Neighborhood social network Nextdoor (NYSE: KIND) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 17% year on year to $65.61 million. Guidance for next quarter’s revenue was better than expected at $63 million at the midpoint, 1.6% above analysts’ estimates.

Is now the time to buy Nextdoor? Find out by accessing our full research report, it’s free.

Nextdoor (KIND) Q3 CY2024 Highlights:

- Revenue: $65.61 million vs analyst estimates of $62.44 million (5.1% beat)

- EBITDA: -$1.32 million vs analyst estimates of -$8.10 million (83.7% beat)

- Revenue Guidance for Q4 CY2024 is $63 million at the midpoint, above analyst estimates of $62 million

- EBITDA guidance for Q4 CY2024 is $2 million at the midpoint, above analyst estimates of -$4.21 million

- Gross Margin (GAAP): 83%, up from 80.9% in the same quarter last year

- EBITDA Margin: -2%, up from -35.3% in the same quarter last year

- Free Cash Flow was -$13.17 million compared to -$5.46 million in the previous quarter

- Weekly Active Users: 45.9 million, up 5.5 million year on year

- Market Capitalization: $949.8 million

Company Overview

Helping residents figure out what's happening on their block in real time, Nextdoor (NYSE: KIND) is a social network that connects neighbors with each other and with local businesses.

Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

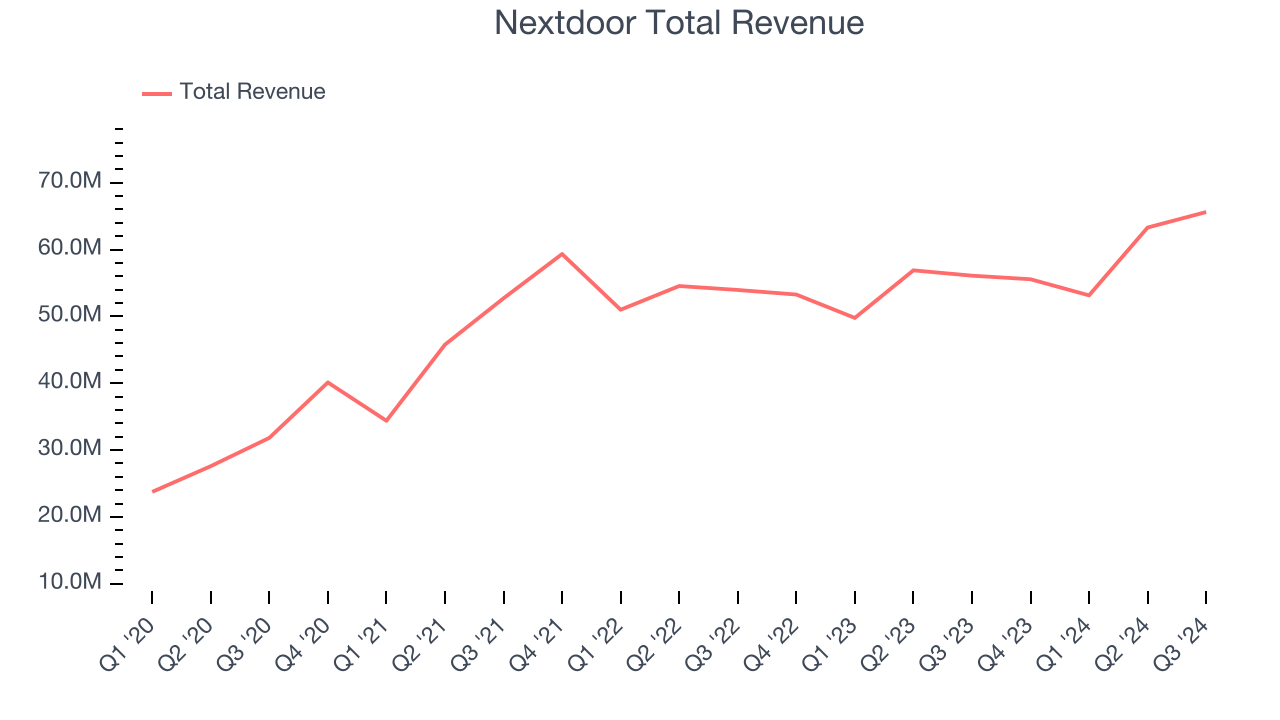

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Nextdoor grew its sales at a decent 11.2% compounded annual growth rate. This is a useful starting point for our analysis.

This quarter, Nextdoor reported year-on-year revenue growth of 17%, and its $65.61 million of revenue exceeded Wall Street’s estimates by 5.1%. Management is currently guiding for a 13.4% year-on-year increase next quarter.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Weekly Active Users

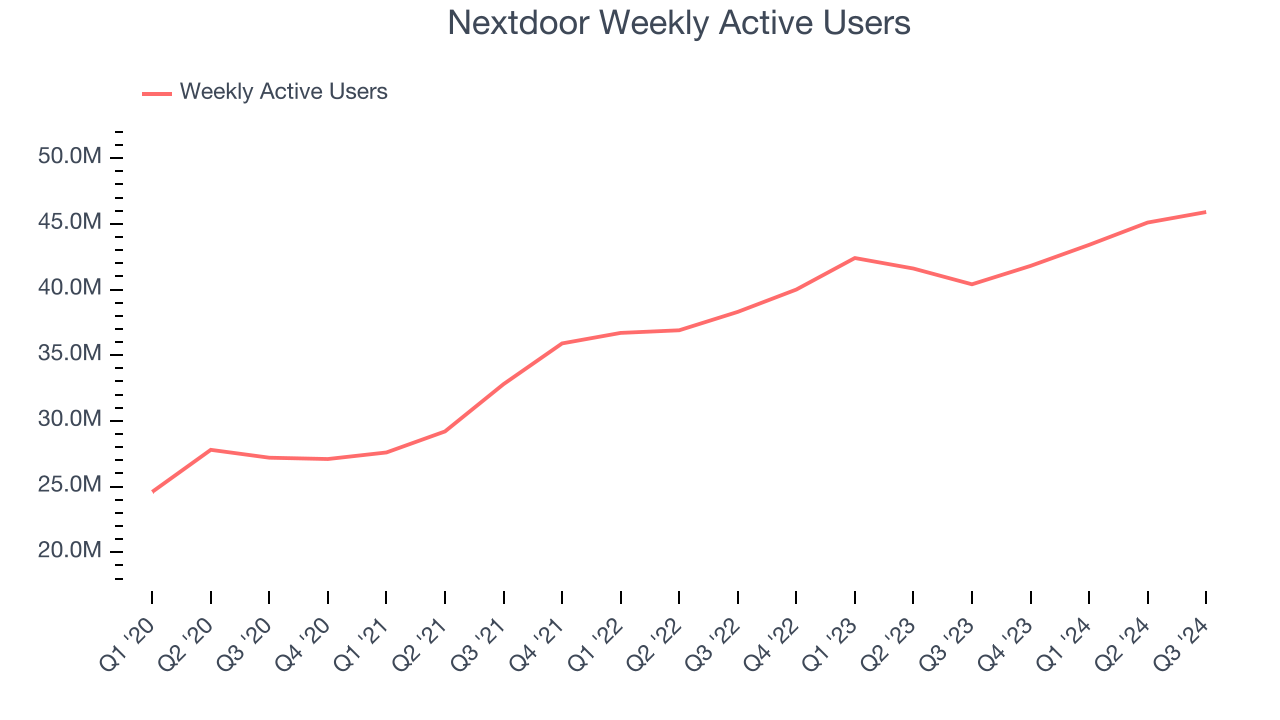

User Growth

As a social network, Nextdoor generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Nextdoor’s weekly active users, a key performance metric for the company, increased by 9.3% annually to 45.9 million in the latest quarter. This growth rate is solid for a consumer internet business and indicates people are excited about its offerings.

In Q3, Nextdoor added 5.5 million weekly active users, leading to 13.6% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

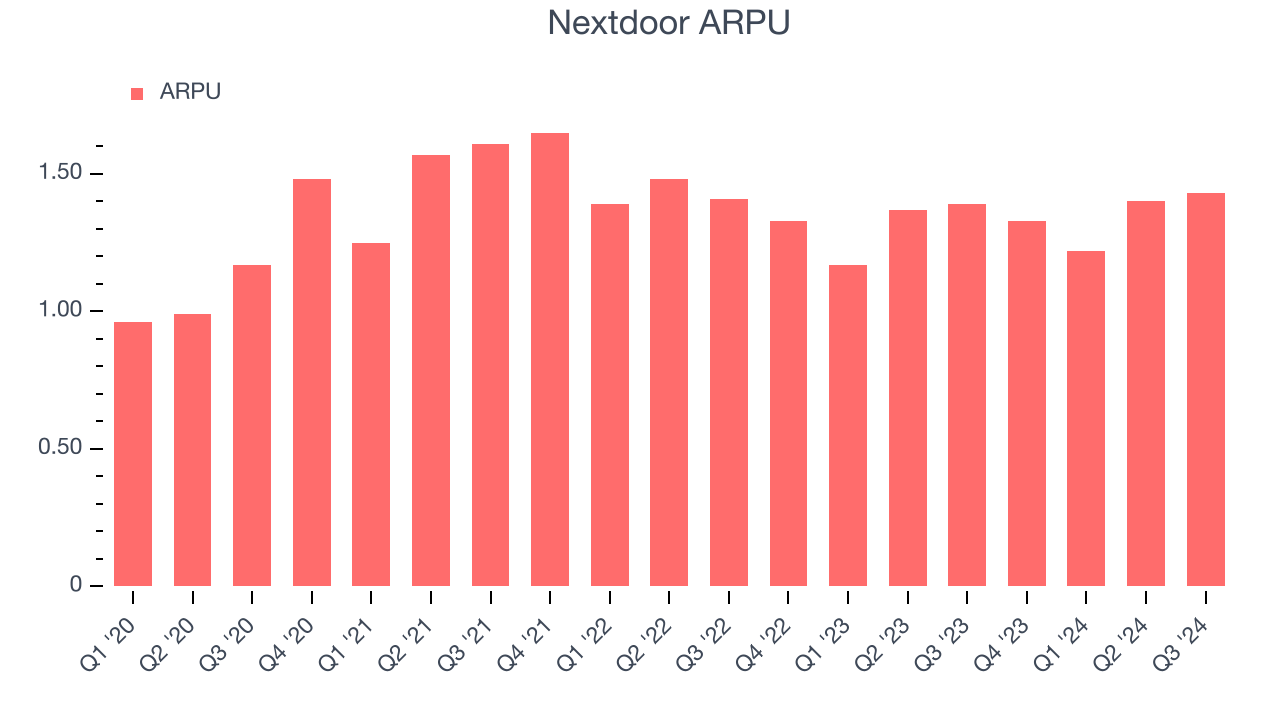

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Nextdoor because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Nextdoor’s audience and its ad-targeting capabilities.

Nextdoor’s ARPU fell over the last two years, averaging 4.3% annual declines. This isn’t great, but the increase in weekly active users is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Nextdoor tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

This quarter, Nextdoor’s ARPU clocked in at $1.43. It grew 2.8% year on year, slower than its user growth.

Key Takeaways from Nextdoor’s Q3 Results

We were impressed by Nextdoor’s optimistic revenue and EBITDA forecast for next quarter, which blew past analysts’ expectations. We were also excited this quarter's revenue and EBITDA outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 3.9% to $2.69 immediately after reporting.

Sure, Nextdoor had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.