Matrix Service’s 26.2% return over the past six months has outpaced the S&P 500 by 15.6%, and its stock price has climbed to $13.11 per share. This run-up might have investors contemplating their next move.

Is now the time to buy Matrix Service, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.We’re glad investors have benefited from the price increase, but we're cautious about Matrix Service. Here are three reasons why there are better opportunities than MTRX and a stock we'd rather own.

Why Do We Think Matrix Service Will Underperform?

Founded in Oklahoma, Matrix Service (NASDAQ: MTRX) provides engineering, fabrication, construction, and maintenance services primarily to the energy and industrial markets.

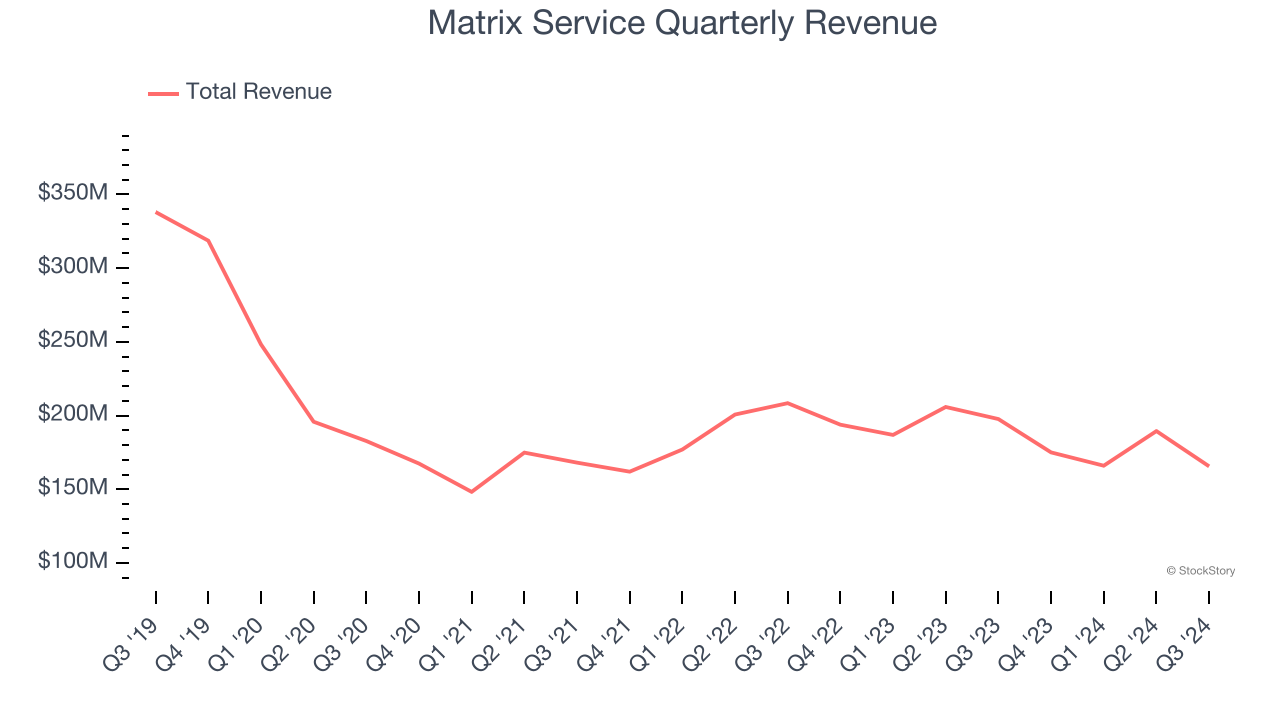

1. Revenue Spiraling Downwards

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Matrix Service’s demand was weak and its revenue declined by 13.5% per year. This fell short of our benchmarks and is a sign of poor business quality.

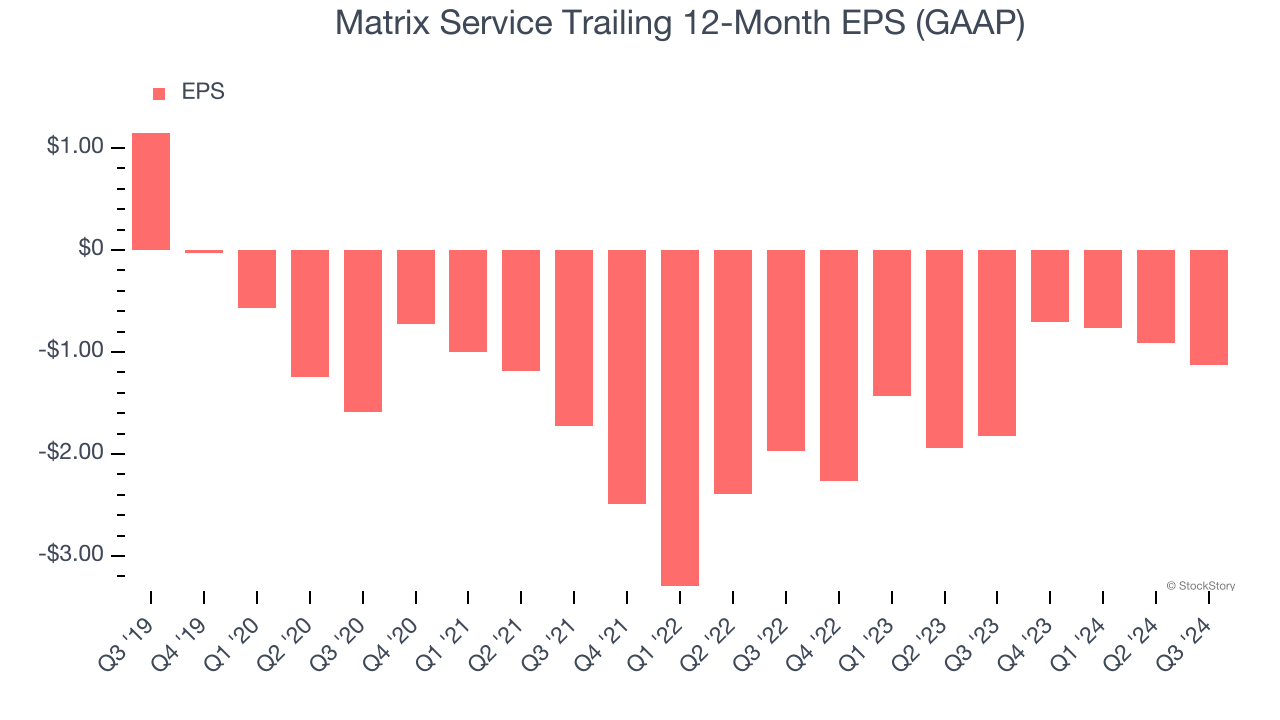

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Matrix Service, its EPS declined by more than its revenue over the last five years, dropping 24.4% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

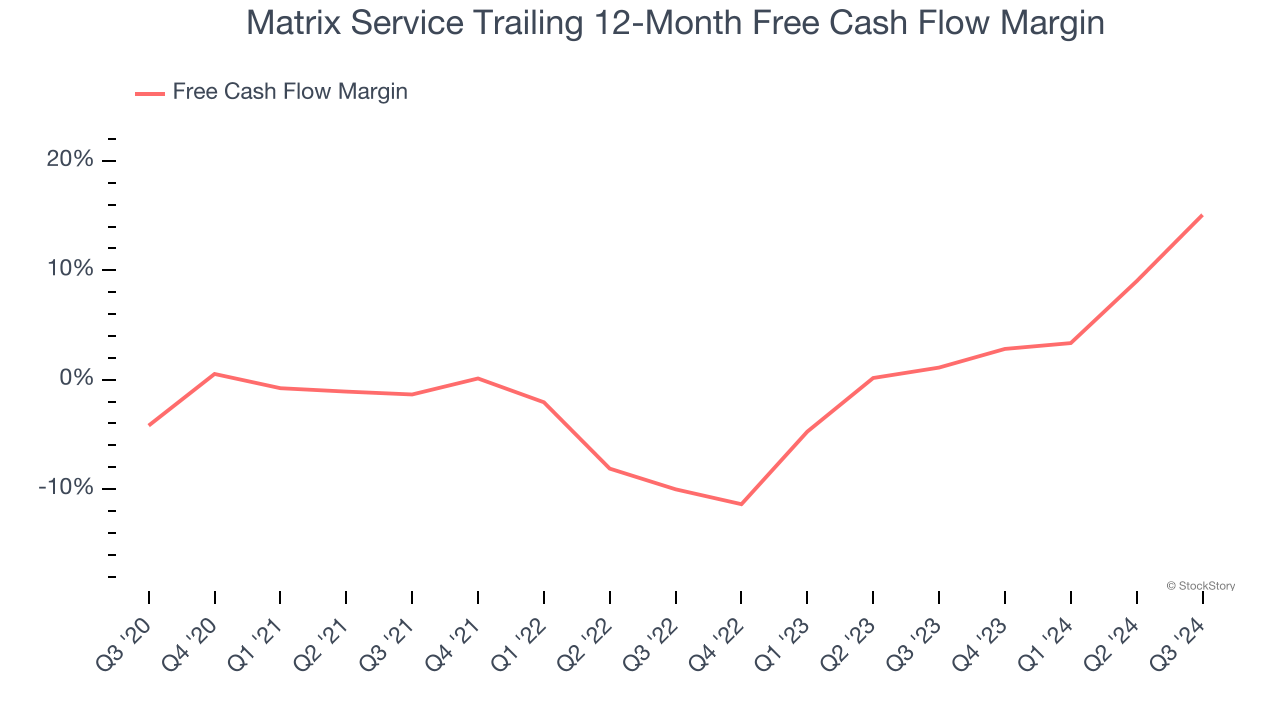

3. Breakeven Free Cash Flow Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Matrix Service broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Final Judgment

Matrix Service falls short of our quality standards. With its shares topping the market in recent months, the stock trades at 38× forward price-to-earnings (or $13.11 per share). At this valuation, there’s a lot of good news priced in - we think there are better investment opportunities out there. Let us point you toward KLA Corporation, a picks and shovels play for semiconductor manufacturing.

Stocks We Would Buy Instead of Matrix Service

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.