Molina Healthcare has been treading water for the past six months, recording a small loss of 3.6% while holding steady at $329.49.

Is now the time to buy MOH? Find out in our full research report, it’s free.

Why Does MOH Stock Spark Debate?

Founded in 1980 as a provider for underserved communities in Southern California, Molina Healthcare (NYSE: MOH) provides managed healthcare services primarily to low-income individuals through Medicaid, Medicare, and Marketplace insurance programs across 21 states.

Two Things to Like:

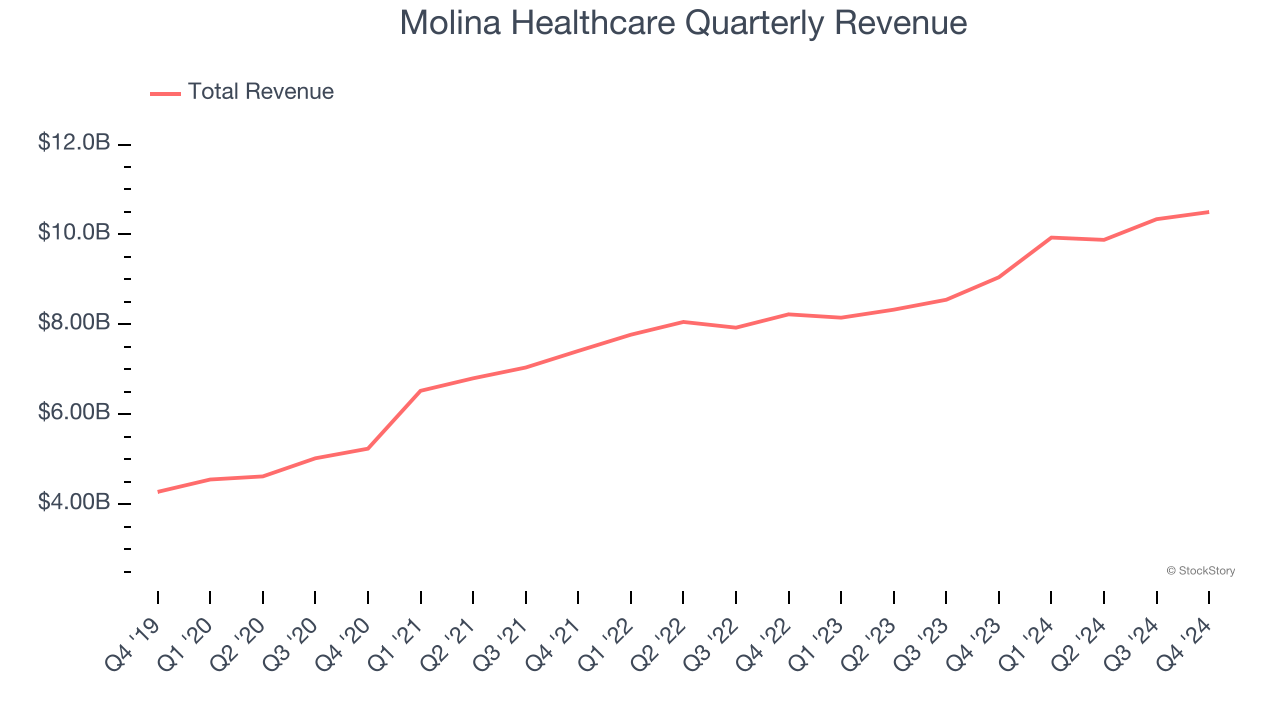

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Molina Healthcare grew its sales at an impressive 19.3% compounded annual growth rate. Its growth surpassed the average healthcare company and shows its offerings resonate with customers.

2. Economies of Scale Give It Negotiating Leverage with Suppliers

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $40.65 billion in revenue over the past 12 months, Molina Healthcare boasts impressive economies of scale. It may not be as large as heavyweights such as UnitedHealth Group and The Cigna Group from a topline perspective, but its heft is still an important advantage in a healthcare industry that is heavily regulated, complex, and resource-intensive.

One Reason to be Careful:

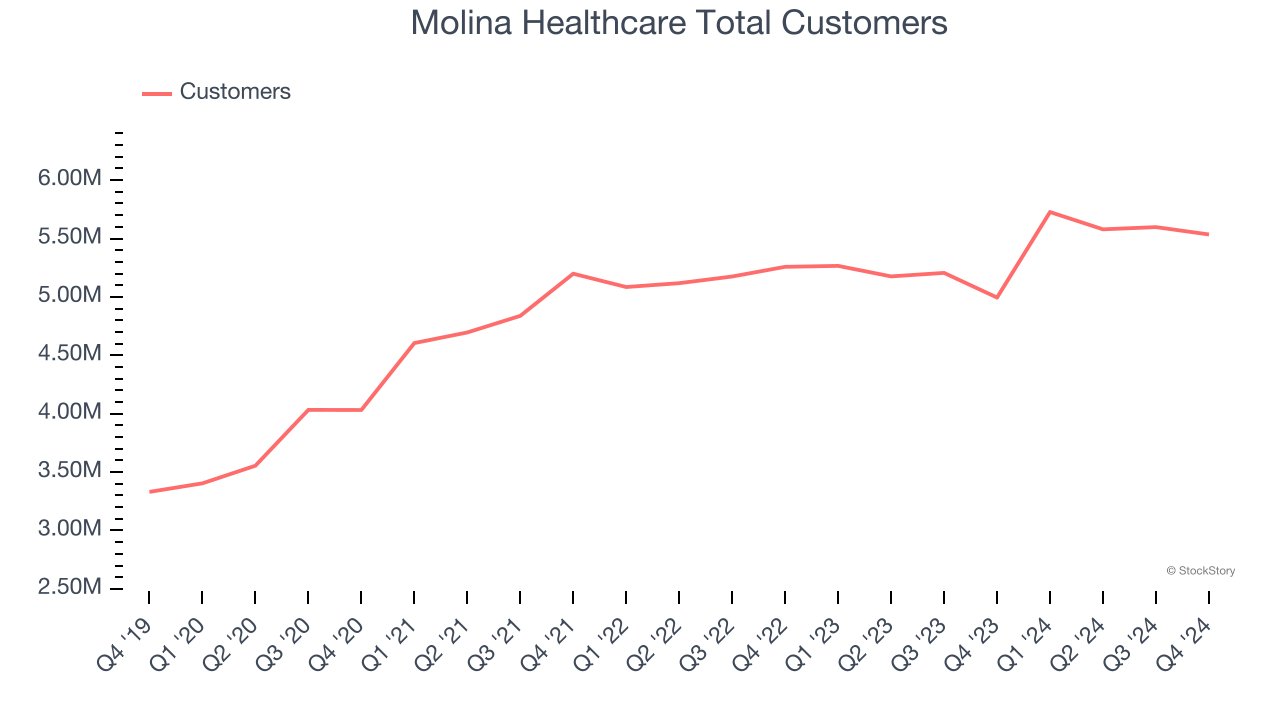

Weak Customer Growth Points to Soft Demand

Revenue growth can be broken down into the number of customers and the average spend per customer. Both are important because an increasing customer base leads to more upselling opportunities while the revenue per customer shows how successful a company was in executing its upselling strategy.

Molina Healthcare’s total customers came in at 5.54 million in the latest quarter, and over the last two years, their count averaged 4.4% year-on-year growth. This performance slightly lagged the sector and suggests that increasing competition is causing challenges in landing new contracts.

Final Judgment

Molina Healthcare’s positive characteristics outweigh the negatives, but at $329.49 per share (or 12.6× forward price-to-earnings), is now the right time to buy the stock? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Molina Healthcare

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.