70% of OEMs worry about the financial impact of Chinese automakers, who now control over 40% of global vehicle production

80% of OEMs say the EV transition is slower than planned, citing infrastructure gaps, high prices, and weak demand, but most expect EV market share to rise in 2025

Kerrigan Advisors today released the results of its third annual OEM survey, sharing insights into the thinking of automotive manufacturers. Conducted prior to the Trump Administration’s April 2nd tariff announcement, the 2025 Kerrigan OEM Survey reveals growing concern among automaker executives about China’s rapid expansion in the global automotive sector – especially in electric vehicles (EVs) – and a slower-than-expected US EV rollout. Additionally, prior to any tariff announcements, OEM executives expressed a largely positive outlook on dealership valuations and profitability in 2025.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250512170126/en/

OEM Execs Concerned About Chinese OEMs' Rising Global Market Share

“Despite acknowledging slower-than-expected EV adoption and rising competition from China, most OEMs remained confident in 2025 sales – though that optimism will now be tested by new tariffs,” said Erin Kerrigan, Founder and Managing Director of Kerrigan Advisors. “With General Motors’ warning last week of a potential $5 billion tariff impact to 2025 earnings, Ford projecting a $1.5 billion hit, and both suspending guidance due to tariff uncertainty, it’s clear the market is shifting quickly. Amid this uncertainty, the strength of the US dealer network continues to be a powerful asset – sustaining profitability, supporting customer relationships, and offering critical stability in the fast-changing global auto industry.”

China’s OEM Share Surge Worries OEMs and US EV Rollout Slows

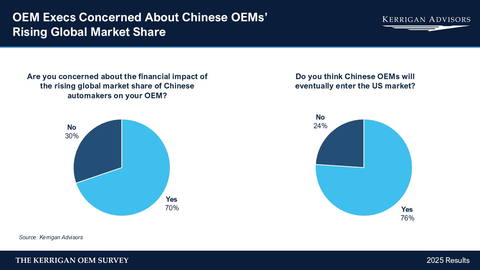

For the first time, the Kerrigan OEM Survey asked automakers about China’s role in the evolving automotive landscape. 70% of OEM respondents expressed concern over the financial implications of Chinese manufacturers’ growing global market share, driven in large part by their dominance in the EV segment. With 76% of US OEMs expecting Chinese brands to enter the domestic market, competitive anxiety is increasing.

Meanwhile, OEMs continue to project growth in US EV adoption, but at a slower pace. 14% of respondents expect EVs to account for 21% or more of new vehicle sales in 2025, despite policy headwinds, including the potential elimination of EV tax credits. 80% of respondents say the EV transition is progressing more slowly than originally planned, likely given charging infrastructure gaps, high vehicle prices, and low consumer demand. However, a growing minority (10%, up from 4% in 2024) now believe the transition is accelerating, likely in response to heavy discounting and incentive-driven inventory reductions.

“The pressure of a slowing US EV rollout and China’s explosive global expansion, particularly in the EV segment, are top of mind for OEMs,” said Ryan Kerrigan, Managing Director of Kerrigan Advisors. “The concern is real – with Chinese automakers expected to enter the US market and already dominating global EV production, OEMs are navigating both competitive disruption and policy uncertainty at once. The coming years will test how effectively the industry can adapt to a rapidly shifting global and technological landscape.”

OEM Dealer Relations Shifting

This year’s survey reflects a shift in OEM dealer relations, with a clear pullback from the agency model. More than half of OEM executives (56%) do not expect the model to take hold in the U.S., likely influenced by legal challenges facing Volkswagen’s Scout and Honda’s Afeela. While support for the model has declined, 35% of respondents are unsure, possibly due to recent rollout of agency-like sales programs such as Hyundai’s Amazon sales program.

Although there is some interest in the direct-to-consumer model, OEMs continue to value the dealer’s central role in customer relationships. Just 8% expect to exclusively own the customer relationship in five years, an 11-point drop from 2024, while 92% anticipate dealers will either lead or share in managing customer engagement and data.

Still, many OEMs are looking to consolidate. 33% plan to reduce the number of dealers in their networks in the next five years, and 28% expect to exercise their right of first refusal (ROFR) on over 25% of buy/sells. These findings align with Kerrigan Advisors’ 2024 Annual Blue Sky Report, which identified ROFRs as a growing trend.

OEMs are also increasing facility requirements: 92% expect them to remain the same or increase, while just 8% anticipate a decrease, a sharp drop from 22% last year.

"OEMs are clearly adjusting their approach to their dealer networks, pulling back from full agency models and acknowledge the vital role dealers play in fostering long-term customer relationships,” said Ryan Kerrigan. "At the same time, many are also seeking fewer, larger dealers in their networks, and are using their ROFR right and more expensive facility requirements to accomplish this goal."

New Vehicle Sales and Gross Margins Stable Pre-Tariffs

Prior to the tariff announcement, OEM executives projected a relatively stable retail environment with 82% expecting flat or rising new vehicle sales, and 52% anticipating gross margins would exceed pre-pandemic levels. However, a 10-point uptick in those expecting a sales decline indicates emerging caution, even before trade policy uncertainty entered the equation.

Rising inventory levels may be fueling this cautious outlook, even before tariffs come into play. 10% of OEMs are projecting inventory levels above 90 days, though there was also an increase in those expecting 30–60 days’ supply (27%, up five percentage points). This mixed sentiment on sales and inventory likely reflects a widening gap in performance across OEMs, with some enjoying strong sales and right-sized inventories, while others face market share losses and an oversupply of vehicles.

Still, OEMs’ projections for dealer profits, valuations and gross margins, combined with expectations of a moderate pullback in new vehicle sales, suggest that dealers are well-positioned to withstand tariff-related headwinds and sustain strong performance into 2025.

“While the survey was conducted before the April 2nd tariff announcement, its findings are especially relevant now,” said Erin Kerrigan. “As the auto industry enters an uncertain stretch, the franchise system’s resilience may again prove critical in absorbing external shocks. OEMs’ mixed outlook on sales and inventory highlights how uneven the market has become—but also how durable and adaptable dealers are. We believe the franchise system is well-positioned to navigate policy-driven disruption and deliver another strong year in 2025.”

Key OEM Survey Data

- 76% of legacy OEMs expect Chinese brands to enter the US market.

- 70% of OEM executives surveyed are concerned about the financial impact of the rising global market share of Chinese auto manufacturers.

- 80% of OEM executives believe the transition to EVs will be slower than originally planned, consistent with last year’s survey.

- Despite the Trump Administration’s plans to eliminate EV tax credits, OEMs still expect EV market share to rise in 2025, with 14% projecting EVs will end the year at greater than 21% of the market.

- 78% of respondents expect dealership blue sky values to remain the same or increase in 2025 and only 22% expect a decrease, an improvement from the 2024 Kerrigan OEM Survey.

- 66% of OEMs project profits will stay the same or increase in the next 12 months, while 34% expect a decline in the next 12 months, an improvement from 54% in 2024. By comparison, 43% of dealers projected a decline in earnings in the most recent Kerrigan Dealer Survey.

- 52% of OEMs anticipate dealers’ gross margins will exceed pre-pandemic levels, with 10% expecting grosses to normalize more than 25% higher than pre-pandemic averages.

- 36% of OEMs project new vehicle sales will increase over the next 12 months, 46% expect sales to remain flat, and 18% expect a decline, an increase from 8% in 2024.

- A more negative sentiment in days’ supply of new vehicles is reflected in a rise in OEMs who project 90+ days’ supply at 10%, up from 8% in 2024, though there was also an increase in those who expect a 30-60 days’ supply at 27%, up from 22% in 2024.

- 33% of OEM executives expect to have fewer dealers in their network in the next five years, and 28% expect to ROFR more than 25% of their buy/sells.

- Regarding the agency model, 56% of OEMs do not expect it to be introduced in the US, while 35% are unsure – a 4-point increase in uncertainty from 2024.

- Only 8% of OEMs expect to exclusively own the customer relationship within five years, down 11 percentage points from 2024. 92% expect dealers to either lead or share in managing customer engagement and data.

- OEMs’ facility requirements for dealers are rising: 25% of OEMs surveyed project an increase over the next five years, 67% expect today’s standards to remain, and only 8% expect a decrease — a 14-point drop from 2024.

- 10% of OEM executives now feel the EV rollout is going faster than planned, more than double the 2024 Kerrigan OEM Survey results.

Methodology

The data for The Kerrigan OEM Survey was gathered from Kerrigan Advisors’ annual survey of automotive OEM executives in conjunction with the issuance of The Blue Sky Report®. The survey is based on over 100 responses from OEM executives in Kerrigan Advisors’ proprietary database. Responses were collected from December 2024 to March 2025, before the Trump Administration announced wide-ranging tariffs.

- To download the full Kerrigan OEM Survey report, click here.

- To download a preview of The Blue Sky Report®, published by Kerrigan Advisors, click here.

- To access The Kerrigan Index™, click here.

- To access results from the latest Kerrigan Dealer Survey, click here.

About Kerrigan Advisors

Kerrigan Advisors is the leading sell-side advisor and thought partner to auto dealers nationwide. Since its founding in 2014, the firm has led the industry with the sale of over 290 dealerships representing more than $9 billion in client proceeds, including the third largest transaction in auto retail history – the sale of Jim Koons Automotive Companies to Asbury Automotive Group. The firm advises the industry’s leading dealership groups, enhancing value through the lifecycle of growing, operating and, when the time is right, selling their businesses. Led by a team of veteran industry experts with backgrounds in investment banking, private equity, accounting, finance and real estate, Kerrigan Advisors does not take listings, rather they develop a customized sales approach for each client to achieve their personal and financial goals. In addition to the firm’s sell-side advisory services, Kerrigan Advisors also provides a suite of consulting and investor services including growth strategy, market valuation assessments, capital allocation, transactional due diligence, open point proposals, operational improvement and real estate due diligence.

Kerrigan Advisors monitors conditions in the buy/sell market and publishes an in-depth analysis each quarter in The Blue Sky Report®, which includes Kerrigan Advisors’ signature blue sky charts, multiples, and analysis for each franchise in the luxury and non-luxury segments. To download a preview of the report, click here. The firm also releases monthly The Kerrigan Index™ composed of the seven publicly traded auto retail companies with operations focused on the US market. The Kerrigan Auto Retail Index is designed to track dealership valuation trends, while also providing key insights into factors influencing auto retail. To access The Kerrigan Index™, click here. To read the 2024 Kerrigan Dealer Survey, click here. Kerrigan Advisors also is the co-author of NADA’s Guide to Buying and Selling a Dealership.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250512170126/en/

Contacts

Kerrigan Advisors Media Contact:

Melanie Webber (melanie@mwebbcom.com), mWEBB Communications, 949-307-1723