![]()

We're witnessing the second-largest bank failure in United States history as regulators shut down Silicon Valley Bank (NASDAQ: SIVB). Nobody has any idea what the implications are. Will regulators step in and make uninsured depositors whole?

The response from regulators is up in the air. The Federal Reserve meets Monday morning while the FDIC combes Silicon Valley Bank's assets, potentially trying to force a sale. And surely congress wants its opportunity to lecture finance executives.

Based on the SPDR S&P Regional Banking ETF (NYSE: KRE) reaction, Wall Street is pretty uncertain, which plummeted 16% for the week.

Some are calling for a repeat of the Global Financial Crisis. In contrast, others maintain that there's no potential for a contagion effect.

But here's what we do know now. Silicon Valley Bank had a lot of large customers with significant deposits. Many of them publicly traded. And some companies reported their exact cash balances in SEC filings or communications with the press.

With over 90% of SVB’s deposits unprotected by FDIC insurance, there’s a distinct possibility that these firms won’t get their cash back.

So we will look over 4 stocks with significant cash holdings in Silicon Valley Bank.

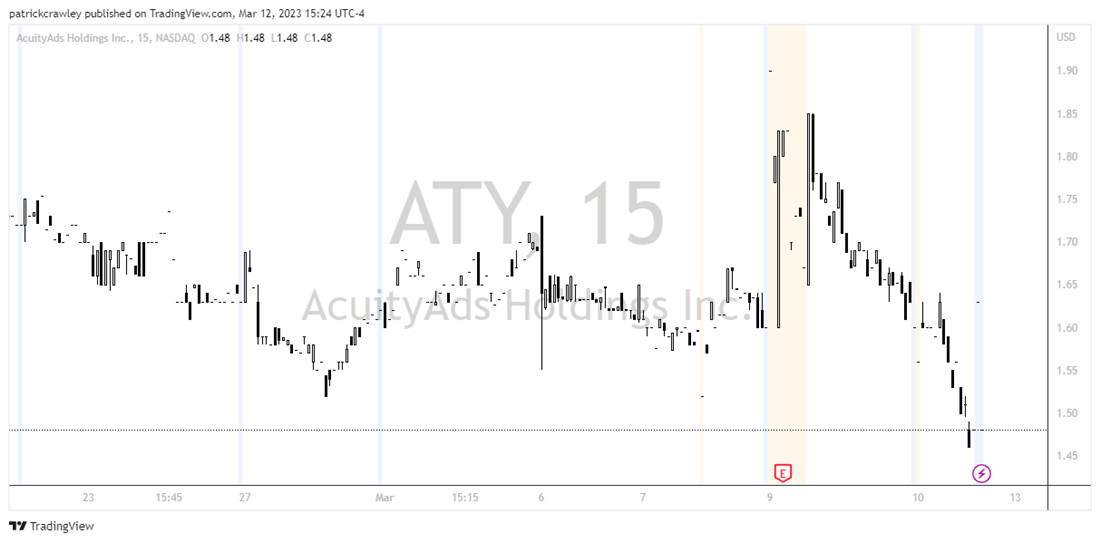

AcuityAds: 92% Of Cash Stuck in Silicon Valley Bank

Toronto-based ad-tech firm AcuityAds (NASDAQ: ATY) is one of SVB’s biggest victims so far. The company revealed in a press release that it holds $55 million in cash in bank accounts held at Silicon Valley Bank. They only have $4.8 million in cash outside the bank at the moment.

If the FDIC doesn’t act swiftly to pay out SVB depositors, the end could be near for AcuityAds. The firm is burning cash at a rate of about $4.5 million per quarter, according to the slowly dwindling cash balance on its balance sheet.

For a company in such a precarious situation amid significantly heightened concerns about liquidity in the financial system, it's hard to imagine AcutiyAds raising much capital if it cannot secure its funds from SVB.

The thinly-traded microcap stock was down 14% intraday on Friday before the Nasdaq halted trading midday.

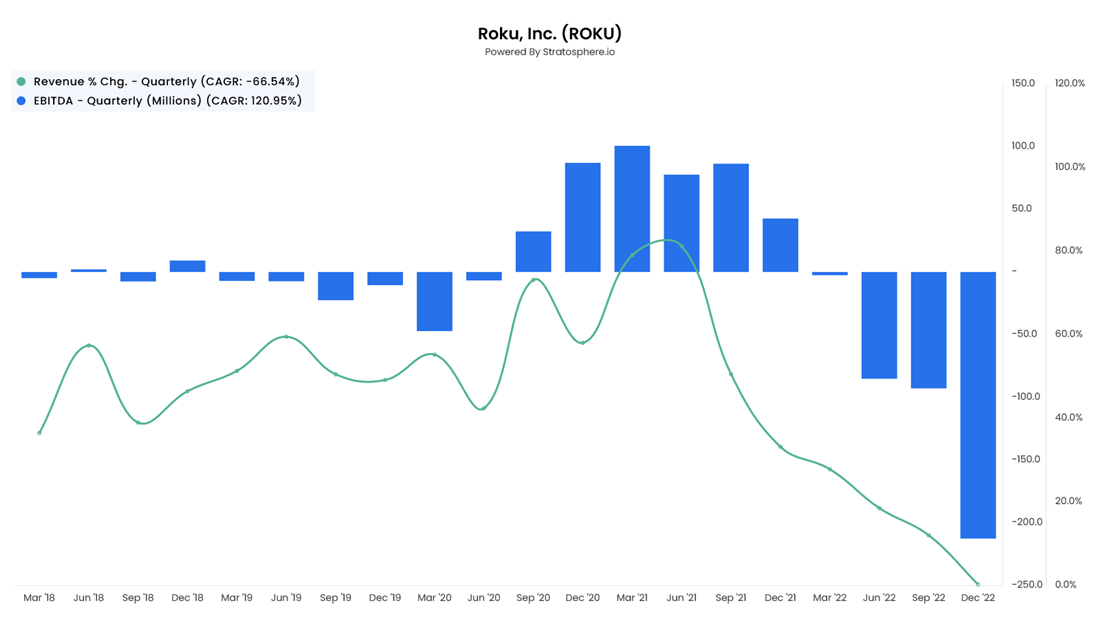

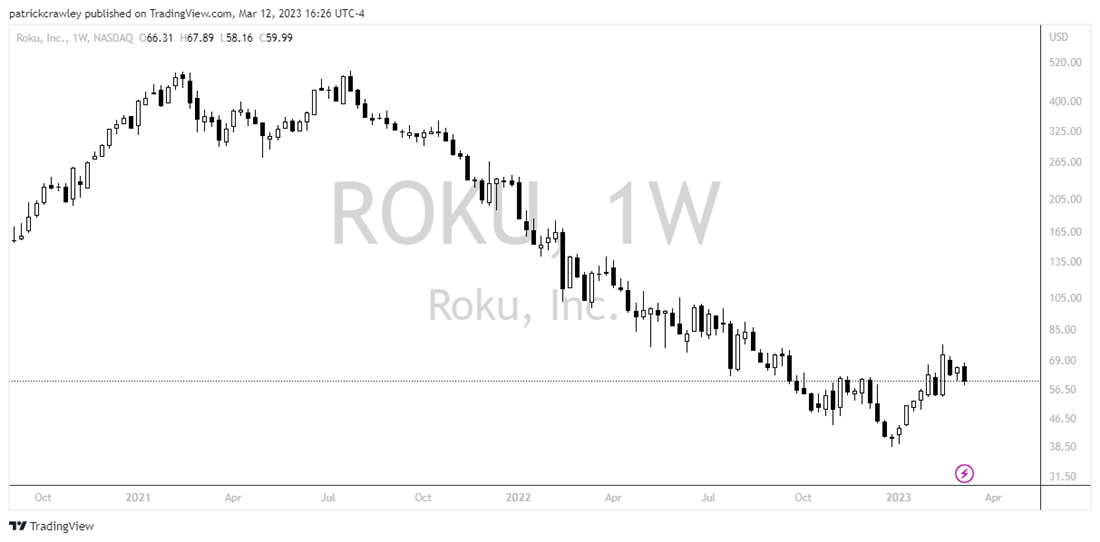

Roku: 26% of Cash Stuck in Silicon Valley Bank

Roku (NASDAQ: ROKU) filed an 8-K and told the market that it has $487 million, or 26% of its cash balance, in uninsured bank accounts at Silicon Valley Bank.

The company still has roughly $1.4 billion in cash across different banks, so it's definitely not doomsday. However, moments like these can serve as an opportunity for the market to re-price a stock like Roku, an unprofitable company with an arguably undifferentiated product offering carrying the valuation of an innovative growth stock.

As you can see, the stock has two telltale signs of a busted growth stock: decelerating revenue growth and becoming unprofitable after initially looking like it turned the corner.

Following the stock's strong start to 2023, up about 45% year-to-date, will the SVB panic send it back into its longer-term downtrend pattern?

Roku’s stock was roughly unchanged in the regular session Friday and declined 3% when the news hit the market.

iRhythm Technologies: 26% of Cash Stuck in Silicon Valley Bank

iRhythm Technologies (NASDAQ: IRTC), a supplier of ECG monitoring equipment, revealed on Friday that it has $55 million, or 26% of its cash, stranded inside the failed Silicon Valley Bank. Furthermore, it has a $35 million outstanding term loan with SVB -- meaning the company won't have access to the capital it presumably needed to borrow from the bank.

The company said it doesn't expect the SVB problems to affect its liquidity or daily operations. But, the company's bank account at SVB was its entire cash position--the rest is held in money market accounts and short-term investments.

So at the very least, the company will have a rough few days dealing with its lack of access to a bank account with millions of dollars while it waits for its money market funds to arrive.

iRhythm’s stock declined 5.7% in Friday’s trading.

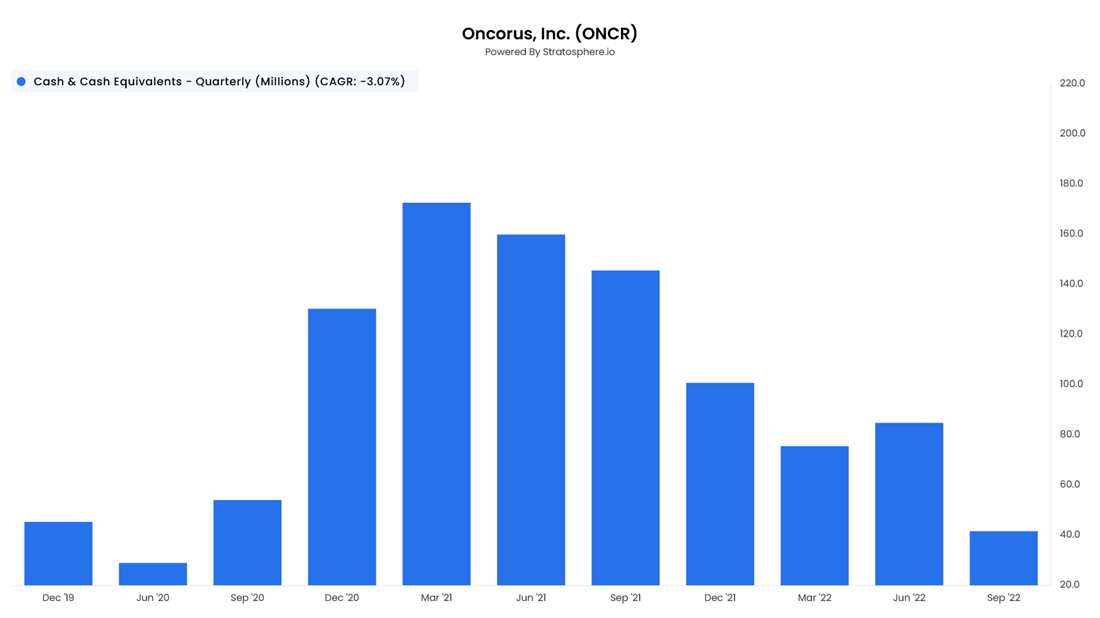

Oncorus: 23% of Cash Stuck in Silicon Valley Bank

Oncorus (NASDAQ: ONCR), a clinical-stage biotech trying to develop a cancer drug, disclosed that about $10 million, or 23% of its total cash and short-term investments balance, is stranded inside Silicon Valley Bank.

Oncorus is a pre-approval biotech firm, meaning they have no drugs to sell until they get FDA approval. This means borrowing money and issuing stock is the business's lifeblood. So any significant hit to its cash holdings means it cannot be regenerated without outside investment.

Things aren't going Oncorus' way over the last two years. Like most clinical-stage biotech companies, Oncorus burns cash rapidly and relies on investor enthusiasm toward biotechnology and positive developments with its drug to fund its business. The company saw its cash balance decline from $172 million in Q1 2021 to about $33 million today, when you account for the cash tied up in SVB.

Oncor’s stock dropped 12% on Friday as the market digested the SVB news.

Bottom Line

With Silicon Valley Bank's stronghold over the Silicon Valley technology industry, most expect a flood of new tech and biotech firms to disclose relationships with SVB on Monday. The implications of this situation will continue to unfold, and how it will affect the broader financial system remains to be seen.