Provides Carbon Credit Stream Portfolio Summary and Signs Term Sheet for Canadian Reforestation Project

MarVivo Blue Carbon Project Achieves Next Funding Milestone

Carbon Streaming Corporation (NEO: NETZ) (OTCQB: OFSTF) (FSE: M2Q) (“Carbon Streaming” or the “Company”) is pleased to provide a general corporate update.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220728005422/en/

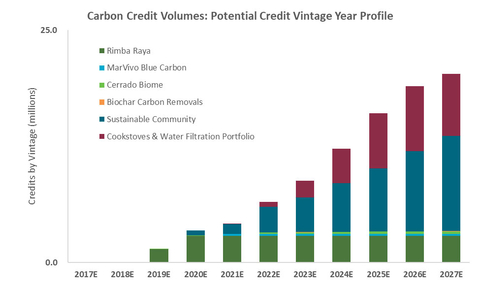

Note: Carbon credit volumes are estimated based on forecasts provided by project partners and historical credit generation by the project. Volumes include credits covered under streaming agreement, credits that are subject to stream participation rights, and associated marketing and sales arrangements. Vintage Year reflects the year in which the associated emission reduction or removal occurred. Actual results may vary.

Justin Cochrane, Founder and CEO stated: “This week marks the one-year anniversary of Carbon Streaming’s public listing on the NEO Exchange. I am proud of the company we are building as we continue to grow and diversify our stream investments, advance our project pipeline, and build internal capabilities. We are excited to see our partners advancing projects, with MarVivo Blue Carbon recently reaching another project milestone”.

Mr. Cochrane continued, “Near term, we are excited by the sustained organic growth potential as 10 or more projects for which we have stream investments are expecting credit issuance by the end of 2023. We look forward to continued collaboration with our project partners and forging productive new partnerships with operators and corporate clients as we advance the collective agenda to ensure a net-zero future.”

Carbon Credit Stream Portfolio Summary

Carbon Streaming continues to build a high quality, diversified portfolio of carbon credit streams and investments. The portfolio has now grown to comprise six streams, covering 13 carbon projects across four continents, with carbon credits expected to be issued from 10 or more carbon projects by the end of 2023. A summary of the portfolio is provided in the following table.

SUMMARY OF KEY STREAM TERMS |

|||

Stream |

Project Description |

Upfront Deposit(1)

|

Initial Term(2) |

| Rimba Raya | One of the world’s first and largest initiatives to protect tropical lowland peat swamp forests | $26.3 million(3)(4) |

20 years |

MarVivo Blue Carbon |

Blue carbon mangrove forest and associated marine habitat conservation |

$6.0 million(4) |

30 years |

Cerrado Biome |

Scale up project to avoid the conversion of native forest and grasslands to commercial agriculture in the Cerrado Biome |

$0.5 million |

30 years |

Biochar Carbon Removals |

Reduction of GHG emissions through establishing and maintaining a thermal wood conversion facility where waste fines and sawdust will be converted into Biochar |

$1.35 million |

25 years |

Cookstoves & Water Filtration Portfolio

|

Portfolio of energy-saving projects, deploying cookstove and water filtration devices.

|

$20.0 million |

15 years |

Sustainable Community

|

Grouped projects enroll and reward members for GHG emission reductions through waste diversion, conversion and energy efficiency initiatives, with plans to expand into transport. |

$20.0 million |

10 years(6) |

Notes:

1 Upfront deposit amounts assume all milestones will be realized and all installments paid in full.

2 Term typically commences upon delivery of first credits and term can be extended should the project continue to issue credits.

3 Includes cash amounts attributable to Strategic Alliance Agreement (excluding value of share consideration granted thereafter).

4 Subject to the formal exercise by Osisko Gold Royalties (“Osisko”) of stream participation rights whereby Osisko would pay 20% of the upfront payment(s) and receive 20% of the applicable stream and carbon credits.

5 Stream agreement subject to closing.

6 Under stream, Company to receive up to 44.1 million credits, which is expected to occur within 10 years.

Carbon Streaming had a successful year applying the streaming model to voluntary carbon credit financing, which has enabled the Company to build a diversified portfolio of world class projects, with significant organic growth potential. The figure below illustrates the Company’s carbon credit volume profile by vintage year, with credit volumes from the current portfolio expected to surpass 20 million carbon credits by the 2027 vintage year and growing beyond.

On an ongoing basis, annual carbon credit issuances generally occur six to 12 months following the vintage year for which the credits are verified. The initial issuances of credits for projects generally incorporate multiple vintages due to the nature of the initial validation and verification processes. Once carbon credits are issued, the Company anticipates selling those credits over the following 12 month period, prior to the next annual credit issuance.

Sugar Maple Tree Reforestation Term Sheet Funding

In July, Carbon Streaming executed a term sheet to provide C$400,000 of upfront funding to the Citadelle Maple Syrup Producers’ Cooperative (“Citadelle”) for a grouped sugar maple Afforestation, Reforestation, Revegetation (ARR) and ecosystem restoration project in Quebec, Canada. Established in 1925, Citadelle is a dynamic agroforestry cooperative of over 1,500 members who tap sugar maple trees on their lands to produce maple syrup and is one of the largest suppliers of 100% pure maple syrup globally.

Citadelle is working with project operator Down to Earth Carbon Ltd. (“DTEC”), a full cycle climate forest project originator, to afforest members’ lands to provide structural biodiversity, enhanced watershed restoration values and sequestration of carbon from the atmosphere. Citadelle is also partnering with One Tree Planted (“OTP”), a non-profit organization focused on global reforestation, who will be contributing to the funding of each tree planted. The initial funding from Carbon Streaming is designed to enable Citadelle, DTEC and OTP to achieve the Fall 2022 and Spring 2023 planting windows and positions Carbon Streaming with a right of first refusal on future carbon credit-based financings.

MarVivo Achieves First Funding Milestone

In June, the MarVivo Blue Carbon Conservation Project (“MarVivo Project”) achieved its second development milestone. The Company has a stream over the MarVivo Project located in Magdalena Bay in Baja California Sur, Mexico. The MarVivo Project is focused on the conservation of mangrove forests and their associated marine habitat, and is anticipated to be one of the largest blue carbon conservation projects in the world.

The US$6 million stream consists of a US$2 million installment paid upon closing, followed by four separate US$1 million payments based on specific project milestones being met during development, implementation, validation, and verification by Verra of the project. Upon achieving the second development milestone in June 2022, the Company made the next installment payment of US$1 million to MarVivo Corporation.

About Carbon Streaming

Carbon Streaming is an ESG principled company offering investors exposure to carbon credits, a key instrument used by both governments and corporations to achieve their carbon neutral and net-zero climate goals. Our business model is focused on acquiring, managing and growing a high-quality and diversified portfolio of investments in projects and/or companies that generate or are actively involved, directly or indirectly, with voluntary and/or compliance carbon credits.

The Company invests capital through carbon credit streaming arrangements with project developers and owners to accelerate the creation of carbon offset projects by bringing capital to projects that might not otherwise be developed. Many of these projects have significant social and economic co-benefits in addition to their carbon reduction or removal potential.

The Company has executed carbon credit streaming agreements related to over 10 projects around the globe, including nature-based, biochar, methane avoidance, clean cookstove and water filtration projects.

To receive corporate updates via e-mail, please subscribe here.

Cautionary Statement Regarding Forward-Looking Information

This news release contains certain forward-looking statements and forward-looking information (collectively, “forward-looking information”) within the meaning of applicable securities laws. All statements, other than statements of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future, including, without limitation, statements and figures with respect to the amount of emission reductions or removals and expected number of carbon credits generated by the Company’s portfolio of projects; the timing and closing of the Cookstove & Water Filtration portfolio stream; the ability for the projects to be independently verified and registered; the timing of delivery of carbon credits under the various streams; expected timelines for the sale of carbon credits; and statements with respect to execution of the Company’s portfolio and partnership strategy.

When used in this news release, words such as “estimates”, “expects”, “plans”, “anticipates”, “will”, “believes”, “intends” “should”, “could”, “may” and other similar terminology are intended to identify such forward-looking statements. This forward-looking information is based on the current expectations or beliefs of the Company based on information currently available to the Company. Forward-looking information is subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking information, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, the Company. They should not be read as a guarantee of future performance or results, and will not necessarily be an accurate indication of whether or not such results will be achieved. Factors that could cause actual results or events to differ materially from current expectations include, among other things: dependence on key management; limited operating history for the Company’s current strategy; concentration risk; inaccurate estimates of growth strategy, including the ability of the Company to source appropriate opportunities/investments; volatility in prices of carbon credits and demand for carbon credits; general economic, market and business conditions; failure or timing delays for projects to be validated and ultimately developed or greenhouse gases emissions reductions and removals to be verified and carbon credits issued; uncertainties and ongoing market developments surrounding the regulatory framework applied to the verification, and cancellation of carbon credits and the Company’s ability to be, and remain, in compliance; actions by governmental authorities, including changes in or to government regulation, taxation and carbon pricing initiatives; uncertainties surrounding the ongoing impact of the COVID-19 pandemic; foreign operations and political risks; risks arising from competition and future acquisition activities; due diligence risks, including failure of third parties’ reviews, reports and projections to be accurate; global financial conditions, including fluctuations in interest rates, foreign exchange rates and stock market volatility; dependence on project developers, operators and owners, including failure by such counterparties to make payments or perform their operational or other obligations to the Company in compliance with the terms of contractual arrangements between the Company and such counterparties; failure of projects to generate carbon credits, or natural disasters such as flood or fire which could have a material adverse effect on the ability of any project to generate carbon credits; change in social or political views towards climate change and subsequent changes in corporate or government policies or regulations; operating and capital costs; potential conflicts of interest; unforeseen title defects; the Company’s ability to complete proposed acquisitions and the impact of such acquisitions on the Company’s business; anticipated future sources of funds to meet working capital requirements; future capital expenditures and contractual commitments; expectations regarding the Company’s growth and results of operations; the Company’s dividend policy; volatility in the market price of the Company’s common shares or warrants; the effect that the issuance of additional securities by the Company could have on the market price of the Company’s common shares or warrants; and the other risks disclosed under the heading “Risk Factors” and elsewhere in the Company’s Annual Information Form dated as of September 27, 2021 filed on SEDAR at www.sedar.com. These risks, as well as others, could cause actual results and events to vary significantly. Accordingly, readers should exercise caution in relying upon forward-looking statements and the Company undertakes no obligation to publicly revise them to reflect subsequent events or circumstances, except as required by law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220728005422/en/

Contacts

ON BEHALF OF THE COMPANY:

Justin Cochrane, Chief Executive Officer

Tel: 647.846.7765

info@carbonstreaming.com

www.carbonstreaming.com

Investor Relations

Andrea Cheung, VP, Investor Relations

info@carbonstreaming.com

Media

Amy Chambers, Director, Marketing, Communications & Sustainability

media@carbonstreaming.com