Over the past six months, Inspired’s shares (currently trading at $8.52) have posted a disappointing 7.7% loss, well below the S&P 500’s 9.3% gain. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Inspired, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.Even though the stock has become cheaper, we're swiping left on Inspired for now. Here are three reasons why you should be careful with INSE and a stock we'd rather own.

Why Is Inspired Not Exciting?

Specializing in digital casino gaming, Inspired (NASDAQ: INSE) is a provider of gaming hardware, virtual sports platforms, and server-based gaming systems.

1. Lackluster Revenue Growth

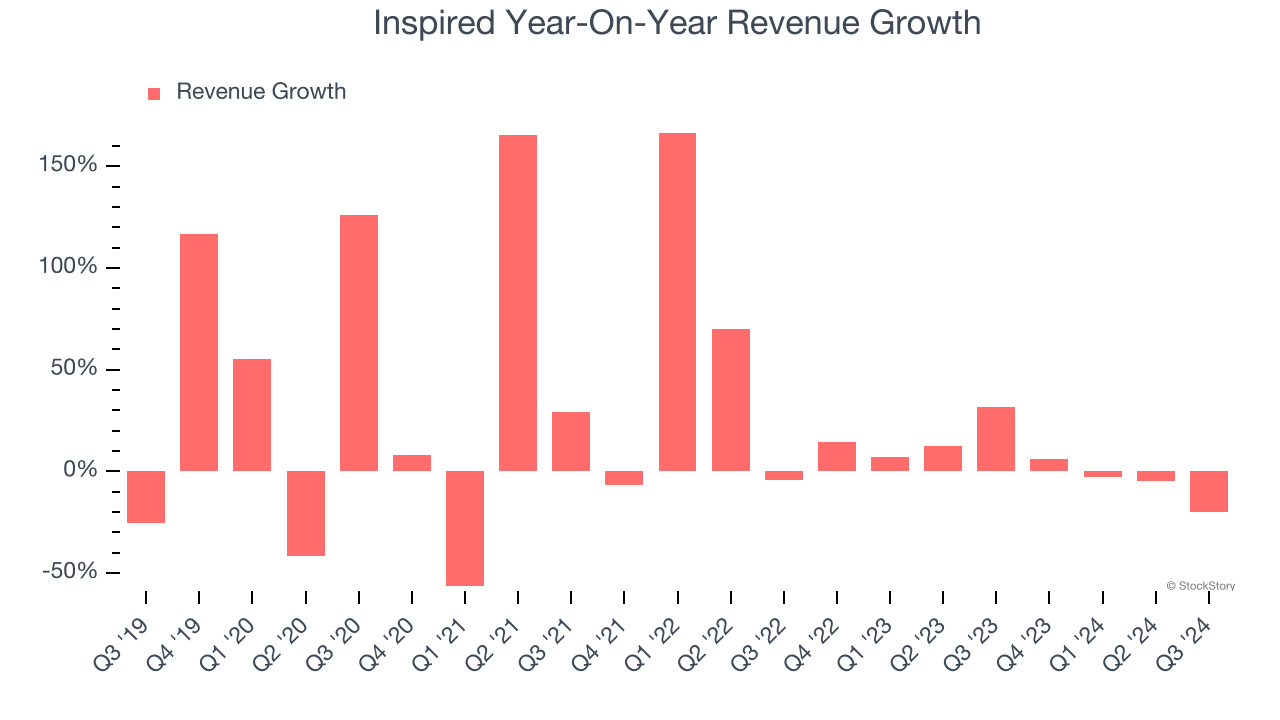

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Inspired’s recent history shows its demand slowed as its annualized revenue growth of 4.6% over the last two years is below its five-year trend.

2. Cash Burn Ignites Concerns

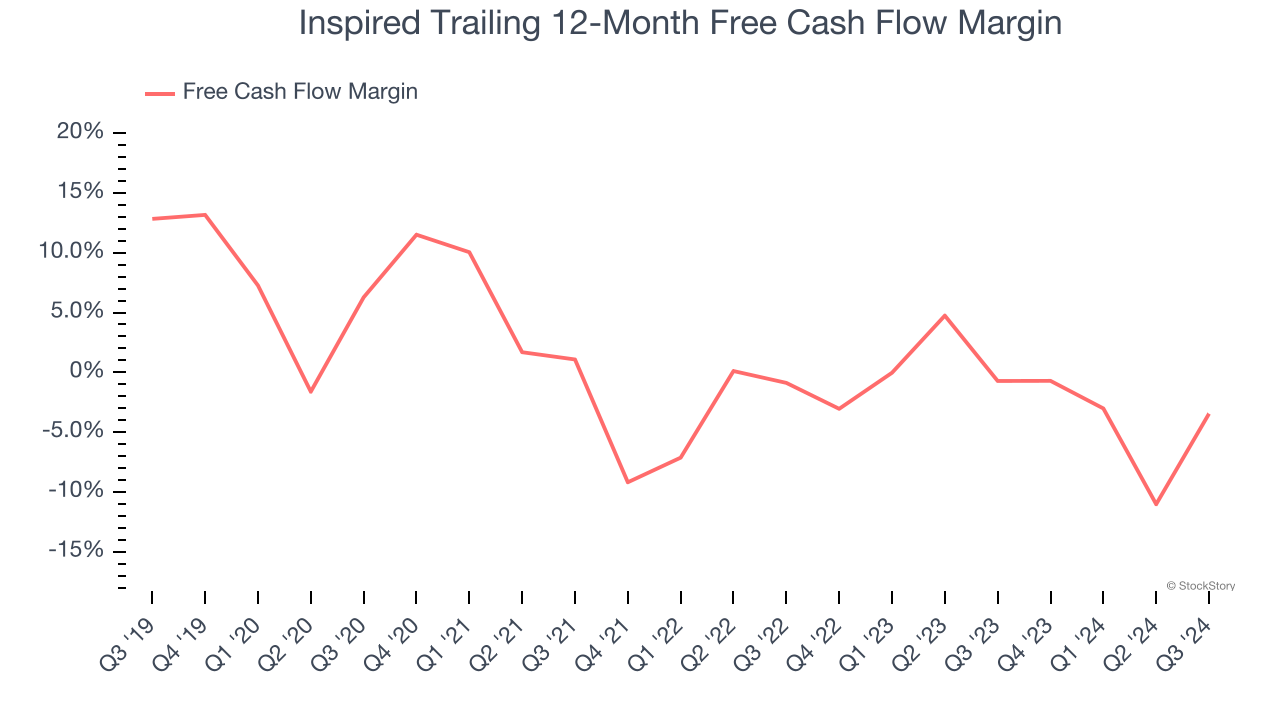

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While Inspired posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, Inspired’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 2%, meaning it lit $2.04 of cash on fire for every $100 in revenue.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Inspired’s revenue to rise by 7.7%. Although this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector.

Final Judgment

Inspired isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 2.2× forward EV-to-EBITDA (or $8.52 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now. Let us point you toward MercadoLibre, the Amazon and PayPal of Latin America.

Stocks We Like More Than Inspired

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.