Live events and entertainment company Live Nation (NYSE: LYV) will be announcing earnings results tomorrow after market hours. Here’s what to expect.

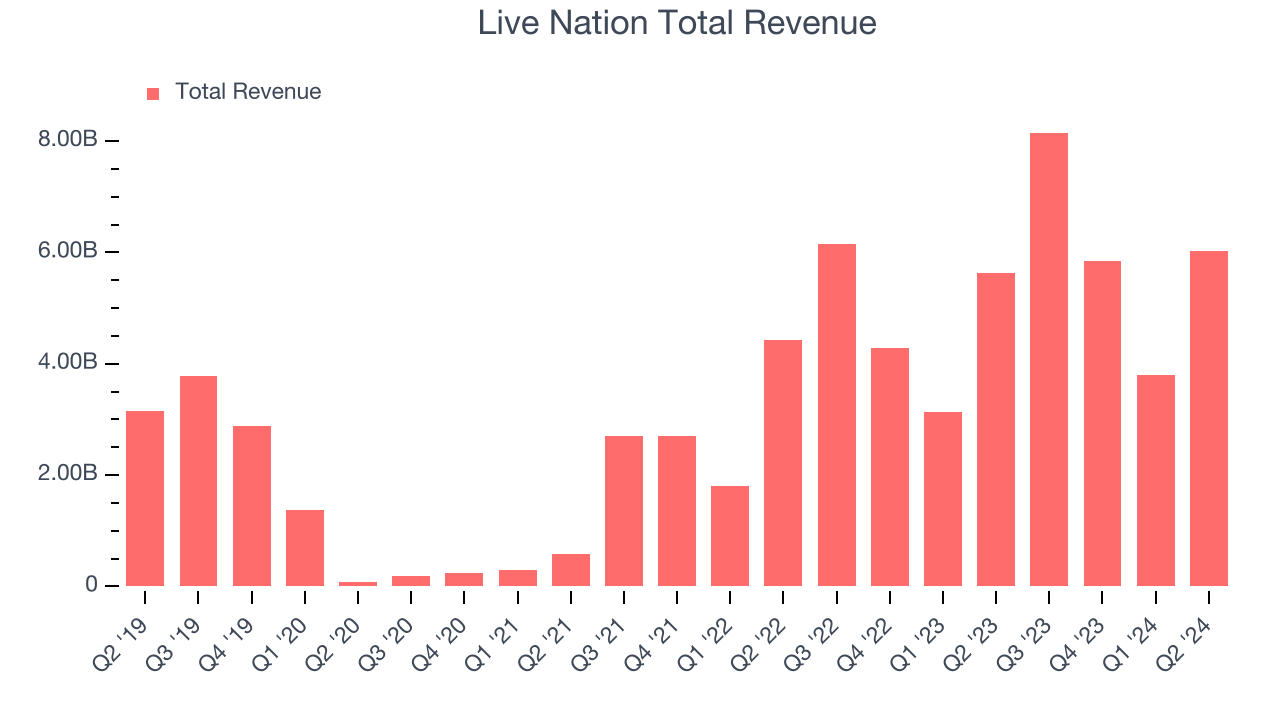

Live Nation met analysts’ revenue expectations last quarter, reporting revenues of $6.02 billion, up 7% year on year. It was an exceptional quarter for the company, with an impressive beat of analysts’ EBITDA estimates.

Is Live Nation a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting Live Nation’s revenue to decline 4.1% year on year to $7.81 billion, a reversal from the 32.5% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $1.65 per share.

Heading into earnings, analysts covering the company have grown increasingly bearish with revenue estimates seeing 7 downward revisions over the last 30 days (we track 17 analysts). Live Nation has a history of exceeding Wall Street’s expectations, beating revenue estimates every single time over the past two years by 18.3% on average.

Looking at Live Nation’s peers in the leisure facilities segment, some have already reported their Q3 results, giving us a hint as to what we can expect. Bowlero delivered year-on-year revenue growth of 14.4%, beating analysts’ expectations by 4.3%, and Planet Fitness reported revenues up 5.3%, topping estimates by 2.5%. Bowlero traded up 11.9% following the results while Planet Fitness was also up 12.7%.

Read our full analysis of Bowlero’s results here and Planet Fitness’s results here.

There has been positive sentiment among investors in the leisure facilities segment, with share prices up 6.4% on average over the last month. Live Nation is up 6.7% during the same time and is heading into earnings with an average analyst price target of $124.58 (compared to the current share price of $123.60).

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.