Since December 2020, the S&P 500 has delivered a total return of 86.5%. But one standout stock has more than doubled the market - over the past five years, Parker-Hannifin has surged 221% to $885.46 per share. Its momentum hasn’t stopped as it’s also gained 33.8% in the last six months thanks to its solid quarterly results, beating the S&P by 19.4%.

Is now still a good time to buy PH? Or are investors being too optimistic? Find out in our full research report, it’s free for active Edge members.

Why Does Parker-Hannifin Spark Debate?

Founded in 1917, Parker Hannifin (NYSE: PH) is a manufacturer of motion and control systems for a wide variety of mobile, industrial and aerospace markets.

Two Positive Attributes:

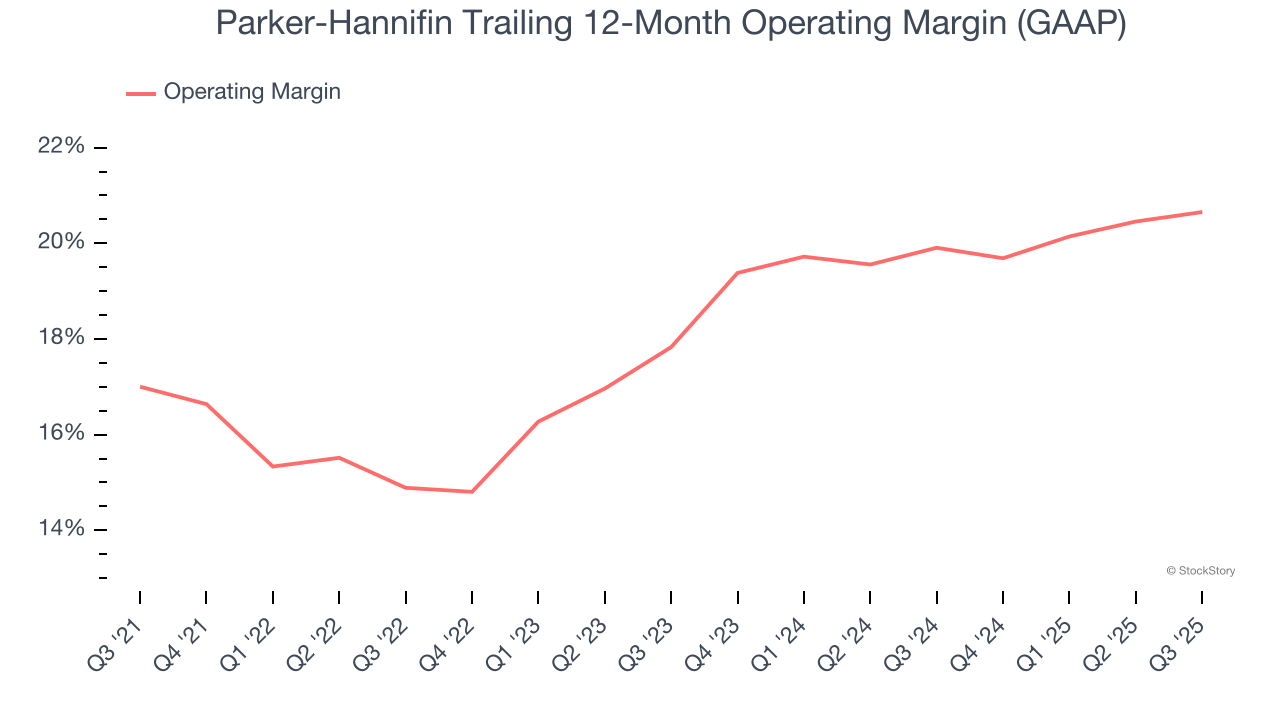

1. Operating Margin Reveals a Well-Run Organization

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Parker-Hannifin has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 18.2%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

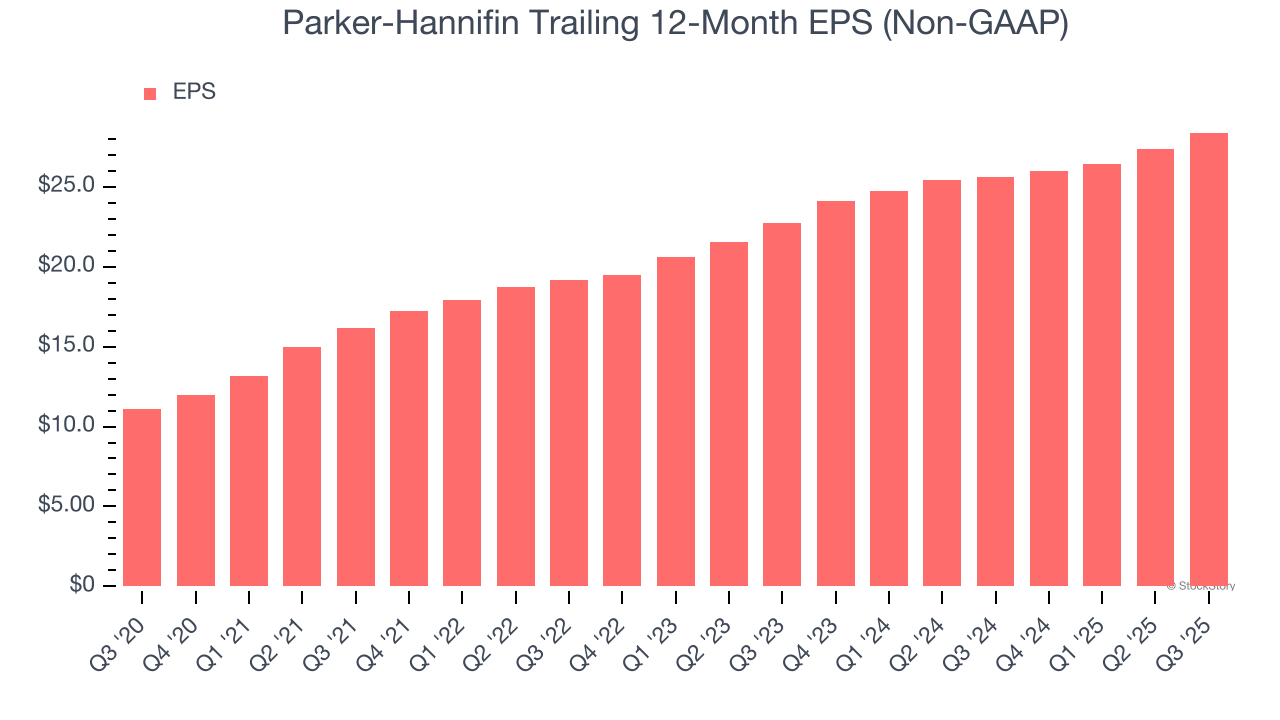

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Parker-Hannifin’s EPS grew at an astounding 20.7% compounded annual growth rate over the last five years, higher than its 8.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

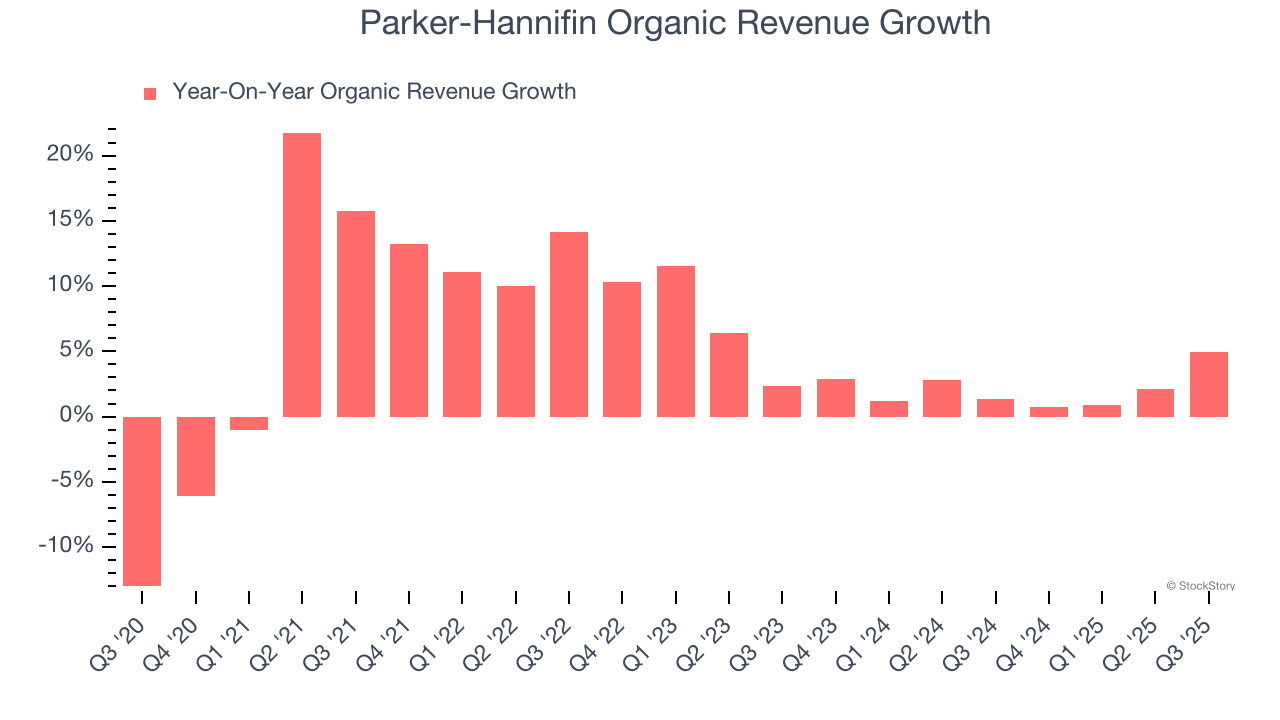

One Reason to be Careful:

Slow Organic Growth Suggests Waning Demand In Core Business

In addition to reported revenue, organic revenue is a useful data point for analyzing Gas and Liquid Handling companies. This metric gives visibility into Parker-Hannifin’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Parker-Hannifin’s organic revenue averaged 2.1% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

Final Judgment

Parker-Hannifin’s positive characteristics outweigh the negatives, and with its shares topping the market in recent months, the stock trades at 29.2× forward P/E (or $885.46 per share). Is now a good time to buy? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than Parker-Hannifin

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.