Rocket Mortgage Ranks Highest in Customer Satisfaction

With the average rate on a 30-year fixed-rate mortgage currently sitting at 6.8%, the highest level since November 2022,1 and costs for everything from home insurance to maintenance and repair to groceries still elevated, mortgage servicer customers are feeling strained. According to the J.D. Power 2023 U.S. Mortgage Servicer Satisfaction Study,SM released today, that combination of reduced financial health,2 an increased rate of mortgage transfers and a rise in reported account problems is driving a significant decline in customer satisfaction.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230727467592/en/

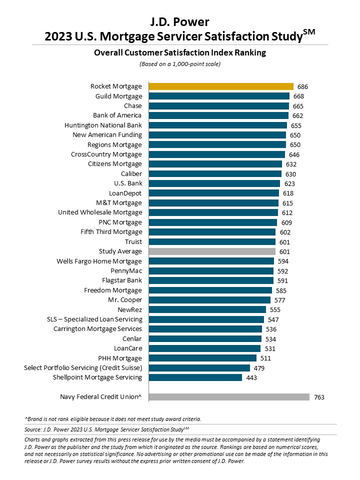

J.D. Power 2023 U.S. Mortgage Servicer Satisfaction Study (Graphic: Business Wire)

"The past year has been an incredibly challenging time for both customers and the mortgage industry—and there remains a lot of uncertainty,” said Craig Martin, executive managing director and global head of wealth and lending intelligence at J.D. Power. “So far, the worst-case scenarios haven’t come to bear but mortgage servicers need to ensure they aren’t ignoring key advanced indicators. We have seen the percentage of financially unhealthy mortgage customers rise to 54% from 48% during the past year. Servicers need to ensure they are building trust and engaging with their customers so they can effectively stay ahead of potential problems when customers face financial hardships. When customers lack trust in their servicer, the costs to serve increases materially because those customers will gravitate to more costly service channels and they are at higher risk to take their complaints beyond the company.”

Following are some key findings of the 2023 study:

- Mortgage servicers cannot ignore customers’ financial health: The proportion of mortgage servicing customers identified as financially unhealthy is 54% this year. Overall satisfaction among financially unhealthy customers is 107 points lower than among customers in the financially healthy category. Default risk is also up 4% this year among mortgage customers.

- Rise in mortgage transfers exacerbates year-over-year decline in customer satisfaction: Overall customer satisfaction with mortgage servicers is 601 (on a 1,000-point scale), down 6 points from 2022. The drop is most significant among the 37% of customers who had their mortgage transferred to a servicer that they did not choose. Overall satisfaction scores are 119 points lower when customers do not choose their servicer.

- Problem resolution suffers: While problem incidence hasn’t had a major shift this year, overall customer satisfaction with problem resolution declines 10 points. Customers who say their most recent problem contact was payment- or escrow-related has increased to 43% from 36% in 2022. At the same time, customers who say they contacted their servicer about their problem has increased to 19% from 17% year over year and the number of customers who say they had a problem that was not resolved has increased to 20% from 15% a year ago.

- Advice for mortgage customers: Mortgage servicers want to help customers when they are under financial stress or having problems with their account. The key for customers is to notify their mortgage servicer as early as possible and to provide as much detail as they can to get the best guidance.

“It’s at times like this, when market conditions and personal financial health are strained, that great customer experiences can have the biggest influence on loyalty and advocacy,” said Bruce Gehrke, senior director of lending intelligence at J.D. Power. “Servicers that recognize proactive customer outreach and effective problem resolution as opportunities to build stronger client relationships—rather than obstacles to overcome—are in a great position to differentiate themselves and set a new standard for the industry to follow.”

Study Ranking

Rocket Mortgage ranks highest among mortgage servicers with a score of 686. Guild Mortgage (668) ranks second and Chase (665) ranks third.

The U.S. Mortgage Servicer Satisfaction Study, formerly known as the U.S. Primary Mortgage Servicer Satisfaction Study, measures customer satisfaction with the mortgage servicing experience in six factors (in order of importance): level of trust; makes it easy to do business with; keeps me informed and educated; people; resolving problems or questions; and digital channels. The study is based on responses from 11,325 customers who have been with their current mortgage loan servicer for at least one year. The study was fielded from October 2022 through May 2023.

For more information about the U.S. Mortgage Servicer Satisfaction Study, visit https://www.jdpower.com/business/financial-services/us-mortgage-servicer-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2023080.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 Freddie Mac

2 J.D. Power measures the financial health of any consumer as a metric combining their spending/savings ratio, creditworthiness, and safety net items like insurance coverage. Consumers are placed on a continuum from healthy to vulnerable.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230727467592/en/

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com