Air cargo transportation and logistics provider Air Transport Services Group (NASDAQ: ATSG) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 9.9% year on year to $471.3 million. Its non-GAAP profit of $0.13 per share was also 24.4% below analysts’ consensus estimates.

Is now the time to buy Air Transport Services? Find out by accessing our full research report, it’s free.

Air Transport Services (ATSG) Q3 CY2024 Highlights:

- Note that on November 4th, ATSG announced that it will be acquired by Stonepeak, a private equity firm, in a $3.1 billion deal

- Revenue: $471.3 million vs analyst estimates of $507.5 million (7.1% miss)

- Adjusted EPS: $0.13 vs analyst expectations of $0.17 (24.4% miss)

- EBITDA: $129.5 million vs analyst estimates of $129.2 million (small beat)

- Gross Margin (GAAP): 36.5%, in line with the same quarter last year

- Operating Margin: 4.6%, down from 8.8% in the same quarter last year

- EBITDA Margin: 27.5%, up from 26.1% in the same quarter last year

- Free Cash Flow was $117.3 million, up from -$2.49 million in the same quarter last year

- Market Capitalization: $1.44 billion

Mike Berger, chief executive officer of ATSG, said, "First off, we are excited about our future with Stonepeak. Our leasing business continued to benefit from strong demand for our freighter aircraft, as we added four Boeing 767-300 freighter leases during the third quarter. Our third quarter results were affected by fewer block hours flown than a year ago and higher expenses, including start-up costs to fly ten more aircraft provided by Amazon. I am delighted to report that the 10th aircraft entered operations this week. For the quarter, we once again generated strong free cash flow, bringing the total to $193 million for the year. Going forward, certain contractual price increases effective in the fourth quarter position us for strong improvement in our ACMI Services segment and we expect to execute three new leases for CAM-owned freighters by year-end 2024. "

Company Overview

Founded in 1980, Air Transport Services Group (NASDAQ: ATSG) provides air cargo transportation and logistics solutions.

Air Freight and Logistics

The growth of e-commerce and global trade continues to drive demand for expedited shipping services, presenting opportunities for air freight companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Despite the advantages of speed and global reach, air freight and logistics companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

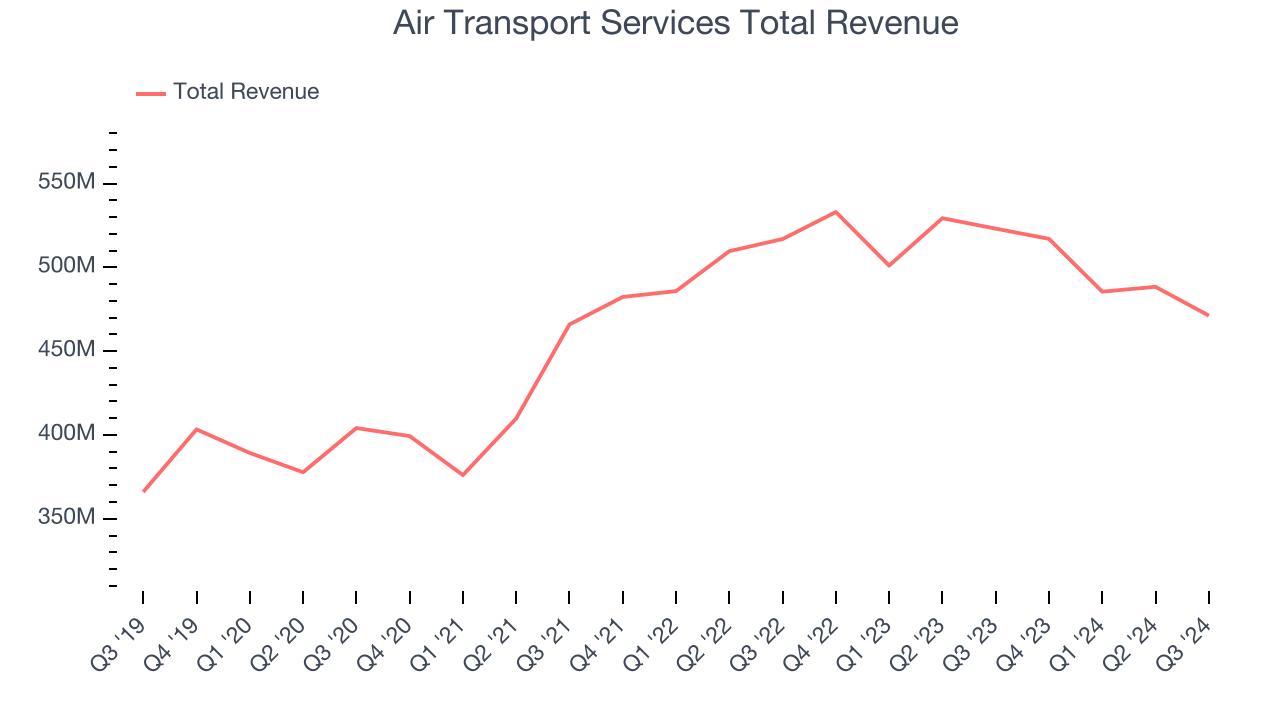

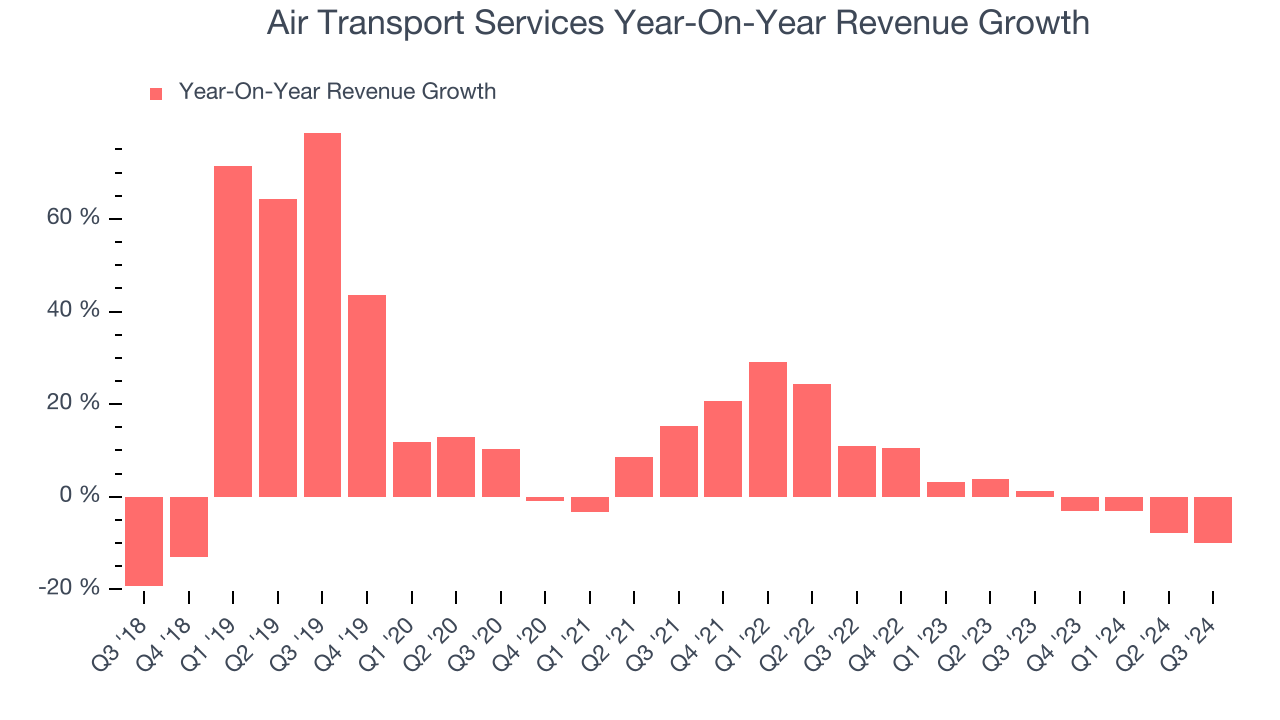

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Thankfully, Air Transport Services’s 8.1% annualized revenue growth over the last five years was decent. This is a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Air Transport Services’s recent history shows its demand slowed as its revenue was flat over the last two years. We also note many other Air Freight and Logistics businesses have faced declining sales because of cyclical headwinds. While Air Transport Services’s growth wasn’t the best, it did perform better than its peers.

We can dig further into the company’s revenue dynamics by analyzing its most important segments, ACMI Services and Cargo Aircraft Management, which are 68.3% and 23.9% of revenue. Over the last two years, Air Transport Services’s ACMI Services revenue (aircraft, crew, maintenance, and insurance) averaged 1.6% year-on-year declines. On the other hand, its Cargo Aircraft Management revenue (aircraft leasing and transport services) averaged 2.2% growth.

This quarter, Air Transport Services missed Wall Street’s estimates and reported a rather uninspiring 9.9% year-on-year revenue decline, generating $471.3 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 7% over the next 12 months, an improvement versus the last two years. Although this projection illustrates the market believes its newer products and services will catalyze better performance, it is still below the sector average.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

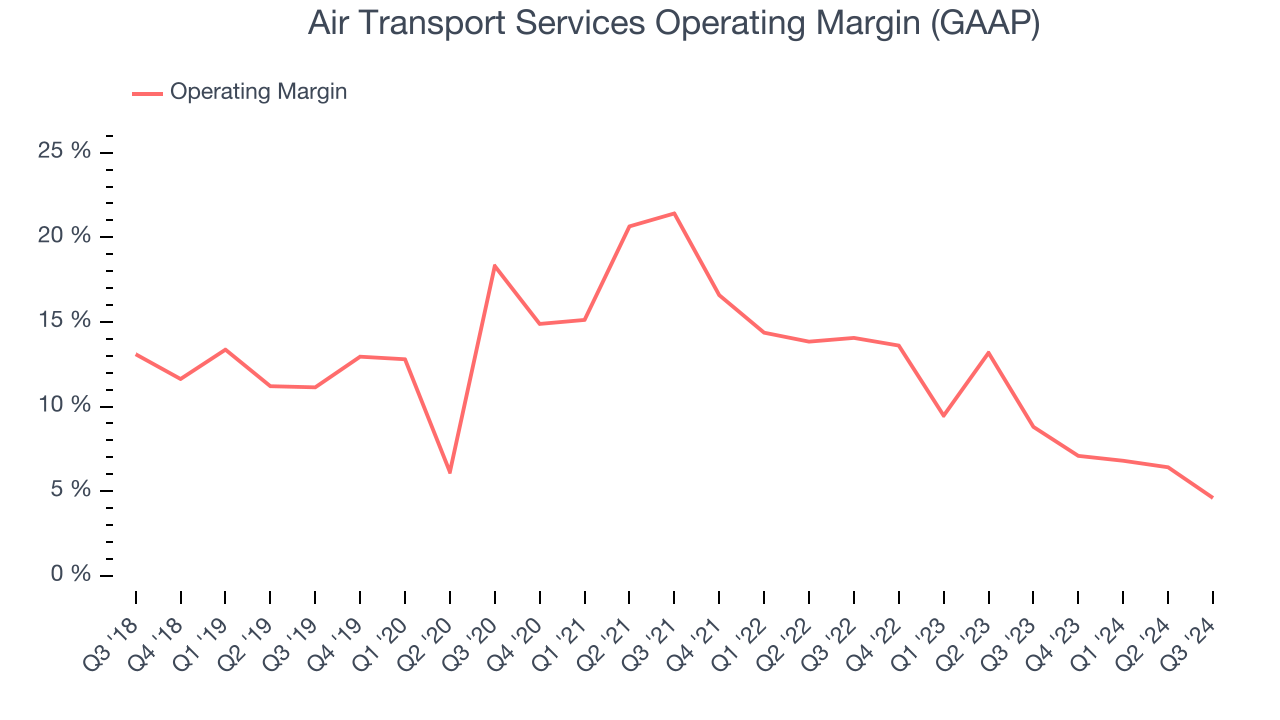

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Air Transport Services has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Air Transport Services’s annual operating margin decreased by 6.4 percentage points over the last five years. Even though its margin is still high, shareholders will want to see Air Transport Services become more profitable in the future.

In Q3, Air Transport Services generated an operating profit margin of 4.6%, down 4.2 percentage points year on year. Since Air Transport Services’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

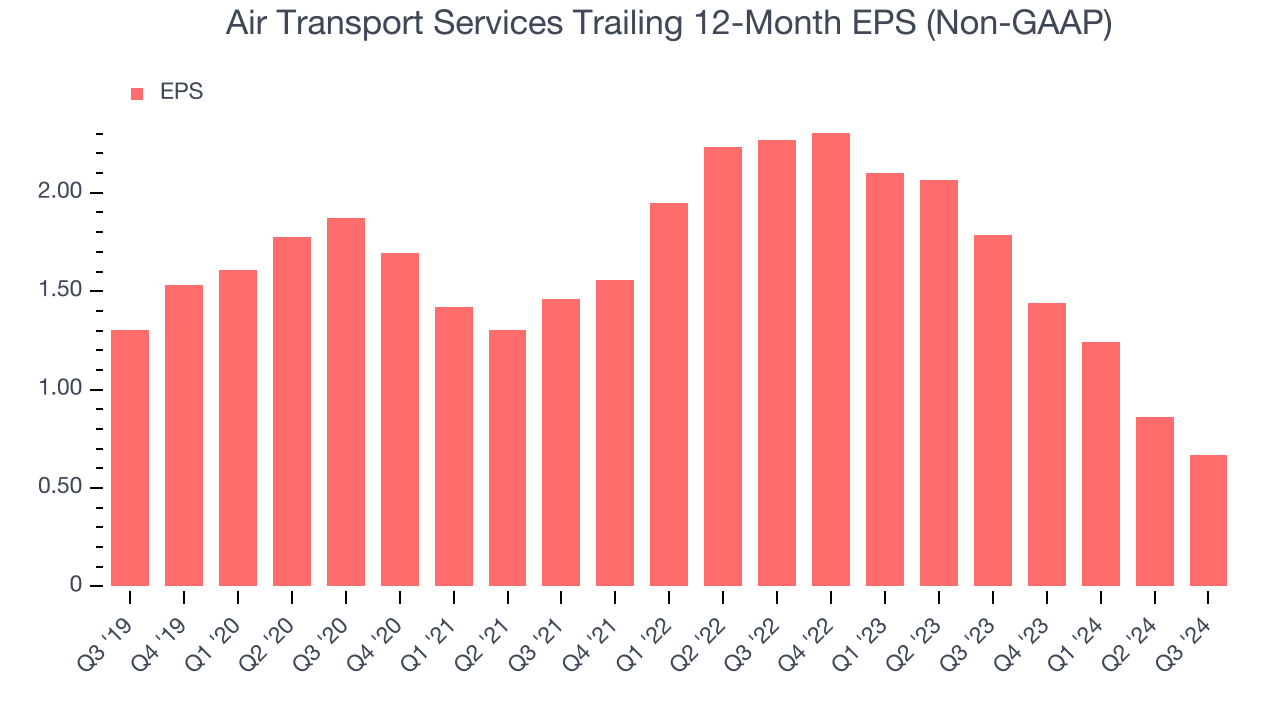

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Air Transport Services, its EPS declined by 12.5% annually over the last five years while its revenue grew by 8.1%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Air Transport Services’s earnings can give us a better understanding of its performance. As we mentioned earlier, Air Transport Services’s operating margin declined by 6.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Air Transport Services, its two-year annual EPS declines of 45.8% show it’s continued to underperform. These results were bad no matter how you slice the data.In Q3, Air Transport Services reported EPS at $0.13, down from $0.32 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Air Transport Services’s full-year EPS of $0.67 to grow by 75.2%.

Key Takeaways from Air Transport Services’s Q3 Results

We struggled to find many strong positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. Note that on November 4th, ATSG announced that it will be acquired by Stonepeak, a private equity firm, in a $3.1 billion deal. The stock remained flat at $22.07 immediately following the results.

So should you invest in Air Transport Services right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.