Cybersecurity software maker Tenable (NASDAQ: TENB) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 12.7% year on year to $227.1 million. On the other hand, the company expects next quarter’s revenue to be around $231 million, slightly below analysts’ estimates. Its non-GAAP profit of $0.32 per share was also 8.5% above analysts’ consensus estimates.

Is now the time to buy Tenable? Find out by accessing our full research report, it’s free.

Tenable (TENB) Q3 CY2024 Highlights:

- Revenue: $227.1 million vs analyst estimates of $223.3 million (1.7% beat)

- Adjusted EPS: $0.32 vs analyst estimates of $0.29 (8.5% beat)

- Adjusted Operating Income: $44.98 million vs analyst estimates of $43.17 million (4.2% beat)

- Revenue Guidance for Q4 CY2024 is $231 million at the midpoint, below analyst estimates of $232.3 million

- Management raised its full-year Adjusted EPS guidance to $1.22 at the midpoint, a 3.8% increase

- Gross Margin (GAAP): 77.8%, in line with the same quarter last year

- Operating Margin: -0.9%, up from -3.9% in the same quarter last year

- Free Cash Flow Margin: 23.2%, up from 13% in the previous quarter

- Billings: $248.4 million at quarter end, up 6.7% year on year

- Market Capitalization: $4.98 billion

"We delivered strong results in Q3, surpassing expectations on both the top and bottom line," said Amit Yoran, Chairman and CEO of Tenable.

Company Overview

Founded in 2002 by three cybersecurity veterans, Tenable (NASDAQ: TENB) provides software as a service that helps companies understand where they are exposed to cyber security risk and how to reduce it.

Vulnerability Management

The demand for cybersecurity is growing as more and more businesses are moving their data and processes into the cloud, which along with a major increase in employees working remotely, has increased their exposure to attacks and malware. Additionally, the growing array of corporate IT systems, applications and internet connected devices has increased the complexity of network security, all of which has substantially increased the demand for software meant to protect data breaches.

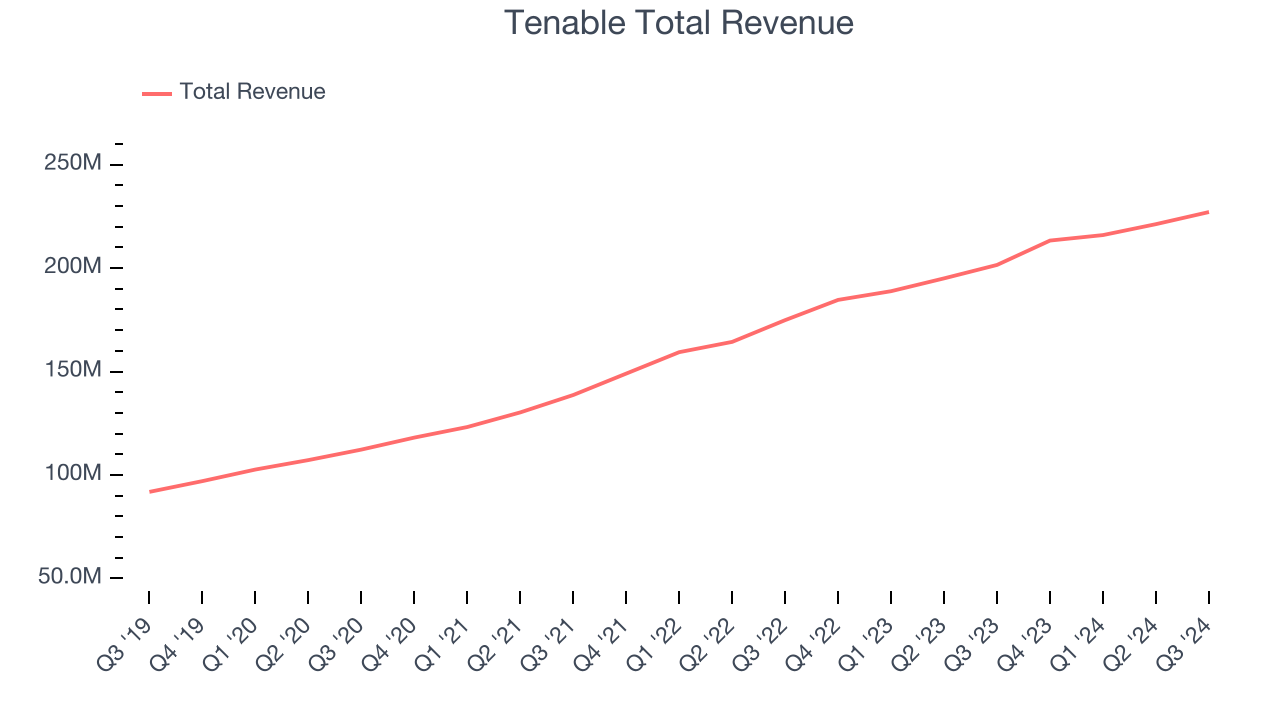

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Tenable grew its sales at a mediocre 19.8% compounded annual growth rate. This shows it couldn’t expand in any major way, a tough starting point for our analysis.

This quarter, Tenable reported year-on-year revenue growth of 12.7%, and its $227.1 million of revenue exceeded Wall Street’s estimates by 1.7%. Management is currently guiding for a 8.3% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.7% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and illustrates the market believes its products and services will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

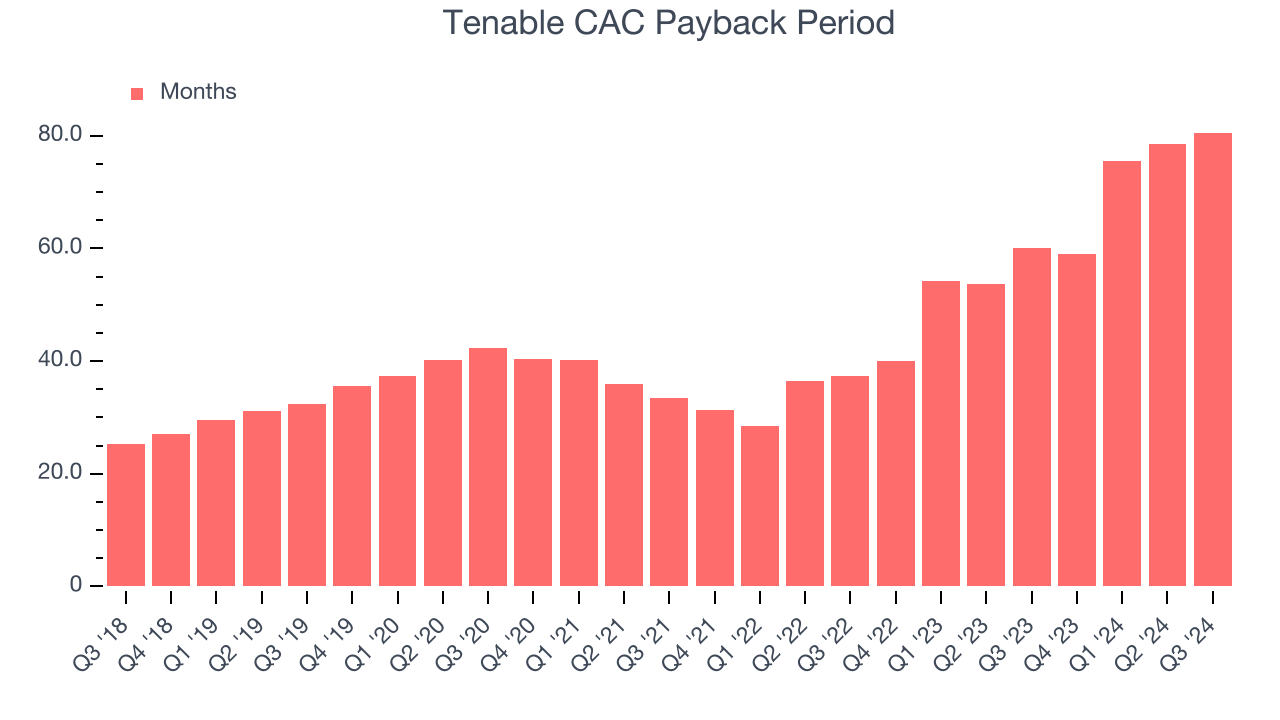

Customer Acquisition Efficiency

Customer acquisition cost (CAC) payback represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for marketing and sales investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s relatively expensive for Tenable to acquire new customers as its CAC payback period checked in at 80.6 months this quarter. The company’s performance indicates that it operates in a competitive market and must continue investing to maintain its growth trajectory.

Key Takeaways from Tenable’s Q3 Results

We were impressed by Tenable’s optimistic full-year EPS forecast, which blew past analysts’ expectations. We were also glad next quarter’s EPS guidance exceeded Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed analysts’ expectations and its billings missed Wall Street’s estimates. Overall, this quarter was mixed but still had some key positives. The stock remained flat at $41.17 immediately following the results.

So do we think Tenable is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.