Over the past six months, IPG Photonics’s shares (currently trading at $77.39) have posted a disappointing 11.7% loss, well below the S&P 500’s 12.1% gain. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy IPG Photonics, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.Even though the stock has become cheaper, we don't have much confidence in IPG Photonics. Here are three reasons why there are better opportunities than IPGP and a stock we'd rather own.

Why Do We Think IPG Photonics Will Underperform?

Both a designer and manufacturer of its products, IPG Photonics (NASDAQ: IPGP) is a provider of high-performance fiber lasers used for cutting, welding, and processing raw materials.

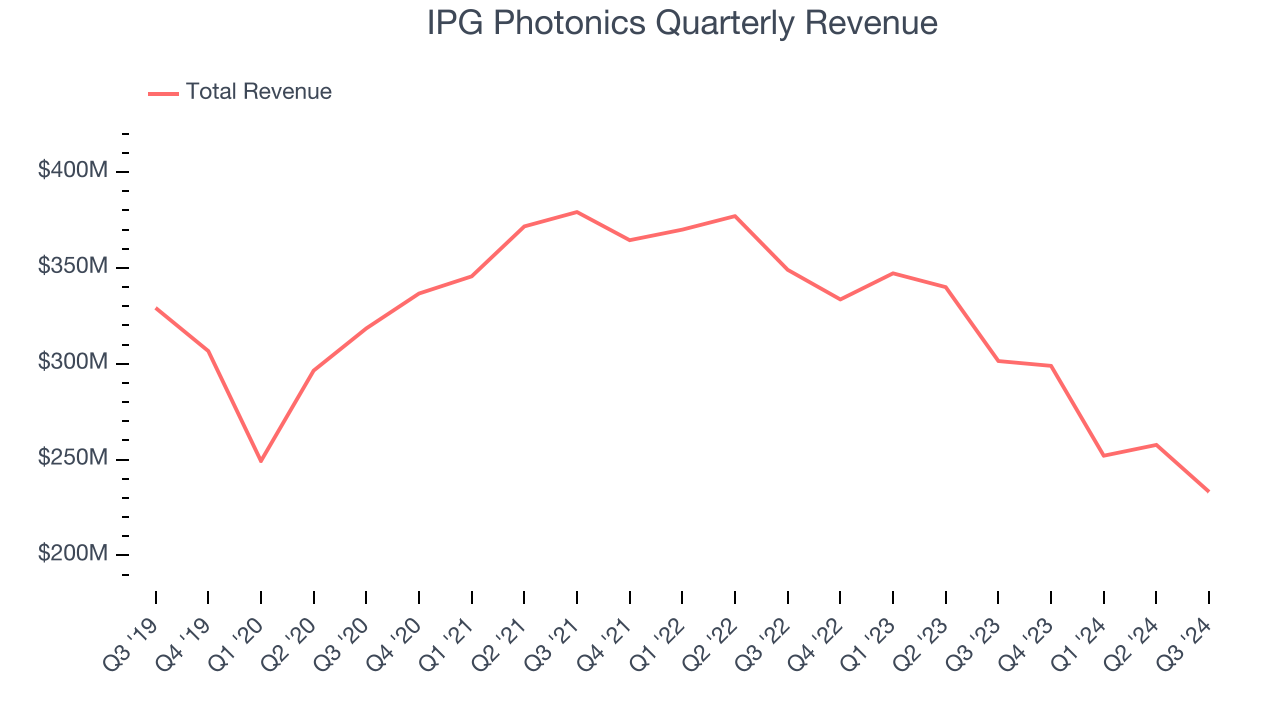

1. Revenue Spiraling Downwards

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. IPG Photonics struggled to consistently generate demand over the last five years as its sales dropped at a 4.9% annual rate. This was below our standards and is a sign of poor business quality. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

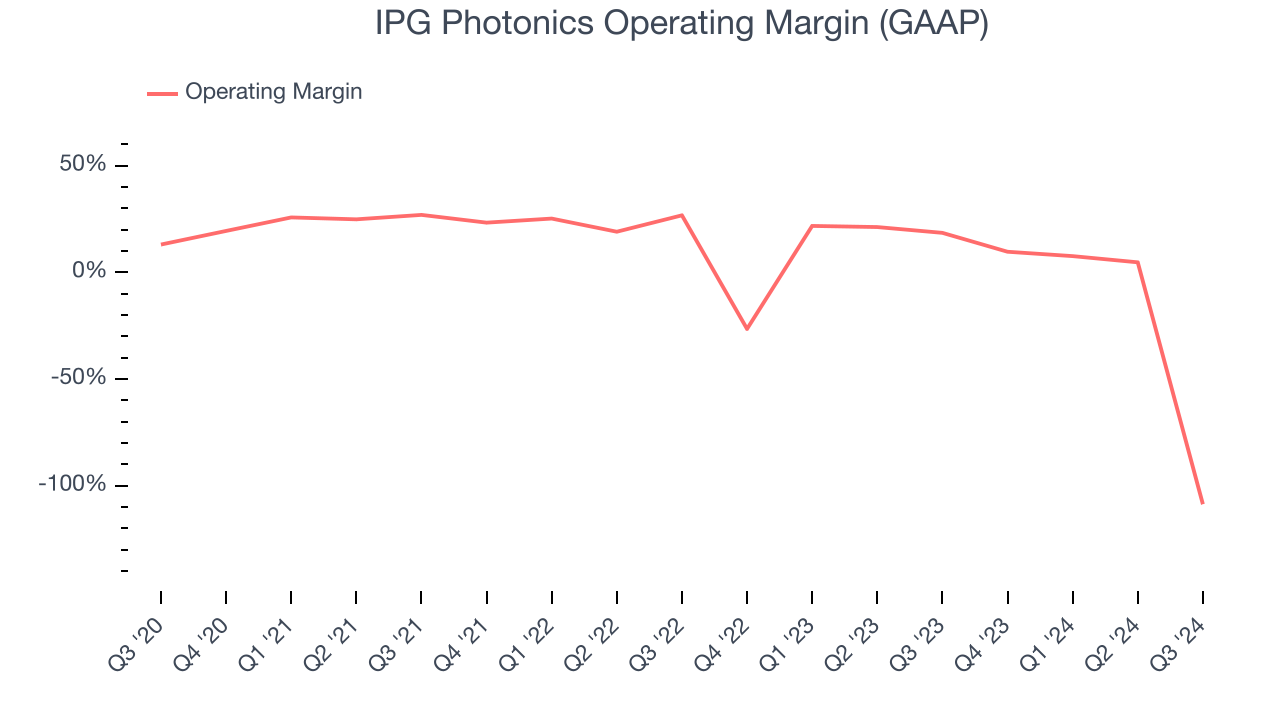

2. Operating Margin Falling

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Looking at the trend in its profitability, IPG Photonics’s operating margin decreased by 30 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers. Its operating margin for the trailing 12 months was negative 18.6%.

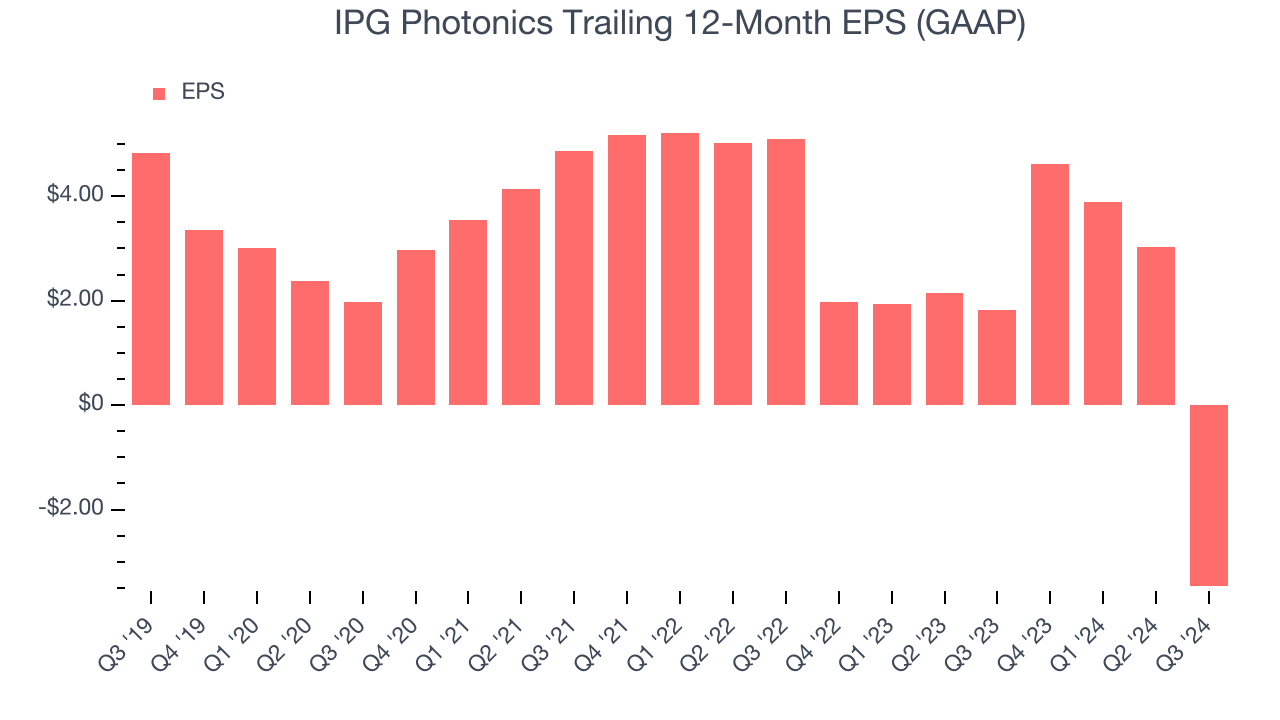

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for IPG Photonics, its EPS declined by more than its revenue over the last five years, dropping 22.1% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

We cheer for all companies solving complex technology issues, but in the case of IPG Photonics, we’ll be cheering from the sidelines. Following the recent decline, the stock trades at 51.5× forward price-to-earnings (or $77.39 per share). This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere. We’d recommend looking at The Trade Desk, the nucleus of digital advertising.

Stocks We Like More Than IPG Photonics

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.