Holding company and industrial conglomerate Icahn (NYSE: IEP) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 25.7% year on year to $2.22 billion. Its GAAP profit of $0.05 per share was also 76.2% below analysts’ consensus estimates.

Is now the time to buy Icahn Enterprises? Find out by accessing our full research report, it’s free.

Icahn Enterprises (IEP) Q3 CY2024 Highlights:

- Revenue: $2.22 billion vs analyst estimates of $2.32 billion (4.1% miss)

- EPS: $0.05 vs analyst estimates of $0.21 (-$0.16 miss)

- Gross Margin (GAAP): -0.1%, down from 14.9% in the same quarter last year

- Operating Margin: -9.2%, down from 7.9% in the same quarter last year

- EBITDA Margin: 8.2%, down from 11.8% in the same quarter last year

- Market Capitalization: $6.13 billion

Company Overview

Founded in 1987, Icahn Enterprises (NASDAQ: IEP) is a diversified holding company primarily engaged in investment and asset management across various sectors.

General Industrial Machinery

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

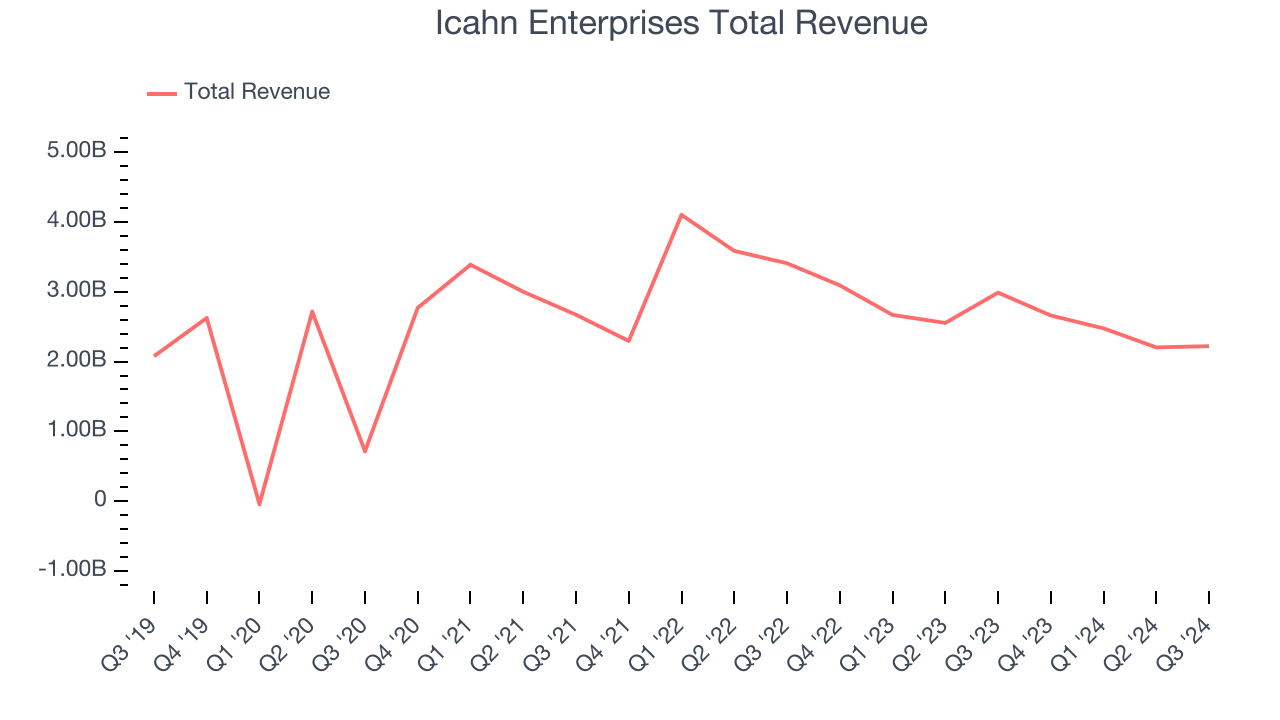

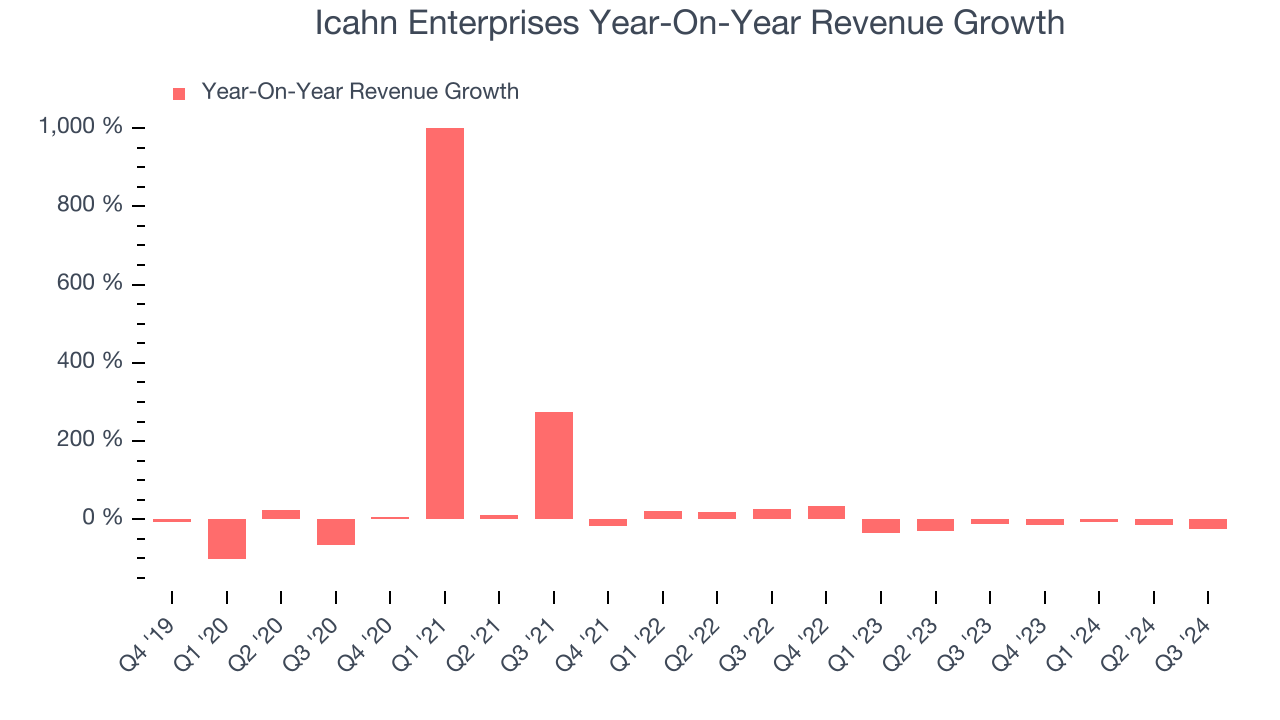

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Icahn Enterprises grew its sales at a weak 1.4% compounded annual growth rate. This shows it failed to expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Icahn Enterprises’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 15.5% annually.

This quarter, Icahn Enterprises missed Wall Street’s estimates and reported a rather uninspiring 25.7% year-on-year revenue decline, generating $2.22 billion of revenue.

Looking ahead, sell-side analysts expect revenue to decline 6.2% over the next 12 months. While this projection is better than its two-year trend it's tough to feel optimistic about a company facing demand difficulties.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

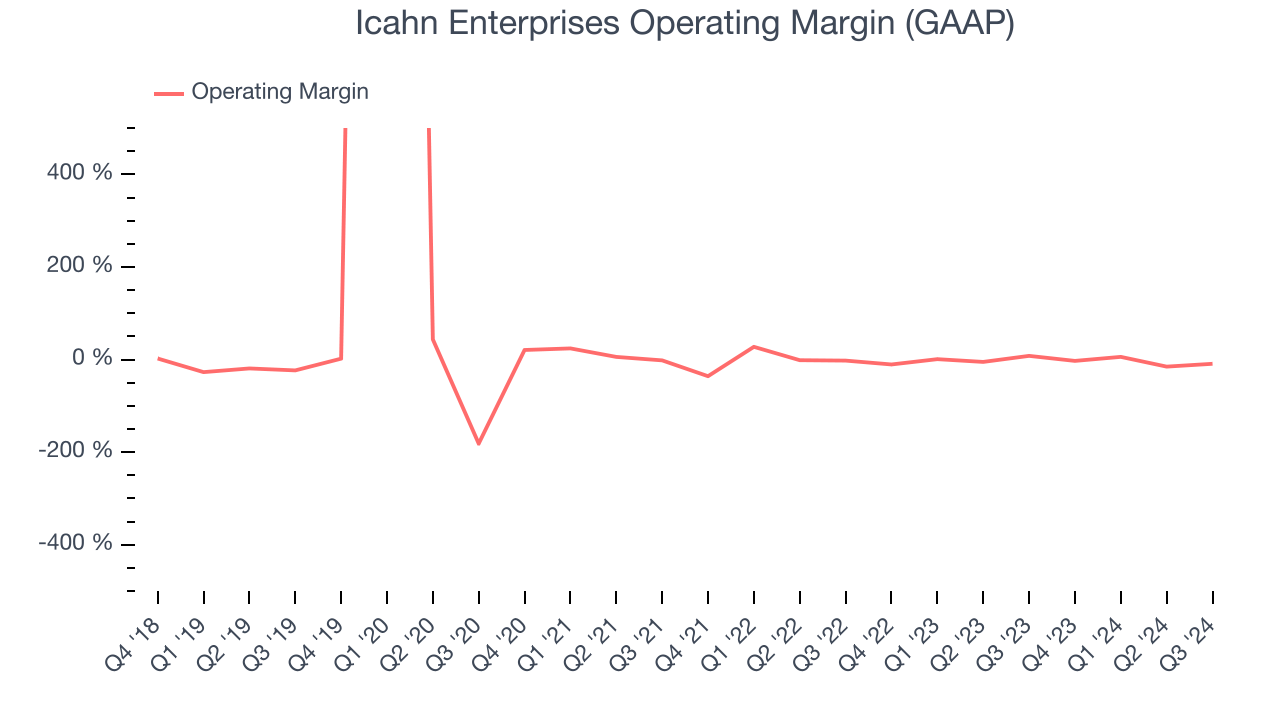

Operating Margin

Icahn Enterprises’s high expenses have contributed to an average operating margin of negative 2.6% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Icahn Enterprises’s annual operating margin rose by 34.3 percentage points over the last five years. Still, it will take much more for the company to reach long-term profitability.

In Q3, Icahn Enterprises generated a negative 9.2% operating margin. The company's lacking profits are certainly concerning.

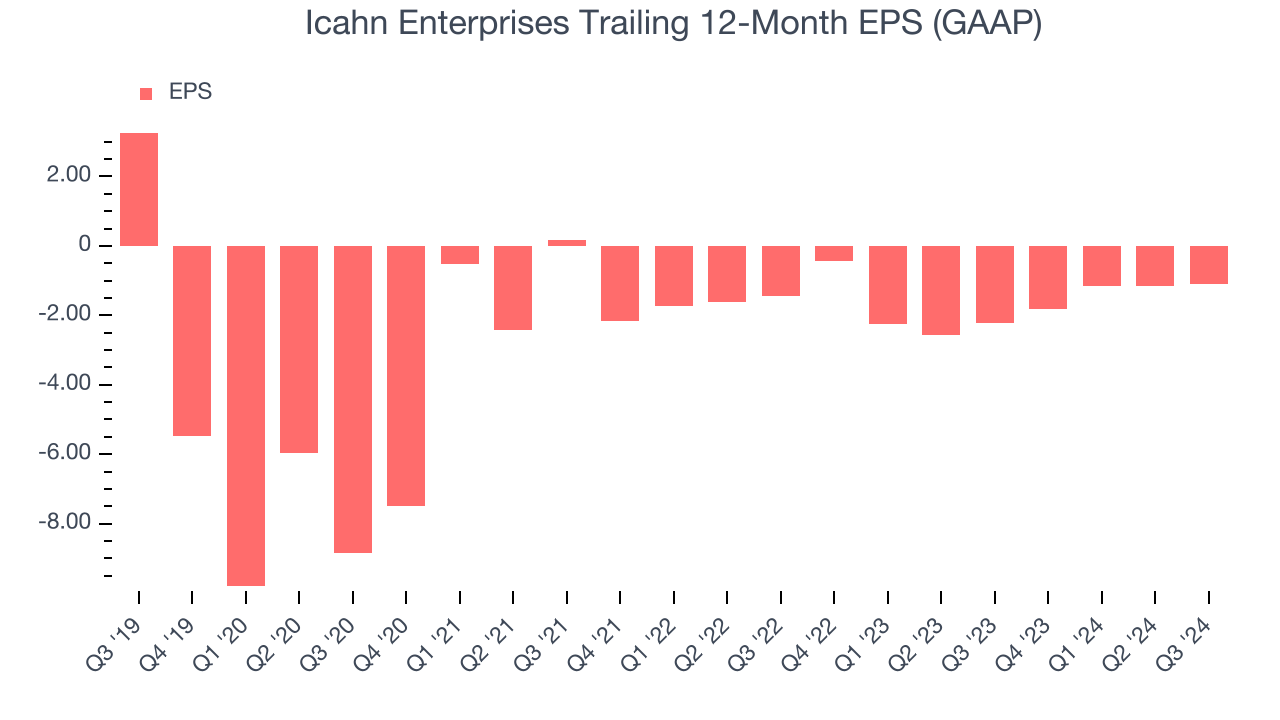

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Icahn Enterprises, its EPS declined by 18.5% annually over the last five years while its revenue grew by 1.4%. However, its operating margin actually expanded during this timeframe, telling us that non-fundamental factors affected its ultimate earnings.

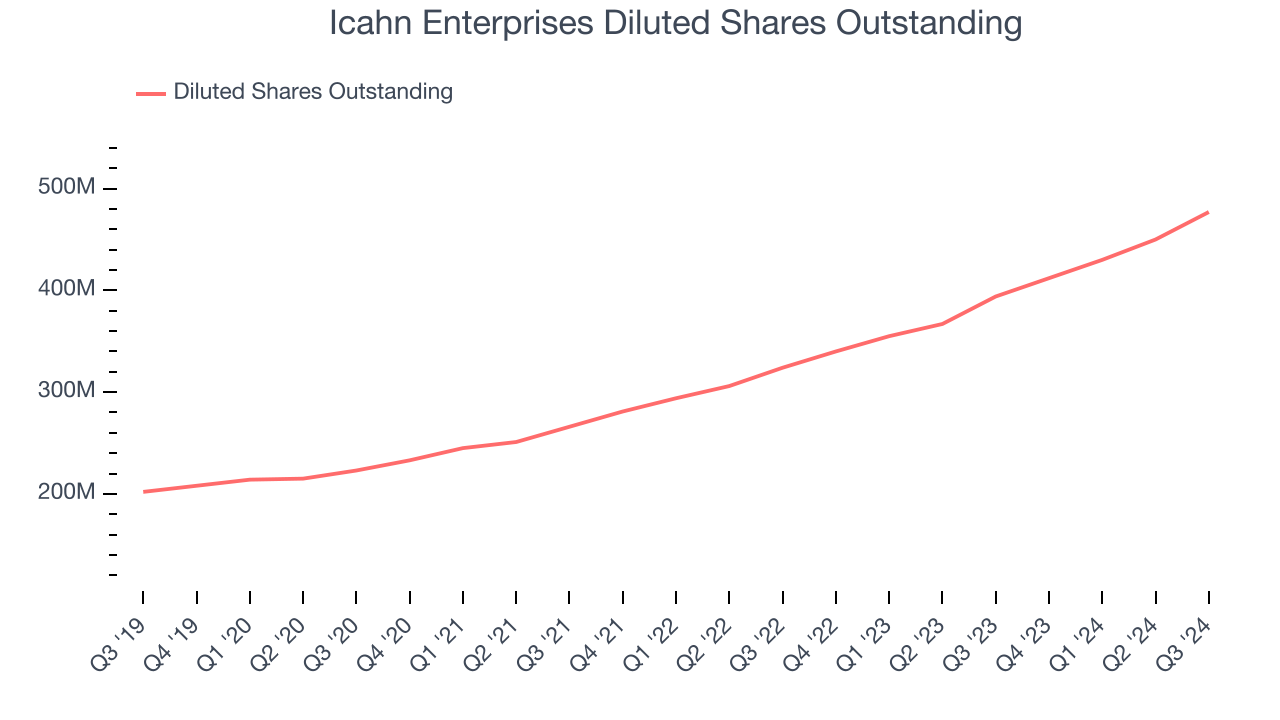

We can take a deeper look into Icahn Enterprises’s earnings to better understand the drivers of its performance. A five-year view shows Icahn Enterprises has diluted its shareholders, growing its share count by 136%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Icahn Enterprises, its two-year annual EPS growth of 12.8% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.In Q3, Icahn Enterprises reported EPS at $0.05, up from negative $0.02 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Icahn Enterprises’s full-year EPS of negative $1.09 will flip to positive $0.77.

Key Takeaways from Icahn Enterprises’s Q3 Results

We struggled to find many strong positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 7.8% to $11.89 immediately after reporting.

Icahn Enterprises’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.