Since November 2019, the S&P 500 has delivered a total return of 92.7%. But one standout stock has more than doubled the market - over the past five years, Netflix has surged 191% to $822.90 per share. The party hasn’t stopped as it’s also gained 33.5% in the last six months, beating the market by 19.1%. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is NFLX’s stock a buy right now? Or is the market overestimating its value?

Find out in our full research report, it's free.Two Reasons We Like Netflix

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix (NASDAQ: NFLX) is a pioneering streaming content platform.

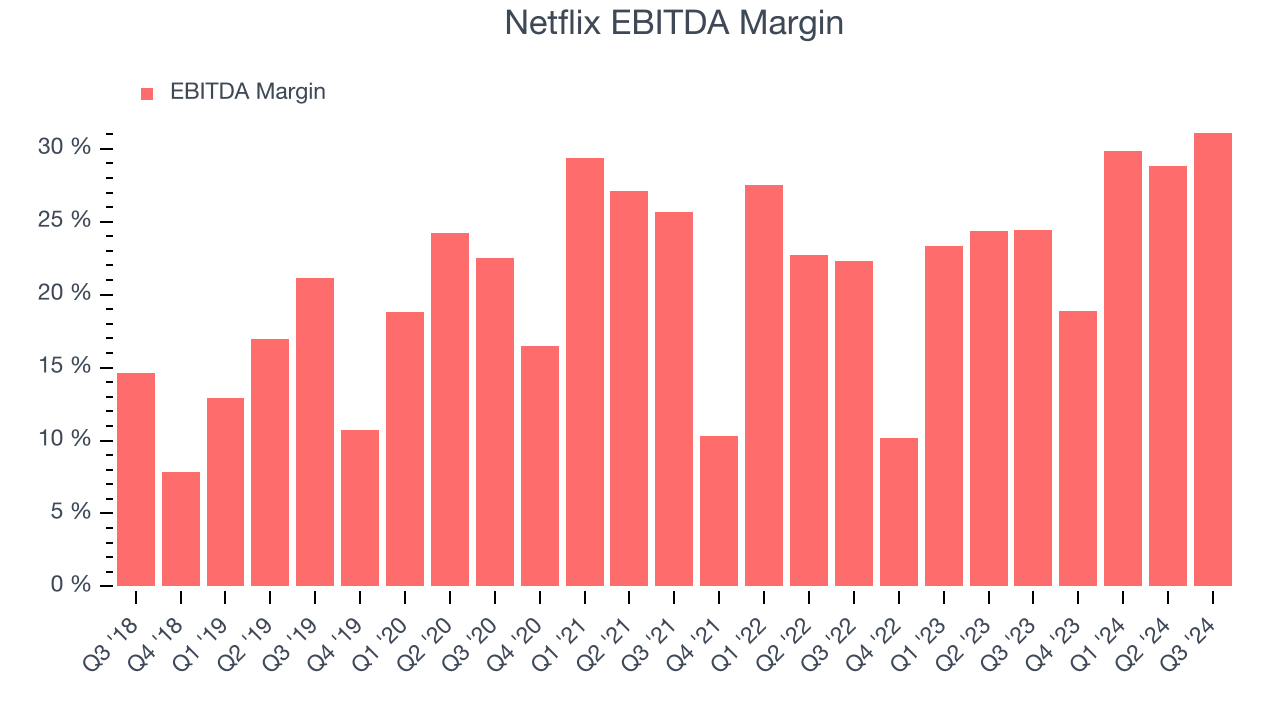

1. EBITDA Margin Reveals a Well-Run Organization

Investors frequently analyze operating income to understand a business’s core profitability. Similar to operating income, EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of profit potential.

Netflix has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 24.2%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

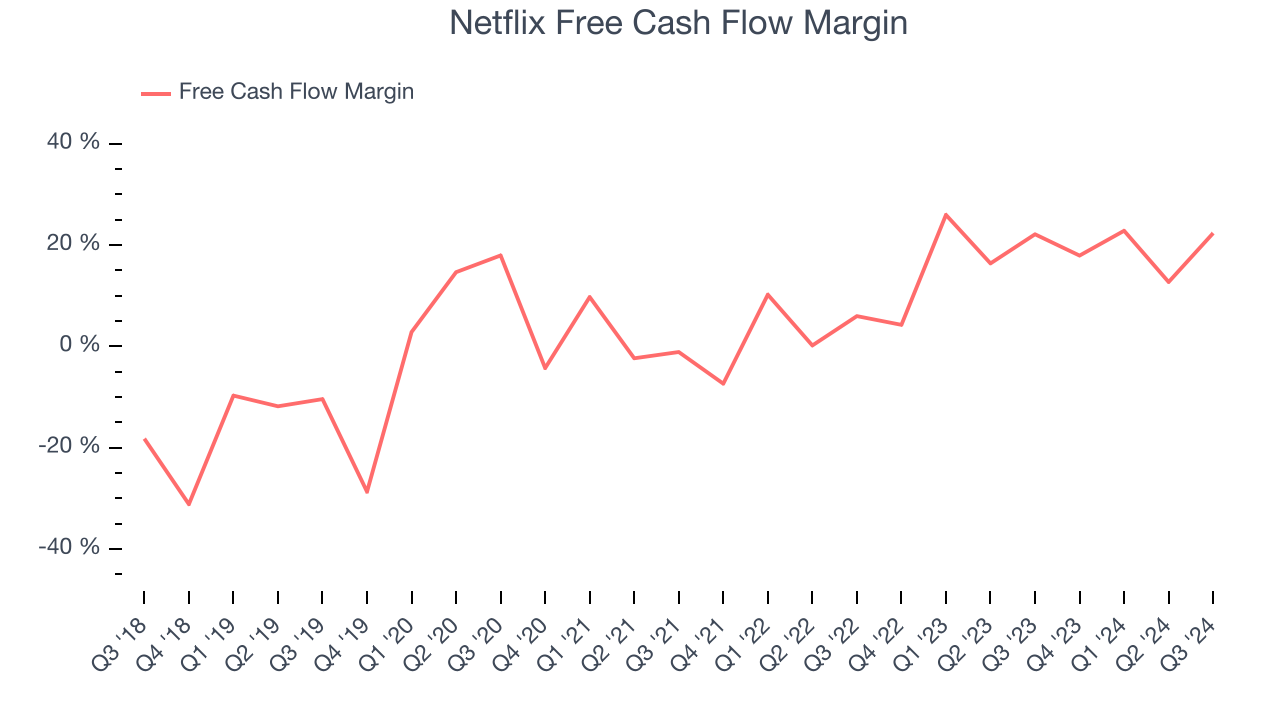

2. Free Cash Flow Margin Increased, Juicing Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Taking a step back, we can see that Netflix’s margin expanded by 18.4 percentage points over the last three years. This is encouraging because its free cash flow profitability rose more than its operating profitability, suggesting it’s becoming a less capital-intensive business. Its free cash flow margin for the trailing 12 months was 19%.

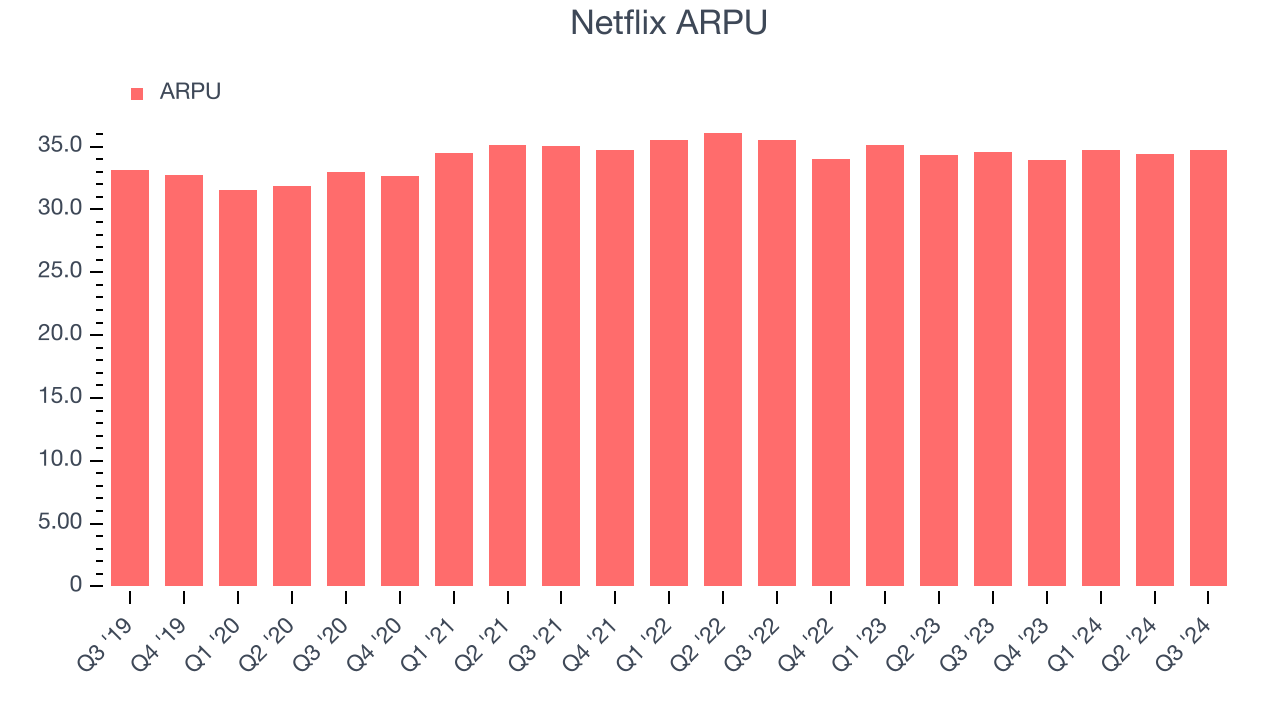

One Reason To Stay Cautious: Customer Spending Decreases… Engagement Falling?

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Netflix because it measures how much the average user spends. ARPU is also a key indicator of how valuable its users are (and can be over time).

Netflix’s ARPU fell over the last two years, averaging 1.4% annual declines. This isn’t great, but the increase in global streaming paid memberships is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Netflix tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

Final Judgment

There are definitely things to like about Netflix, and with its shares topping the market in recent months, the stock trades at 29x forward EV-to-EBITDA, or $822.90 per share. Is now a good time to buy?

See our comprehensive research report, it's free.Stocks We Like More Than Netflix

Now, with the elections behind us, rates dropping and inflation cooling off, many analysts are expecting a breakout market to the end of the year — and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our 9 Best Market-Beating Stocks. These are a curated subset of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% five-year return) as well as under-the-radar businesses like Comfort Systems (+783%) and United Rentals (+550%). Find your next big winner with StockStory today, it’s free.