Since June 2024, Meritage Homes has been in a holding pattern, posting a small return of 4.1% while floating around $177.01. The stock also fell short of the S&P 500’s 12.1% gain during that period.

Is there a buying opportunity in Meritage Homes, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.We don't have much confidence in Meritage Homes. Here are three reasons why there are better opportunities than MTH and a stock we'd rather own.

Why Is Meritage Homes Not Exciting?

Originally founded in 1985 in Arizona as Monterey Homes, Meritage Homes (NYSE: MTH) is a homebuilder specializing in designing and constructing energy-efficient and single-family homes in the US.

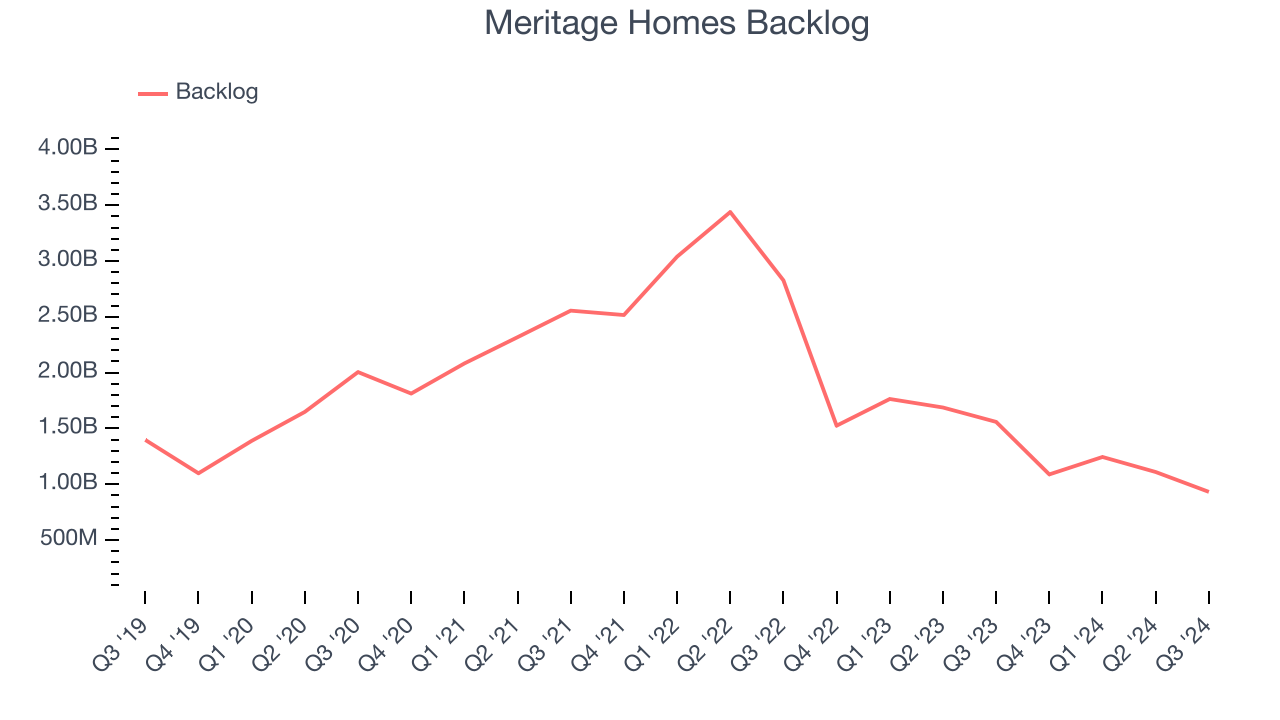

1. Backlog Declines as Orders Drop

Investors interested in Home Builders companies should track backlog in addition to reported revenue. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Meritage Homes’s future revenue streams.

Meritage Homes’s backlog came in at $931.7 million in the latest quarter, and it averaged 38.7% year-on-year declines over the last two years. This performance was underwhelming and shows the company is not winning new orders. It also suggests there may be increasing competition or market saturation.

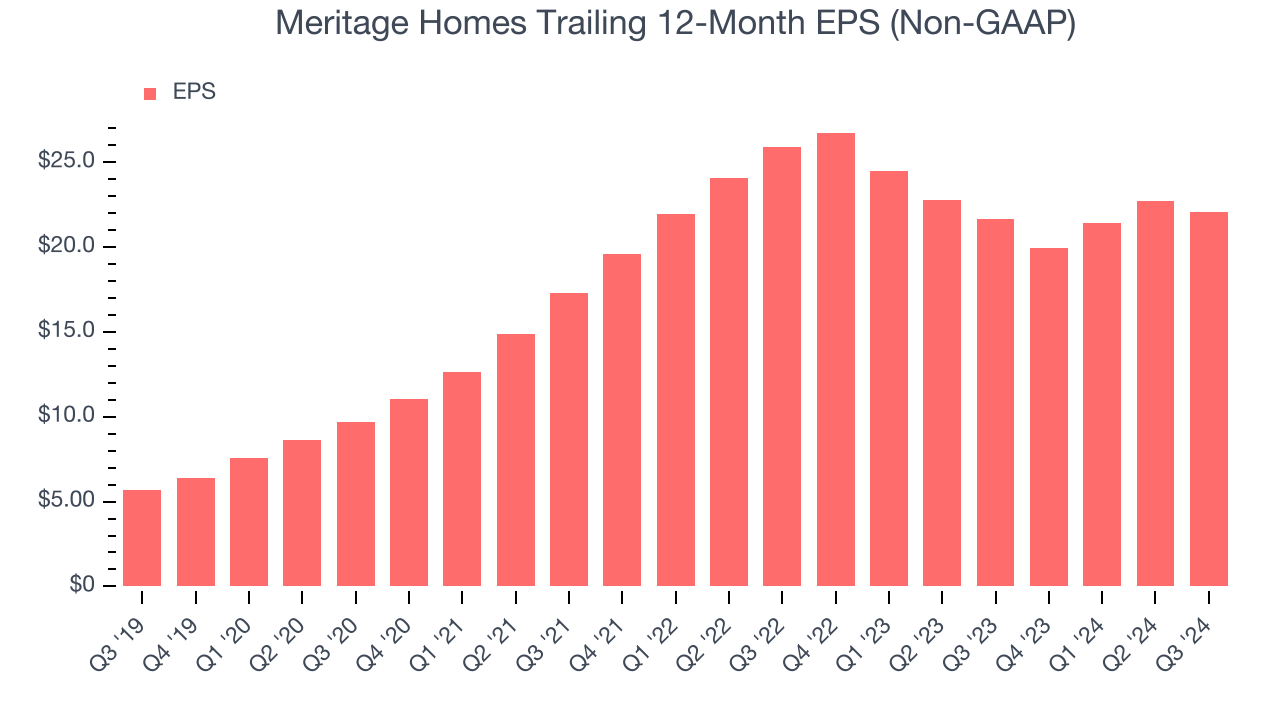

2. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Meritage Homes, its EPS declined by 7.7% annually over the last two years while its revenue grew by 5.3%. This tells us the company became less profitable on a per-share basis as it expanded.

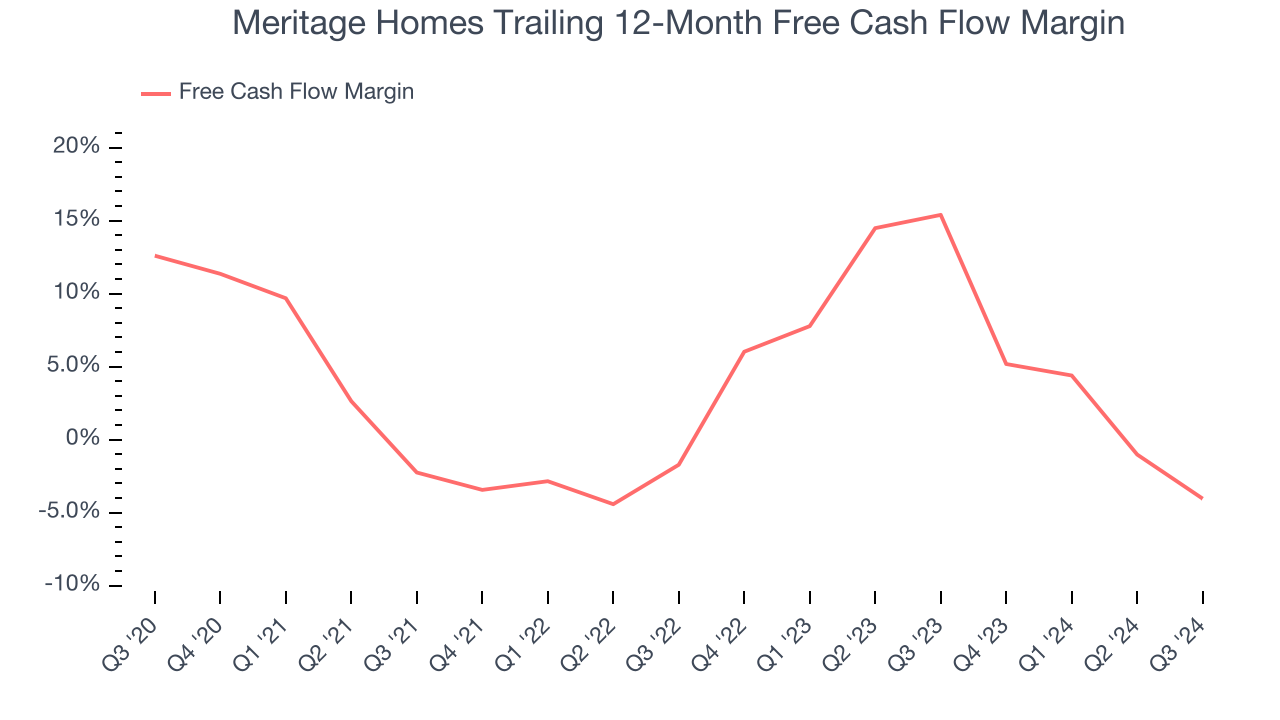

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Meritage Homes’s margin dropped by 16.6 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. Meritage Homes’s free cash flow margin for the trailing 12 months was negative 4%.

Final Judgment

Meritage Homes isn’t a terrible business, but it doesn’t pass our bar. With its shares lagging the market recently, the stock trades at 8.8× forward price-to-earnings (or $177.01 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at Uber, whose profitability just reached an inflection point.

Stocks We Would Buy Instead of Meritage Homes

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.