Over the past six months, J. M. Smucker’s stock price has fallen to $107.20. Shareholders have lost 6.2% of their capital, highly disappointing when considering the S&P 500 has climbed 10.7%. This may have investors wondering how to approach the situation.

Is now the time to buy J. M. Smucker, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.Despite the more favorable entry price, we're swiping left on J. M. Smucker for now. Here are three reasons why we avoid SJM and one stock we'd rather own.

Why Is J. M. Smucker Not Exciting?

Best known for its fruit jams and spreads, J.M Smucker (NYSE: SJM) is a packaged foods company whose products span from peanut butter and coffee to pet food.

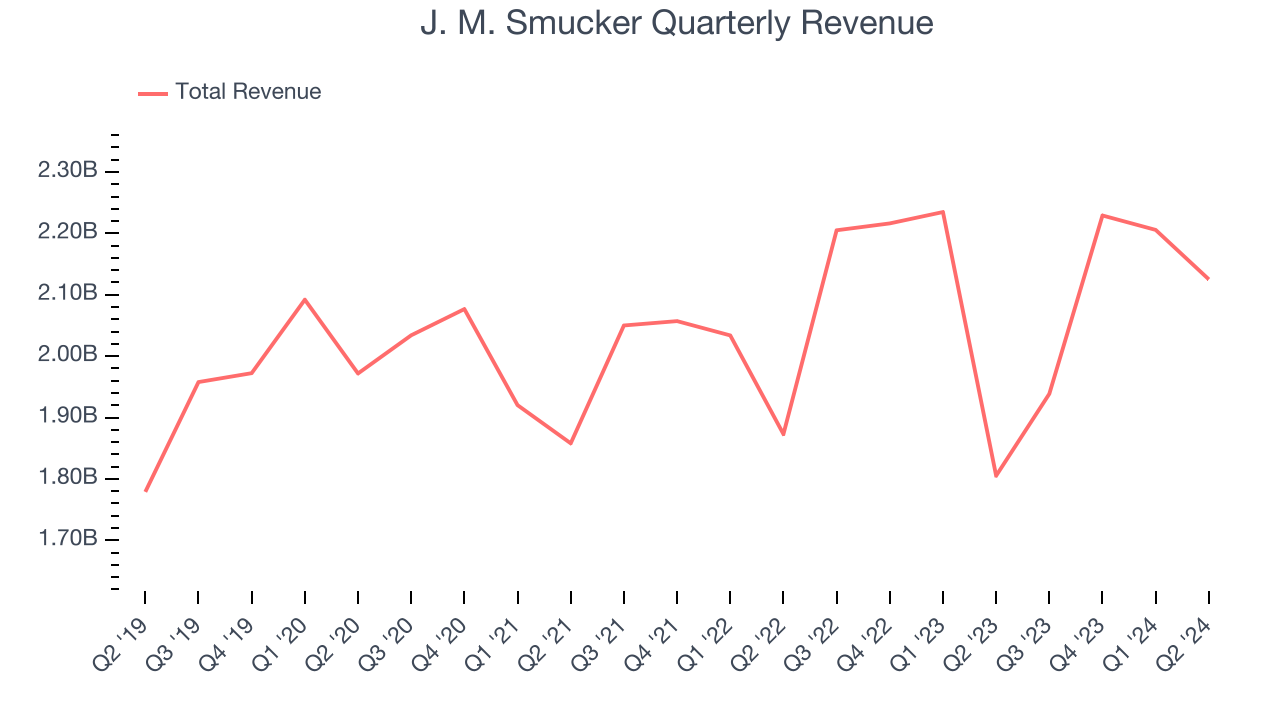

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Unfortunately, J. M. Smucker’s 2.5% annualized revenue growth over the last three years was sluggish. This fell short of our benchmark for the consumer staples sector.

2. Free Cash Flow Margin Dropping

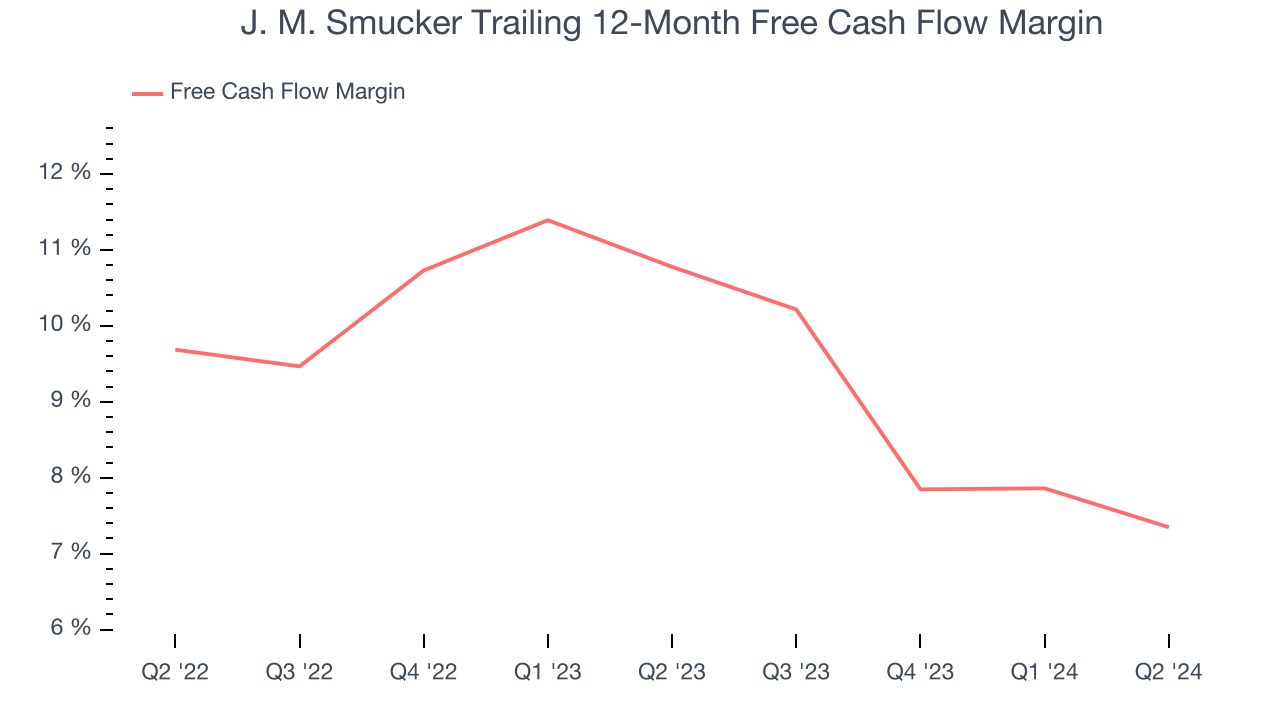

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, J. M. Smucker’s margin dropped by 3.4 percentage points over the last year. J. M. Smucker’s two-year free cash flow profile was compelling, but shareholders are surely hoping for its trend to reverse. Continued declines could signal that the business is becoming more capital-intensive. Its free cash flow margin for the trailing 12 months was 7.3%.

3. Previous Growth Initiatives Haven’t Paid Off Yet

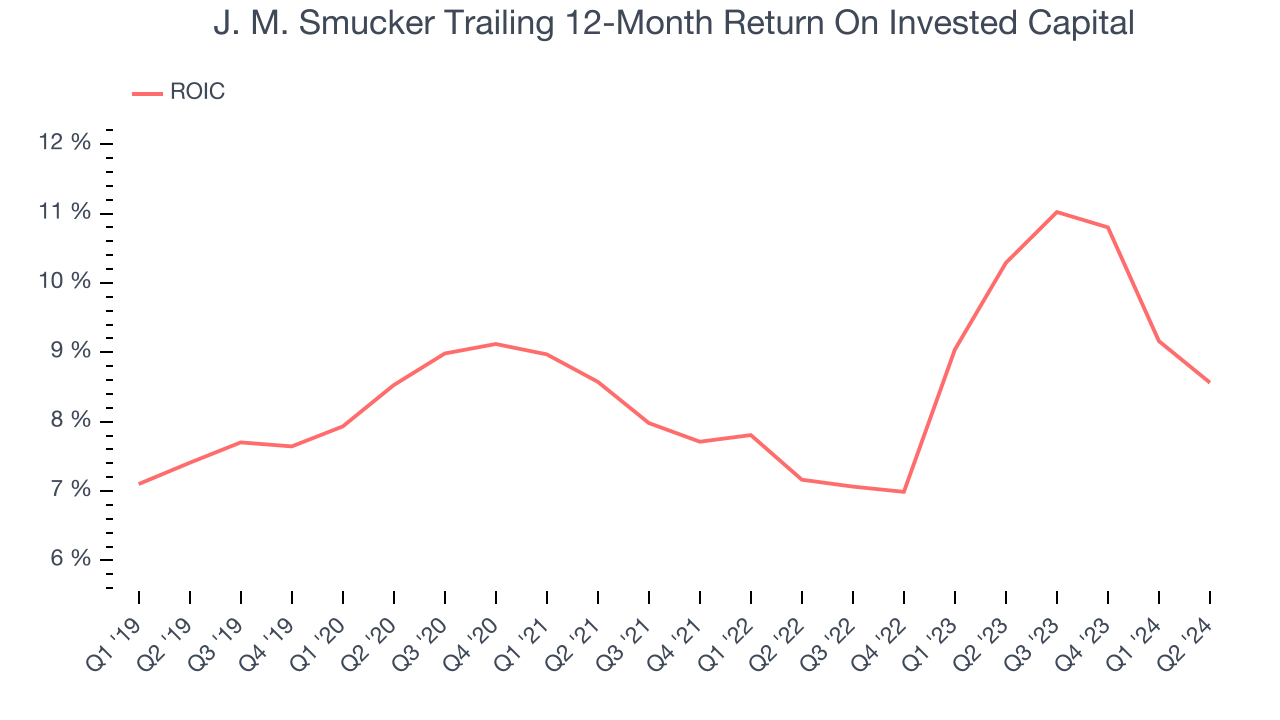

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it raised (debt and equity).

J. M. Smucker’s five-year average ROIC was 8.6%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+. Its returns suggest it historically did a mediocre job at investing in profitable growth initiatives.

Final Judgment

J. M. Smucker’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 10.5x forward price-to-earnings (or $107.20 per share). While this valuation could be justified, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest taking a look at Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Like More Than J. M. Smucker

With rates dropping, inflation stabilizing, and the elections in the rear-view mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.