Remitly’s 36.2% return over the past six months has outpaced the S&P 500 by 25.5%, and its stock price has climbed to $19.64 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy RELY? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Is Remitly a Good Business?

With Amazon founder Jeff Bezos as an early investor, Remitly (NASDAQ: RELY) is an online platform that enables consumers to safely and quickly send money globally.

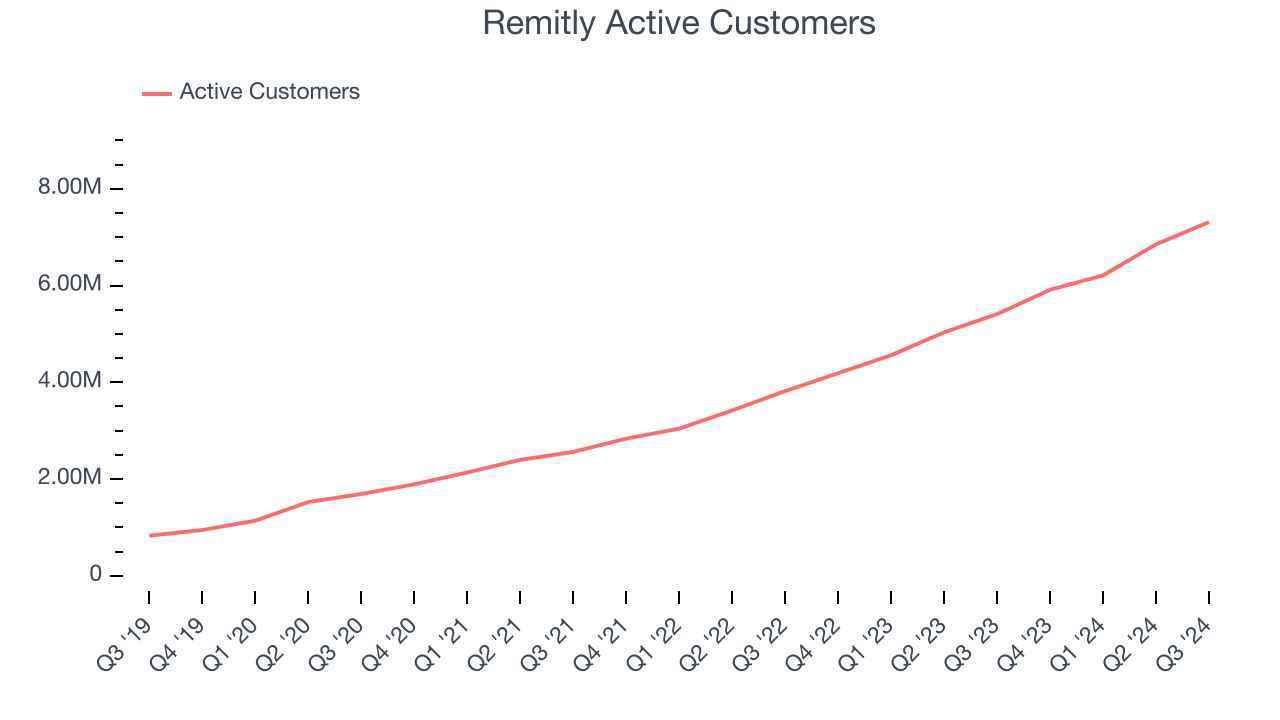

1. Active Customers Skyrocket, Fueling Growth Opportunities

As an online marketplace, Remitly generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, Remitly’s active customers, a key performance metric for the company, increased by 41.9% annually to 7.31 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

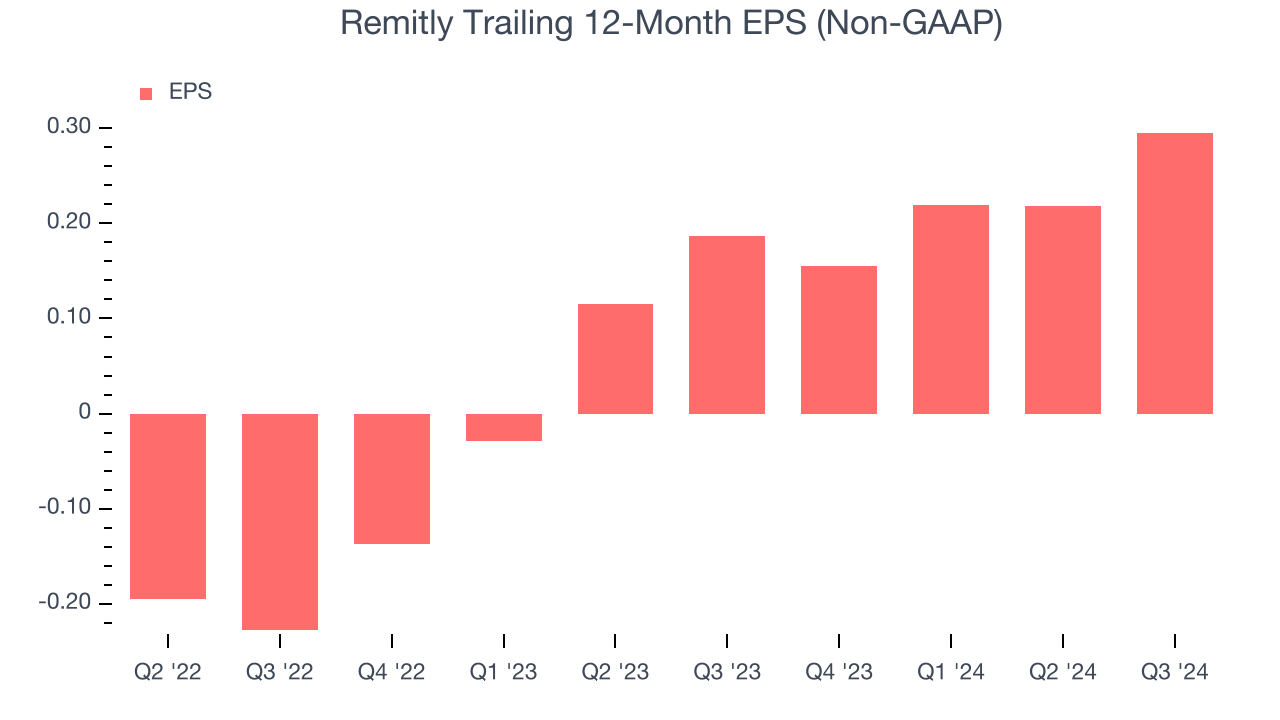

2. Long-Term EPS Growth Is Outstanding

Analyzing the change in earnings per share (EPS) tells us whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Remitly’s full-year EPS flipped from negative to positive over the last two years. This is a good sign and shows it’s at an inflection point.

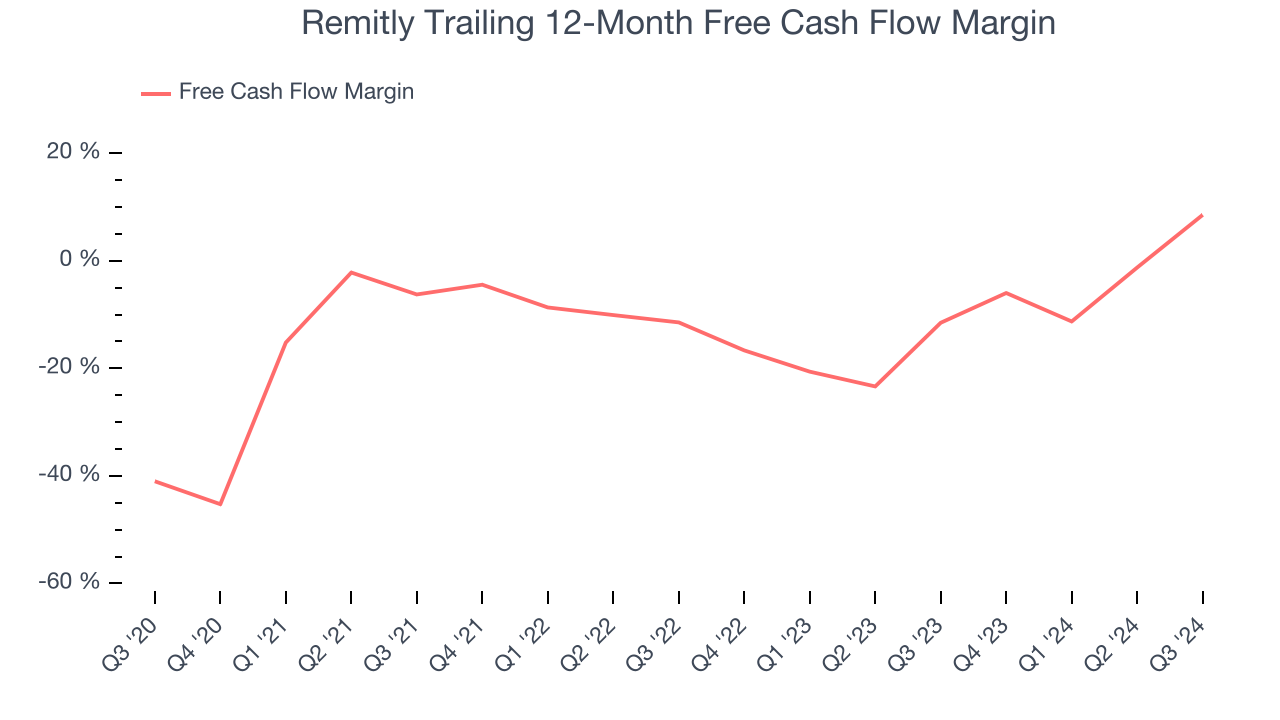

3. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Remitly’s margin expanded by 14.8 percentage points over the last few years. The company’s improvement shows it’s heading in the right direction, and because its free cash flow profitability rose more than its operating profitability, continued increases could signal it’s becoming a less capital-intensive business. Remitly’s free cash flow margin for the trailing 12 months was 8.5%.

Final Judgment

These are just a few reasons Remitly is a rock-solid business worth owning, and with its shares topping the market in recent months, the stock trades at 27.3x forward EV-to-EBITDA (or $19.64 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Remitly

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.