The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how advertising software stocks fared in Q3, starting with Zeta (NYSE: ZETA).

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

The 6 advertising software stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 4.6% while next quarter’s revenue guidance was 0.9% above.

Luckily, advertising software stocks have performed well with share prices up 16.3% on average since the latest earnings results.

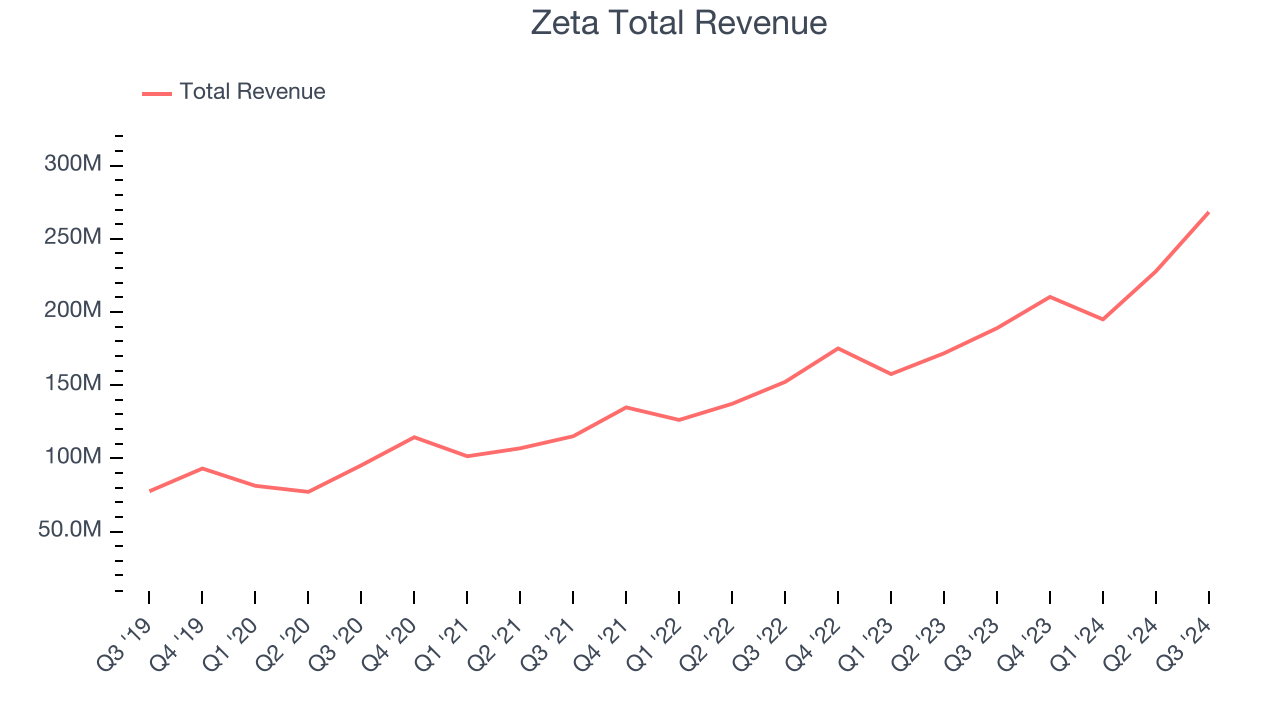

Best Q3: Zeta (NYSE: ZETA)

Co-founded by former Apple CEO John Scully, Zeta Global (NYSE: ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

Zeta reported revenues of $268.3 million, up 42% year on year. This print exceeded analysts’ expectations by 6.3%. Overall, it was a stunning quarter for the company with a solid beat of analysts’ billings estimates and EBITDA guidance for next quarter exceeding analysts’ expectations.

“The bets we made seven years ago on AI, the investment in a ‘1 of 1’ marketing platform, and our commitment to our customers’ success has resulted in record setting third-quarter financial results, above of our previously raised guidance,” said David A. Steinberg, Co-Founder, Chairman, and CEO of Zeta.

Zeta pulled off the fastest revenue growth and highest full-year guidance raise of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 33.8% since reporting and currently trades at $24.34.

Is now the time to buy Zeta? Access our full analysis of the earnings results here, it’s free.

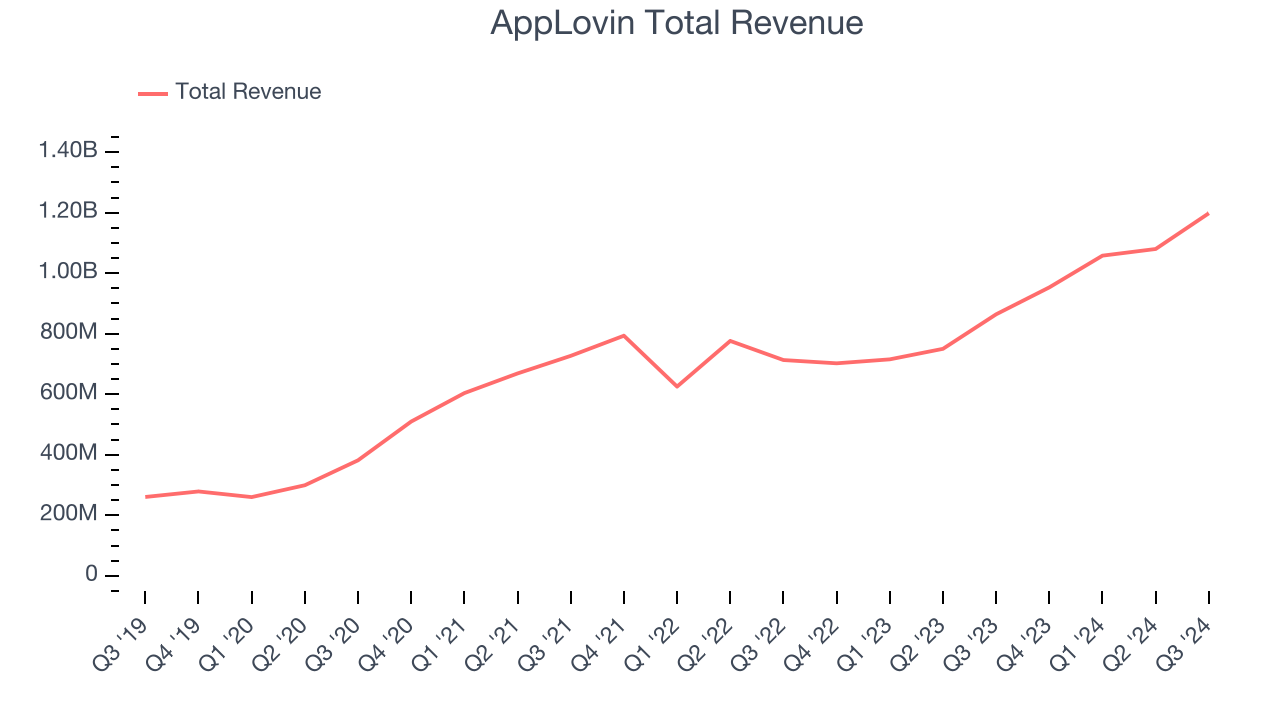

AppLovin (NASDAQ: APP)

Co-founded by Adam Foroughi, who was frustrated with not being able to find a good solution to market his own dating app, AppLovin (NASDAQ: APP) is both a mobile game studio and provider of marketing and monetization tools for mobile app developers.

AppLovin reported revenues of $1.20 billion, up 38.6% year on year, outperforming analysts’ expectations by 5.9%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 103% since reporting. It currently trades at $341.50.

Is now the time to buy AppLovin? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: The Trade Desk (NASDAQ: TTD)

Founded by former Microsoft engineers Jeff Green and Dave Pickles, The Trade Desk (NASDAQ: TTD) offers cloud-based software that uses data to help advertisers better plan, place, and target their online ads.

The Trade Desk reported revenues of $628 million, up 27.3% year on year, exceeding analysts’ expectations by 1.2%. Still, it was a mixed quarter as it posted a slight miss of analysts’ billings estimates.

Interestingly, the stock is up 2.2% since the results and currently trades at $135.39.

Read our full analysis of The Trade Desk’s results here.

DoubleVerify (NYSE: DV)

When Oren Netzer saw a digital ad for US-based Target while sitting in his Tel Aviv apartment, he knew there was an unsolved problem, so he started DoubleVerify (NYSE: DV), a provider of advertising solutions to businesses that helps with ad verification, fraud prevention, and brand safety.

DoubleVerify reported revenues of $169.6 million, up 17.8% year on year. This print met analysts’ expectations. More broadly, it was a mixed quarter as it also produced an impressive beat of analysts’ EBITDA estimates but revenue guidance for next quarter missing analysts’ expectations significantly.

DoubleVerify had the weakest performance against analyst estimates and weakest full-year guidance update among its peers. The stock is up 5.9% since reporting and currently trades at $20.73.

Read our full, actionable report on DoubleVerify here, it’s free.

PubMatic (NASDAQ: PUBM)

Founded in 2006 as an online ad platform helping ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

PubMatic reported revenues of $71.79 million, up 12.7% year on year. This result topped analysts’ expectations by 8.7%. Zooming out, it was a satisfactory quarter as it also produced an impressive beat of analysts’ EBITDA estimates.

PubMatic pulled off the biggest analyst estimates beat but had the slowest revenue growth among its peers. The stock is flat since reporting and currently trades at $16.56.

Read our full, actionable report on PubMatic here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September, a quarter in November) have kept 2024 stock markets frothy, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there's still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.