Since June 2024, Elastic has been in a holding pattern, posting a small loss of 4.9% while floating around $103.68. The stock also fell short of the S&P 500’s 6.1% gain during that period.

Is there a buying opportunity in Elastic, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We're sitting this one out for now. Here are two reasons why we avoid ESTC and a stock we'd rather own.

Why Is Elastic Not Exciting?

Started by Shay Banon as a search engine for his wife's growing list of recipes at Le Cordon Bleu cooking school in Paris, Elastic (NYSE: ESTC) helps companies integrate search into their products and monitor their cloud infrastructure.

1. Operating Losses Sound the Alarms

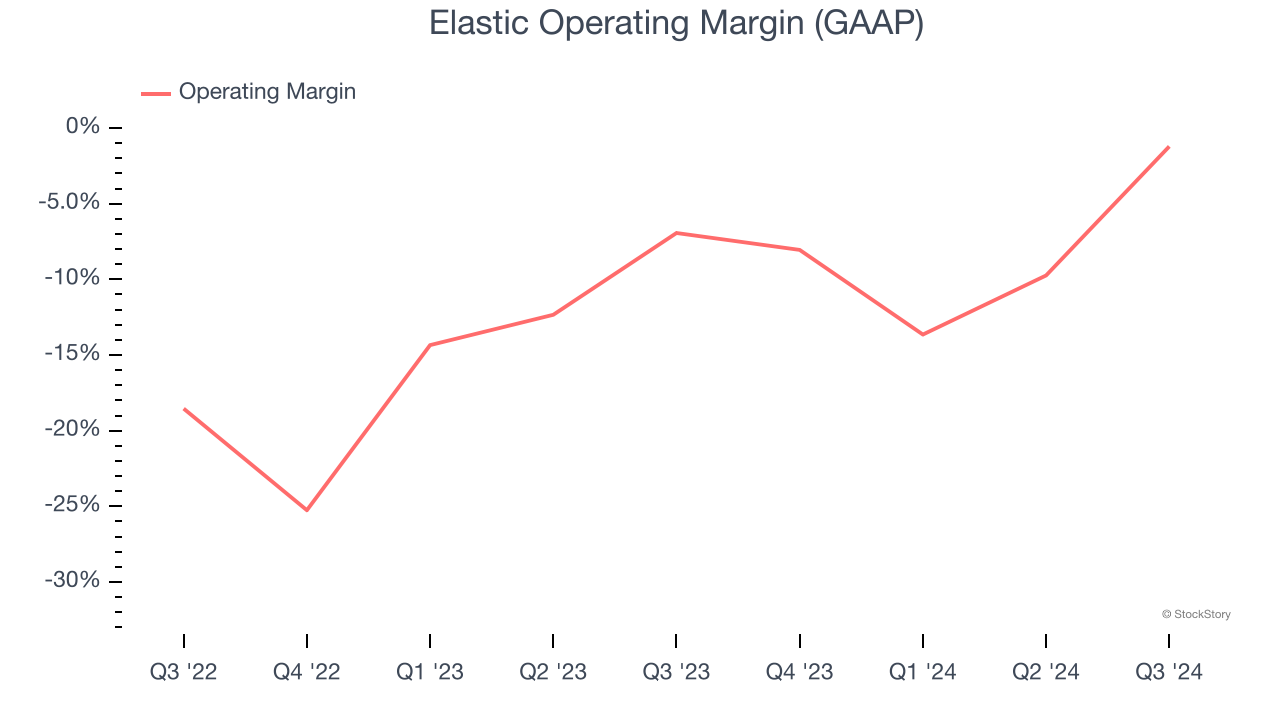

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Elastic’s expensive cost structure has contributed to an average operating margin of negative 8% over the last year. Unprofitable, high-growth software companies require extra attention because they spend heaps of money to capture market share. As seen in its fast historical revenue growth, this strategy seems to have worked so far, but it’s unclear what would happen if Elastic reeled back its investments. Wall Street seems to be optimistic about its growth, but we have some doubts.

2. Free Cash Flow Projections Disappoint

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the next year, analysts’ consensus estimates show they’re expecting Elastic’s free cash flow margin of 14.6% for the last 12 months to remain the same.

Final Judgment

Elastic isn’t a terrible business, but it doesn’t pass our quality test. With its shares lagging the market recently, the stock trades at 7× forward price-to-sales (or $103.68 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Elastic

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.