Over the past six months, LKQ’s stock price fell to $37.22. Shareholders have lost 10.3% of their capital, which is disappointing considering the S&P 500 has climbed by 7.7%. This might have investors contemplating their next move.

Is now the time to buy LKQ, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.Even with the cheaper entry price, we don't have much confidence in LKQ. Here are three reasons why we avoid LKQ and a stock we'd rather own.

Why Do We Think LKQ Will Underperform?

A global distributor of vehicle parts and accessories, LKQ (NASDAQ: LKQ) offers its customers a comprehensive selection of high-quality, affordably priced automobile products.

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, LKQ’s 3% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the consumer discretionary sector.

2. Slow Organic Growth Suggests Waning Demand In Core Business

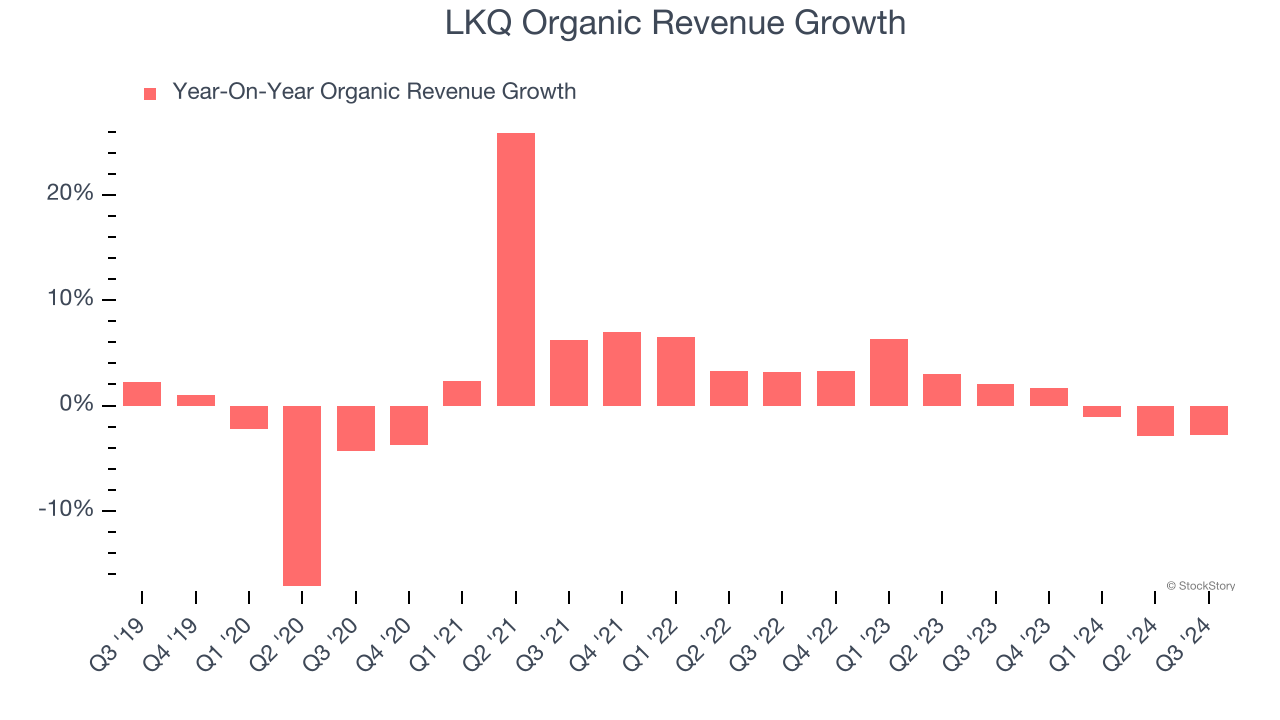

We can better understand Specialized Consumer Services companies by analyzing their organic revenue. This metric gives visibility into LKQ’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, LKQ’s organic revenue averaged 1.2% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

3. Previous Growth Initiatives Haven’t Paid Off Yet

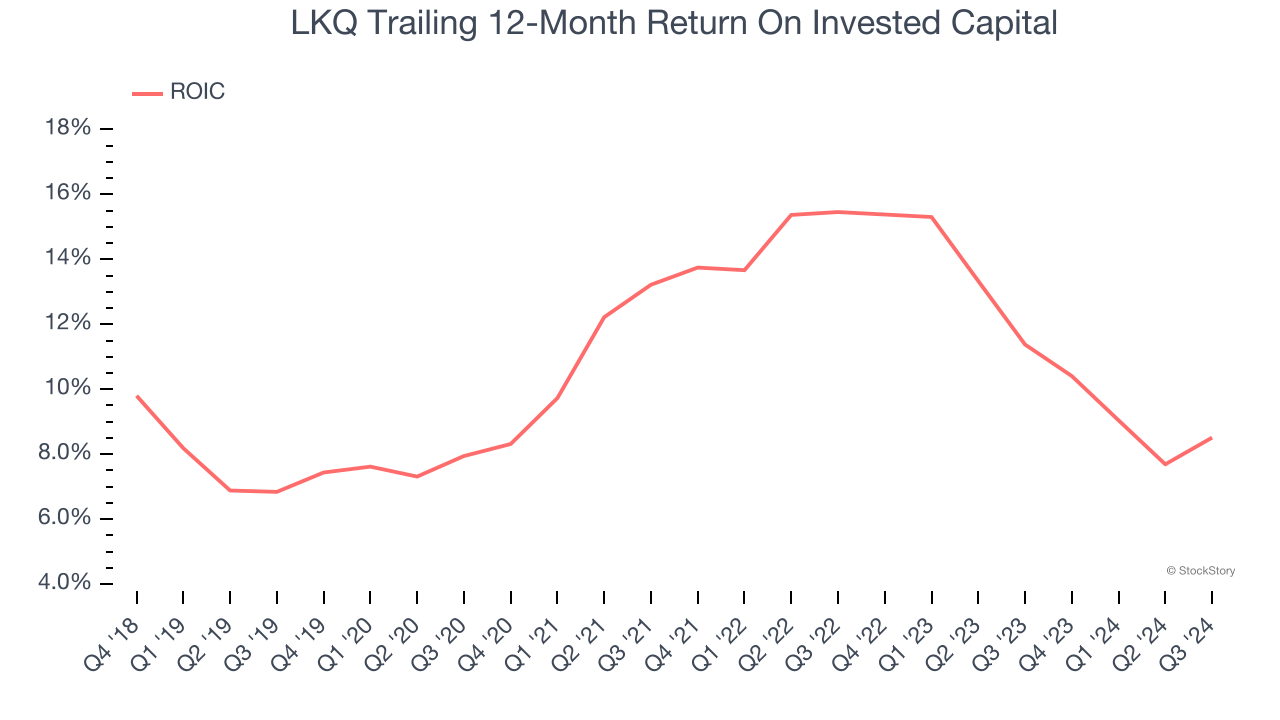

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

LKQ historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 11.3%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

Final Judgment

LKQ falls short of our quality standards. After the recent drawdown, the stock trades at 9.7× forward price-to-earnings (or $37.22 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. We’d suggest looking at The Trade Desk, the nucleus of digital advertising.

Stocks We Would Buy Instead of LKQ

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.