Over the past six months, Dynatrace has been a great trade, beating the S&P 500 by 15.9%. Its stock price has climbed to $53.11, representing a healthy 22% increase. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy DT? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Do Investors Watch Dynatrace?

Founded in Austria in 2005, Dynatrace (NYSE: DT) provides companies with software that allows them to monitor the performance of their full technology stack, from software applications to the infrastructure they run on.

Three Positive Attributes:

1. ARR Surges as Recurring Revenue Flows In

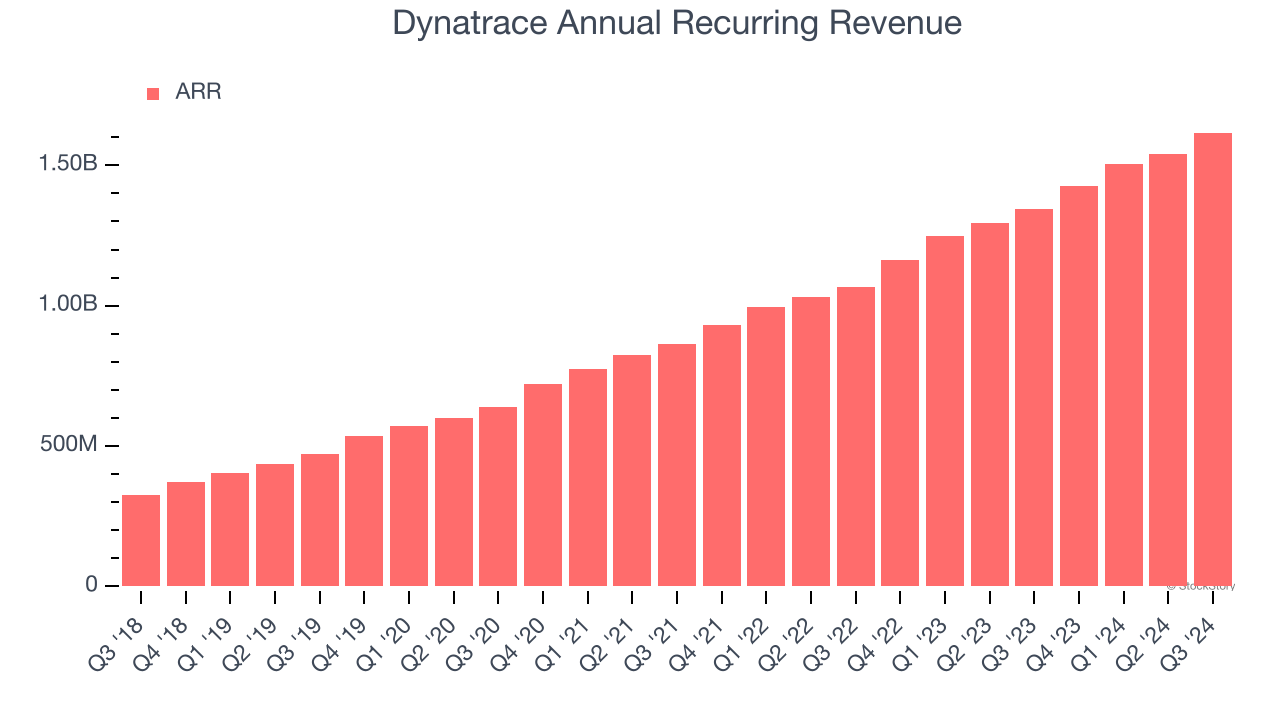

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Dynatrace’s ARR punched in at $1.62 billion in Q3, and over the last four quarters, its year-on-year growth averaged 20.7%. This performance was impressive and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes Dynatrace a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

2. Elite Gross Margin Powers Best-In-Class Business Model

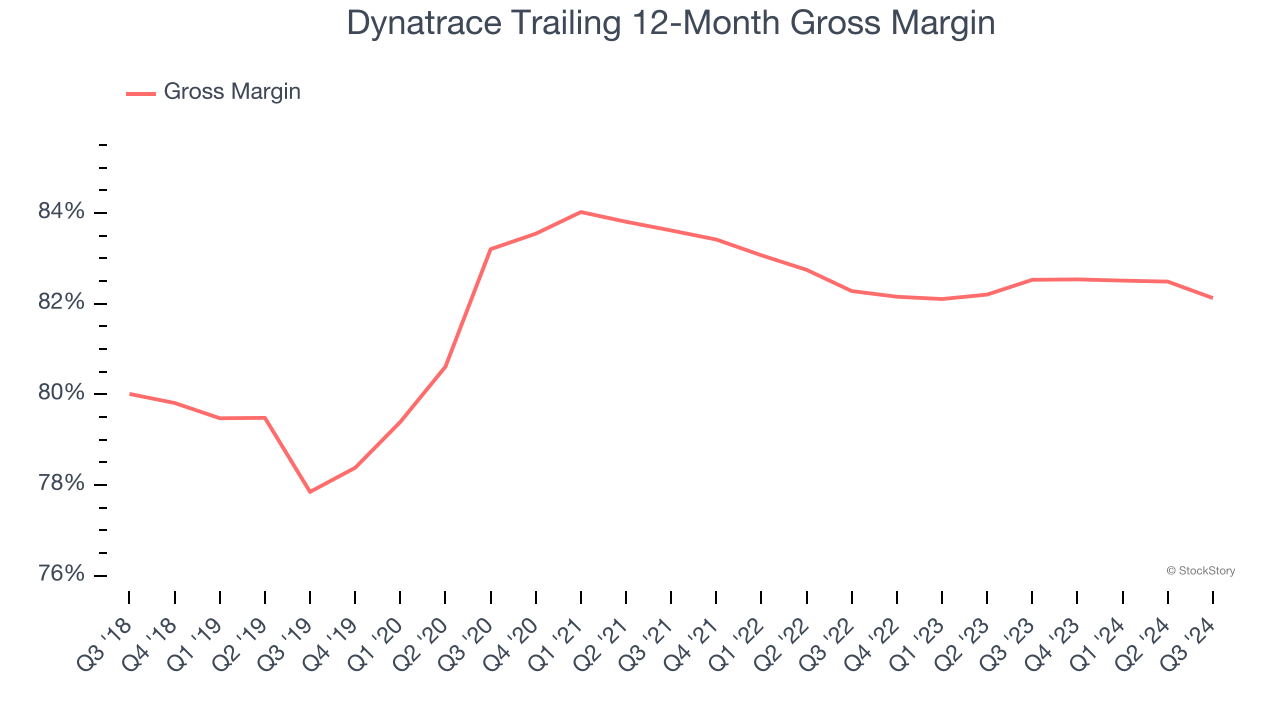

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

Dynatrace’s gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 82.1% gross margin over the last year. Said differently, roughly $82.13 was left to spend on selling, marketing, and R&D for every $100 in revenue.

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

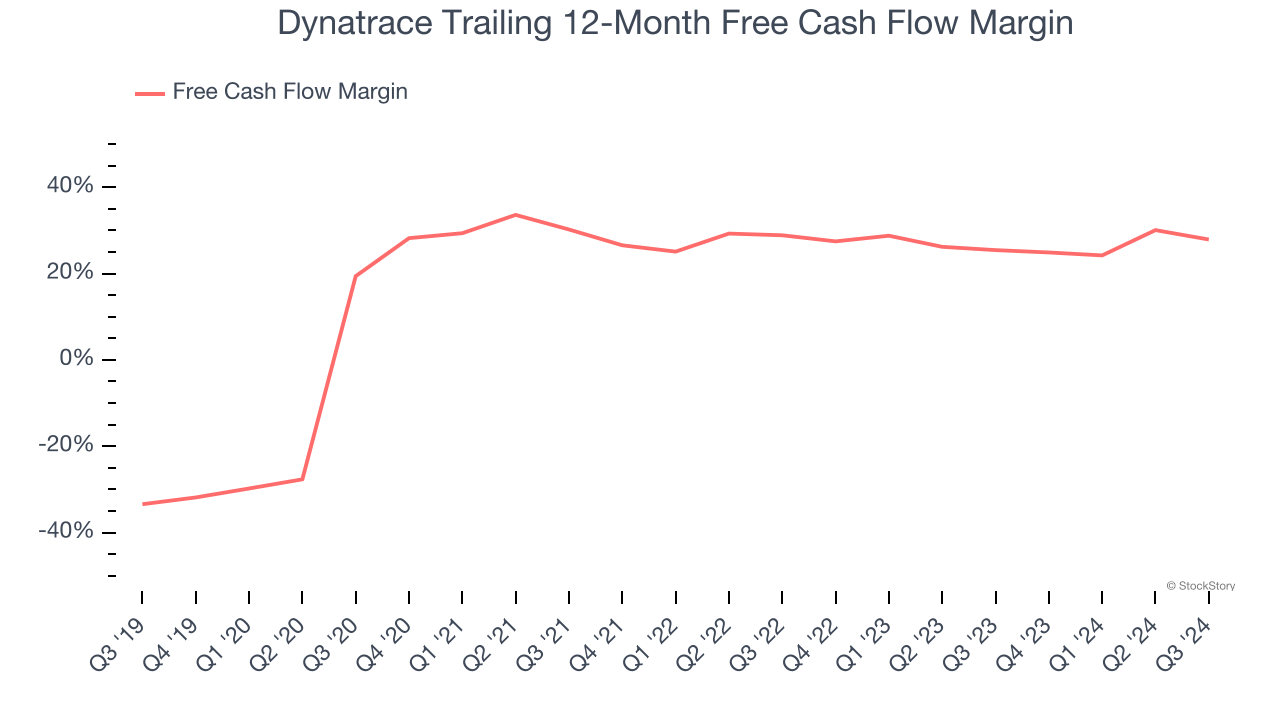

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Dynatrace has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging 27.9% over the last year.

Final Judgment

There are definitely things to like about Dynatrace, and with its shares topping the market in recent months, the stock trades at 9.1× forward price-to-sales (or $53.11 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Dynatrace

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.