Zoom’s 36.9% return over the past six months has outpaced the S&P 500 by 22.3%, and its stock price has climbed to $86.41 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Zoom, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.We’re glad investors have benefited from the price increase, but we're cautious about ZM. Here are three reasons why we avoid Zoom and one stock we'd rather own instead.

Why Is Zoom Not Exciting?

Started by Eric Yuan who once ran engineering for Cisco’s video conferencing business, Zoom (NASDAQ: ZM) offers an easy-to-use, cloud-based platform for video conferencing, audio conferencing, and screen sharing.

1. Long-Term Revenue Growth Disappoints

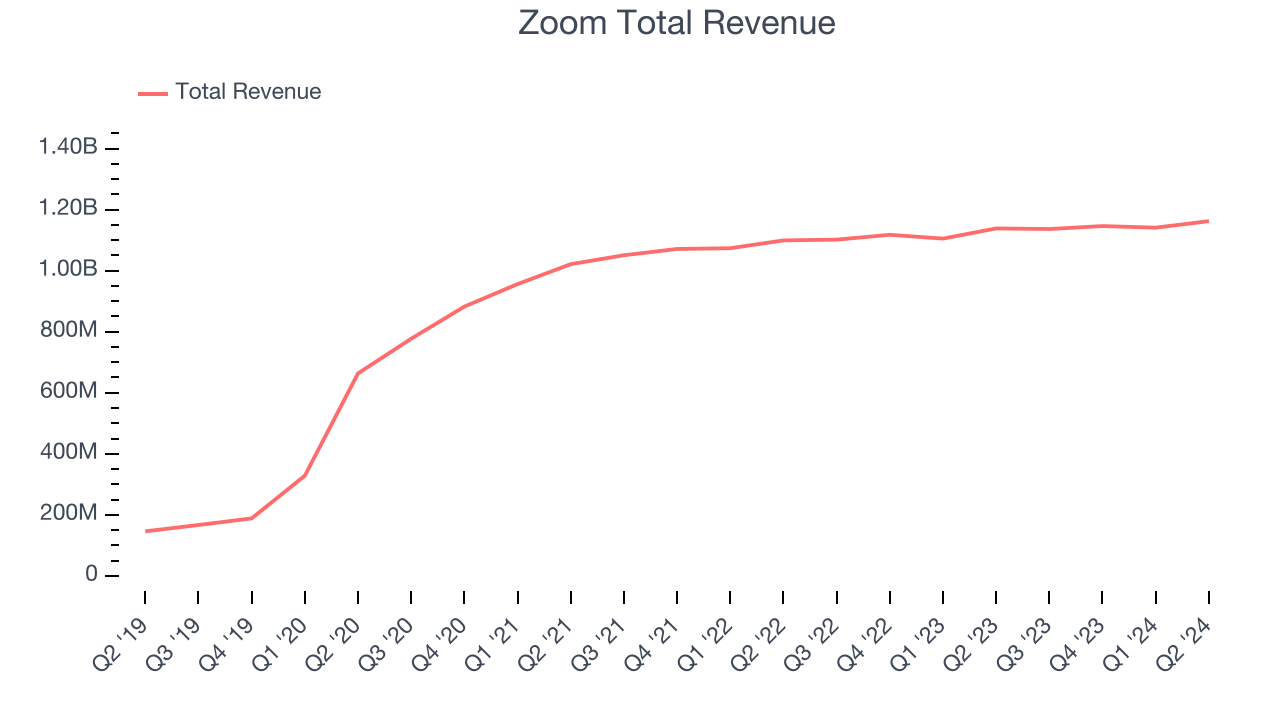

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Zoom grew its sales at a sluggish 8% compounded annual growth rate. This was well below the ~21% median annual increase for SaaS companies.

2. Weak ARR Growth Points to Soft Demand

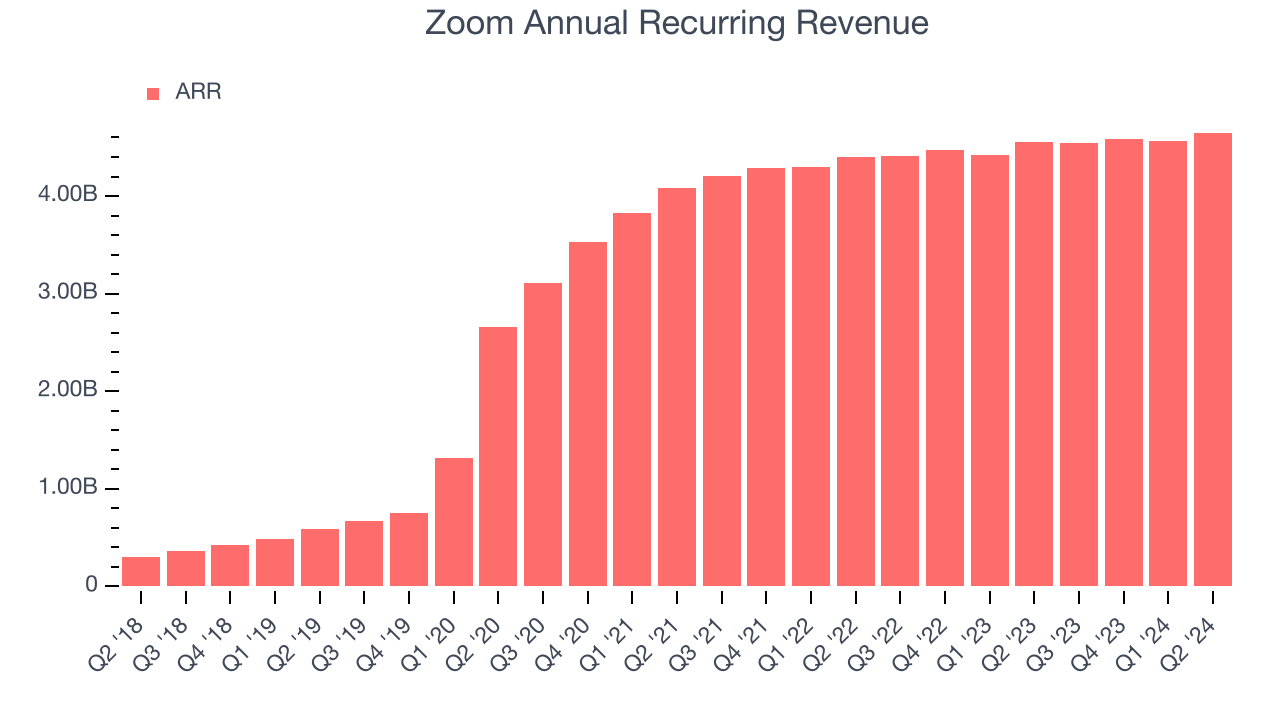

Investors interested in Zoom should track its annual recurring revenue (ARR) in addition to reported revenue. While reported revenue for a SaaS company can include low-margin items like implementation fees, ARR is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Over the last year, Zoom’s ARR growth has been flat-out bad, averaging 2.8% year-on-year increases and coming in at $4.65 billion in the latest quarter. This performance mirrored its total sales and suggests there may be increasing competition that is causing challenges in securing longer-term commitments.

3. Long Payback Periods Delay Returns

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Zoom’s recent sales and marketing investments haven’t yielded returns as its CAC payback period was negative, meaning it lost revenue while spending money on new customer acquisition efforts. This inefficiency confirms it operates in a highly competitive environment where there is little differentiation between Zoom’s products and its peers.

Final Judgment

Zoom isn’t a terrible business by any means, but it doesn’t pass our quality test. With its shares outperforming the market lately, the stock trades at 5.8x forward price-to-sales, or $86.41 per share. At this valuation, there’s a lot of good news priced in. There are better investment opportunities out there - we’d recommend you take a look at Nextracker, the market leader in utility-scale solar trackers and foundations.

Stocks We Like More Than Zoom

With rates dropping, inflation stabilizing, and elections in the rearview mirror, signs of a new bull run are emerging - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. These are a curated subset of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% five-year return) as well as under-the-radar businesses like Comfort Systems (+783%) and United Rentals (+550%). Find your next big winner with StockStory today, it’s free.