Mohawk Industries trades at $140.34 per share and has stayed right on track with the overall market, gaining 13.8% over the last six months while the S&P 500 has returned 10.5%.

Is now the time to buy Mohawk Industries, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.We don't have much confidence in Mohawk Industries. Here are three reasons why we avoid MHK and one stock we'd rather own.

Why Do We Think Mohawk Industries Will Underperform?

Established in 1878, Mohawk Industries (NYSE: MHK) is a leading producer of floor-covering products for both residential and commercial applications.

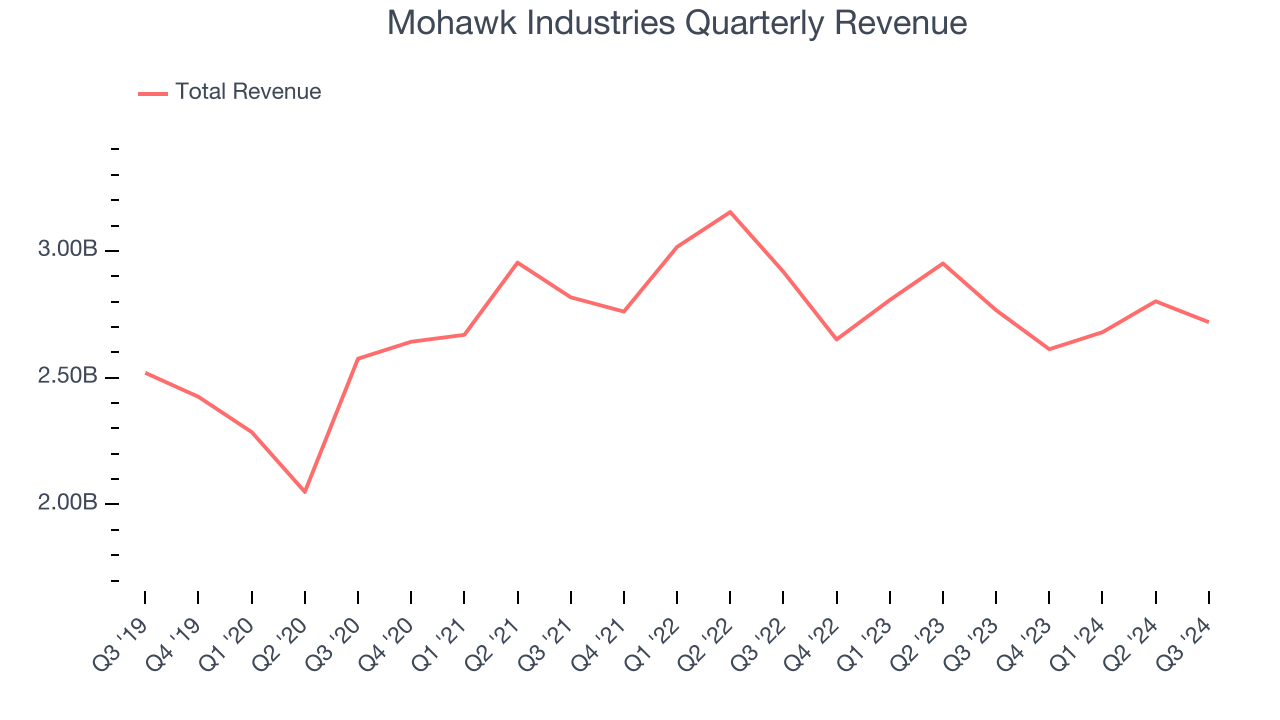

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Mohawk Industries’s 1.6% annualized revenue growth over the last five years was weak. This fell short of our benchmark for the consumer discretionary sector.

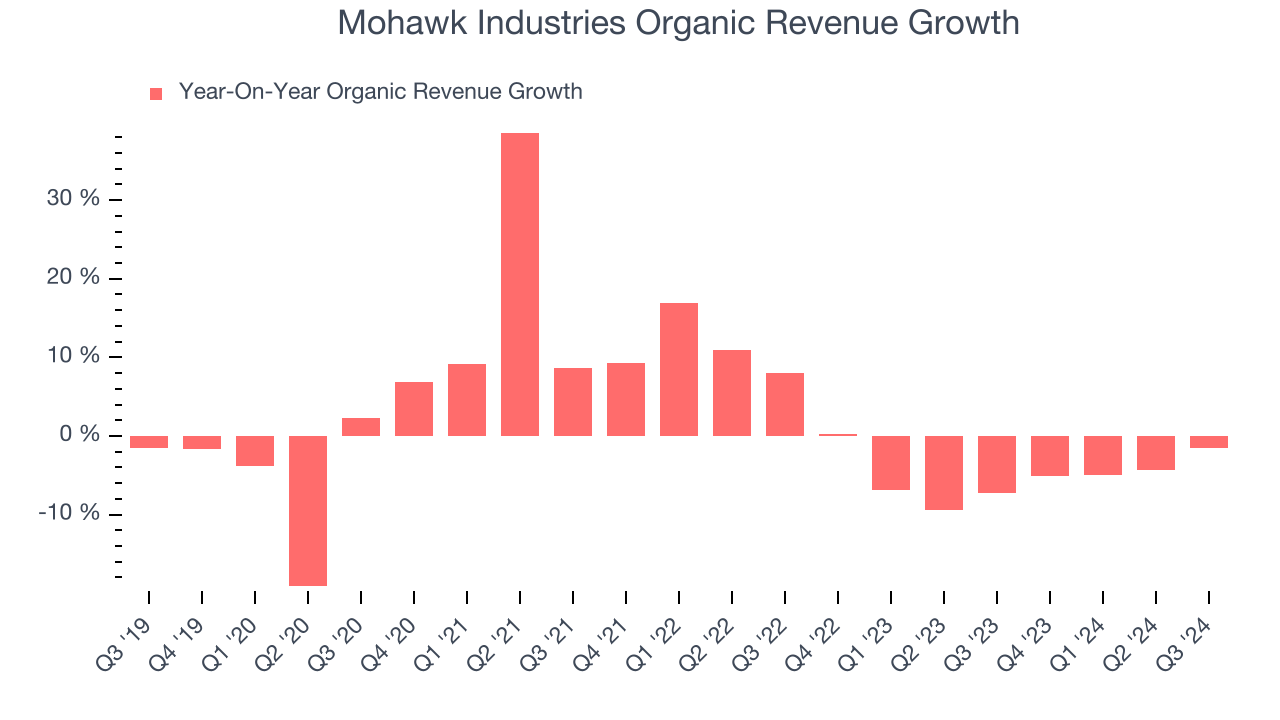

2. Core Business Falling Behind as Demand Declines

We can better understand consumer discretionary companies by analyzing their organic revenue. This metric gives visibility into Mohawk Industries’s core business as it excludes the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

Over the last two years, Mohawk Industries’s organic revenue averaged 4.9% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Mohawk Industries might lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

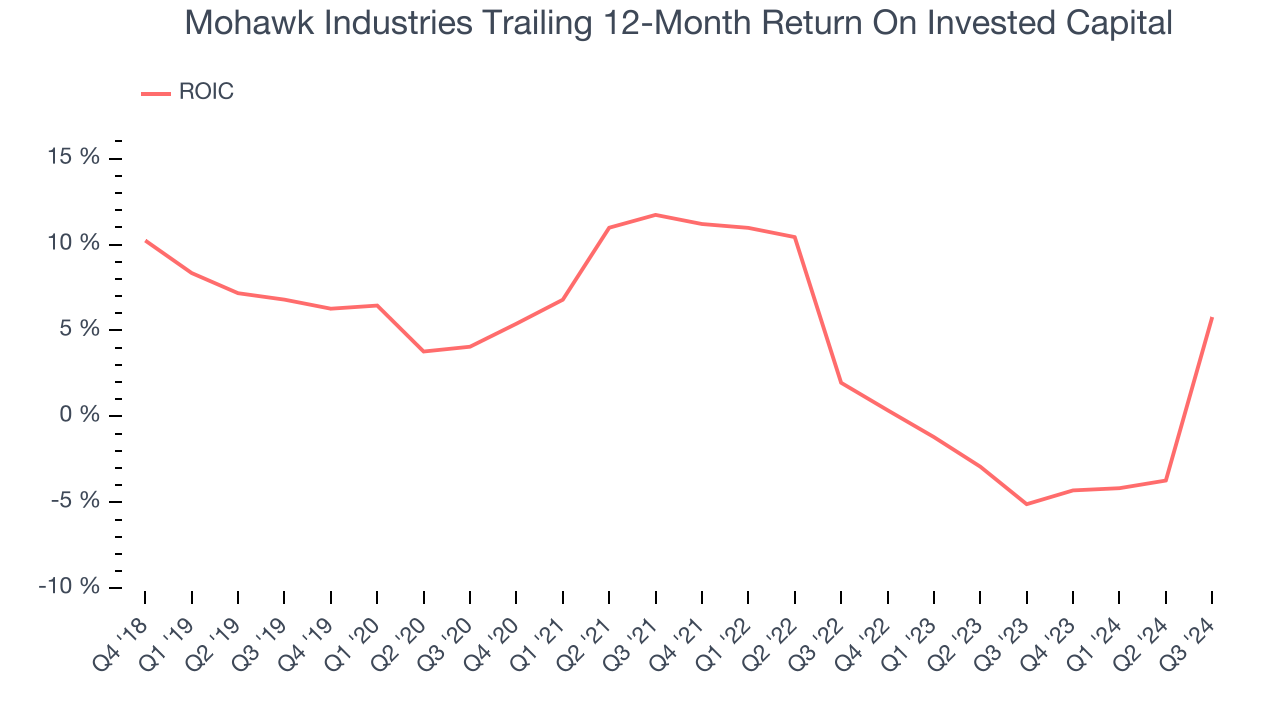

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it raised (debt and equity).

We typically prefer to invest in businesses with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Mohawk Industries’s ROIC has decreased over the last few years. Paired with its already low returns, these declines suggest its profitable business opportunities are few and far between.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Mohawk Industries, we’ll be cheering from the sidelines. That said, the stock currently trades at 12.4x forward price-to-earnings (or $140.34 per share). This valuation could be reasonable, but the company’s shaky fundamentals present too much downside risk. There are more exciting stocks to buy at the moment. Let us point you toward Deere, the leading supplier of autonomous agriculture equipment.

Stocks We Like More Than Mohawk Industries

With rates dropping, inflation stabilizing, and the elections in the rear-view mirror, all signals point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our High Quality Stocks with strong momentum. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.