Cryptocurrency exchange Coinbase (NASDAQ: COIN) fell short of the market’s revenue expectations in Q3 CY2024, but sales rose 78.8% year on year to $1.21 billion. Its GAAP profit of $0.28 per share was also 27.1% below analysts’ consensus estimates.

Is now the time to buy Coinbase? Find out by accessing our full research report, it’s free.

Coinbase (COIN) Q3 CY2024 Highlights:

- Revenue: $1.21 billion vs analyst estimates of $1.25 billion (3.7% miss)

- EPS: $0.28 vs analyst expectations of $0.38 (27.1% miss)

- EBITDA: $178.3 million vs analyst estimates of $440 million (59.5% miss)

- Gross Margin (GAAP): 85.7%, in line with the same quarter last year

- Operating Margin: 14.1%, up from -11.8% in the same quarter last year

- EBITDA Margin: 14.8%, down from 26.5% in the same quarter last year

- Market Capitalization: $54.58 billion

Company Overview

Regarded by many as the face of crypto, Coinbase (NASDAQ: COIN) is a digital exchange helping the world onboard into the blockchain ecosystem.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

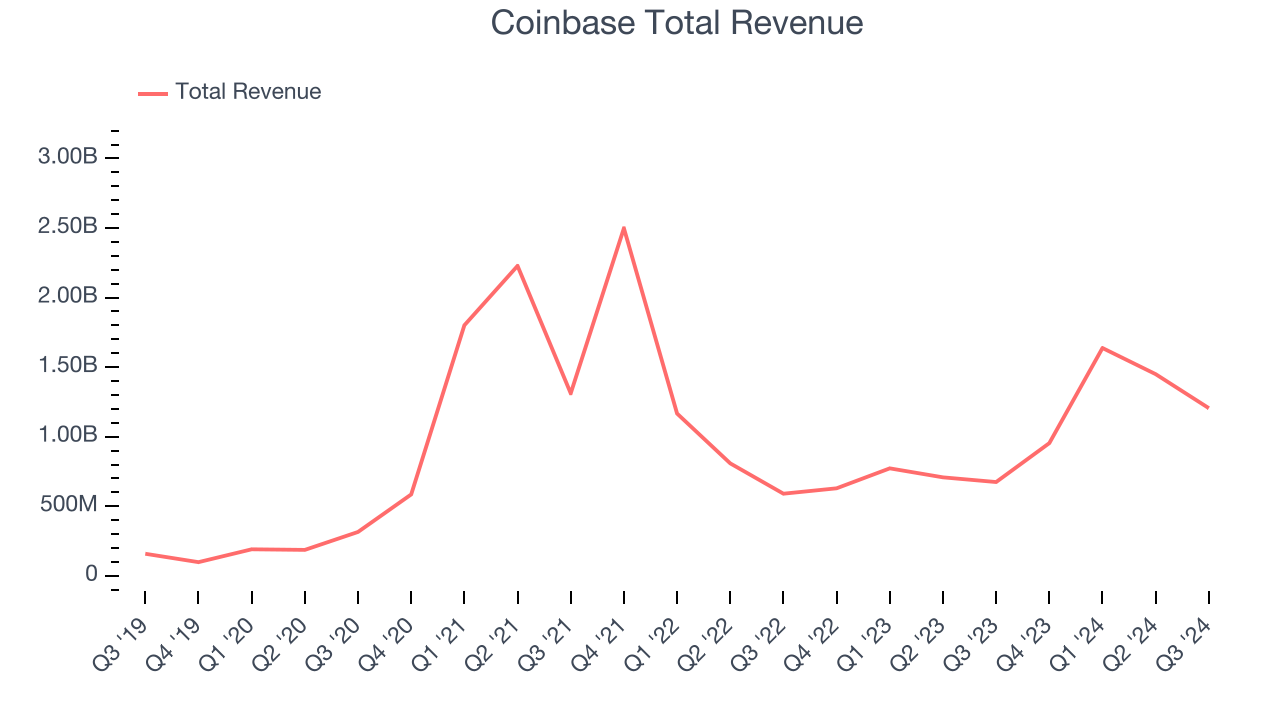

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Coinbase struggled to generate demand over the last three years as its sales dropped by 4% annually, a rough starting point for our analysis.

This quarter, Coinbase achieved a magnificent 78.8% year-on-year revenue growth rate, but its $1.21 billion of revenue fell short of Wall Street’s lofty estimates.

Looking ahead, sell-side analysts expect revenue to grow 8.2% over the next 12 months, an acceleration versus the last three years. While this projection indicates the market believes its newer products and services will fuel better performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

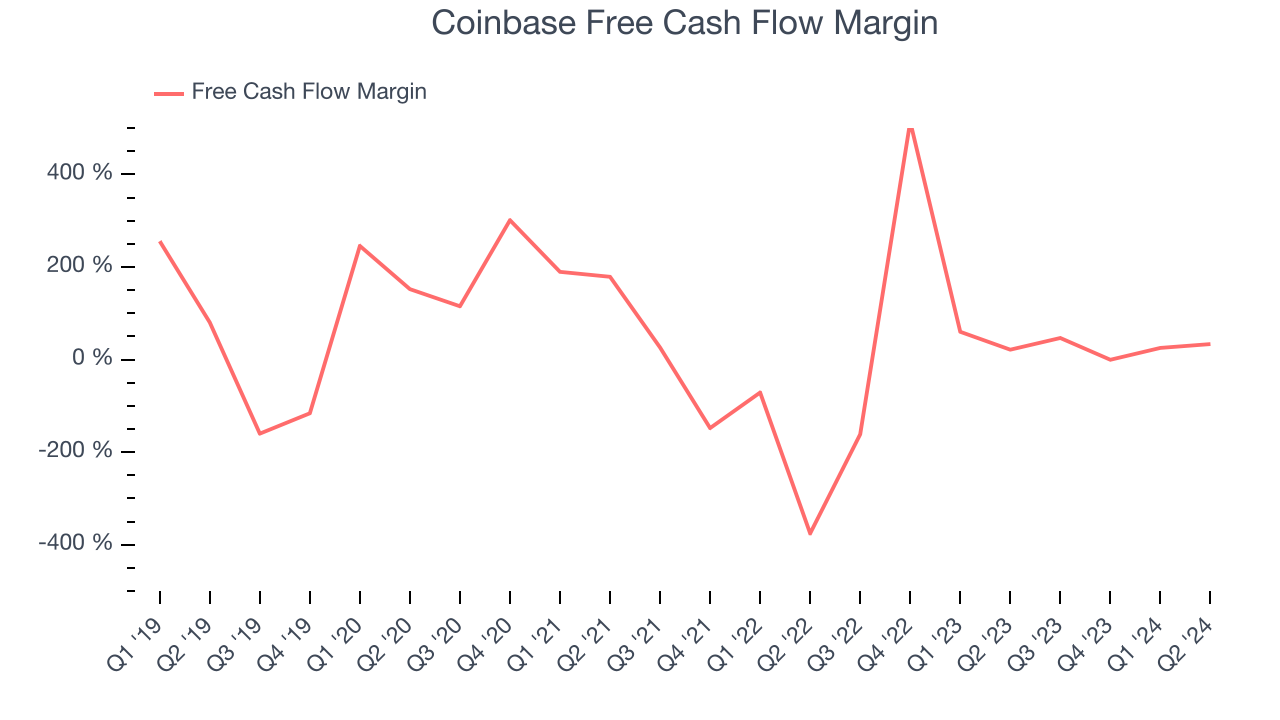

Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Coinbase has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the consumer internet sector, averaging an eye-popping 74% over the last two years.

Taking a step back, we can see that Coinbase’s margin dropped meaningfully over the last three years. Coinbase’s two-year free cash flow profile was compelling, but shareholders are surely hoping for its trend to reverse. Continued declines could signal that the business is becoming more capital-intensive.

Key Takeaways from Coinbase’s Q3 Results

We were impressed by Coinbase’s exceptional revenue growth this quarter. On the other hand, its revenue, EBITDA, and EPS missed analysts’ expectations. Overall, this was a softer quarter. The stock traded down 2.9% to $205.71 immediately after reporting.

Coinbase’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.