Salesforce has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed 14.2% to $328.51 per share while the index has gained 11.5%.

Is now a good time to buy CRM? Find out in our full research report, it’s free.

Why Does CRM Stock Spark Debate?

Launched in 1999 from a rented one-bedroom apartment in San Francisco by Marc Benioff and his three co-founders, Salesforce (NYSE: CRM) is a software-as-a-service platform that helps companies access, manage, and share sales information.

Two Positive Attributes:

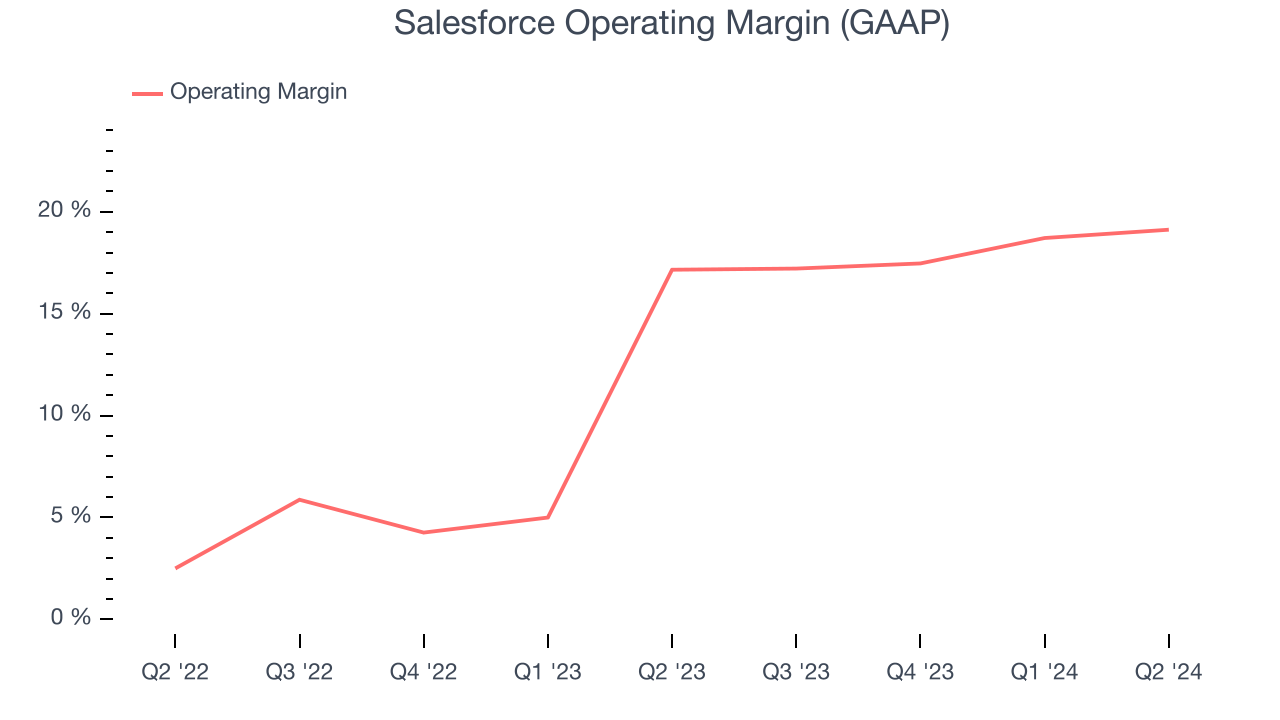

1. Operating Margin Reveals a Well-Run Organization

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after hiring engineers to develop products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Salesforce has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 18.1%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

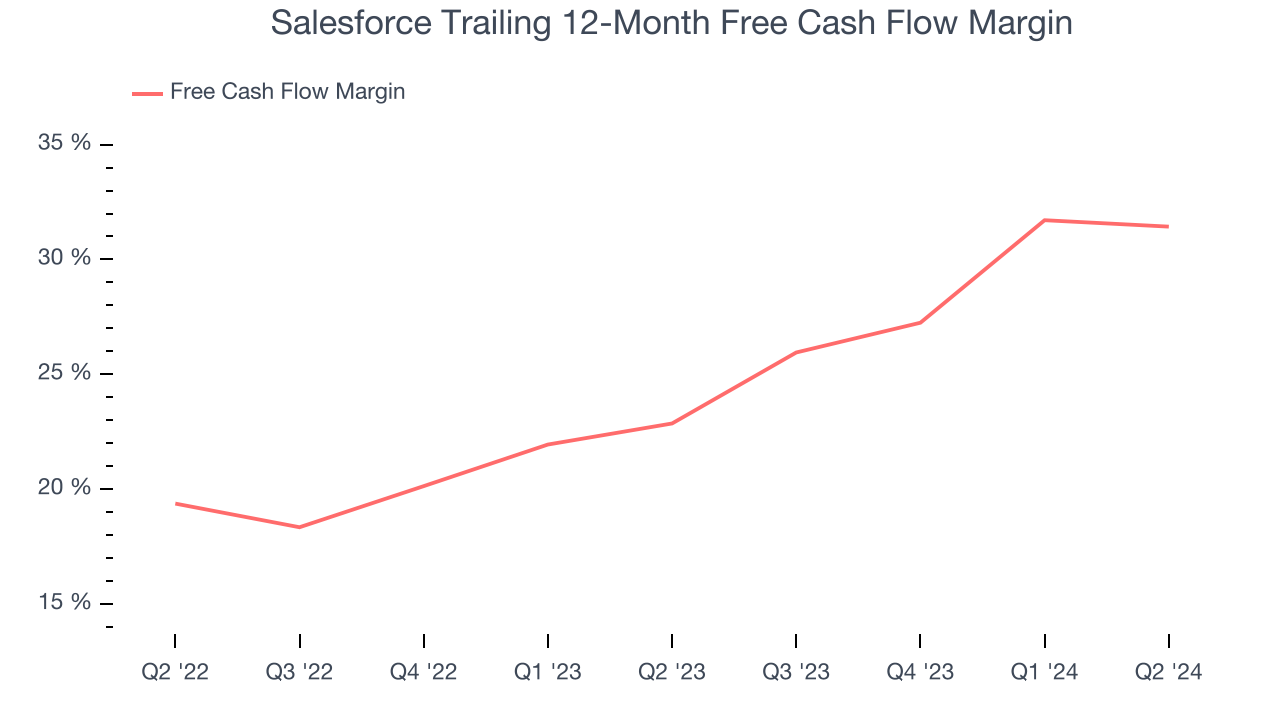

2. Excellent Free Cash Flow Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Salesforce has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 31.4% over the last year.

One Reason to be Careful:

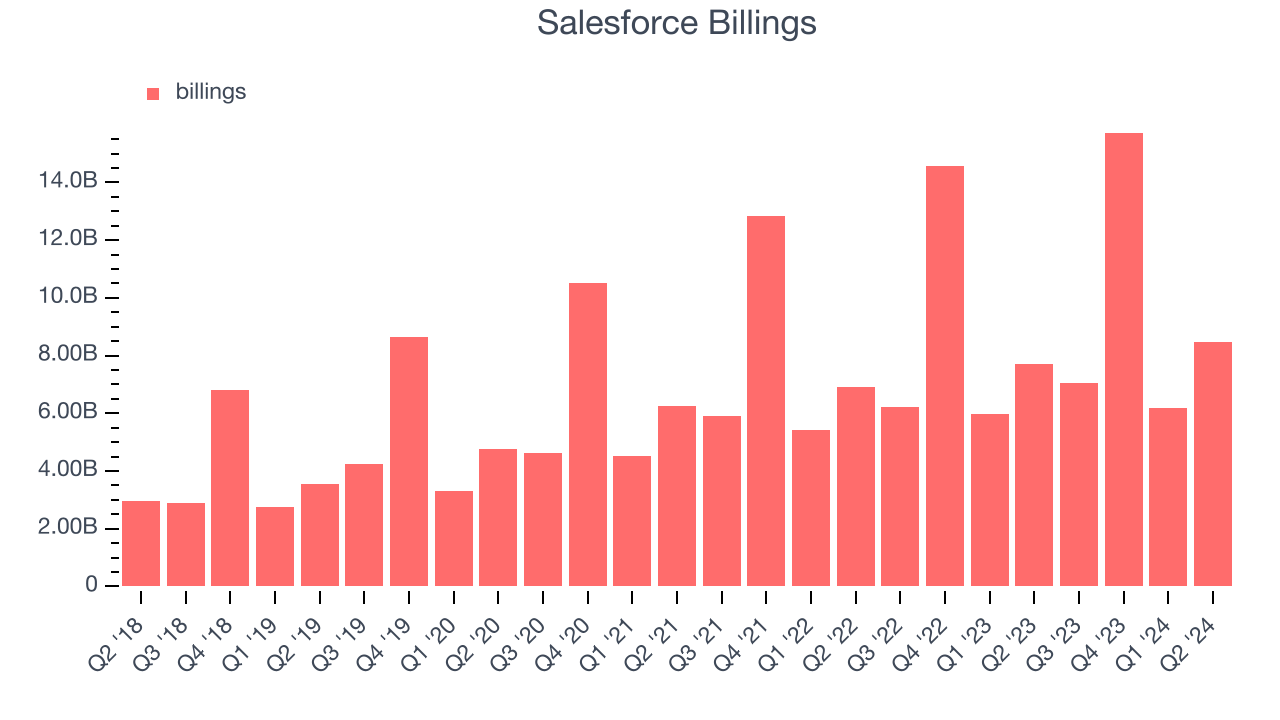

Weak Billings Point to Soft Demand

In addition to revenue, billings is a non-GAAP metric that sheds additional light on Salesforce’s business quality. Billings is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Salesforce’s billings came in at $8.49 billion in the latest quarter, and over the last four quarters, its growth averaged 8.7% year-on-year increases. This performance was underwhelming and suggests that increasing competition is causing challenges in acquiring/retaining customers.

Final Judgment

Salesforce has huge potential even with the open question, but at $328.51 per share (or 8.2x forward price-to-sales), is now the right time to buy the stock? See for yourself in our in-depth research report, it’s free.

Stocks We Would Buy Instead of Salesforce

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.