Packaged bakery food company Flower Foods (NYSE: FLO) met Wall Street’s revenue expectations in Q3 CY2024, but sales were flat year on year at $1.19 billion. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $5.13 billion at the midpoint. Its non-GAAP profit of $0.33 per share was 12.3% above analysts’ consensus estimates.

Is now the time to buy Flowers Foods? Find out by accessing our full research report, it’s free.

Flowers Foods (FLO) Q3 CY2024 Highlights:

- Revenue: $1.19 billion vs analyst estimates of $1.20 billion (in line)

- Adjusted EPS: $0.33 vs analyst estimates of $0.29 (12.3% beat)

- EBITDA: $133.3 million vs analyst estimates of $125.8 million (6% beat)

- The company reconfirmed its revenue guidance for the full year of $5.13 billion at the midpoint

- Management slightly raised its full-year Adjusted EPS guidance to $1.26 at the midpoint

- EBITDA guidance for the full year is $536 million at the midpoint, in line with analyst expectations

- Gross Margin (GAAP): 49.8%, up from 48.5% in the same quarter last year

- Operating Margin: 7.6%, up from -4.9% in the same quarter last year

- EBITDA Margin: 11.2%, up from 10.1% in the same quarter last year

- Free Cash Flow Margin: 7.4%, down from 8.4% in the same quarter last year

- Organic Revenue was flat year on year

- Sales Volumes fell 2.4% year on year (4.1% in the same quarter last year)

- Market Capitalization: $4.64 billion

"Strong performance by our leading brands and successful execution of our cost initiatives and portfolio strategy drove better-than-expected earnings in the third quarter," said Ryals McMullian, chairman and CEO of Flowers Foods.

Company Overview

With Wonder Bread as its premier brand, Flower Foods (NYSE: FLO) is a packaged foods company that focuses on bakery products such as breads, buns, and cakes.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Flowers Foods carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

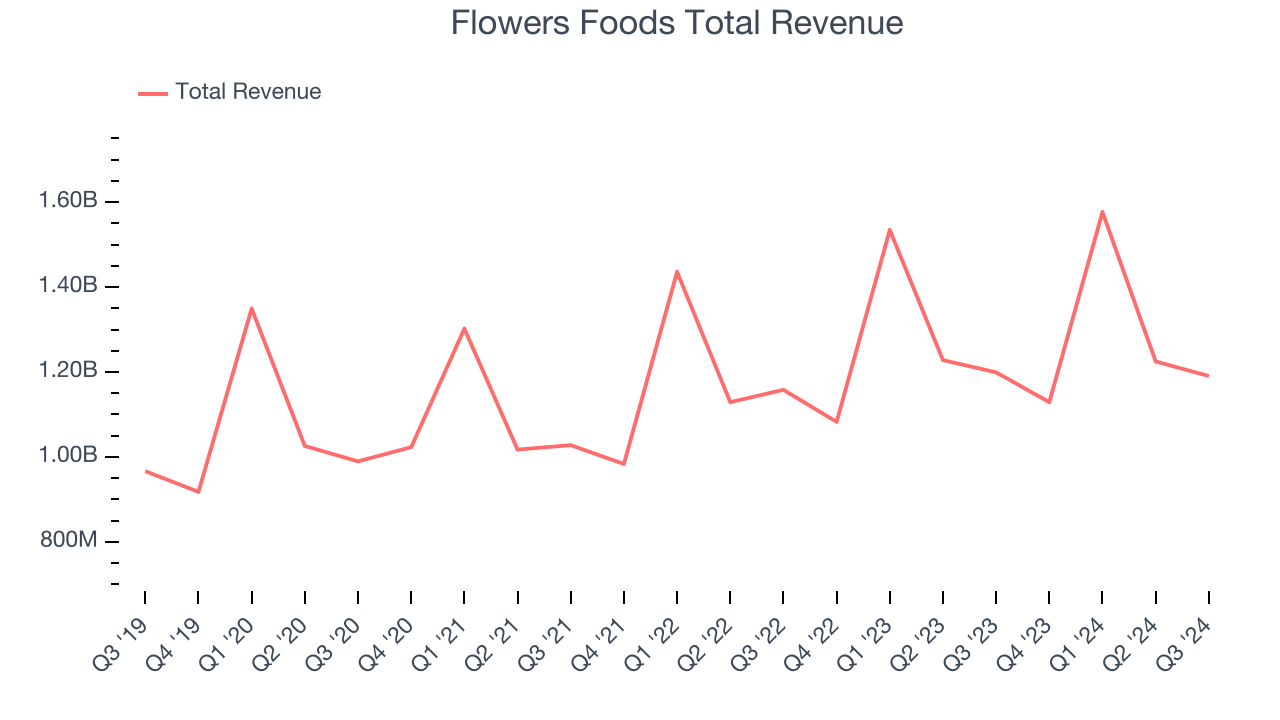

As you can see below, Flowers Foods’s 5.4% annualized revenue growth over the last three years was tepid as consumers bought less of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, Flowers Foods’s $1.19 billion of revenue was flat year on year and in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.4% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and illustrates the market thinks its products will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Volume Growth

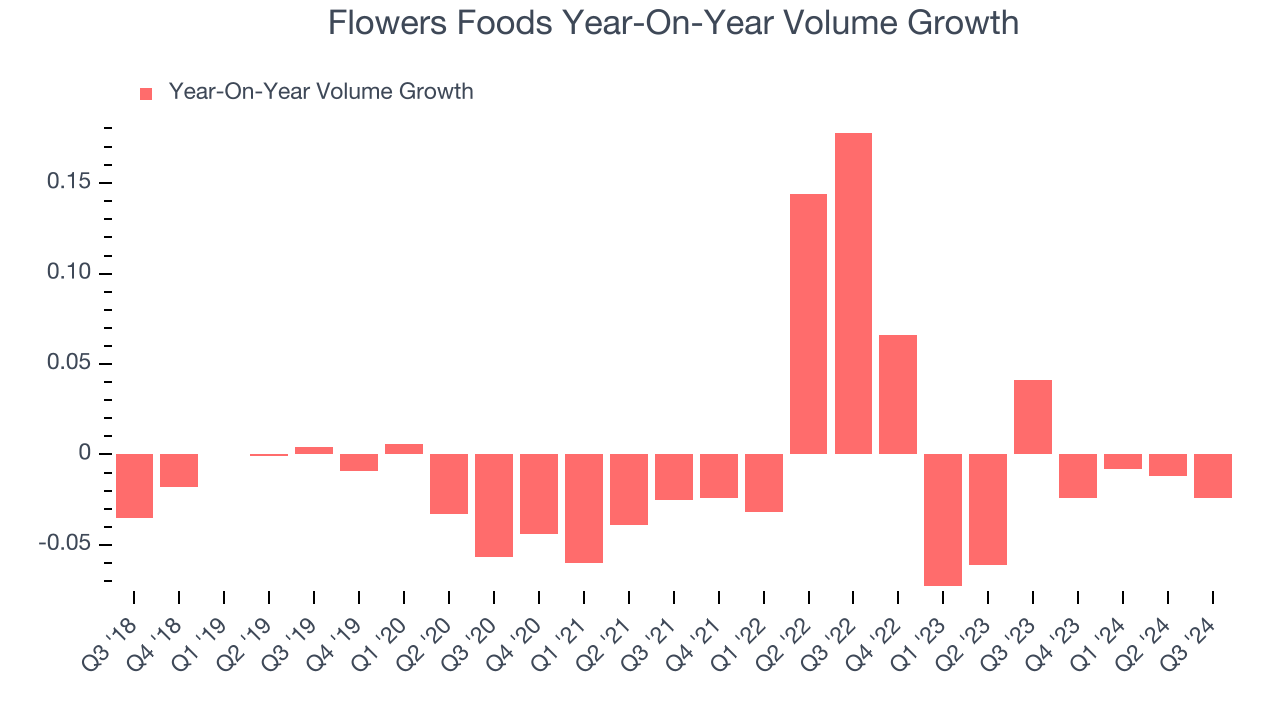

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Flowers Foods’s average quarterly sales volumes have shrunk by 1.2% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

In Flowers Foods’s Q3 2024, sales volumes dropped 2.4% year on year. This result was a reversal from the 4.1% year-on-year increase it posted 12 months ago. A one quarter hiccup shouldn’t deter you from investing in a business. We’ll be monitoring the company to see how things progress.

Key Takeaways from Flowers Foods’s Q3 Results

We liked that Flowers Foods beat analysts’ EBITDA and EPS expectations this quarter despite in line revenue. It was also a big positive that full year EPS guidance was raised. On the other hand, its organic revenue missed. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock remained flat at $22.08 immediately after reporting.

Big picture, is Flowers Foods a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.