Since December 2019, the S&P 500 has delivered a total return of 89.3%. But one standout stock has more than doubled the market - over the past five years, Ryder has surged 201% to $158.01 per share. Its momentum hasn’t stopped as it’s also gained 31.9% in the last six months, beating the S&P by 21.6%.

Is there a buying opportunity in Ryder, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.Despite the momentum, we're swiping left on Ryder for now. Here are three reasons why you should be careful with R and a stock we'd rather own.

Why Do We Think Ryder Will Underperform?

As one of the first companies to introduce the idea of leasing trucks, Ryder (NYSE: R) provides rental vehicles to businesses and delivers packages directly to homes or businesses.

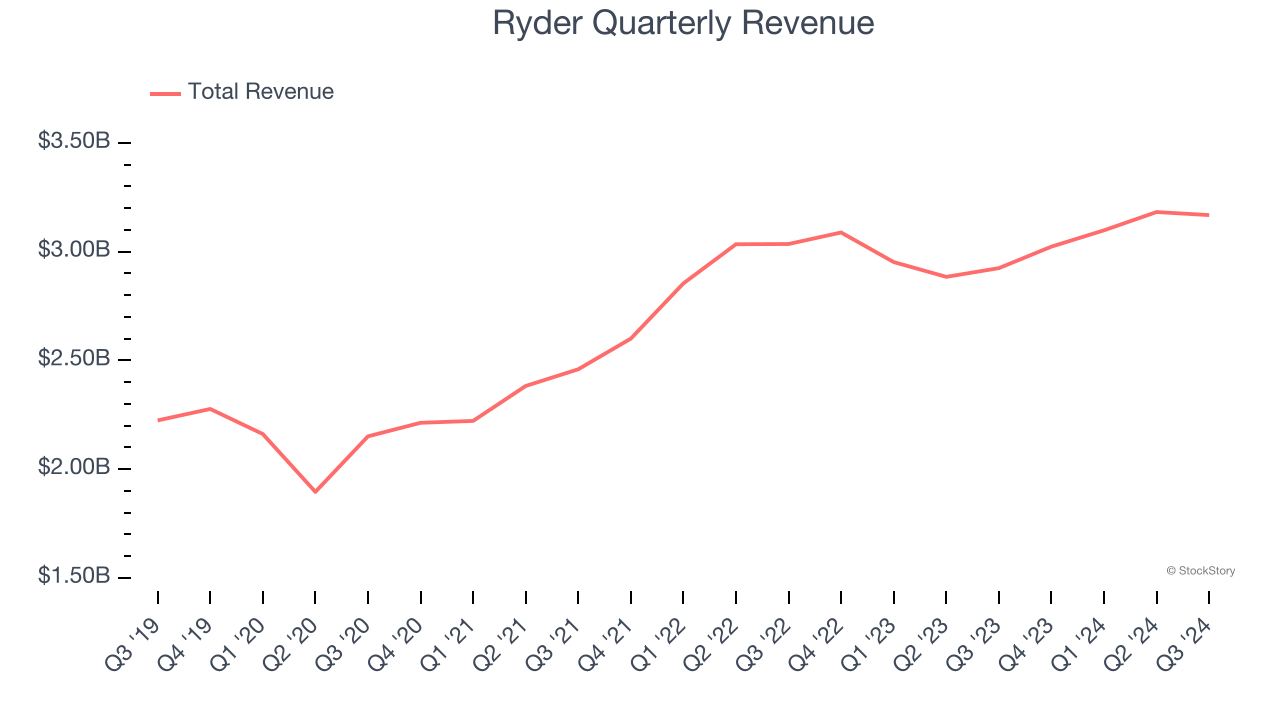

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Ryder’s sales grew at a mediocre 7% compounded annual growth rate over the last five years. This was below our standard for the industrials sector.

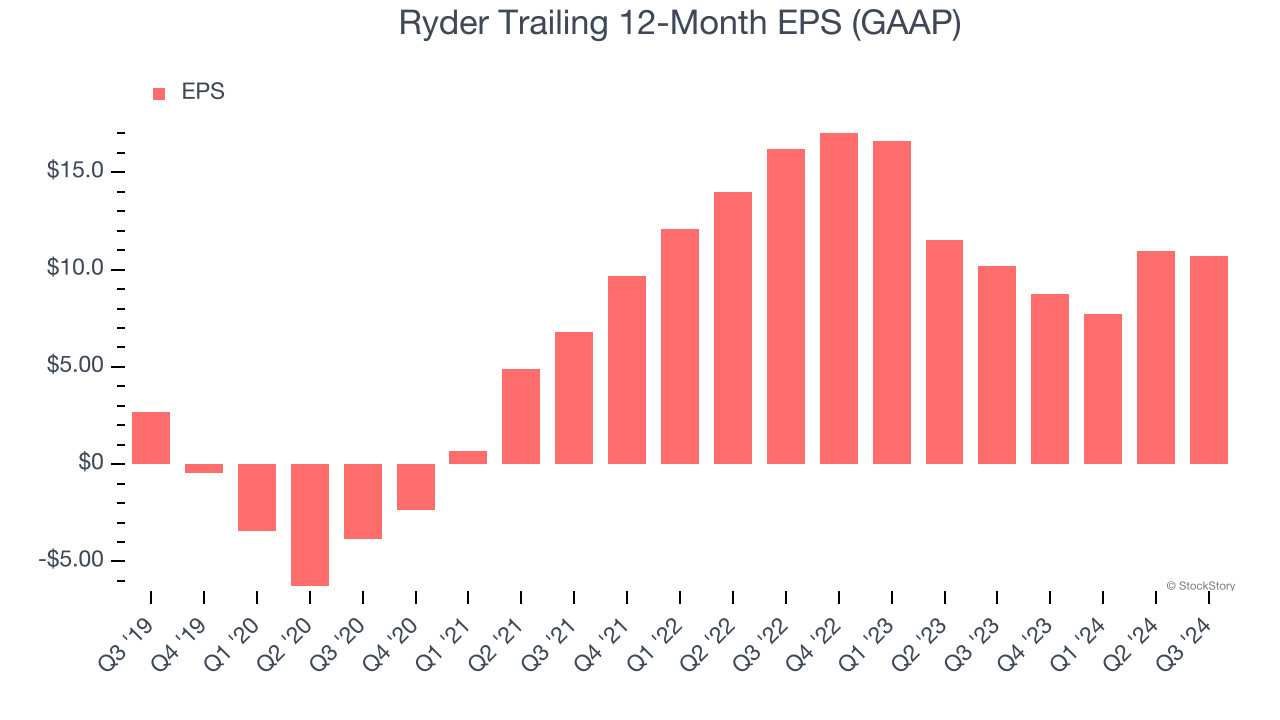

2. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Ryder, its EPS declined by 18.8% annually over the last two years while its revenue grew by 4%. This tells us the company became less profitable on a per-share basis as it expanded.

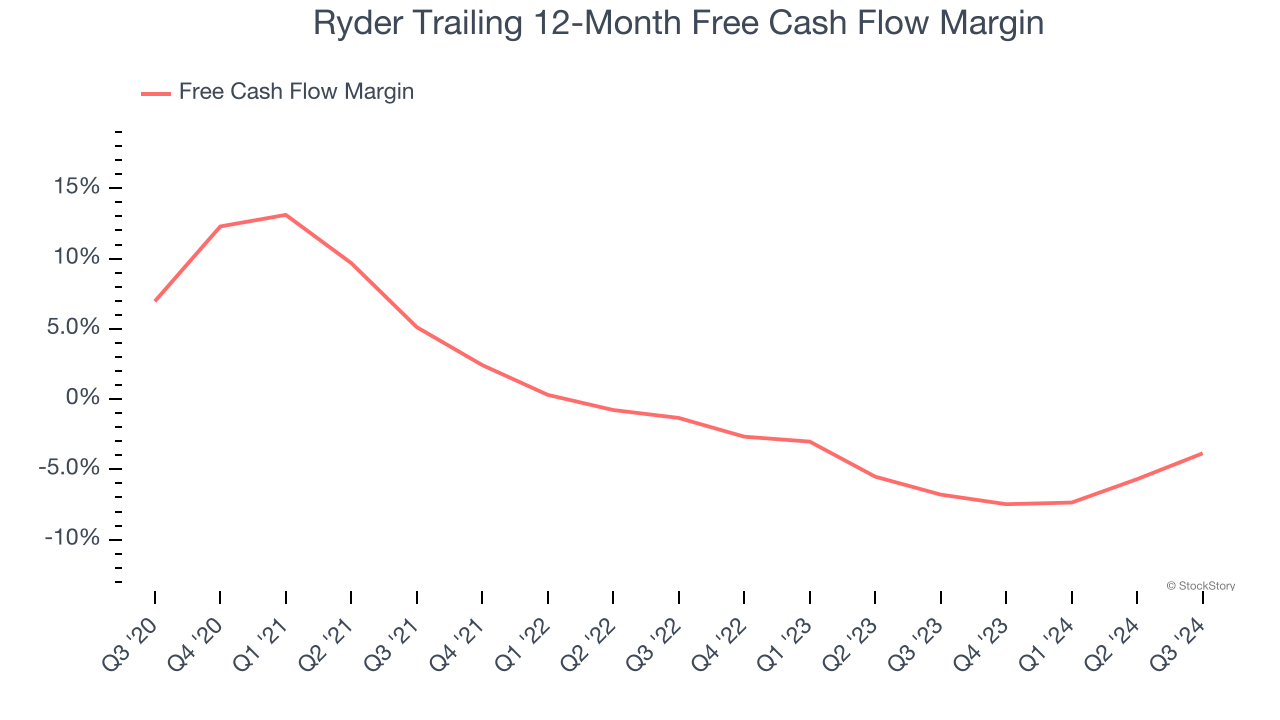

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Ryder’s margin dropped by 10.8 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the longer-term trend returns, it could signal it’s becoming a more capital-intensive business. Ryder’s free cash flow margin for the trailing 12 months was negative 3.9%.

Final Judgment

We see the value of companies helping their customers, but in the case of Ryder, we’re out. With its shares outperforming the market lately, the stock trades at 12.1× forward price-to-earnings (or $158.01 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are better investments elsewhere. Let us point you toward Yum! Brands, an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of Ryder

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.