Crane trades at $152.20 and has moved in lockstep with the market. Its shares have returned 6.7% over the last six months while the S&P 500 has gained 6%.

Is now the time to buy Crane, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.We're cautious about Crane. Here are three reasons why we avoid CR and a stock we'd rather own.

Why Do We Think Crane Will Underperform?

Based in Connecticut, Crane (NYSE: CR) is a diversified manufacturer of engineered industrial products, including fluid handling, and aerospace technologies.

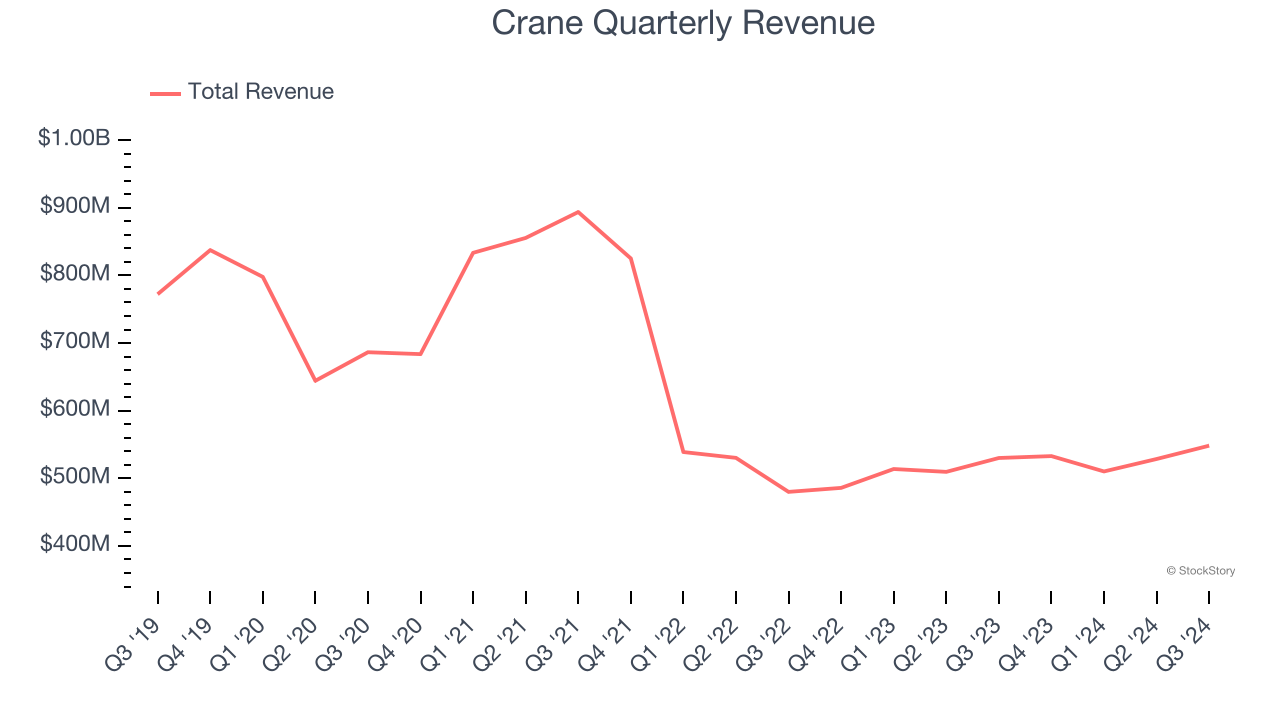

1. Revenue Spiraling Downwards

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Crane struggled to consistently generate demand over the last five years as its sales dropped at a 6.5% annual rate. This was below our standards and signals it’s a low quality business.

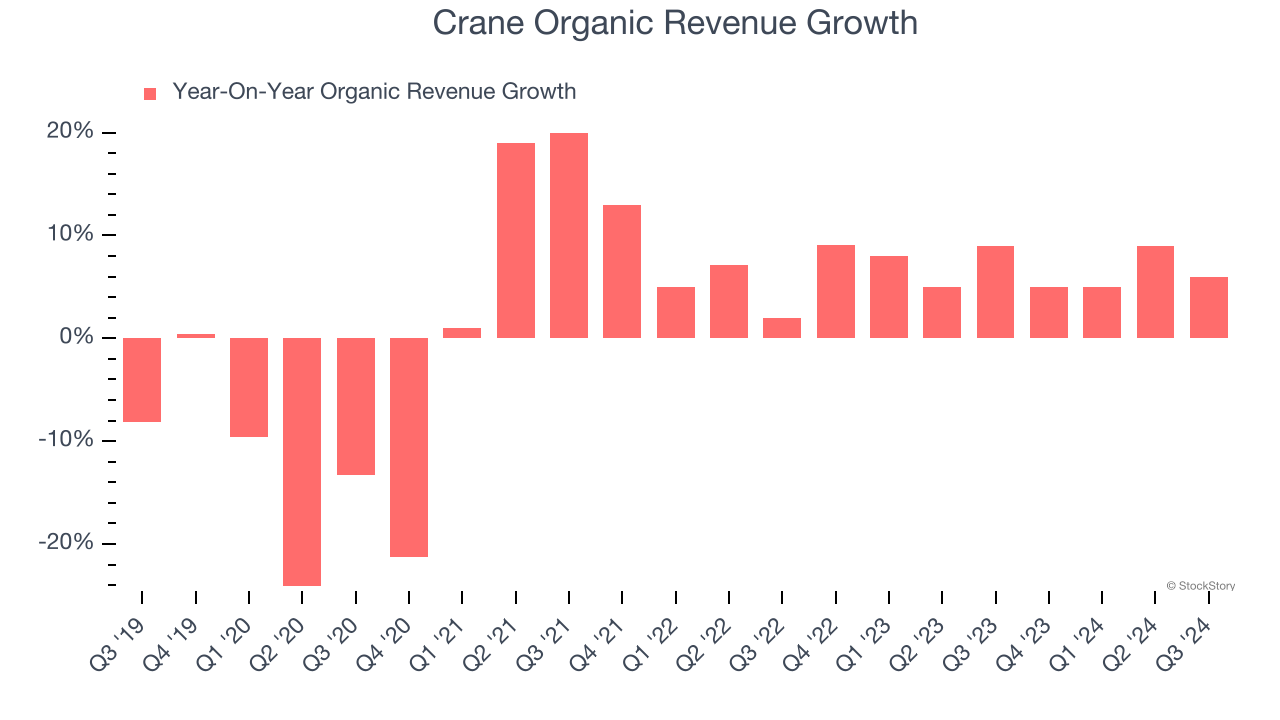

2. Slow Organic Growth Suggests Waning Demand In Core Business

Investors interested in General Industrial Machinery companies should track organic revenue in addition to reported revenue. This metric gives visibility into Crane’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Crane’s organic revenue averaged 7% year-on-year growth. This performance slightly lagged the sector and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

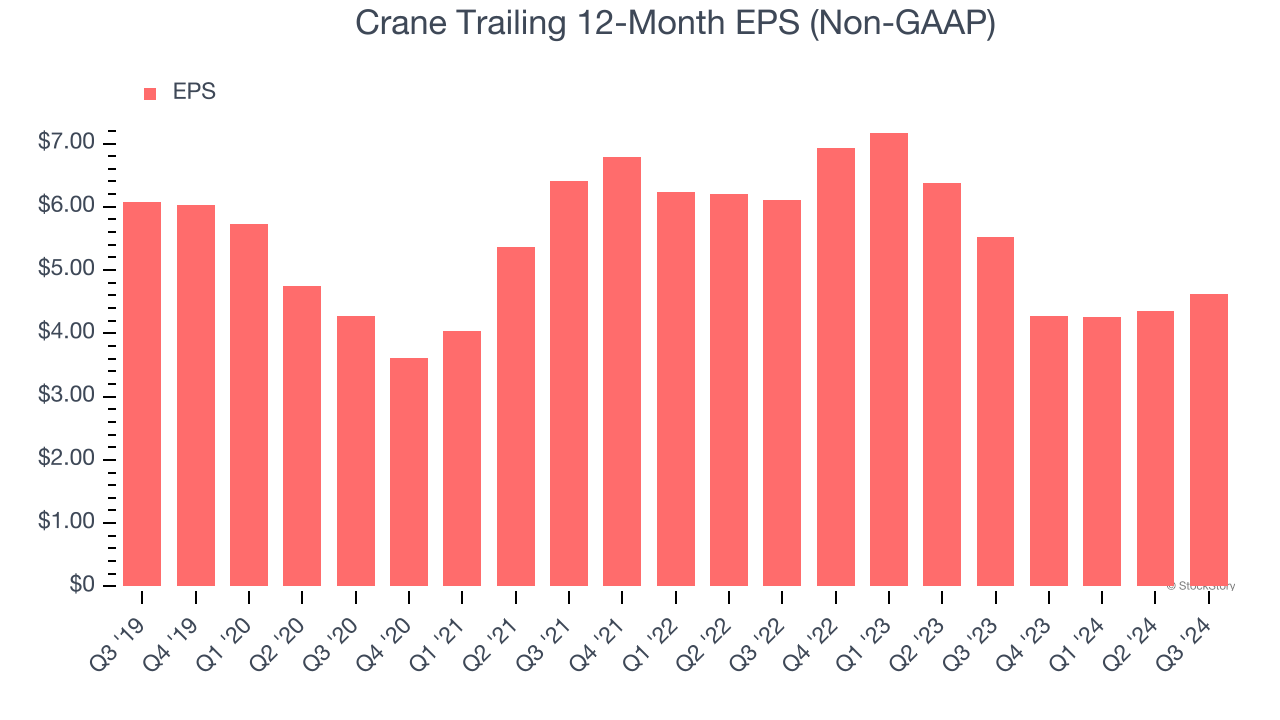

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Crane, its EPS and revenue declined by 5.4% and 6.5% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Crane’s low margin of safety could leave its stock price susceptible to large downswings.

Final Judgment

Crane doesn’t pass our quality test. That said, the stock currently trades at 27× forward price-to-earnings (or $152.20 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. We’d recommend looking at Yum! Brands, an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of Crane

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.