Dover trades at $201.22 and has moved in lockstep with the market. Its shares have returned 10.7% over the last six months while the S&P 500 has gained 12.1%.

Is now the time to buy Dover, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.We don't have much confidence in Dover. Here are three reasons why you should be careful with DOV and a stock we'd rather own.

Why Do We Think Dover Will Underperform?

A company who manufactured critical equipment for the United States military during World War II, Dover (NYSE: DOV) manufactures engineered components and specialized equipment for numerous industries.

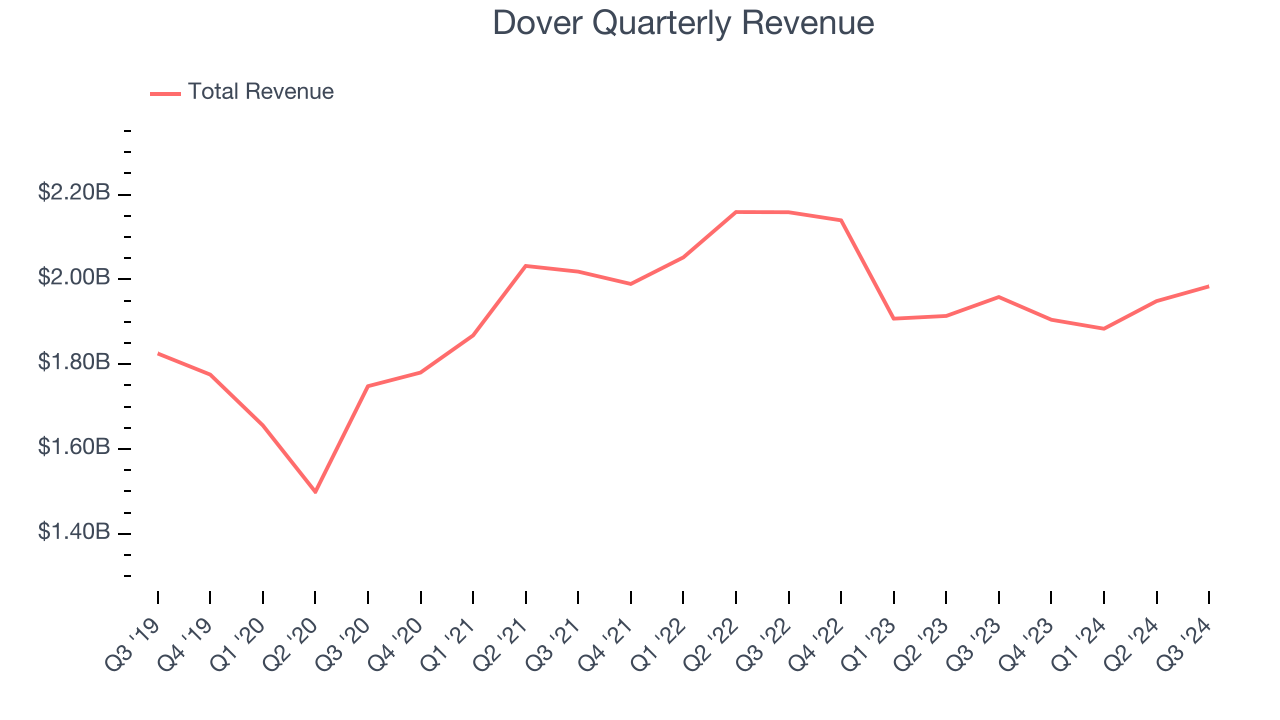

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Dover’s 1.5% annualized revenue growth over the last five years was weak. This was below our standards.

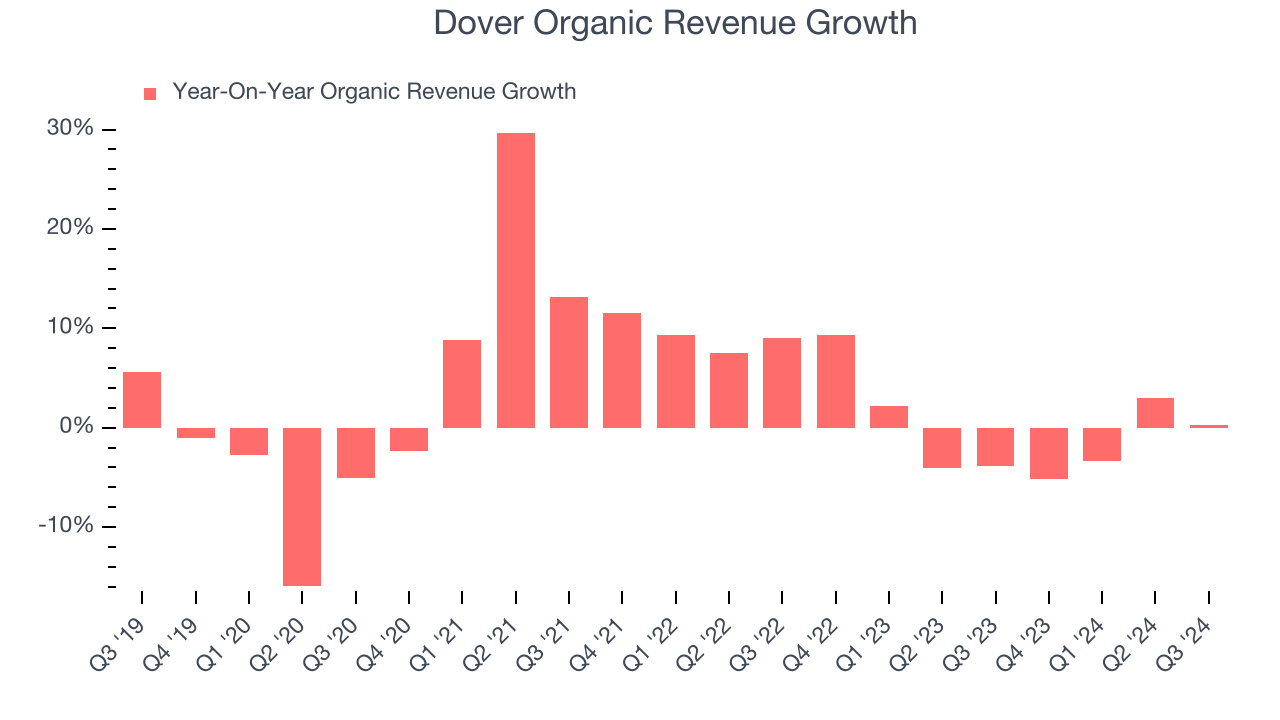

2. Core Business Falling Behind as Demand Plateaus

Investors interested in General Industrial Machinery companies should track organic revenue in addition to reported revenue. This metric gives visibility into Dover’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Dover failed to grow its organic revenue. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Dover might have to lean into acquisitions to accelerate growth, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

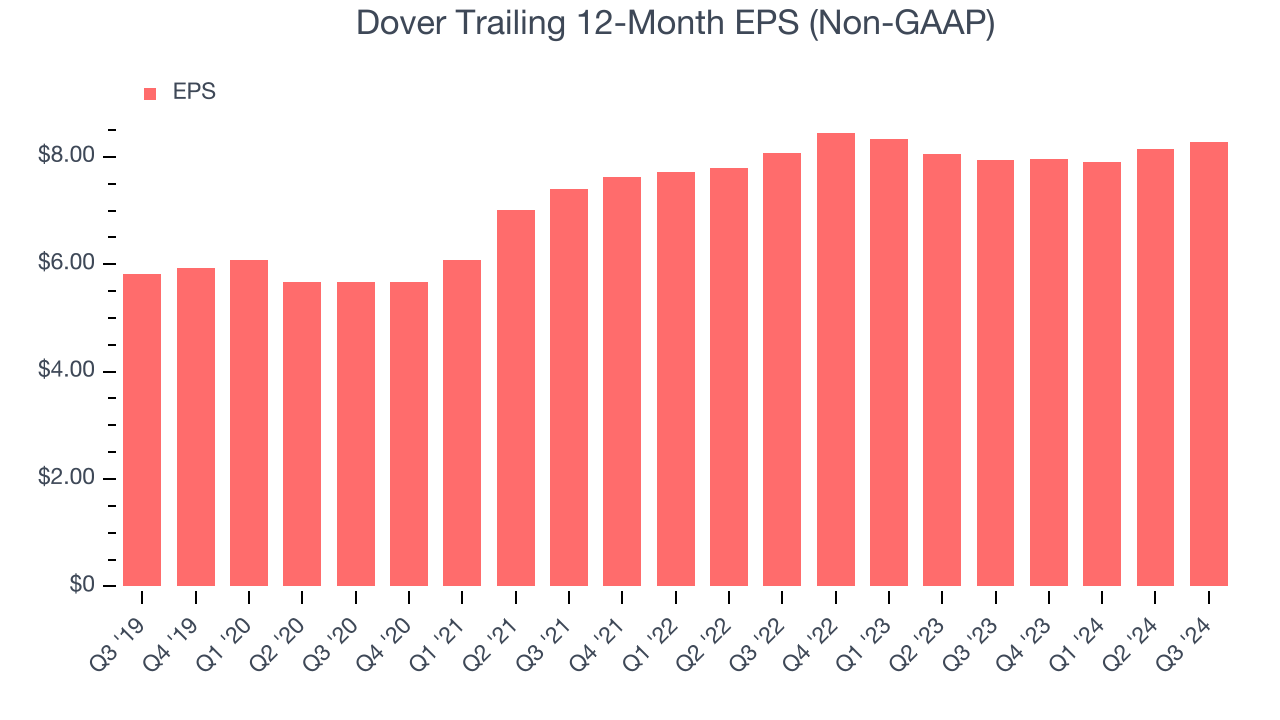

3. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Dover’s EPS grew at an unimpressive 7.3% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 1.5% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

Dover falls short of our quality standards. That said, the stock currently trades at 22.1× forward price-to-earnings (or $201.22 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. We’d suggest looking at ServiceNow, one of our all-time favorite software stocks with a durable competitive moat.

Stocks We Like More Than Dover

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.