Wrapping up Q3 earnings, we look at the numbers and key takeaways for the household products stocks, including Colgate-Palmolive (NYSE: CL) and its peers.

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

The 10 household products stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.9% while next quarter’s revenue guidance was 1.1% below.

In light of this news, share prices of the companies have held steady as they are up 2.8% on average since the latest earnings results.

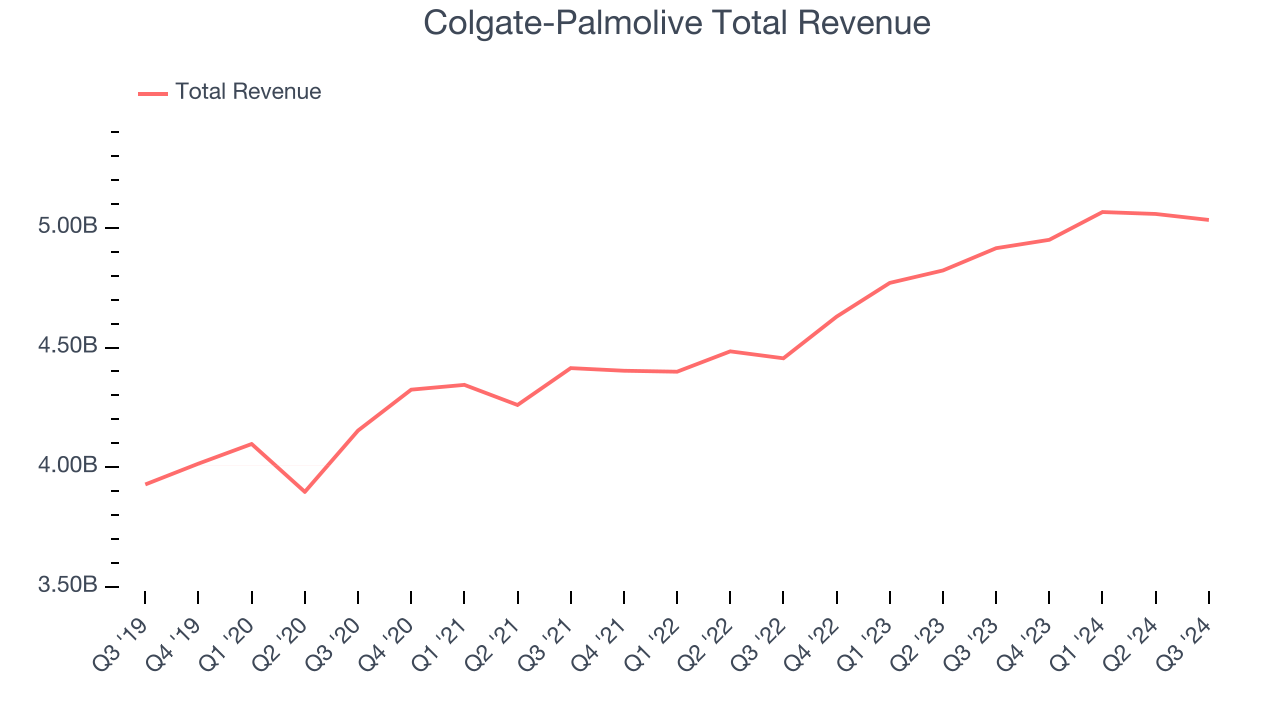

Colgate-Palmolive (NYSE: CL)

Formed after the 1928 combination between toothpaste maker Colgate and soap maker Palmolive-Peet, Colgate-Palmolive (NYSE: CL) is a consumer products company that focuses on personal, household, and pet products.

Colgate-Palmolive reported revenues of $5.03 billion, up 2.4% year on year. This print exceeded analysts’ expectations by 0.5%. Despite the top-line beat, it was still a mixed quarter for the company with a decent beat of analysts’ organic revenue estimates but a slight miss of analysts’ EBITDA estimates.

Colgate-Palmolive Company (NYSE: CL) today reported results for third quarter 2024. Noel Wallace, Chairman, President and Chief Executive Officer, commented on the Base Business third quarter results, “We are very pleased to have delivered another quarter of strong top and bottom line results with earnings exceeding our expectations. Net sales increased 2.4% and organic sales grew 6.8% (on top of 8.8% organic sales growth in the year ago quarter) driven by a healthy balance of volume growth and higher pricing. Every operating division delivered positive volume growth for the second consecutive quarter as we focus on increasing household penetration to drive category growth and market shares.

Unsurprisingly, the stock is down 2.9% since reporting and currently trades at $96.84.

Is now the time to buy Colgate-Palmolive? Access our full analysis of the earnings results here, it’s free.

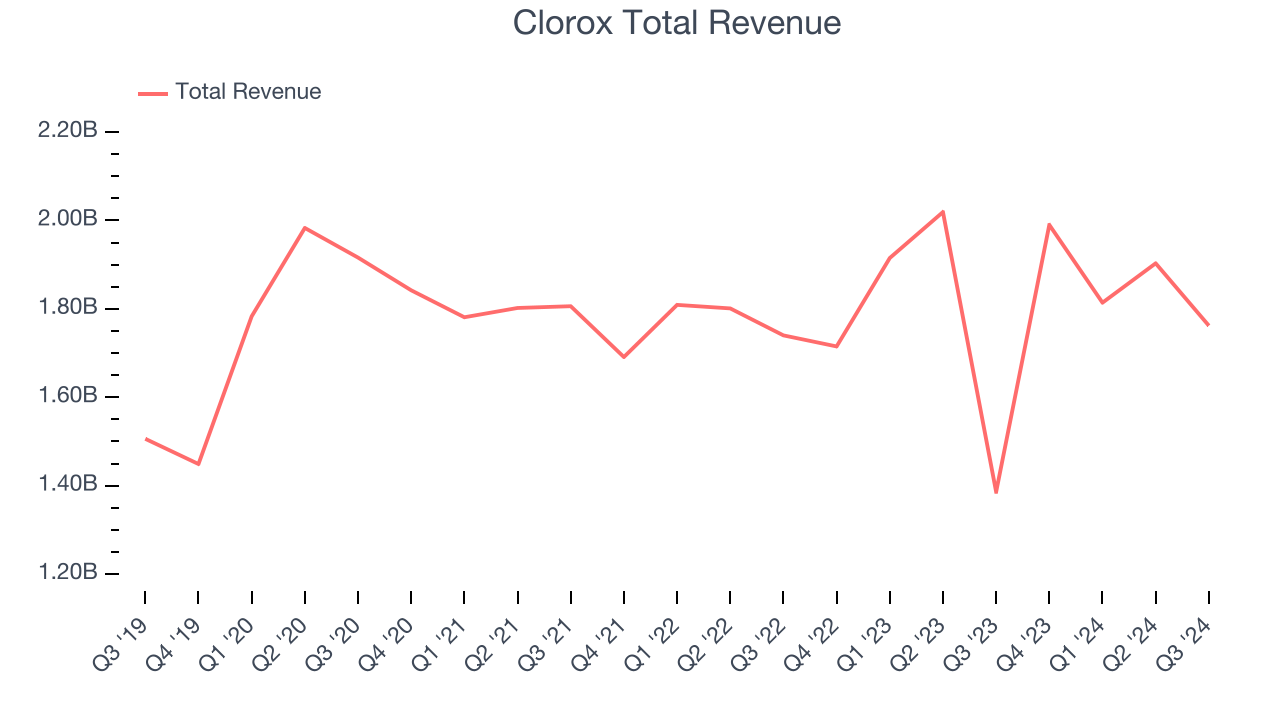

Best Q3: Clorox (NYSE: CLX)

Founded in 1913 with bleach as the sole product offering, Clorox (NYSE: CLX) today is a consumer products giant whose product portfolio spans everything from bleach to skincare to salad dressing to kitty litter.

Clorox reported revenues of $1.76 billion, up 27.1% year on year, outperforming analysts’ expectations by 7.6%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ organic revenue estimates.

Clorox achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 6.9% since reporting. It currently trades at $167.35.

Is now the time to buy Clorox? Access our full analysis of the earnings results here, it’s free.

Slowest Q3: Central Garden & Pet (NASDAQ: CENT)

Enhancing the lives of both pets and homeowners, Central Garden & Pet (NASDAQ: CENT) is a leading producer and distributor of essential products for pet care, lawn and garden maintenance, and pest control.

Central Garden & Pet reported revenues of $669.5 million, down 10.8% year on year, falling short of analysts’ expectations by 5.9%. It was a softer quarter as it posted full-year EPS guidance missing analysts’ expectations significantly and a significant miss of analysts’ organic revenue estimates.

Central Garden & Pet delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 3.4% since the results and currently trades at $40.

Read our full analysis of Central Garden & Pet’s results here.

Church & Dwight (NYSE: CHD)

Best known for its Arm & Hammer baking soda, Church & Dwight (NYSE: CHD) is a household and personal care products company with a vast portfolio that spans laundry detergent to toothbrushes to hair removal creams.

Church & Dwight reported revenues of $1.51 billion, up 3.8% year on year. This print beat analysts’ expectations by 1%. Aside from that, it was a satisfactory quarter as it also produced a solid beat of analysts’ EBITDA estimates but EPS guidance for next quarter missing analysts’ expectations.

The stock is up 10.5% since reporting and currently trades at $110.38.

Read our full, actionable report on Church & Dwight here, it’s free.

Procter & Gamble (NYSE: PG)

Founded by candle maker William Procter and soap maker James Gamble, Proctor & Gamble (NYSE: PG) is a consumer products behemoth whose product portfolio spans everything from facial tissues to laundry detergent to feminine care to men’s grooming.

Procter & Gamble reported revenues of $21.74 billion, flat year on year. This result came in 1.1% below analysts' expectations. More broadly, it was a mixed quarter as it also logged a decent beat of analysts’ EPS estimates but gross margin in line with analysts’ estimates.

The stock is up 4.1% since reporting and currently trades at $179.34.

Read our full, actionable report on Procter & Gamble here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.