As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the cybersecurity industry, including Varonis Systems (NASDAQ: VRNS) and its peers.

Cybersecurity continues to be one of the fastest-growing segments within software for good reason. Almost every company is slowly finding itself becoming a technology company and facing rising cybersecurity risks. Businesses are accelerating adoption of cloud-based software, moving data and applications into the cloud to save costs while improving performance. This migration has opened them to a multitude of new threats, like employees accessing data via their smartphone while on an open network, or logging into a web-based interface from a laptop in a new location.

The 9 cybersecurity stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 6.4% since the latest earnings results.

Weakest Q3: Varonis Systems (NASDAQ: VRNS)

Beginning with protecting Windows file shares in 2005 and evolving into a comprehensive security platform, Varonis Systems (NASDAQ: VRNS) provides data security software that helps organizations protect sensitive information, detect threats, and comply with privacy regulations.

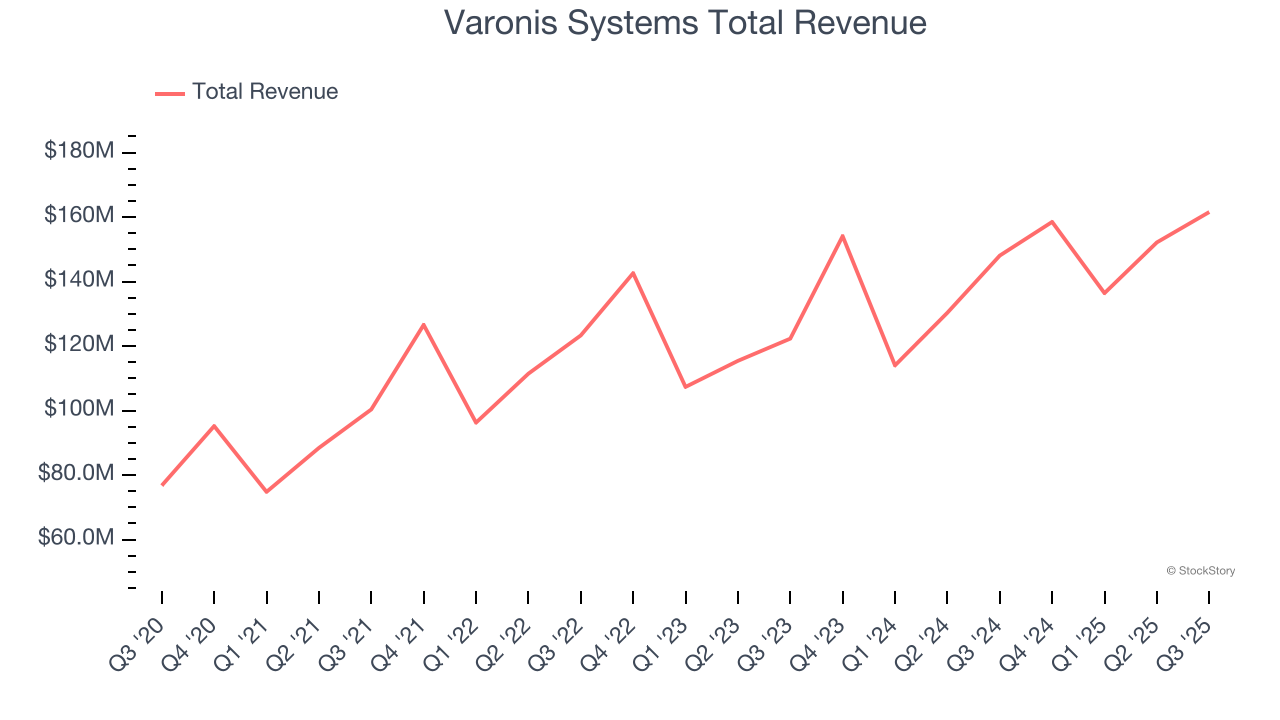

Varonis Systems reported revenues of $161.6 million, up 9.1% year on year. This print fell short of analysts’ expectations by 2.7%. Overall, it was a softer quarter for the company with full-year revenue guidance slightly missing analysts’ expectations and revenue guidance for next quarter slightly missing analysts’ expectations.

Yaki Faitelson, Varonis CEO, said, “We continued to see healthy demand for our SaaS platform, which now represents 76% of total company ARR. This adoption is driven by the automated outcomes that it provides as well as customer interest in deploying AI initiatives and securing data in the cloud. At the same time, in the final weeks of the quarter, we experienced lower renewals in the Federal vertical and in our non-Federal on-prem subscription business, which led to a shortfall relative to our expectations.”

Varonis Systems delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 47.4% since reporting and currently trades at $33.17.

Read our full report on Varonis Systems here, it’s free for active Edge members.

Best Q3: Qualys (NASDAQ: QLYS)

Originally developed to address the growing complexity of IT security in the cloud era, Qualys (NASDAQ: QLYS) provides a cloud-based platform that helps organizations identify, manage, and protect their IT assets from cyber threats across on-premises, cloud, and mobile environments.

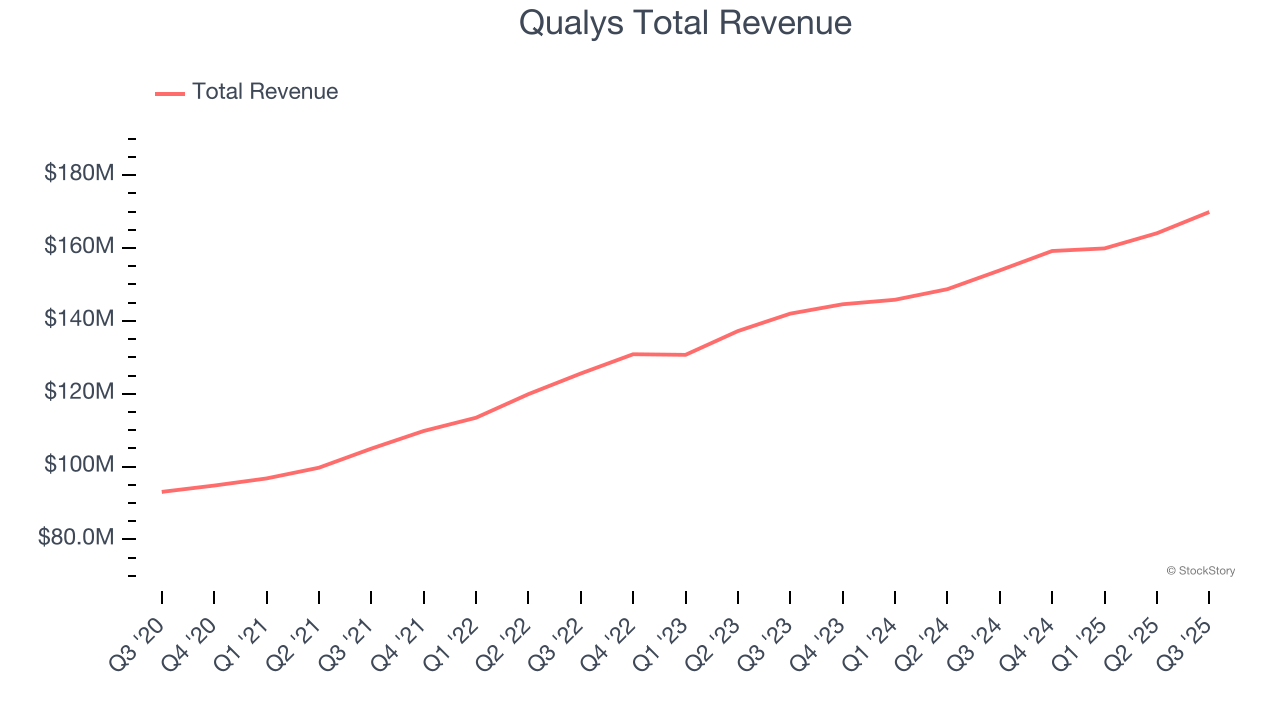

Qualys reported revenues of $169.9 million, up 10.4% year on year, outperforming analysts’ expectations by 2.2%. The business had an exceptional quarter with EPS guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

Qualys scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 25.5% since reporting. It currently trades at $152.08.

Is now the time to buy Qualys? Access our full analysis of the earnings results here, it’s free for active Edge members.

Tenable (NASDAQ: TENB)

Starting with the widely-used Nessus vulnerability scanner first released in 1998, Tenable (NASDAQ: TENB) provides exposure management solutions that help organizations identify, assess, and prioritize cybersecurity vulnerabilities across their IT infrastructure and cloud environments.

Tenable reported revenues of $252.4 million, up 11.2% year on year, exceeding analysts’ expectations by 2.1%. Still, it was a slower quarter as it posted EPS guidance for next quarter missing analysts’ expectations significantly and a significant miss of analysts’ annual recurring revenue estimates.

As expected, the stock is down 5% since the results and currently trades at $27.21.

Read our full analysis of Tenable’s results here.

CrowdStrike (NASDAQ: CRWD)

Known for detecting the massive SolarWinds hack in 2020 that compromised numerous government agencies, CrowdStrike (NASDAQ: CRWD) provides cloud-based cybersecurity solutions that protect endpoints, cloud workloads, identity, and data through its Falcon platform.

CrowdStrike reported revenues of $1.23 billion, up 22.2% year on year. This print topped analysts’ expectations by 1.6%. It was a strong quarter as it also logged a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is flat since reporting and currently trades at $518.25.

Read our full, actionable report on CrowdStrike here, it’s free for active Edge members.

SentinelOne (NYSE: S)

Built on the principle of "fighting machine with machine," SentinelOne (NYSE: S) provides an AI-powered cybersecurity platform that autonomously prevents, detects, and responds to threats across endpoints, cloud workloads, and identity systems.

SentinelOne reported revenues of $258.9 million, up 22.9% year on year. This result surpassed analysts’ expectations by 1.1%. Overall, it was a strong quarter as it also produced a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

SentinelOne delivered the highest full-year guidance raise among its peers. The company added 59 enterprise customers paying more than $100,000 annually to reach a total of 1,572. The stock is down 12.1% since reporting and currently trades at $15.04.

Read our full, actionable report on SentinelOne here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.