Fluid and gas handling company MRC (NYSE: MRC) fell short of the market’s revenue expectations in Q4 CY2024, with sales falling 13.5% year on year to $664 million. Its non-GAAP loss of $0.08 per share was significantly below analysts’ consensus estimates.

Is now the time to buy MRC Global? Find out by accessing our full research report, it’s free.

MRC Global (MRC) Q4 CY2024 Highlights:

- Revenue: $664 million vs analyst estimates of $726.9 million (13.5% year-on-year decline, 8.7% miss)

- Adjusted EPS: -$0.08 vs analyst estimates of $0.08 (significant miss)

- Adjusted EBITDA: $32 million vs analyst estimates of $34.95 million (4.8% margin, 8.4% miss)

- Outlook: "We anticipate growth in all three business sectors in 2025 and for revenue to be up low to high-single digits. In addition, we expect to generate at least $100 million in cash from operations, achieve our target net debt leverage ratio of 1.5x by year end and to have ample cash to begin execution of our recently announced $125 million share buyback authorization.”

- Operating Margin: 1.8%, down from 3.6% in the same quarter last year

- Free Cash Flow Margin: 4.2%, down from 10.7% in the same quarter last year

- Market Capitalization: $947 million

Rob Saltiel, MRC Global’s President and Chief Executive Officer, commented, “We are optimistic about our business outlook for 2025 due to the rebound of our gas utilities business, the return of inflation to our product pricing, the growth of U.S. natural gas infrastructure investment and our penetration into chemicals, mining and data center markets. We are also very excited to announce today our new IMTEC joint venture which simplifies the development of smart meters for our gas utilities customers. We anticipate growth in all three business sectors in 2025 and for revenue to be up low to high-single digits. In addition, we expect to generate at least $100 million in cash from operations, achieve our target net debt leverage ratio of 1.5x by year end and to have ample cash to begin execution of our recently announced $125 million share buyback authorization.”

Company Overview

Producing bomb casings and tracks for vehicles during WWII, MRC (NYSE: MRC) offers pipes, valves, and fitting products for various industries.

Infrastructure Distributors

Focusing on narrow product categories that can lead to economies of scale, infrastructure distributors sell essential goods that often enjoy more predictable revenue streams. For example, the ongoing inspection, maintenance, and replacement of pipes and water pumps are critical to a functioning society, rendering them non-discretionary. Lately, innovation to address trends like water conservation has driven incremental sales. But like the broader industrials sector, infrastructure distributors are also at the whim of economic cycles as external factors like interest rates can greatly impact commercial and residential construction projects that drive demand for infrastructure products.

Sales Growth

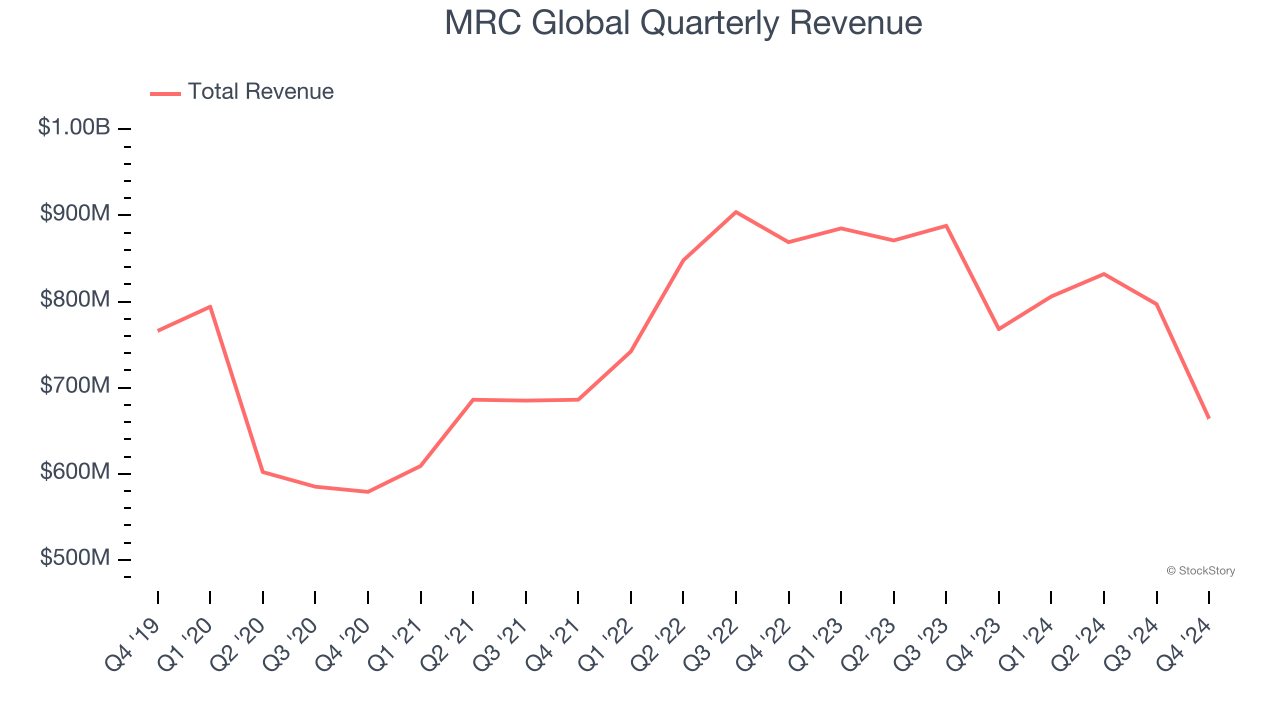

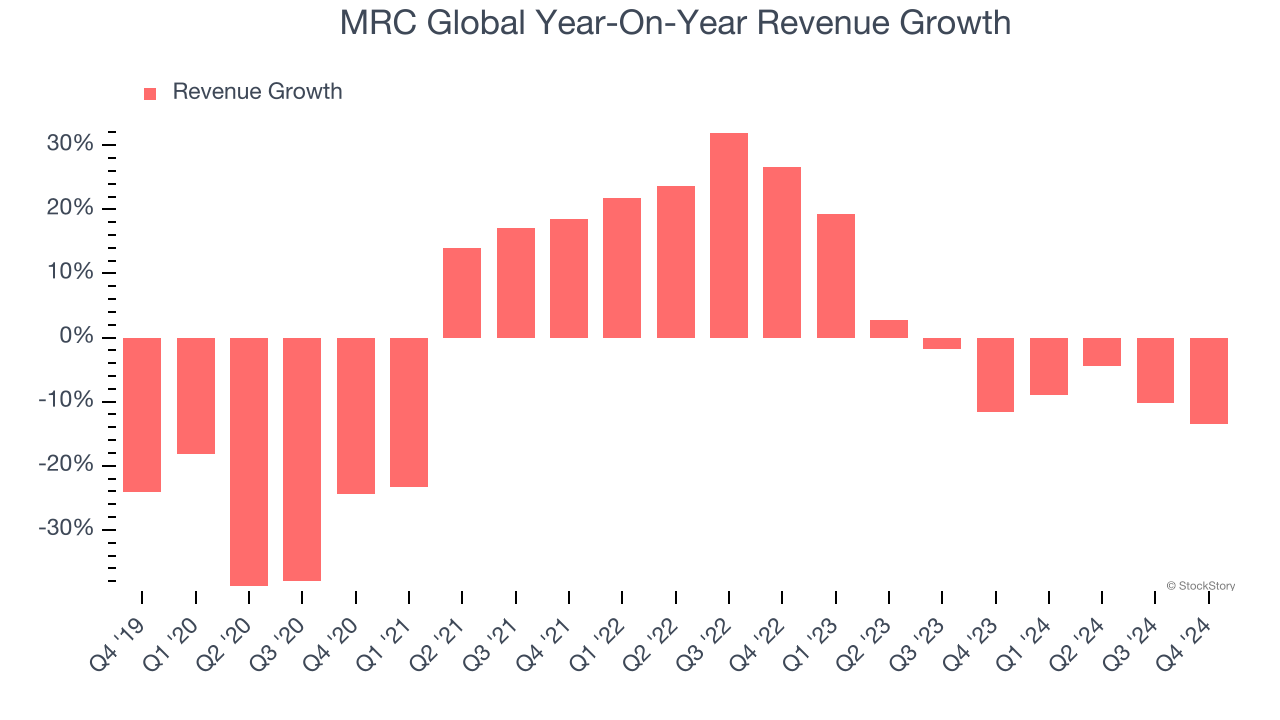

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, MRC Global’s demand was weak and its revenue declined by 3.3% per year. This wasn’t a great result and is a sign of poor business quality.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. MRC Global’s annualized revenue declines of 4% over the last two years align with its five-year trend, suggesting its demand has consistently shrunk.

MRC Global also breaks out the revenue for its most important segments, Valves and Fittings, which are 37.3% and 21.8% of revenue. Over the last two years, MRC Global’s Valves revenue (fluid control) averaged 1.2% year-on-year growth. On the other hand, its Fittings revenue (pipe connectors) averaged 2.7% declines.

This quarter, MRC Global missed Wall Street’s estimates and reported a rather uninspiring 13.5% year-on-year revenue decline, generating $664 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months. Although this projection indicates its newer products and services will spur better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

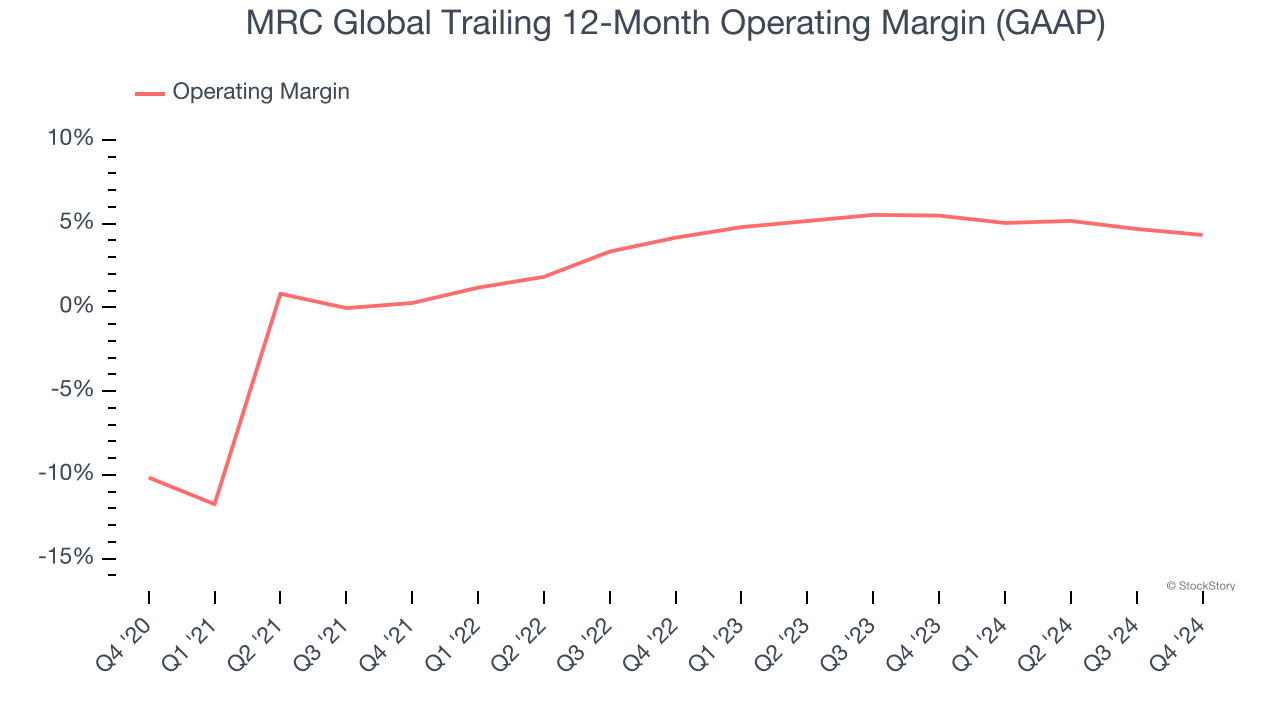

Operating Margin

MRC Global was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.4% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, MRC Global’s operating margin rose by 14.5 percentage points over the last five years.

In Q4, MRC Global generated an operating profit margin of 1.8%, down 1.8 percentage points year on year. Since MRC Global’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

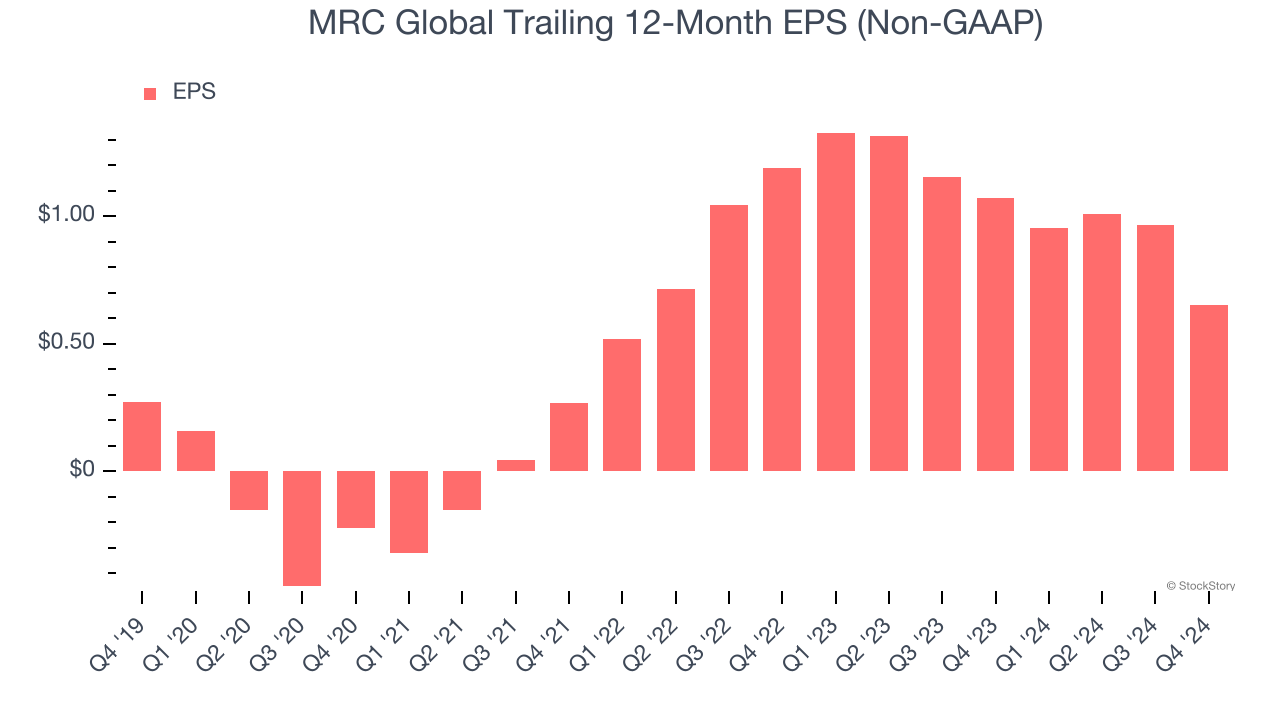

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

MRC Global’s EPS grew at an astounding 19.1% compounded annual growth rate over the last five years, higher than its 3.3% annualized revenue declines. This tells us management adapted its cost structure in response to a challenging demand environment.

Diving into the nuances of MRC Global’s earnings can give us a better understanding of its performance. As we mentioned earlier, MRC Global’s operating margin declined this quarter but expanded by 14.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For MRC Global, its two-year annual EPS declines of 26% mark a reversal from its (seemingly) healthy five-year trend. We hope MRC Global can return to earnings growth in the future.

In Q4, MRC Global reported EPS at negative $0.08, down from $0.23 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects MRC Global’s full-year EPS of $0.65 to grow 65.5%.

Key Takeaways from MRC Global’s Q4 Results

We anticipate growth in all three business sectors in 2025 and for revenue to be up low to high-single digits. In addition, we expect to generate at least $100 million in cash from operations, achieve our target net debt leverage ratio of 1.5x by year end and to have ample cash to begin execution of our recently announced $125 million share buyback authorization.”

So should you invest in MRC Global right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.