Online payroll and human resource software provider Asure (NASDAQ: ASUR) fell short of the market’s revenue expectations in Q3 CY2024, with sales flat year on year at $29.3 million. Next quarter’s revenue guidance of $31 million underwhelmed, coming in 9.7% below analysts’ estimates. Its GAAP loss of $0.15 per share was also 257% below analysts’ consensus estimates.

Is now the time to buy Asure? Find out by accessing our full research report, it’s free.

Asure (ASUR) Q3 CY2024 Highlights:

- Revenue: $29.3 million vs analyst estimates of $31.33 million (6.5% miss)

- EPS: -$0.15 vs analyst estimates of -$0.04 (-$0.11 miss)

- EBITDA: $5.44 million vs analyst estimates of $6.40 million (15% miss)

- Revenue Guidance for Q4 CY2024 is $31 million at the midpoint, below analyst estimates of $34.33 million

- EBITDA guidance for Q4 CY2024 is $6.5 million at the midpoint, below analyst estimates of $8.17 million

- Gross Margin (GAAP): 67.2%, down from 72.5% in the same quarter last year

- Operating Margin: -12.7%, down from 0.9% in the same quarter last year

- EBITDA Margin: 18.6%, down from 21.2% in the same quarter last year

- Free Cash Flow was -$1.48 million compared to -$514,000 in the previous quarter

- Billings: $28.06 million at quarter end, down 2.5% year on year

- Market Capitalization: $255.3 million

Asure Chairman and CEO, Pat Goepel, stated, “Our third quarter performance reflects strong, continued growth, with recurring revenue up 20% year-over-year. We’ve made great strides in transitioning to a more valuable revenue model, with 98% of our revenues now recurring, compared to 81% in the same quarter last year. Additionally, new bookings were up 141% year-over-year. Our backlog has grown significantly — over 35% from Q2 2024 and over 250% from Q3 2023. While large enterprise tax product deals have contributed to our success, their pace of implementation can vary. That said, we remain confident in our ability to maintain this positive trajectory.”

Company Overview

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ: ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

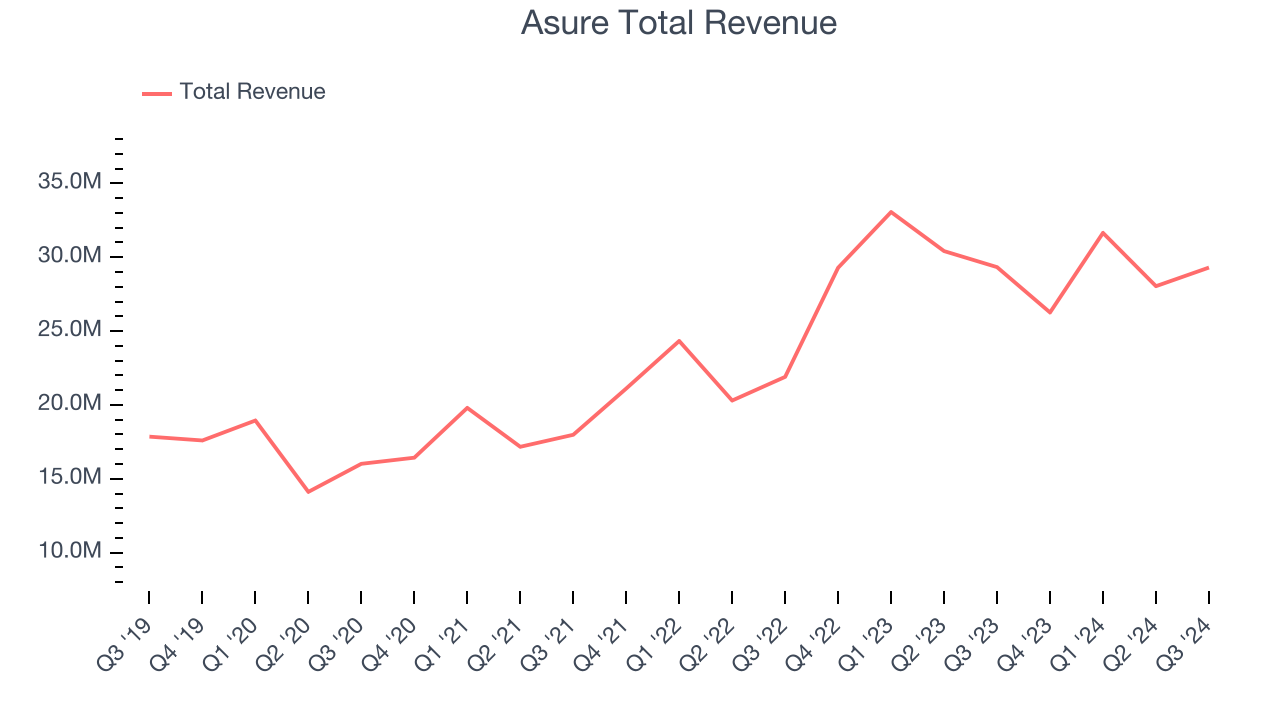

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Asure’s 17.3% annualized revenue growth over the last three years was mediocre. This shows it couldn’t expand in any major way, a tough starting point for our analysis.

This quarter, Asure missed Wall Street’s estimates and reported a rather uninspiring 0.1% year-on-year revenue decline, generating $29.3 million of revenue. Management is currently guiding for a 18% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 18.3% over the next 12 months, similar to its three-year rate. This projection is admirable and illustrates the market sees some success for its newer products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

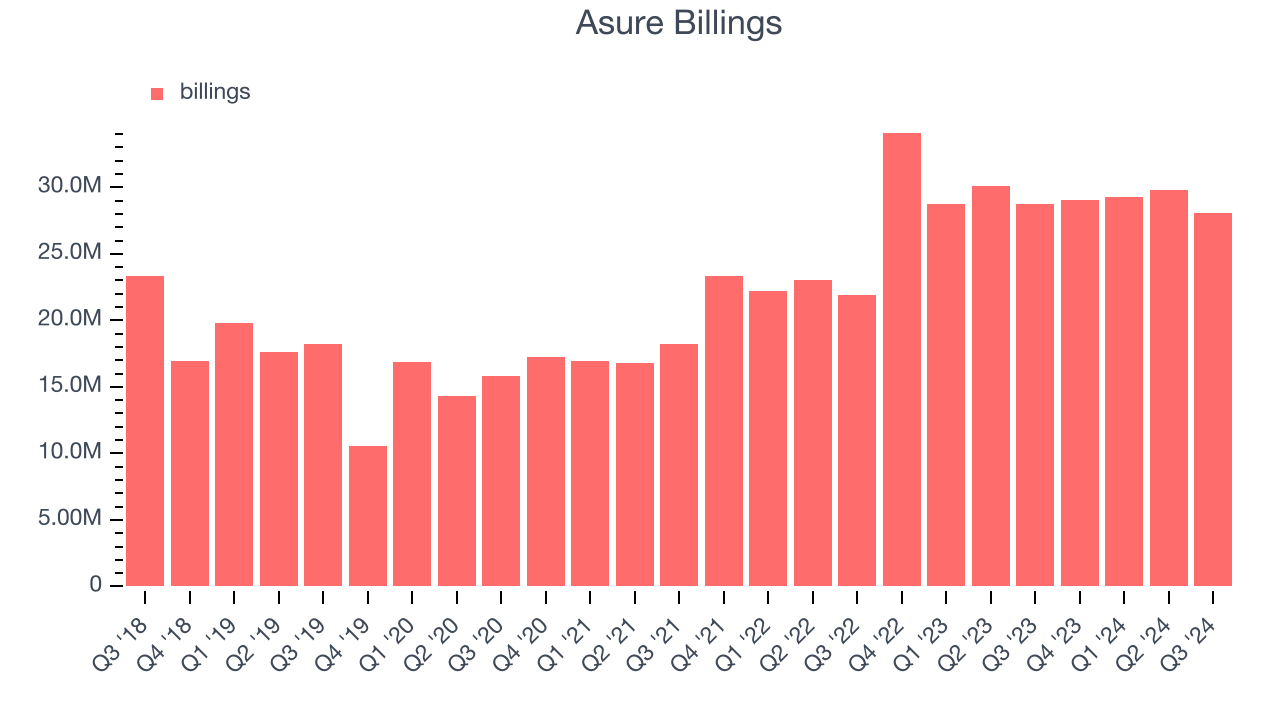

Billings

In addition to revenue, billings is a non-GAAP metric that sheds additional light on Asure’s business quality. Billings is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Over the last year, Asure’s billings averaged 4.1% year-on-year declines and fell to $28.06 million in the latest quarter. This performance mirrored its revenue and shows the company faced challenges in acquiring and retaining customers. It also suggests there may be increasing competition or market saturation. If Asure wants to accelerate billings growth, it must enhance its offerings and marketing strategies.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Asure is extremely efficient at acquiring new customers, and its CAC payback period checked in at 2.6 months this quarter. The company’s efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving it the freedom to invest resources into new growth initiatives while maintaining optionality.

Key Takeaways from Asure’s Q3 Results

We struggled to find many strong positives in these results. Its full-year revenue guidance was below expectations and its revenue guidance for next quarter missed Wall Street’s estimates. Overall, this quarter was pretty bad. The stock traded down 18.4% to $8.10 immediately following the results.

Asure may have had a tough quarter, but does that actually create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.