The short call butterfly spread is also referred to as a short butterfly with calls or a short call butterfly trade. This is an advanced options trading strategy used to capitalize on a medium to large underlying price move in either direction. This strategy is also conducive to volatile and trending markets, especially with high implied volatility (IV).

A short call butterfly spread limits your downside risk while capping upside gains. You receive a credit once the trade is executed and all 4 options positions are established, which means you receive the profit upfront. While brokerage platforms may enable you to place the trade simultaneously, yours may require you to place it manually.

Components of the Short Call Butterfly Spread

A short call butterfly utilizes 3 equal distant strike prices: 1 high strike in-the-money (ITM) call, 2 middle strike at-the-money (ATM) calls, and 1 low strike price out-of-the-money (OTM) call. Like a butterfly, there is a body, which is the middle strike price and 2 wings, which are the high strike and low strike prices.

A short call butterfly spread is executed by shorting/selling 1 high strike ITM call, 1 low strike call OTM, and buying 2 long mid-strike ATM calls. For example, if we wanted to execute a short call butterfly spread on XYZ, we would short 1 XYZ $70 call, buy 2 XYZ $65 calls and short 1 XYZ $60 call. All options have the same expiration date.

Another way to a short call butterfly is to consider it a combination of 2 strategies, which include a bull call spread and a bear call spread. The bull call spread is comprised of buying 1 lower strike call and selling 1 higher strike call. A bear call spread is comprised of selling 1 lower strike call and buying 1 higher strike call. The final result is a short 1 higher strike call, short 1 lower strike call, long 2 medium ATM strike calls, and 2 wings and a body in the middle. It is the opposite of a long call butterfly spread, which is meant to capitalize on range-bound stocks.

Practical Examples of Short Call Butterfly Spreads

Let's use a real-world example with a computer and technology sector stock, Uber Technologies Inc. (NYSE: UBER).

On May 22, 2024, UBER was trading at $65. Let’s assume we want to construct a short call butterfly spread, which would require two wings and a body.

How to Execute a Short Call Butterfly Spread

Now that we know how to construct a short call butterfly spread, it’s time to execute the strategy. Let’s break it down into 5 steps:

Step 1: Assess Market Conditions

The macro market conditions can directly and indirectly affect your trade. Since 70% of a stock's move is often attributed to the macro market conditions, we want to be mindful of the benchmark indexes like the S&P 500 or Nasdaq 100. Ideally, we want to have volatility and a strong trending market to have the best chance for the butterfly spread to play out. You can also check the VIX, which is the volatility index for the S&P 500. A VIX reading above 20 is considered high volatility. The medium VIX is between 13 to 19. A low VIX reading is 12 or below. A low VIX reading doesn't rule out a short butterfly spread trade. It just means the wind is not blowing heavily on our backs.

Step 2: Select the Right Strike Prices

Since UBER is trading right at $65, we can use that as the middle or mid-point ATM strike or the body. The wings would entail equidistant strikes from the middle strike price. If we choose a 5-point spread, then we would select the $70 and the $60 strikes since they are both 5 points away from the $65 mid-point strike.

As a rule of thumb, the wider the spreads, the higher your potential profit, but the probability of reaching max profit or even breakeven drops. On the flip side, your profit potential shrinks as spreads get tighter, and the probability of achieving breakeven to max profits rises.

Step 3: Set Up the Options Trades

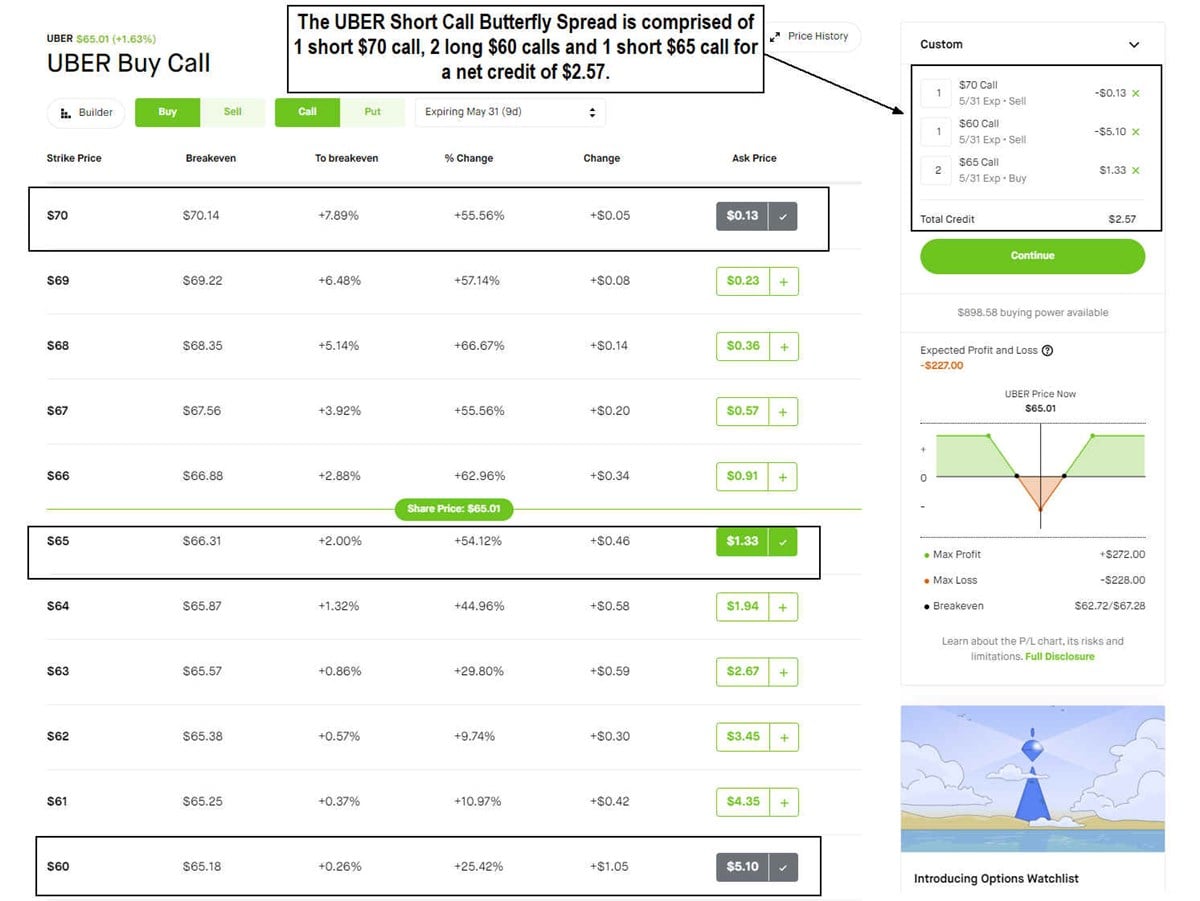

To set up the trade, we can see the quotes for the UBER May 31, 2024, expiration calls. We decided to use the $65 ATM calls for the midpoint and body and the $70 and $60 strikes as the wings. The strategy will consist of three trades comprised of four options positions.

The short call butterfly spread would be comprised of the following:

Short 1 UBER $70 strike call at 13 cents

Long 2 UBER $65 strike calls at $1.33

Short 1 UBER $60 strike call at $5.10

The 1 UBER short $70 strike call and 1 UBER long $65 call is a bull call spread. The 1 UBER short $60 strike call and 1 UBER long $65 call is a bear call spread. It's 4 positions that share 3 strike prices.

The resulting short call butterfly spread results in a $2.57 credit or $257 paid to us upfront.

Step 4: Monitor and Adjust the Spread

Once your short call butterfly spread is constructed and executed, you will have to monitor the position. The underlying stock will also be moving. The breakeven price levels are at $62.72 and $67.28. This means UBER needs to fall below $62.72 or rise through $67.28 or higher on expiration to be profitable trades. If UBER rallies to $70 or falls to $60, you may consider closing out the trade before expiration. Keep in mind that Theta is your friend, so closing out the trades before expiration will cost you some premium. Also, remember that Theta erodes quickly from one week before expiration.

Potential Risks and Rewards

The maximum profit potential on the trade is $257, which is the credit received upfront when we execute the short call butterfly spread. With credit spreads, you receive the good news first with a payment upfront, and it can only go down from there. The max profit occurs if UBER closes at or above the $70 upper strike or at or below the $60 lower strike on expiration. The max profit is calculated by subtracting the cost of the 2 long calls ($2.66) at the center strike from the credit received on the 2 short calls ($5.23) at the upper and lower strike prices. Each contract is worth 100 shares, so the $2.57 max profit equates to $257.

The maximum loss potential on the trade is $243. This occurs if UBER stays at the $65 mid-point or center strike price on expiration. The max loss is calculated by the spread between the lowest and center strike price of $5 minus the premium received of $2.57, resulting in $243.

Breakeven levels occur at $62.72 and $67.28 on the upside. As UBER moves beyond the breakeven levels, the position starts to earn profits. While it would be nice to hit maximum profit by having UBER close at or beyond the wing strikes, it only has to move beyond breakeven to start making profits.

Conclusion

You're all set! In this article, we reviewed what is and how to construct a short call butterfly spread, which is basically a combination of a bull call spread and a bear call spread. We reviewed the 5 steps to executing a short call butterfly spread using UBER as a real-world example and covered the risks and potential outcomes of the trade. Take your time and practice on a demo account if you can before risking real cash.

Advance Your Investment Game with MarketBeat

For further education and tools on your stock market journey, check out the products on MarketBeat.