared to the prior month (April 2022). Four metros (Tampa, FL, Atlanta, GA, Miami, FL, Dallas, TX) have reported three straight months of annualized one-month appreciation rates in excess of 20 percent. Tampa, FL was the strongest metro area this month (+26.5% annualized 1-month appreciation). While the general regional numbers remain strongly positive, this month’s slower readings in 17 metros (in a month that is typically rising due to seasonal influences) suggest that regional markets across the U.S. may start to show signs of slowing home price appreciation.

The metro areas that reported the largest slowdowns relative to the prior month are all in the West. Three metro areas in particular, San Francisco, CA, Seattle, WA, and San Diego, CA, showed substantial slowdowns in appreciation rates. The average annualized one-month change for each was down more than 45 percent from the prior month’s appreciation rate. Each of them, however, has a 12-month appreciation rate in excess of 10 percent.

In an unusual twist, Tampa, FL went from the weakest of our top metros one year ago to the strongest in May 2022, while San Francisco, the weakest this month, was actually the strongest one year ago.

ABOUT THE HOMEGENIUS HPI

homegenius Real Estate LLC, a subsidiary of Radian Group Inc., provides national and regional indices for download at radian.com/hpi, along with information on how to access the full library of indices.

Additional content on the housing market can also be found on the homegenius and Radian News and Insights pages.

homegenius offers the HPI data set along with a client access portal for content visualization and data extraction. The engine behind the homegenius HPI has created more than 100,000 unique data series, which are updated on a monthly basis.

The homegenius HPI Portal is a self-service data and visualization platform that contains a library of thousands of high-value indices based on both geographic dimensions as well as by market, or property attributes. The platform provides monthly updated access to nine different geographic dimensions, from the national level down to zip codes. In addition, the homegenius HPI provides unique insights into market changes, conditions and strength across multiple property attributes, including bedroom count and livable square footage. To help enhance customers’ understanding of granular real estate markets, the library is expanded regularly to include more insightful indices.

homegenius Inc., a subsidiary of Radian Group Inc. (NYSE: RDN), and its family of companies combine an array of title, real estate and technology products and services into a full-service ecosystem. homegenius offers innovative experiences from search to close, enabling mortgage lenders, mortgage and real estate investors, consumers, GSEs, and real estate brokers and agents to benefit from integrated and personalized solutions leveraging advanced technology and the latest advancements in data science, machine learning and artificial intelligence. For additional information on the homegenius family of companies, visit homegenius.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220628006083/en/

Contacts

For the Media:

Rashi Iyer – Phone: 215.231.1167

Email: rashi.iyer@radian.com

For Investors:

John Damian – Phone: 215.231.1383

Email: john.damian@radian.com