Since June 2024, Dillard's has been in a holding pattern, posting a small return of 2.1% while floating around $434.67. The stock also fell short of the S&P 500’s 10.3% gain during that period.

Is there a buying opportunity in Dillard's, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.We don't have much confidence in Dillard's. Here are three reasons why there are better opportunities than DDS and a stock we'd rather own.

Why Is Dillard's Not Exciting?

With stores located largely in the Southern and Western US, Dillard’s (NYSE: DDS) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

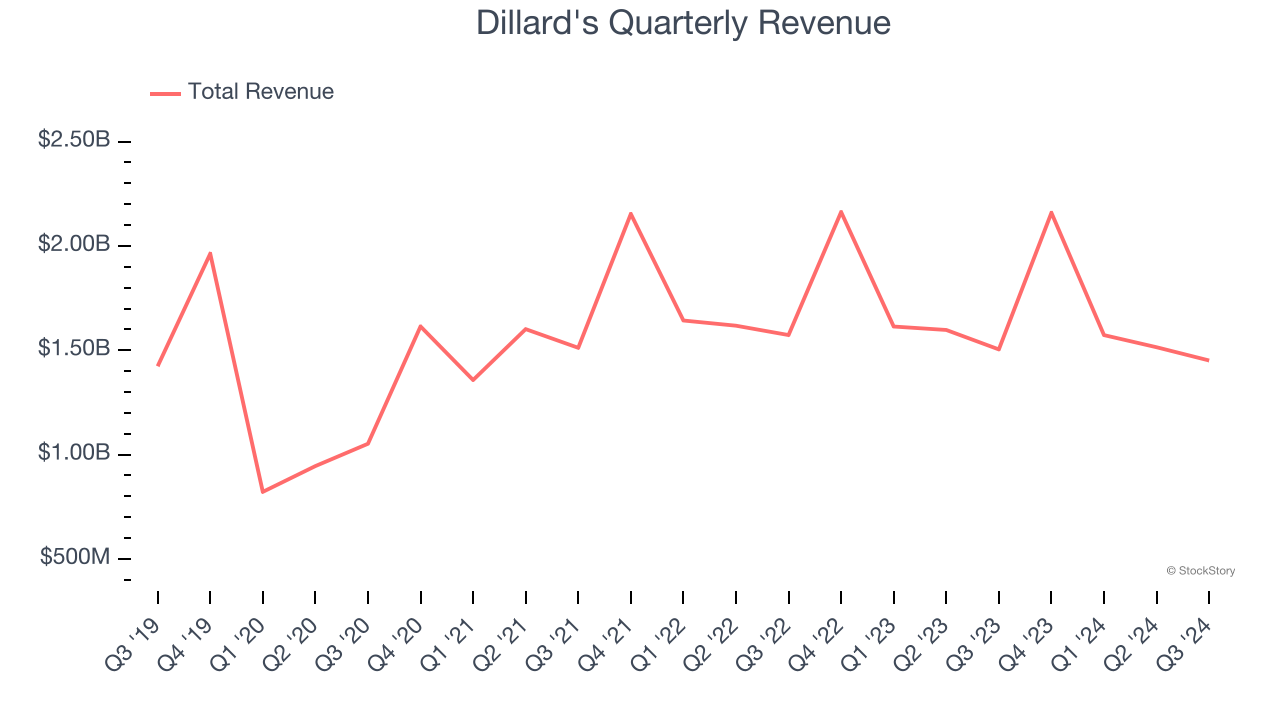

1. Long-Term Revenue Growth Flatter Than a Pancake

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Dillard's struggled to consistently increase demand as its $6.70 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and signals it’s a lower quality business.

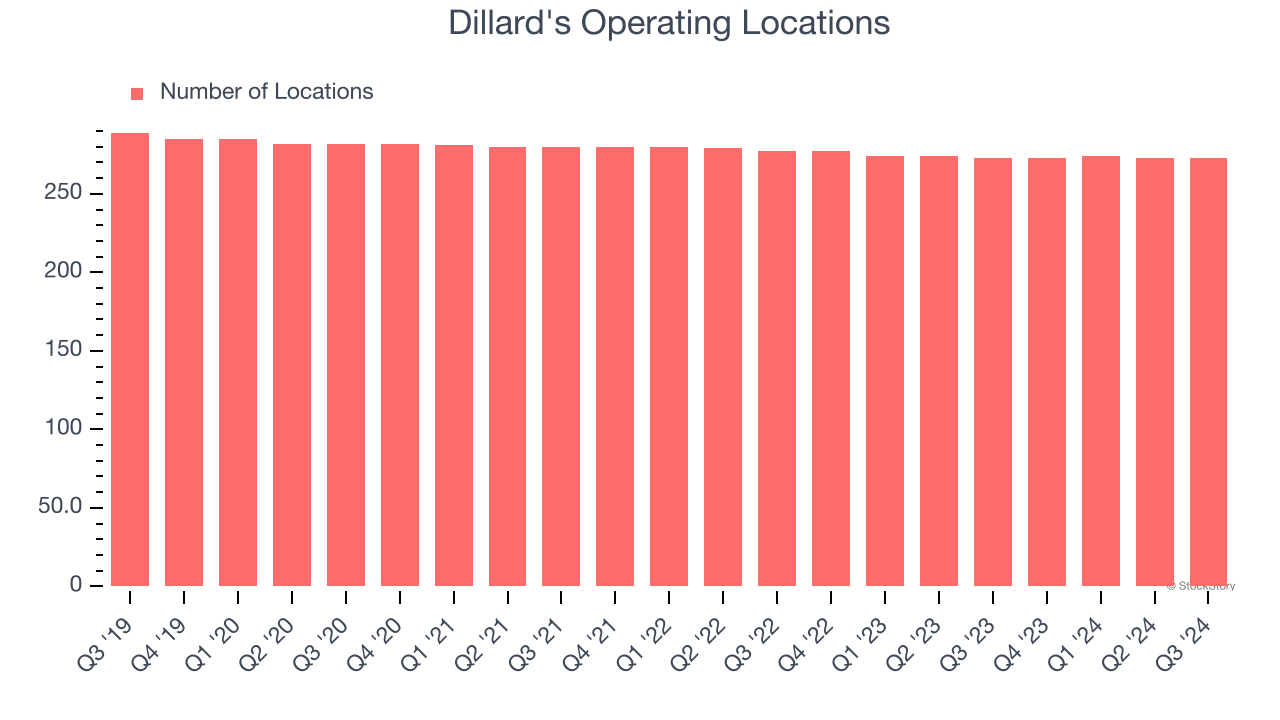

2. Stores Are Closing, a Headwind for Revenue

A retailer’s store count often determines how much revenue it can generate.

Dillard's operated 273 locations in the latest quarter. Over the last two years, the company has generally closed its stores, averaging 1% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

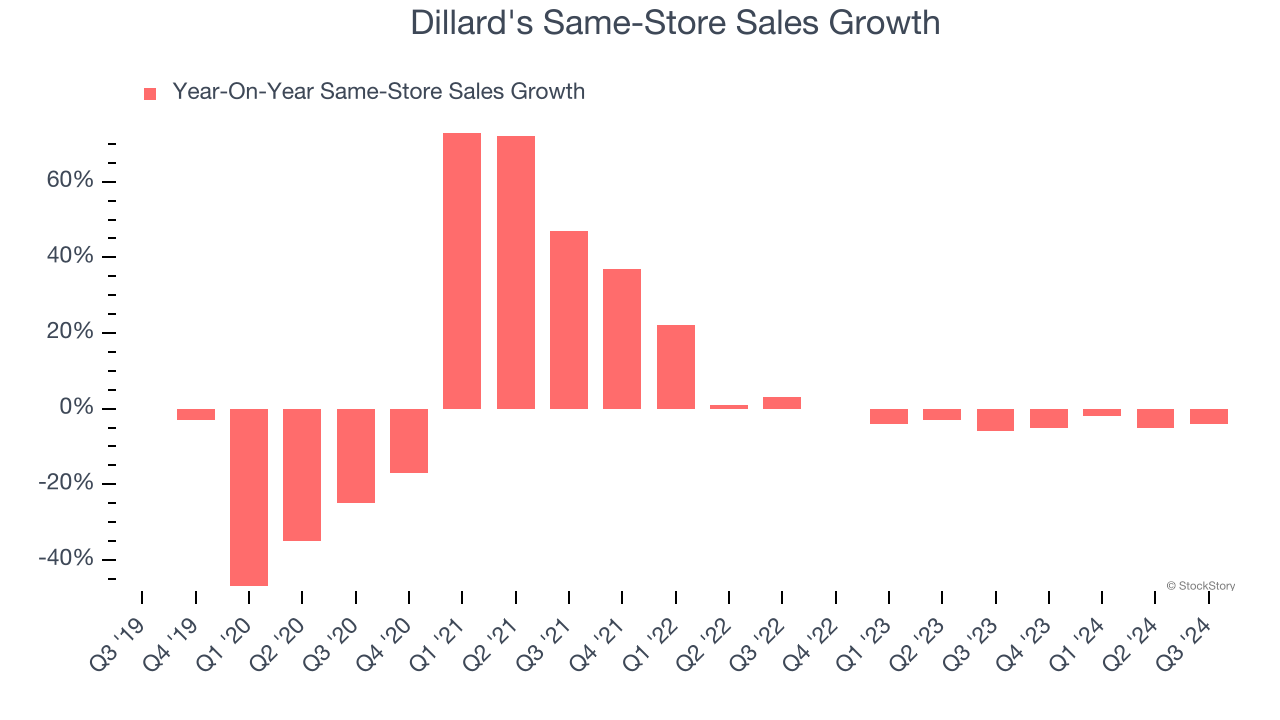

3. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

Dillard’s demand has been shrinking over the last two years as its same-store sales have averaged 3.6% annual declines.

Final Judgment

Dillard's isn’t a terrible business, but it doesn’t pass our quality test. With its shares underperforming the market lately, the stock trades at 15.3× forward price-to-earnings (or $434.67 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d suggest looking at Google, whose cloud computing and YouTube divisions are firing on all cylinders.

Stocks We Like More Than Dillard's

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.